Introduction:

Financial freedom is a dream that many of us aspire to achieve. It represents the ability to live life on your terms, without being bound by financial constraints. While it may seem like an elusive goal, there are practical steps you can take to work towards achieving financial freedom. In this article, we will explore ten proven financial freedom ideas that can help you take control of your finances and secure your future.

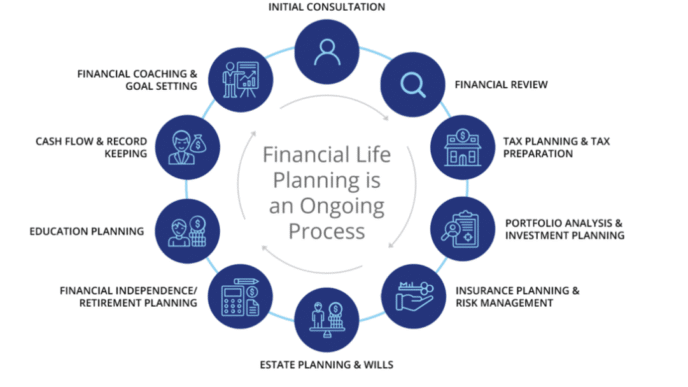

- Create a Budget and Stick to It: The foundation of financial freedom begins with a well-planned budget. Creating a budget helps you understand your income, expenses, and savings goals. By tracking your spending and making informed financial decisions, you can take the first step towards achieving financial freedom.

- Eliminate Debt: Debt can be a significant barrier to financial freedom. Make a plan to pay off high-interest debts, such as credit card balances and personal loans. Once you free yourself from debt, you can redirect those payments towards your savings and investments.

- Build an Emergency Fund: Life is full of unexpected expenses, from medical bills to car repairs. Building an emergency fund can provide you with a financial safety net. Aim to save at least three to six months’ worth of living expenses in a high-yield savings account.

- Invest Wisely: Investing your money can help it grow over time, but it’s essential to do so wisely. Diversify your investments across different asset classes, such as stocks, bonds, and real estate. Consider consulting with a financial advisor to develop an investment strategy that aligns with your financial goals.

- Maximize Retirement Contributions: Contributing to retirement accounts like a 401(k) or an IRA can help secure your financial future. Take advantage of any employer matching contributions and consider increasing your contributions as your income grows.

- Develop Multiple Income Streams: Relying solely on a single source of income can be risky. Explore opportunities to create multiple income streams, such as side gigs, freelancing, or investing in income-producing assets.

- Live Below Your Means: Living below your means doesn’t mean depriving yourself, but it does involve making mindful spending choices. By avoiding lifestyle inflation and saving the difference, you can accelerate your journey towards financial freedom.

- Continuously Educate Yourself: Financial literacy is a key component of achieving financial freedom. Stay informed about personal finance, investment strategies, and money management. There are numerous books, courses, and online resources available to help you expand your financial knowledge.

- Set Clear Financial Goals: Having specific financial goals can provide you with direction and motivation. Whether it’s saving for a down payment on a house, funding your children’s education, or retiring early, setting clear goals can keep you focused on your path to financial freedom.

- Seek Professional Guidance: If navigating the complexities of financial planning and investment seems overwhelming, don’t hesitate to seek professional guidance. Financial advisors can offer tailored advice and strategies to help you achieve your financial goals.

Conclusion:

Financial freedom is not an overnight achievement, but rather a journey that requires dedication and discipline. By implementing these ten proven financial freedom ideas, you can take significant steps towards securing your future and enjoying the peace of mind that comes with financial independence. Start today, and watch your financial future unfold with promise and opportunity.