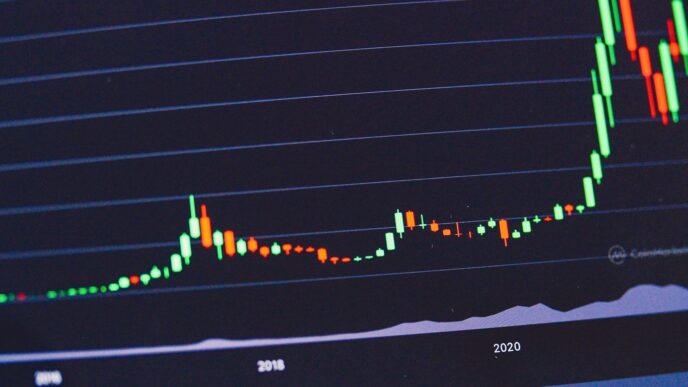

Bitcoin experienced a significant drop in value after President Donald Trump announced the establishment of a Strategic Bitcoin Reserve. The announcement, which was anticipated to bolster the cryptocurrency market, instead led to a sell-off as investors reacted to the lack of new government purchases of Bitcoin.

Key Takeaways

- Bitcoin’s price fell approximately 6%, dropping from around $90,400 to $84,979 shortly after the announcement.

- The Strategic Bitcoin Reserve will only utilize Bitcoin already held by the government from criminal forfeitures, not new acquisitions.

- Other cryptocurrencies, including Ethereum and Solana, also saw declines following the news.

- Market analysts are divided on the long-term implications of the reserve, with some viewing it as a positive step for crypto recognition.

Overview Of The Strategic Bitcoin Reserve

On March 6, 2025, President Trump signed an executive order to create a Strategic Bitcoin Reserve, which will be funded solely by Bitcoin seized from criminal activities. This reserve is intended to act as a store of value, similar to a digital Fort Knox, but it does not involve any new purchases of Bitcoin by the government.

The announcement was made by David Sacks, the White House’s AI and crypto czar, who emphasized that the reserve would not cost taxpayers anything. The U.S. government is estimated to hold around 200,000 Bitcoin, valued at approximately $17.7 billion, which will form the core of this reserve.

Market Reaction

The immediate market reaction was negative, with Bitcoin’s price plummeting to as low as $84,000 before slightly recovering to around $87,200. Other major cryptocurrencies also faced declines:

- Ethereum (ETH): Dropped 6.1% to $2,100.

- Solana (SOL): Fell 6.8%.

- Cardano (ADA): Decreased by 13.8%.

This sell-off was attributed to the market’s disappointment over the lack of aggressive government action to purchase more Bitcoin, which many had anticipated.

Analysts’ Perspectives

While some analysts expressed disappointment, others viewed the establishment of the reserve as a positive development for the cryptocurrency market. They argue that it signifies increased recognition and legitimacy for Bitcoin within the U.S. government.

- Positive Outlook: Some industry leaders believe that the reserve could pave the way for broader adoption of Bitcoin and other cryptocurrencies.

- Cautious Sentiment: Others remain skeptical, emphasizing the need for clearer details on how the government plans to manage its Bitcoin holdings and the implications for market stability.

Conclusion

The creation of the Strategic Bitcoin Reserve marks a significant moment in the intersection of government policy and cryptocurrency. While the immediate market reaction was negative, the long-term effects of this initiative remain to be seen. Investors and analysts alike will be closely monitoring how the U.S. government manages its digital assets moving forward, as well as any potential future developments in cryptocurrency regulation.

Sources

- Bitcoin plunges 6% as Trump’s crypto reserve falls short of hopes, Cointelegraph.

- Bitcoin Price Drops As President Trump Creates Strategic Crypto Reserve, The Daily Hodl.

- Bitcoin Tumbles Below $85K as Trump’s Crypto Reserve Order Sparks Sell-Off – Markets and Prices Bitcoin News, Bitcoin.com News.

- Bitcoin Price Slides as Crypto Market Reacts to Trump’s Strategic Reserve Order, Decrypt.

- just below $90k as Trump reserve move underwhelms By Investing.com, Investing.com.