Artificial Intelligence (AI) is reshaping the financial technology landscape, driving innovation and efficiency across various sectors. From enhancing security measures to personalizing customer experiences, AI’s integration into fintech is not just a trend but a transformative force that is redefining how financial services operate.

Key Takeaways

- AI enhances operational efficiency and security in fintech.

- 70% of finance professionals utilize AI for recruitment processes.

- AI-driven solutions improve customer personalization and fraud detection.

The Role of AI in Fraud Detection

AI technologies are revolutionizing fraud detection in financial transactions. By employing machine learning algorithms, financial institutions can analyze vast amounts of transaction data in real-time, identifying anomalies and potential fraud attempts almost instantaneously.

- Real-Time Analysis: AI processes data swiftly, allowing for immediate detection of suspicious activities.

- Pattern Recognition: Advanced algorithms can identify complex patterns that traditional methods might miss, significantly reducing false positives.

Personalizing Financial Services

AI is also pivotal in personalizing financial services, tailoring experiences to individual customer needs. By analyzing user data such as spending habits and financial goals, AI can provide customized banking advice and investment solutions.

- Robo-Advisors: These AI-powered tools automate financial planning, making professional advice accessible to a broader audience.

- Tailored Investment Solutions: AI assesses risk tolerance and personal goals to create optimized investment portfolios.

Algorithmic Trading and Market Efficiency

In the realm of trading, AI enhances market efficiency through algorithmic trading. By analyzing extensive datasets, AI can identify trading opportunities and execute trades with precision.

- Data Processing: AI analyzes real-time market data to provide insights that inform trading strategies.

- Stock Trend Forecasting: Deep learning models predict stock trends, aiding traders in making informed decisions.

Streamlining Regulatory Compliance

AI is streamlining regulatory compliance through RegTech solutions. By automating data management and reporting, financial institutions can enhance accuracy and reduce costs associated with compliance.

- Automated Compliance: AI tracks regulatory changes and automates necessary updates, ensuring institutions remain compliant with minimal effort.

- Risk Management: Predictive analytics powered by AI helps in assessing risks more effectively.

Challenges and Ethical Considerations

Despite its benefits, the integration of AI in fintech comes with challenges, particularly concerning data privacy and algorithmic bias.

- Data Privacy: The reliance on large datasets necessitates stringent data protection measures to maintain customer trust.

- Bias Mitigation: Continuous monitoring of AI algorithms is essential to prevent the perpetuation of biases in lending and other financial services.

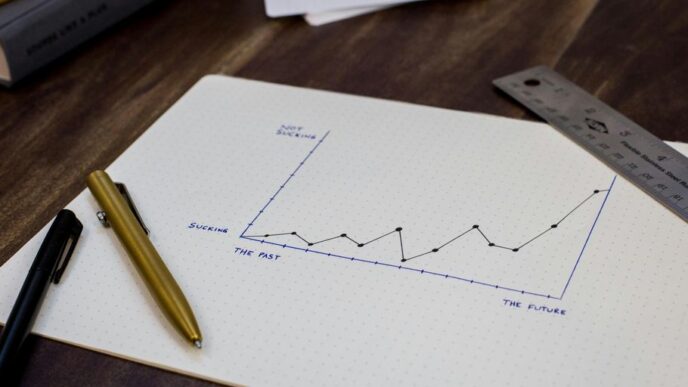

The Future of AI in Fintech

Looking ahead, the potential of AI in fintech is vast. Emerging technologies such as blockchain and quantum computing are set to further enhance security and efficiency in financial services.

- Financial Inclusion: AI is paving the way for alternative credit scoring methods, broadening access to financial services for underserved populations.

- Continuous Innovation: The ongoing evolution of AI technologies promises to unlock new opportunities in product development and market analysis.

In conclusion, AI is not just transforming fintech; it is redefining the entire financial landscape. As the industry continues to embrace these advanced technologies, the focus must remain on responsible implementation to ensure sustainable growth and inclusivity in financial services.