Artificial intelligence is redefining how global corporations make financial decisions, forecast risks, and shape long-term strategy. Few researchers have captured this transformation with the clarity and authority of Lawrence Damilare Oyeniyi, a Nigerian-born scholar whose work bridges data science and finance. His recent study, AI-Driven Decision Models Supporting Corporate Finance Strategy Optimization and Improving Managerial Forecasting Accuracy, published in late 2022 in the International Journal of Scientific Research in Computer Science, Engineering and Information Technology, has become one of the most widely discussed academic contributions in financial innovation. The research examines how artificial intelligence can replace outdated forecasting habits with precision-driven, adaptive, and transparent decision systems. Speaking on the motivation behind his research, Oyeniyi said, “The biggest weakness in corporate finance is not lack of data, but the failure to understand what the data is saying.” He continued, “Managers are making million-dollar decisions using models designed for markets that no longer exist.” His statement reflects the scale of the problem—according to a 2022 PwC Global Finance Survey, 68 percent of CFOs admitted that their forecasts failed to anticipate major cost fluctuations during the COVID-19 recovery period, while McKinsey reported that inaccurate forecasting led to an average 6 percent decline in corporate profitability across Fortune 500 companies.

Oyeniyi’s study addresses these gaps through artificial intelligence models that continuously learn from changing data and adjust financial projections in real time. “AI gives life to information,” he said. “It tracks the pulse of a company’s performance minute by minute.” The research demonstrates how machine learning, predictive analytics, and natural language processing can analyze millions of data points—ranging from financial statements to social sentiment—and provide forward-looking insights that are more reliable than static spreadsheets. “We’ve reached a point where human judgment alone cannot keep up with the speed of markets,” Oyeniyi explained. “AI doesn’t replace intuition. It validates it with evidence.”

His work also exposes how traditional financial planning has failed to adapt to complexity. A study by Deloitte in 2021 found that 54 percent of large organizations still relied on manual spreadsheets for forecasting. As Oyeniyi noted, “You cannot fight uncertainty with Excel.” He explained that static tools lack the capacity to integrate macroeconomic volatility, shifting regulations, and nonlinear risks. “AI reads what managers miss,” he said. “It identifies early warnings before they become losses.” In one of the model validations cited in his research, firms using AI-enhanced forecasting achieved a 23 percent improvement in prediction accuracy and reduced decision lag by nearly half.

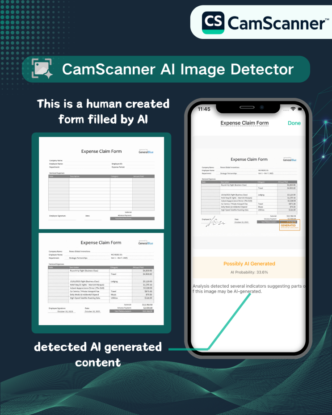

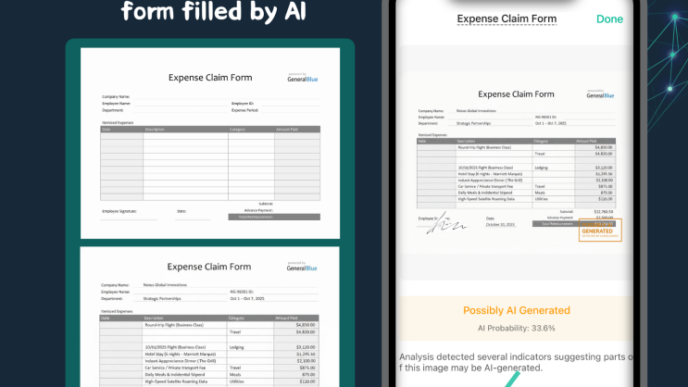

Oyeniyi is deliberate in reminding readers that artificial intelligence must remain transparent and accountable. “Finance runs on trust,” he said. “If a system cannot explain how it reached a decision, it has no place in the boardroom.” His study warns that black-box algorithms, when left unchecked, can replicate systemic bias or produce flawed outcomes. The risk is not theoretical: in 2020, a leading European bank’s AI-based credit model was found to discriminate against certain loan applicants, prompting regulators to tighten disclosure rules. “AI is powerful, but without explainability, it becomes dangerous,” Oyeniyi noted. He advocates for regular model audits and bias checks as part of corporate governance. “Ethics must be built into the code,” he said. “You cannot separate technology from responsibility.”

The study’s findings also point to measurable business outcomes. In simulated tests across multinational finance operations, Oyeniyi’s models improved the accuracy of cash flow forecasts, reduced liquidity shortfalls, and enhanced portfolio risk assessment. “When models learn from experience, they outperform even the best intuition,” he explained. “Accuracy is not luck; it’s logic refined through data.” In manufacturing and retail trials, AI forecasting systems lowered inventory waste by up to 15 percent while improving cost planning. “AI doesn’t just predict numbers—it anticipates behavior,” he said.

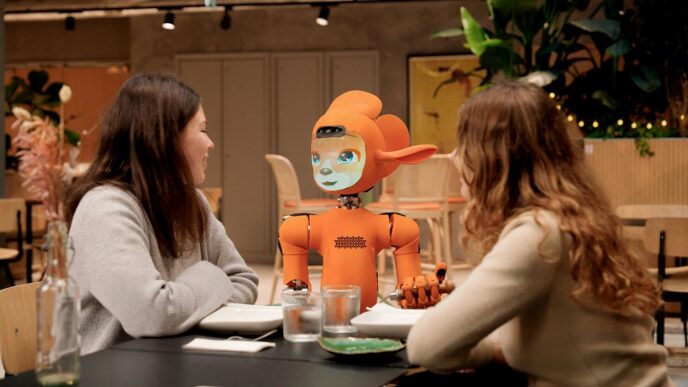

Oyeniyi’s perspective is grounded in practical realism. He often reminds executives that adoption is not a technical challenge but a cultural one. “Many leaders still fear losing control to machines,” he said. “But AI is not a rival. It’s a partner.” His research calls for financial teams to embrace continuous learning and collaboration between human insight and algorithmic intelligence. “The best results come when humans and machines share responsibility,” he explained. “Let the model calculate the risk, and let the manager decide what the risk means.”

He also highlights policy and regulatory implications. “AI in finance needs oversight as much as innovation,” he said. Regulators, he argues, must adapt faster than the systems they monitor. “We cannot have 21st-century algorithms operating under 20th-century laws,” he remarked. His proposed solution combines blockchain technology with AI to improve auditability and data traceability. “Blockchain gives AI memory,” he explained. “It records every decision, every change, every error. That’s how you build accountability into intelligence.”

In his research and interviews, Oyeniyi repeatedly emphasizes that AI’s role extends beyond profit optimization. “A good financial decision should also be a responsible one,” he said. “AI allows us to measure financial performance and environmental impact at the same time.” His models integrate ESG (Environmental, Social, and Governance) data with financial metrics, allowing organizations to assess long-term sustainability alongside quarterly returns. He added, “If your model ignores social and environmental costs, it’s not forecasting—it’s fiction.”

The study also tackles the urgent need for upskilling within finance teams. A 2022 KPMG report found that 72 percent of finance professionals lack the technical knowledge to interpret AI outputs confidently. Oyeniyi considers this a barrier that must be dismantled through education. “The future CFO will need to speak both accounting and code,” he said. “Without digital literacy, you’re managing blind.” He advocates for blended finance-data training in corporations, ensuring that decision-makers understand both the models and their limitations. “AI makes no sense if managers don’t know how to question it,” he explained.

Oyeniyi’s work has drawn significant international attention for its practicality and ethical grounding. Analysts in the UK, Europe, and Nigeria cite his framework as a credible blueprint for transitioning from static financial management to dynamic decision intelligence. He remains humble about the growing recognition. “The goal was never to publish a paper,” he said. “It was to solve a problem that affects every company—uncertainty.” Since its release, the study has been referenced by consulting firms such as PwC and EY, and discussed at business intelligence conferences in Lagos, London, and Berlin. His research aligns with global data showing that 75 percent of corporate strategy failures stem from inaccurate forecasting and poor data interpretation, according to a 2022 Gartner analysis.

In reflecting on his work, Oyeniyi often distills complex systems into simple principles. “Data without judgment is chaos,” he said. “Judgment without data is blindness.” This balance defines his vision for the future of finance—where human reason and machine learning work hand in hand to achieve accuracy, foresight, and integrity. He views artificial intelligence not as a replacement for human thinking, but as its natural extension. “Machines see patterns,” he said. “Humans see meaning. Together, they make better decisions.”

At the core of his philosophy lies an insistence on accountability. “AI is not about predicting profits,” he said. “It’s about predicting possibilities.” That idea captures both the ethical and strategic depth of his research. His belief that technology must serve fairness as well as efficiency sets his work apart in a field often dominated by profit-first innovation. “We don’t need faster finance,” Oyeniyi concluded. “We need smarter finance—finance that learns, explains, and earns trust.”

Lawrence Damilare Oyeniyi’s recent study has become a reference point for how artificial intelligence can rebuild confidence in corporate decision-making. It combines academic rigor with practical impact, offering a clear framework for the next era of financial leadership. His message remains steady and urgent: the future of finance will belong to those who understand not only the numbers but the intelligence behind them.