Bitcoin’s price has been fluctuating around the $85,000 mark amid growing uncertainty in the market, primarily driven by U.S. tariff policies and political tensions involving President Donald Trump and Federal Reserve Chair Jerome Powell. As investors grapple with these developments, the cryptocurrency market is showing signs of instability.

Key Takeaways

- Bitcoin hovers around $85,000, reflecting market uncertainty.

- Tariff concerns and political tensions are impacting investor sentiment.

- Altcoins like Solana and Cardano are gaining traction amid Bitcoin’s stagnation.

Market Overview

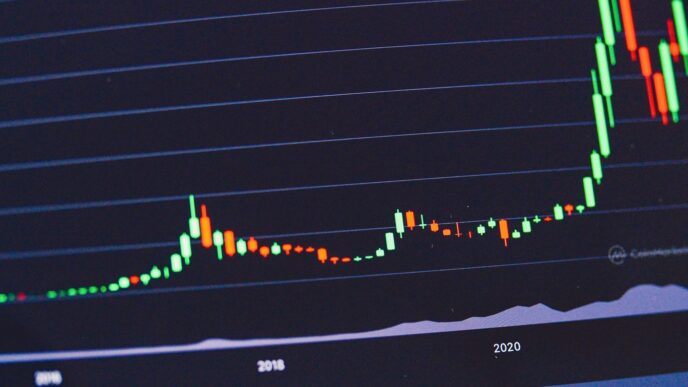

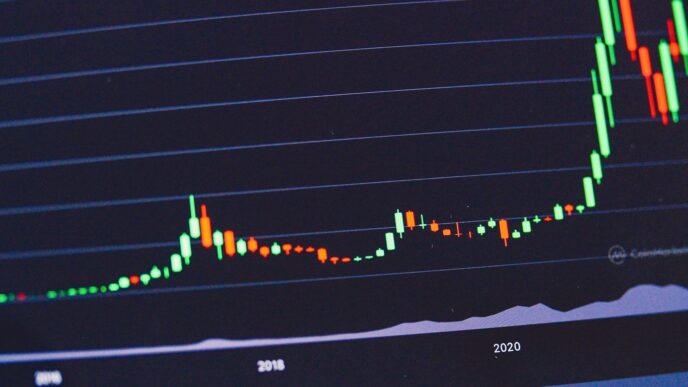

Bitcoin (BTC) has experienced a rollercoaster of price movements recently, with its value hovering just below $85,000. The cryptocurrency market is reacting to mixed signals from the U.S. government regarding tariffs on Chinese goods, which has created a ripple effect across various asset classes.

On April 14, Bitcoin saw a slight increase of 1.6%, reaching nearly $85,000, as positive trade-related news emerged. However, this upward momentum was short-lived, as the price dropped to around $83,482 by April 17, reflecting a decline of over 2% due to renewed tariff discussions.

Political Tensions and Tariff Concerns

The ongoing tariff war between the U.S. and China has added layers of complexity to the market. President Trump has been vocal about his dissatisfaction with the Federal Reserve’s policies, particularly criticizing Powell’s approach to interest rates. This tension has led to fears of stagflation, where rising prices coincide with stagnant economic growth.

- Key Events:

- Trump has hinted at potential tariffs on electronics, which could further impact the market.

- Powell’s hawkish comments have raised concerns about tighter monetary policy, dampening investor enthusiasm.

Altcoins Gaining Ground

While Bitcoin’s price remains volatile, altcoins are experiencing a surge in interest. Solana (SOL) and Cardano (ADA) have emerged as top performers, attracting investors looking for opportunities outside of Bitcoin. This shift indicates a potential rotation of capital within the cryptocurrency market as traders seek to capitalize on volatility.

- Top Gainers:

- Solana: +6%

- Cardano: +5%

- Dogecoin: +4%

Investor Sentiment and Future Outlook

The current market sentiment is cautious, with many investors seeking downside protection amid the uncertainty. Options trading data shows a mix of bullish and bearish positions, indicating that traders are preparing for potential price swings.

- Options Activity:

- Increased demand for call options at $90,000 to $100,000 strikes for May and June.

- Renewed interest in put options at $80,000, reflecting concerns over potential declines.

As the market navigates these turbulent waters, analysts are closely monitoring key support levels for Bitcoin. A break below $81,000 could trigger further liquidations, exacerbating the current volatility.

Conclusion

The interplay between political developments, tariff policies, and market sentiment is creating a challenging environment for Bitcoin and the broader cryptocurrency market. As investors remain on edge, the coming weeks will be crucial in determining whether Bitcoin can regain its footing or if further declines are on the horizon. With altcoins gaining traction, the landscape of cryptocurrency investment may be shifting, offering new opportunities for traders willing to adapt to the changing dynamics.