So, what’s happening to the crypto market right now? It feels like there’s always something new popping up, doesn’t it? From big companies making moves to governments figuring out rules, it’s a lot to keep track of. We’re seeing a mix of exciting developments and some serious challenges. Let’s break down some of the latest news and what experts are saying about where things are headed.

Key Takeaways

- New venture capital trends and regulatory wins are shaping a new phase for crypto.

- ETHZilla has approved a significant share buyback, showing confidence in its ETH holdings.

- Anchorage Digital is launching a new venture unit to support early-stage crypto projects.

- The US SEC is considering an Injective ETF, while Hong Kong aims for quicker virtual asset licensing.

- Despite some outflows from global crypto funds, platforms like Robinhood are reporting increased user activity in crypto.

Understanding What Is Happening to the Crypto Market

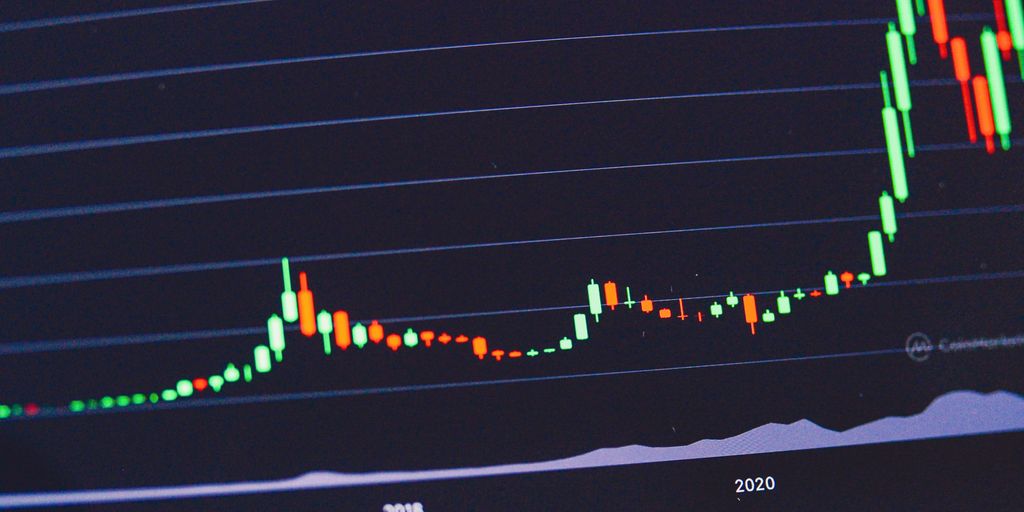

The crypto market is always buzzing, and lately, it feels like there’s a lot happening all at once. It’s not just one thing, either. We’re seeing big shifts driven by how venture capital is flowing, some wins on the regulatory front, and even how regular folks are starting to use crypto in new ways. It’s like a mix of old and new forces shaping everything.

Venture Trends and Regulatory Wins Shape Crypto’s New Era

Big money is moving around in the venture space, which is a pretty good sign for the future. Companies are getting funded, and there’s a general sense that smart people are putting their money into projects they think will last. On top of that, there have been some positive steps with regulators. Getting clearer rules, even if they’re still being worked out, helps a lot. It makes things less uncertain for businesses and investors. This combination of investment and clearer guidelines is helping to set a new tone for the whole industry.

Consumer Innovation Driving Market Evolution

It’s not just the big players. Everyday people are finding new ways to use crypto, too. Think about how people are using digital assets for gaming, or even just sending money to friends. These everyday uses might seem small, but they add up. When more people start using crypto for practical things, it makes the whole market grow and change. It shows that crypto isn’t just for trading; it’s becoming a tool for real-world activities.

Expert Analysis on Market Dynamics

Experts are watching all these changes closely. They’re looking at how new regulations might affect prices, or how a big company’s decision to buy back shares could impact its token. They also talk about how things like tax laws in different countries can make people more or less likely to invest in things like Bitcoin. It’s a complex picture, and understanding these different pieces helps paint a clearer view of where the market might be headed. For more on market news, check out CoinDesk’s latest updates.

Key Developments in the Cryptocurrency Landscape

Things are certainly moving in the crypto world, with a few big stories grabbing attention lately. It feels like there’s always something new happening, and keeping up can be a job in itself.

ETHZilla Approves Significant Share Buyback

ETHZilla, a major player in the Ethereum ecosystem, recently gave the green light for a substantial share buyback program. This move, valued at around $250 million, comes as the company sees its Ethereum holdings grow. It’s a sign that they’re confident in their position and looking to reward shareholders while also managing their assets.

Solana Treasury Firm in Development

There’s buzz about a new firm being set up to manage a significant treasury for the Solana network. Reports suggest this initiative could be looking to raise over $400 million. Big names like ParaFi and Pantera are reportedly involved, which signals some serious backing for this project aimed at strengthening Solana’s financial infrastructure.

New Solana Treasury Eyes Substantial Funding

Following up on the previous point, this new Solana treasury is aiming for a big funding round. The goal is to bring in more than $400 million. Having major investment firms like ParaFi and Pantera looking to contribute shows a lot of faith in Solana’s future and the need for robust treasury management within the ecosystem.

Institutional Interest and Investment Trends

Big money is definitely paying attention to crypto these days. We’re seeing some interesting moves from major players that show they’re not just dabbling anymore.

For starters, Anchorage Digital, a place that handles digital assets for institutions, just started a new venture unit. Their goal is to put money into those early-stage crypto projects, the ones building the next big thing on the blockchain. It’s a pretty clear sign that even established financial companies are looking for the next wave of innovation in this space.

On the flip side, it’s not all sunshine and rainbows. Global crypto funds have seen some serious cash leave them recently. We’re talking about the biggest outflows since way back in March. This could mean investors are getting a bit nervous or just moving their money around to different assets. It’s hard to say for sure without more data, but it’s definitely something to keep an eye on.

But then you have companies like Robinhood. They actually reported that more people are using their platform for crypto trading. It seems like despite the overall outflows from funds, individual investors are still pretty active. It’s a mixed bag out there, really. Some big players are investing in the future, while others are pulling back, and regular folks are still trading.

Here’s a quick look at some of the recent activity:

- Anchorage Digital launches a venture unit to back early-stage crypto projects.

- Global crypto funds experienced their largest weekly outflows since March, totaling $1.4 billion.

- Robinhood reported increased crypto activity in their latest earnings.

Regulatory and Policy Shifts Affecting Crypto

The world of cryptocurrency is always shifting, and a big part of that is how governments and big financial players are starting to get involved. It’s not just about tech anymore; it’s about rules and how money moves.

We’re seeing different approaches across the globe. For instance, the US Securities and Exchange Commission (SEC) is looking into new ideas, like a potential Injective ETF. They’ve opened up a comment period, which means they’re asking for public input before making any decisions. This kind of step shows they’re trying to figure out how to handle these new digital assets within existing financial frameworks.

Meanwhile, places like Hong Kong are trying to speed things up. They’re aiming for faster licensing for virtual asset companies. This suggests a move towards making it easier for legitimate businesses to operate, which could bring more stability and investment into the market. It’s a different strategy than just waiting and seeing.

On a higher political level, there’s talk about needing clearer rules. Someone like Donald Trump has been vocal, calling for straightforward laws and SEC guidelines for digital assets. The idea is that clear rules would help everyone involved, from big companies to individual investors, know where they stand. It’s a common theme: more clarity usually leads to more confidence.

It’s also interesting to see how established financial institutions are reacting. Some are looking at ways to get more involved, while others are still trying to understand what clients want before jumping in. This mix of proactive steps and cautious observation is pretty typical when a new technology starts to shake things up.

Market Sentiment and Future Outlook

The crypto market is always buzzing with talk about what’s next, and lately, there’s been a lot of chatter about potential upturns. Some big names in the space are predicting a "FOMO season," which basically means people might start buying in quickly out of fear of missing out on gains. This kind of sentiment can really move prices, so it’s something to keep an eye on.

On the institutional side, things are also shifting. While some global crypto funds have seen money move out, others are showing increased activity. For instance, Robinhood reported a jump in its crypto business, which suggests that even with market ups and downs, people are still engaging with digital assets. It’s a mixed bag, really.

Looking at specific regions, Japan’s interest in Bitcoin seems to be closely linked to potential tax reforms. If the government makes changes that are friendlier to crypto investors, we could see more people there buying BTC. It just goes to show how government policies can really shape market behavior.

Meanwhile, major banks are trying to figure out the best way forward. Bank of America, for example, is looking into client demand before they roll out their own stablecoin. This careful approach highlights the growing importance of stablecoins, but also the need for established financial institutions to get it right before jumping in.

Here’s a quick look at some related trends:

- Binance Founder Predicts ‘FOMO Season’: Suggests a potential surge in buying activity driven by market excitement.

- Japanese Interest in BTC Tied to Tax Reforms: Indicates that regulatory changes can significantly influence investor behavior.

- Bank of America Assesses Stablecoin Demand: Shows traditional finance is cautiously exploring the stablecoin market based on customer interest.

It’s clear that sentiment can swing wildly, and external factors like regulations and institutional adoption play a huge role in where the market is headed. We’re seeing a lot of different forces at play, making it an interesting time to follow the crypto space. For those looking to understand the current market shifts, checking out analyses on Bitcoin’s price drop can offer some perspective.

Security Incidents and Asset Management

It’s been a rough patch for some crypto players lately, with a couple of big security scares making headlines. CoinDCX, a pretty well-known exchange, recently went through a major hack. Reports say they lost around $44 million in the process. That’s a huge chunk of change, and it really makes you think about how secure your digital assets are on these platforms.

On a different note, the UK Home Office is planning to sell off a massive amount of seized Bitcoin. We’re talking about $7 billion worth here. It’s a sign that governments are getting more serious about dealing with illicit funds, but it also means a lot of Bitcoin could hit the market, potentially affecting prices.

Meanwhile, GameSquare is expanding its crypto treasury program, adding another $150 million. This shows that some companies are still betting big on crypto, even with the recent security issues. It’s a mixed bag out there – some are getting hit hard, while others are doubling down.

Here’s a quick look at some recent treasury and security events:

- CoinDCX Hack: Lost approximately $44 million.

- UK Home Office Bitcoin Sale: Planning to sell $7 billion in seized Bitcoin.

- GameSquare Treasury Expansion: Increased program by $150 million.

These events highlight the ongoing risks and opportunities in the crypto space. It’s important to stay informed about these developments, especially when considering where to keep your own digital assets. The security of platforms like Solana remains a key concern for many users.

Wrapping It Up

So, what’s the takeaway from all this crypto action? It’s clear the market is still a wild ride, with big players making moves and regulators keeping a close eye. We’re seeing companies like ETHZilla making big decisions, while countries are exploring how Bitcoin could fit into their economies. Plus, new tech like wallets in Telegram are popping up, changing how we interact with digital assets. It’s a lot to keep track of, and things can change fast. Staying informed is key, whether you’re a seasoned investor or just curious about what’s next in this evolving space.

Frequently Asked Questions

What’s making the crypto market change right now?

The crypto market is changing a lot! New companies are investing more money, and governments are starting to make clearer rules. People are also finding new ways to use digital money, which is making things exciting.

How are new investments and rules affecting crypto?

Some big companies are putting money into crypto startups. Also, new rules are being made that help the crypto world grow in a safer way. People are also coming up with cool new ideas for using crypto.

Are there any big company moves happening in crypto?

Yes, major players like ETHZilla are buying back their own shares, which is a good sign. There’s also a lot of talk about creating big funds for Solana, which could mean more support for that digital currency.

What are governments doing about crypto?

Governments are paying more attention. For example, the U.S. is looking at new ideas for crypto investments, Hong Kong wants to speed up approvals for crypto businesses, and even former President Trump has spoken about needing clearer rules.

What do experts think will happen next with crypto prices?

Some people think a ‘fear of missing out’ (FOMO) season is coming, meaning prices might go up fast. Also, countries like Japan might buy more Bitcoin if their tax rules become more friendly for crypto.

Are there any security problems or big sales happening with crypto?

Unfortunately, some crypto companies have been hacked, like CoinDCX losing money. On the flip side, governments are selling off seized Bitcoin, and companies like GameSquare are putting more money into their crypto programs.