So, you’re looking at Fat Coin, huh? It’s been quite a ride lately. This cryptocurrency is known for its big swings, and trying to figure out where it’s headed can feel like a guessing game. We’ll break down what’s been happening with Fat Coin, what makes its price jump around, and what some of the charts and social media buzz might tell us. Basically, we’re going to try and make sense of this wild ride in the crypto market, especially when it comes to fat coin.

Key Takeaways

- Fat Coin’s price has been pretty volatile, with a decent number of “green days” recently, meaning its price went up more often than down over the last month.

- If you had short-sold $1,000 worth of Fat Coin today and bought it back on October 19, 2025, you could potentially make about $312.90, which is a 31.29% return.

- For 2028, Fat Coin might see its price go up to $0.00001306, which is about a 13.58% increase from its current price. Some months, like October, could see even bigger jumps.

- The price of Fat Coin, like other assets, is mainly affected by how much people want to buy it versus how much is available. Big holders, sometimes called “whales,” can really move the price because the fat coin market isn’t huge.

- Social media, especially tweets from influencers, can cause quick and big changes in Fat Coin’s price and how much of it is being traded. This can even affect other similar coins. For example, a tweet about Fat Coin caused a 50% price jump and a 150% increase in trading volume in just 30 minutes.

Current Market Dynamics of Fat Coin

Price Volatility and Green Days for Fat Coin

Okay, so Fat Coin has been all over the place lately. One day it’s up, the next it’s down – classic crypto, right? But seriously, the volatility has been pretty intense. We’ve seen some huge swings in price, making it both exciting and terrifying for investors. According to some sources, Fat Coin had green days for 20 out of 30 days, which is actually pretty good. It means there’s been more positive movement than negative overall. But still, those dips can be scary. It’s important to keep an eye on the market value to understand the overall trend.

Fat Coin’s Performance Against Key Indicators

How’s Fat Coin doing compared to other cryptos? That’s the big question. Well, it’s a mixed bag. Sometimes it follows Bitcoin’s lead, other times it seems to do its own thing. It’s been described as "sidelined", which means it’s not really making big moves. Here’s a quick rundown:

- Bitcoin (BTC): Fat Coin sometimes mirrors BTC’s movements, but not always.

- Ethereum (ETH): Less correlation with ETH, Fat Coin seems to have its own drivers.

- Other Meme Coins: There’s definitely some influence from other meme coins like DOGE and SHIB, especially when there’s social media buzz.

Short-Term Fat Coin Price Predictions

Alright, let’s talk predictions. Everyone wants to know where Fat Coin is headed, right? Honestly, it’s anyone’s guess. But here’s what some analysts are saying:

- Neutral Outlook: Some indicators suggest a neutral outlook for 2025, meaning it could go either way.

- Potential Uptrend: Predictions for 2028 show a possible uptrend, with a projected price increase.

- Monitor Catalysts: Keep an eye out for events that could trigger renewed interest or volatility. A tweet can send the price soaring, or a negative news story can tank it. It’s all about staying informed.

Factors Influencing Fat Coin’s Price

Supply and Demand Mechanics of Fat Coin

Like any asset, Fat Coin’s price is a dance between supply and demand. If more people want to buy Fat Coin than sell it, the price goes up. If more people are selling, the price drops. Simple, right? But what causes those shifts in desire? That’s where it gets interesting. Scarcity plays a big role. If the supply of Fat Coin is limited, and demand increases, expect the price to jump. Conversely, if a ton of new Fat Coins suddenly flood the market, the price will likely fall. Understanding these basic principles is key to grasping Fat Coin’s volatility.

Impact of Whales on Fat Coin Movements

In the relatively small pond of Fat Coin, big fish – or "whales" – can make huge waves. These are individuals or entities that hold a significant amount of Fat Coin. Their buy or sell orders can trigger massive price swings. Imagine someone dumping a million Fat Coins – that’s going to scare the market and drive the price down, at least temporarily. Keeping an eye on whale activity is something a lot of traders do. It’s not foolproof, but it can give you a heads-up about potential big moves.

Real-World Events Affecting Fat Coin Value

Fat Coin doesn’t exist in a vacuum. Real-world events can have a big impact on its price. Think about it: if a major company announces it’s accepting Fat Coin as payment, that’s going to boost confidence and drive up demand. On the flip side, if governments start cracking down on crypto exchange hacks or introduce strict regulations, that could send the price tumbling. Even news about other cryptocurrencies can have a ripple effect, especially if Fat Coin is seen as a highly correlated coin. It’s all connected!

Technical Analysis and Trading Signals for Fat Coin

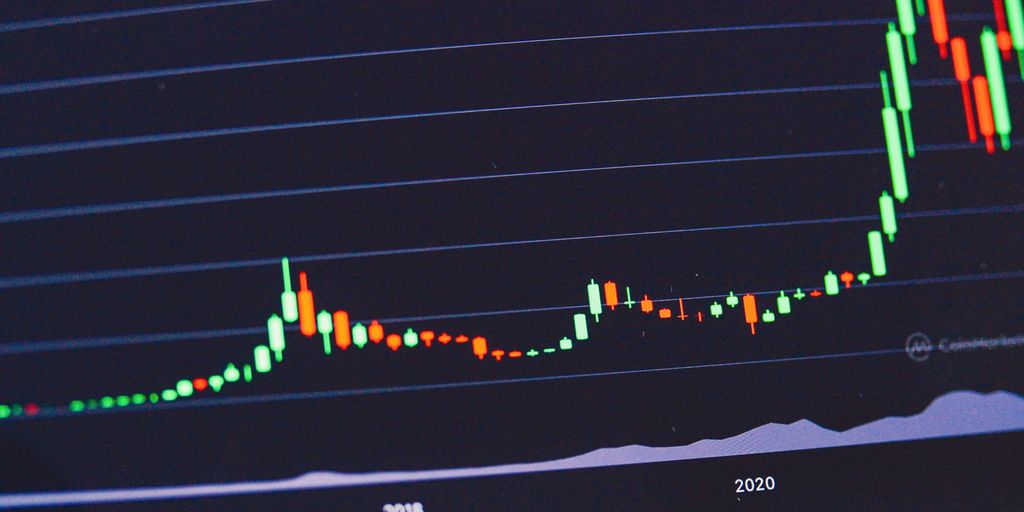

Candlestick Patterns and Fat Coin Forecasts

Okay, so let’s talk about how to read those Fat Coin charts. Most traders I know are all about candlestick charts. They give you way more info than just a simple line. You can zoom in to see what’s happening every five minutes, or zoom out to see the big picture over weeks. Candlesticks show the opening, closing, highest, and lowest prices for a specific period.

- A green candle means the price closed higher than it opened.

- A red candle means the opposite.

- Some charts use filled and hollow bodies instead of colors.

Relative Strength Index (RSI) for Fat Coin

The Relative Strength Index, or RSI, is something a lot of people use. It’s an oscillator that goes from 0 to 100. Basically, it tells you if Fat Coin is overbought or oversold. If the RSI is above 70, it might be overbought, and a price correction could be coming. If it’s below 30, it might be oversold, and the price could bounce back up. It’s not perfect, but it’s another tool in the box. Traders also use Fibonacci retracement level indicators to try and figure out where the price might go next.

Moving Average Convergence Divergence (MACD) Trends

The MACD is another popular indicator. It uses moving averages to spot trends. You’ve got the MACD line, the signal line, and the histogram. When the MACD line crosses above the signal line, it’s often seen as a buy signal. When it crosses below, it’s a sell signal. The histogram just shows the difference between the two lines. A lot of people also watch the 50-day moving averages, 100-day, and 200-day moving averages. If Fat Coin’s price goes above those, it’s usually a good sign. If it drops below, watch out!

Social Media’s Role in Fat Coin Volatility

Social media is a HUGE deal when it comes to how Fat Coin’s price jumps around. It’s not just about news anymore; it’s about memes, opinions, and trends that can change in minutes. The speed at which information (or misinformation) spreads can cause wild swings in price, making it both exciting and risky for investors. Let’s break down how social media impacts Fat Coin.

Impact of Influencer Tweets on Fat Coin

Influencers can really move the needle. A single tweet from a popular crypto personality can send Fat Coin soaring or plummeting. Remember when AltcoinGordon tweeted a meme about Fat Coin? The price jumped 50% in like, half an hour! That’s the power of a well-timed, well-received tweet. It’s not always rational, but it’s the reality. It’s important to keep an eye on what these influencers are saying, but also to remember they might have their own agendas. It’s a good idea to check out meme coins like Fat Coin and $RETARD coin, which are often discussed on social media.

Community Engagement and Trading Volume Spikes

When the Fat Coin community gets excited, things get interesting. A surge in community engagement often leads to a spike in trading volume. This can happen for a bunch of reasons: a new partnership, a funny meme going viral, or even just a coordinated buying effort. The more people talking about Fat Coin, the more people are likely to buy or sell, which creates volatility. Here’s a quick look at how community engagement can affect trading volume:

- Increased social media mentions

- Higher participation in online forums

- More frequent searches for Fat Coin

Ripple Effects on Other Meme Coins

Fat Coin doesn’t exist in a vacuum. What happens to Fat Coin can affect other meme coins, and vice versa. If Fat Coin is doing well, people might get more interested in other similar coins, hoping to catch the next big wave. But if Fat Coin crashes, it can create fear and uncertainty in the whole meme coin market. It’s like a chain reaction. The table below shows how Fat Coin’s performance can influence other meme coins:

| Meme Coin | Correlation with Fat Coin | Potential Impact |

|---|---|---|

| Doge | Moderate | Increased/Decreased trading volume based on Fat Coin |

| Shiba Inu | Low | Minor impact, mostly driven by overall market sentiment |

| Pepe | High | Significant price swings mirroring Fat Coin |

Investment Outlook and Profitability of Fat Coin

Historical Profitability of Fat Coin Investments

So, how has Fat Coin performed in the past? Well, looking back, it’s been a bit of a rollercoaster. There have been periods of significant gains, followed by dips that might make you sweat. Over the last month, Fat Coin had green days 67% of the time, which is pretty decent. But remember, past performance isn’t a guarantee of future success. It’s more like looking in the rearview mirror – it tells you where you’ve been, not necessarily where you’re going. For example, FAT crypto recently hit an all-time high, but that doesn’t mean it will keep going up forever.

Fat Coin’s Potential ROI for Short-Selling

Short-selling Fat Coin? Risky, but potentially rewarding. The idea is to borrow Fat Coin, sell it high, and then buy it back later at a lower price to return to the lender, pocketing the difference. But if the price goes up instead of down, you could lose a lot. Current analysis suggests that shorting Fat Coin in July could yield a potential return of around 30%. But, and this is a big but, crypto is volatile. What looks good today could be terrible tomorrow. Always do your research and understand the risks before shorting any cryptocurrency.

Long-Term Price Projections for Fat Coin

Okay, crystal ball time. What does the future hold for Fat Coin? Predicting the price of any cryptocurrency is tough, but analysts are giving it a shot. For example, projections for 2028 suggest a possible uptrend, with the price potentially increasing by around 13%. That’s not bad, but it’s not a get-rich-quick scheme either. Here’s a quick look at some potential price points:

- October 2025: Potential ROI of 23.82%

- November 2025: Potential gain of 23.96%

- 2028: Expected price increase of 13.58%

Keep in mind these are just predictions. The crypto market is influenced by all sorts of things, from regulatory changes to market sentiment, so take these projections with a grain of salt. Investing in Fat Coin, like any crypto, involves risk. Don’t invest more than you can afford to lose, and always be prepared for the unexpected.

Understanding Market Sentiment for Fat Coin

The Fear and Greed Index Explained

The Fear and Greed Index is a tool used to gauge the overall market sentiment. It ranges from 0 to 100, with different levels indicating varying degrees of fear or greed among investors. A score of 0-24 suggests extreme fear, 25-49 indicates fear, 50 is neutral, 51-75 represents greed, and 76-100 signifies extreme greed. This index combines several factors, including volatility, trading volume, social media activity, and even Google Trends data. It’s important to remember that the Fear and Greed Index for Fat Coin often relies heavily on Bitcoin-related market data, so it might not perfectly reflect Fat Coin’s specific sentiment.

Interpreting Sentiment for Fat Coin Trading

So, how do you use this information when trading Fat Coin? Well, some traders see extreme fear as a buying opportunity, figuring that the market is oversold. Conversely, extreme greed might signal a good time to sell, as the market could be overbought. Currently, the Fat Coin Fear & Greed Index is at 64, which puts it in the "Greed" zone. This could mean that investors are feeling pretty optimistic about Fat Coin right now. But remember, it’s just one indicator, and you should always do your own research before making any trades. You can also look at crypto trading signals to help you make informed decisions.

Shifts in Market Sentiment Post-Events

Market sentiment can change quickly, especially after significant events. For example, a major announcement about Fat Coin, a big move by a whale, or even just a viral tweet can all cause sentiment to shift. Let’s say there’s a rumor that Fat Coin is going to be listed on a major exchange. You might see the Fear and Greed Index jump into the "Extreme Greed" zone as everyone rushes to buy. On the other hand, if there’s a security breach or some other negative news, you could see a rapid shift towards fear. Keeping an eye on these shifts can help you anticipate potential price movements and adjust your trading strategy accordingly. Here’s a quick list of things that can affect sentiment:

- Major announcements

- Whale activity

- Social media trends

- Overall market conditions

On-Chain Metrics and Fat Coin Health

Active Addresses and Network Activity

Okay, so let’s talk about what’s really going on with Fat Coin under the hood. Forget the hype for a minute. We need to look at the blockchain itself. Are people actually using Fat Coin? The number of active addresses gives us a clue. If the number is climbing, that’s a good sign – more people are transacting with it. If it’s dropping, well, that suggests interest might be waning. Network activity, like the number of transactions per day, also paints a picture. A healthy network shows consistent transaction flow. A sudden spike might indicate a whale moving coins, or it could be a sign of increased adoption.

Network Value to Transactions (NVT) Ratio

The NVT ratio is like the price-to-earnings ratio in the stock market, but for crypto. It compares the market cap of Fat Coin to the value of transactions happening on the network. A high NVT ratio could mean the coin is overvalued, because the network value is high compared to the transaction volume. A low NVT ratio could mean it’s undervalued. But, like any single metric, it’s best to use it with other indicators. It’s not perfect, but it gives you another angle to consider. Here’s a simplified example:

| Metric | Value |

|---|---|

| Market Cap | $100,000 |

| Daily Transaction Volume | $10,000 |

| NVT Ratio | 10 |

Total Value Locked (TVL) in Fat Coin DeFi

If Fat Coin is being used in decentralized finance (DeFi) applications, the Total Value Locked (TVL) is important. TVL represents the total value of Fat Coin locked in smart contracts, like lending protocols or decentralized exchanges. A rising TVL usually means more people are trusting and using Fat Coin in DeFi, which is a positive sign. A falling TVL? Not so good. It could mean people are pulling their funds out, maybe because they found better opportunities elsewhere, or they’re losing confidence. Keep an eye on this, especially if you’re thinking about using Fat Coin in any altcoin presale opportunities. Here are some things to consider:

- Is the TVL growing steadily?

- How does Fat Coin’s TVL compare to other similar coins?

- Are there any specific DeFi platforms driving the TVL?

Wrapping Things Up: What to Remember About Fat Coin

So, we’ve gone over a lot about Fat Coin and its ups and downs. It’s pretty clear that this coin, like many in the crypto world, can change fast. We saw how things like social media buzz can really make its price jump, even if it’s just for a little while. And those technical charts, with their lines and patterns, they can give us some ideas, but they aren’t crystal balls. The main takeaway here is that Fat Coin, with its quick swings, needs a careful approach. If you’re thinking about getting into it, or if you’re already holding some, just remember to do your own homework. Stay updated on what’s happening, and always be ready for things to shift. It’s a wild ride out there, and being prepared is your best bet.

Frequently Asked Questions

How often has Fat Coin’s price gone up recently?

Fat Coin has seen its price jump up on 20 out of the last 30 days, which is about 67% of the time. This means it’s been going up more often than down recently.

What’s the current mood around Fat Coin?

Right now, the feeling about Fat Coin is ‘Neutral’. This is based on a special tool called the Fear & Greed Index, which is at 64, meaning people are feeling pretty ‘Greedy’ about the market in general. But for Fat Coin specifically, it’s more in the middle.

Is it a good idea to put money into Fat Coin?

Based on how Fat Coin has performed in the past, and how many ‘green days’ it’s had (days where the price went up), investing in Fat Coin right now looks like it could make you money.

What’s the forecast for Fat Coin’s price in the near future?

Our predictions suggest that Fat Coin’s price might go down by about 25.08% by July 31, 2025. So, if you’re thinking about buying, it might be a good time, but be aware of the possible drop.

Can I make money by ‘short-selling’ Fat Coin?

If you were to ‘short-sell’ $1,000 worth of Fat Coin today and buy it back around October 19, 2025, you could potentially make about $312.90. That’s a profit of about 31.29% in just over three months, not counting any fees.

What makes Fat Coin’s price change so much?

The price of Fat Coin, like any other digital money, changes because of how many people want to buy it versus how many people want to sell it. Big news, new updates to the coin, and even what large owners (‘whales’) do can also make the price jump around a lot.