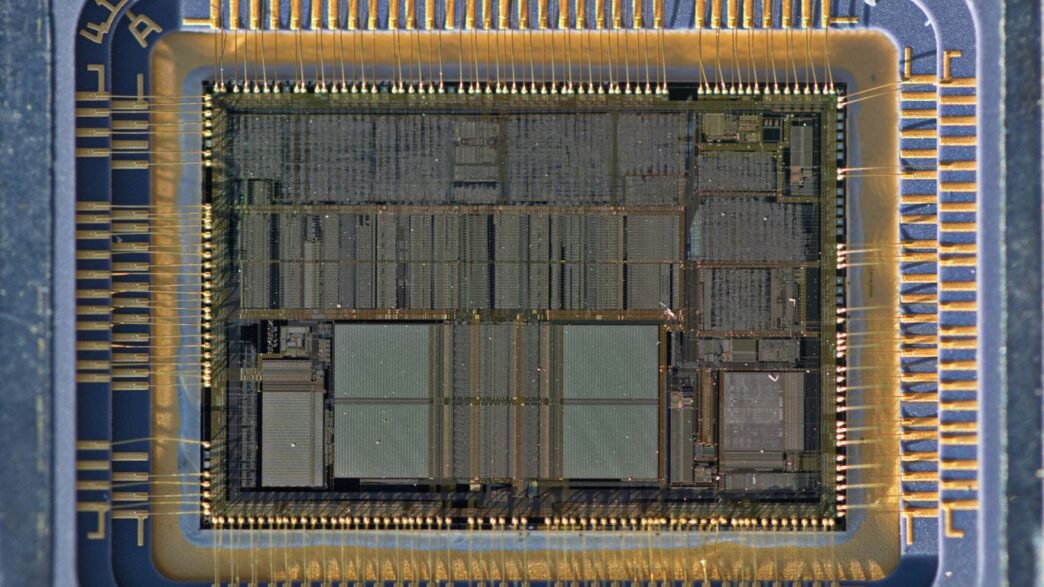

The world of semiconductors is a fast-paced game, and right now, TSMC is leading the pack. You hear about them everywhere, but what does their huge market share actually mean? We’re going to break down TSMC’s dominance, look at why they’re so far ahead, and what it means for everyone else in the tech world. It’s a big deal, affecting everything from your phone to the AI powering the future.

Key Takeaways

- TSMC holds a commanding lead in the global foundry market, with its market share projected to reach 66% by 2025, showing its continued dominance over competitors like Samsung and Intel.

- Technological leadership in advanced nodes, such as 3nm and upcoming 2nm processes, along with consistent high-yield production, are major drivers of TSMC’s market share growth.

- Samsung, while the second-largest player, faces challenges with yield rates and market share that has dipped to around 9-12%, indicating a widening gap with TSMC.

- Businesses heavily rely on TSMC, making supply chain diversification and strategic sourcing crucial to mitigate risks associated with geopolitical tensions and potential production bottlenecks.

- TSMC’s strong financial performance, with revenues significantly outpacing competitors, directly reflects its market strength and its critical role in the global semiconductor supply chain.

TSMC’s Commanding Market Share

It’s pretty clear that TSMC is the big player when it comes to making the chips that power pretty much everything these days. We’re talking about a company that holds a massive chunk of the global foundry market. This isn’t just a slight lead; it’s a dominant position that shapes the entire industry.

Analyzing TSMC’s Dominant Foundry Position

Looking at the numbers, TSMC’s share of the global foundry market is really something else. In Q3 2024, they were sitting at about 64.9%, and projections show this only going up, maybe reaching 66% by 2025. That means almost two-thirds of all outsourced chip manufacturing happens through them. It’s a big deal because it gives them a lot of say in how things work, from pricing to what gets made.

Here’s a quick look at how their share has been trending:

| Quarter | Market Share |

|---|---|

| Q2 2024 | 62% |

| Q3 2024 | 64.9% |

| Projected 2024 | 64% |

| Projected 2025 | 66% |

This kind of control means that if you’re a business needing advanced chips, TSMC is usually your first stop. They’re leading the pack in making the most cutting-edge chips, like the 3nm and soon-to-be 2nm technology. Companies like Apple, Nvidia, and AMD are all relying on them heavily, which just solidifies TSMC’s spot at the top.

The Impact of TSMC’s Market Leadership

So, what does this mean for everyone else? Well, TSMC’s leadership means they have a lot of influence. They can set trends, and their decisions impact supply chains worldwide. For businesses that depend on these chips – whether for AI, phones, cars, or computers – this dominance has real consequences.

- Supply Chain Dependencies: Relying so heavily on one supplier can be risky. If TSMC has production issues or capacity constraints, it can affect many companies at once.

- Pricing Power: With such a large market share, TSMC has significant influence over chip prices. This can lead to higher costs for businesses if demand outstrips supply.

- Innovation Pace: TSMC’s ability to push forward with new technologies means companies that want the latest and greatest chips have to work with them.

Understanding TSMC’s Projected Market Growth

The trend lines are pointing upwards for TSMC. Projections suggest their market share will continue to climb. This growth isn’t just happening by accident; it’s a result of their consistent performance, ability to scale up production, and strong relationships with major clients. As demand for chips in areas like AI and automotive keeps surging, TSMC is in a prime position to capture more of that market. Their ongoing investments in new manufacturing processes and planned expansions in places like the US and Europe are all part of a strategy to keep their lead and serve a wider range of customers, further cementing their dominant position in the years ahead.

Factors Fueling TSMC’s Ascendancy

It’s pretty wild how TSMC has gotten to where it is, right? It’s not just luck, though. A few big things are really pushing them forward.

Technological Prowess in Advanced Nodes

First off, they’re just plain better at making the most advanced chips. Think about their 3nm process – it’s a huge deal. Companies like Apple and Nvidia are practically lining up to use it because TSMC can actually make a lot of them, and they work well. While other companies are still trying to get their own fancy new chip-making methods to work right, TSMC has already figured out how to do it at scale. This means they can produce the cutting-edge chips that everyone wants, and do it reliably.

Supply Chain Resilience and Client Trust

Another massive factor is that TSMC is known for being dependable. In today’s world, with all the global uncertainty and worries about supply chains breaking down, that’s a really big deal. Companies want to know they can get the chips they need, when they need them. TSMC has built up a reputation for being that reliable partner. This makes businesses feel more secure signing long-term deals with them, which just locks in their position even more.

Strategic Execution and Scalability

Finally, TSMC is just really good at executing its plans and scaling up production. They invest heavily in new technologies, like their upcoming 2nm process, which keeps them ahead of the curve. Plus, they have these huge factories that can churn out massive quantities of chips. This ability to grow and adapt, while keeping clients happy with consistent supply and advanced tech, is a winning combination. It’s like they’ve got the whole operation running like a well-oiled machine, which is why so many big tech names trust them with their most important chip designs.

Competitive Landscape and Key Players

It’s pretty clear TSMC is the big dog in the semiconductor foundry world, but they aren’t the only ones playing the game. Let’s look at who else is in the ring and what they’re up to.

Samsung’s Position in the Foundry Market

Samsung is definitely the second-biggest player, but they’ve been having a bit of a tough time lately. In Q3 2024, their share of the global foundry market dropped to 9.3%. That’s a noticeable dip, and it makes you wonder if they can catch up. A big part of the problem seems to be with how well their newest, most advanced chips are actually being made – the "yield rates," as they call it. Plus, some companies get a little nervous because Samsung also makes its own chips, like the Exynos ones. This makes them a competitor to some of their own customers, which can cause trust issues. Even though they’re building factories in the US, a lot of their high-tech stuff is still in South Korea, and some businesses prefer more spread-out manufacturing options.

Intel’s Role in Semiconductor Manufacturing

Intel has been a giant in the chip world for ages, but mostly for making their own processors. Now, they’re really trying to get into the foundry business, meaning they want to make chips for other companies too. It’s a big shift for them, and they’re investing a lot to try and compete with TSMC and Samsung. They’ve got a lot of history and technical know-how, but breaking into the established foundry market is a huge challenge. They’re aiming to offer advanced manufacturing, but it’s a long road to gain the kind of trust and market share TSMC has.

Emerging Players and Market Dynamics

While TSMC, Samsung, and Intel are the main contenders, the landscape is always changing. Other countries and companies are pouring money into semiconductor manufacturing. China, for instance, is pushing hard to build up its domestic chip-making capabilities. Japan is also trying to revive its semiconductor industry. These efforts, along with government initiatives like the CHIPS Act in the US, are creating new dynamics. The goal for many is to reduce reliance on a few key players and build more resilient supply chains. It’s a complex web, and while TSMC is way out in front right now, the industry is always looking for the next big thing or a more stable alternative.

Implications of TSMC’s Dominance for Businesses

So, TSMC is pretty much running the show when it comes to making chips, right? With a market share hovering around 65% and projected to climb even higher, it means most of the world’s advanced chips come from them. This isn’t just a number; it’s a big deal for any company that needs these tiny, powerful components.

Navigating Supply Chain Dependencies

When one company makes that many chips, it’s natural to worry about what happens if something goes wrong. Think about it: if TSMC has a hiccup, whether it’s a natural disaster, a political issue, or just a massive order that strains their capacity, it can ripple through countless industries. We saw this play out during the global chip shortage, and TSMC’s central role means these kinds of disruptions are always a possibility. Businesses that rely heavily on TSMC need to have backup plans. It’s not about not trusting them, but about being smart and prepared for the unexpected.

Strategic Sourcing and Diversification

Because TSMC is so dominant, companies are really looking at how they get their chips. Putting all your eggs in one basket, even a really good basket like TSMC, can be risky. So, what are businesses doing?

- Exploring Alternatives: While TSMC is the leader, companies like Samsung are still in the game, even if their market share is much smaller. Intel is also trying to ramp up its foundry services. Businesses are evaluating these other options, looking at their technology, reliability, and pricing.

- Building Stronger Relationships: For those who absolutely need TSMC’s cutting-edge tech, the focus is on securing long-term contracts and building really solid partnerships. This can sometimes mean agreeing to certain terms or committing to specific volumes well in advance.

- Considering Regional Options: Some companies are looking at foundries in different geographic areas to spread risk, especially with ongoing global tensions.

Understanding Pricing and Availability Trends

With such a huge chunk of the market, TSMC has a lot of say in how much chips cost and when you can get them. Their revenue growth, which has been pretty impressive, shows that demand is high. This often means that if you’re not an early customer or a major client, you might face:

- Higher Prices: As demand stays strong and TSMC pushes into more advanced, expensive manufacturing processes, prices tend to go up.

- Longer Lead Times: Getting your chip design manufactured can take longer, especially for the latest technologies. Planning way ahead is key.

- Capacity Constraints: Even with their massive scale, there’s only so much they can produce. Securing a spot on their production lines requires careful planning and often, significant commitment.

Revenue and Financial Performance Metrics

Comparing TSMC’s Revenue Against Competitors

Looking at the money companies make is a pretty straightforward way to see who’s doing well in the chip-making world. In 2023, TSMC pulled in about $69.3 billion. That’s a pretty big number, and it puts them ahead of others. For example, Intel brought in around $54.23 billion, and Samsung’s chip business made about $50.99 billion in the same year. This revenue difference isn’t just about numbers; it shows how much trust and business TSMC has secured from the biggest tech companies.

Quarter-Over-Quarter Revenue Growth Analysis

It’s also interesting to see how revenue changes from one quarter to the next. In the third quarter of 2024, TSMC saw its revenue jump by 13% compared to the previous quarter, reaching $23.53 billion. This kind of growth often points to high demand for their chips, especially with things like AI and new phones needing more and more processing power. On the flip side, Samsung’s foundry revenue actually dropped by 12.4% in the same quarter. While a dip doesn’t always mean trouble, it does show that market conditions can shift.

Revenue as an Indicator of Market Strength

So, what does all this money talk really tell us? Well, revenue is a big clue about a company’s standing. When a company like TSMC consistently brings in more money than its rivals, it usually means they’re making the chips that everyone wants and needs. It suggests they have the technology, the capacity, and the customer relationships to keep the orders coming in.

Here’s a quick look at some recent figures:

- 2023 Total Revenue:

- TSMC: ~$69.3 billion

- Intel: ~$54.23 billion

- Samsung: ~$50.99 billion

- Q3 2024 Quarter-over-Quarter Growth:

- TSMC: +13%

- Samsung: -12.4%

This kind of financial performance is a strong signal about who’s leading the pack in semiconductor manufacturing.

The Future Trajectory of TSMC’s Market Share

So, what’s next for TSMC? It looks like they’re not slowing down anytime soon. Projections show their lead in the foundry market only getting bigger.

Projected Market Share Gains Through 2025

We’re talking about TSMC holding onto a massive chunk of the global foundry business. Estimates put their market share at around 64% for 2024, and that’s expected to climb to about 66% by 2025. That means almost two-thirds of all outsourced chip manufacturing could be happening under their roof. It’s a pretty big deal when you think about how many devices rely on these chips.

- 2023: Around 59%

- 2024 (Projected): 64%

- 2025 (Projected): 66%

This kind of growth isn’t just happening by accident. It’s a result of them consistently being the go-to for the latest and greatest chip technology.

The Role of Next-Generation Technologies

TSMC isn’t just resting on its laurels. They’re pushing hard into new manufacturing processes, like the 2-nanometer (2nm) technology. This constant innovation is a big reason why major companies like Apple, Nvidia, and AMD keep signing long-term deals with them. When you’re making the most advanced chips, everyone wants a piece of that action. Staying ahead in these cutting-edge nodes is key to keeping that market share growing.

Geopolitical Influences on Market Share

Things happening in the world also play a part. With all the talk about supply chain security and international relations, many companies are looking to spread out their manufacturing. TSMC’s plans to build facilities in places like the U.S. and Europe are a smart move. It helps them serve a wider range of customers and reduces some of the risks associated with relying too heavily on one region. This global expansion could further solidify their dominant position, making them an even more attractive partner for businesses worldwide.

Looking Ahead: TSMC’s Continued Reign

So, what’s the takeaway from all this? It’s pretty clear that TSMC isn’t just a big player in the semiconductor world; it’s the main event. With market share numbers that are hard to ignore, projected to keep climbing, they’ve really set the pace. While other companies like Samsung are still in the game, TSMC’s consistent performance, especially with those super-advanced chips everyone wants, keeps them way out in front. For anyone building or buying tech, understanding TSMC’s position is key. They’re the ones making the magic happen for so many of the devices we use every day, and it looks like that’s not changing anytime soon. It’ll be interesting to see if anyone can even come close to their level of production and trust in the coming years.

Frequently Asked Questions

What is TSMC and why is it so important?

TSMC stands for Taiwan Semiconductor Manufacturing Company. It’s like the biggest factory in the world that makes the tiny computer chips that power almost everything, from your phone to supercomputers. It’s super important because so many companies rely on TSMC to make their chips.

How much of the chip market does TSMC control?

TSMC is a huge player! In 2024, it’s expected to make about 64% of all the chips made by outside companies. This means almost two out of every three chips are made by TSMC. By 2025, they might even make 66%!

Why is TSMC so good at making chips?

TSMC is great because they have the best technology for making the smallest and most powerful chips. They also have a really reliable way of making chips, which means companies can count on them. Plus, they’ve built strong relationships with big tech companies.

Who are TSMC’s main competitors?

The biggest competitor is Samsung, which is also a major chip maker. Intel is another big name in the chip world, but they are trying to catch up in making chips for other companies. There are also smaller companies trying to grow in this market.

What happens if TSMC has problems making chips?

Since TSMC makes so many chips, if they have a problem, it can affect many companies and even cause shortages of electronics. This is why some businesses try to work with other chip makers too, to have a backup plan.

Will TSMC keep being the leader in the future?

It looks like TSMC will stay the leader for a while. They are always working on new and better chip technology, and big companies are planning to use their factories for years to come. However, things in technology can change quickly, and new challenges or competitors could always appear.