Right then, let’s have a look at what’s been happening with AI startup funding news. It seems like 2026 is shaping up to be quite a year, building on the momentum from last year. We’ve seen some big numbers, and it looks like the trend of massive investment is continuing. But it’s not all straightforward; there are a few things to keep an eye on, like where all this money is going and what it means for companies trying to go public. We’ll break down the main points so you know what’s what.

Key Takeaways

- The IPO market is looking stronger, with more companies, especially those with AI connections, expected to go public. However, the window for these listings can change quickly.

- Mega-rounds, where companies raise $100 million or more, are becoming common in the AI startup scene, with significant amounts of capital flowing into a few key players.

- Certain sectors, like physical AI, autonomous systems, and AI infrastructure, are attracting a lot of investment, while others might see less attention.

- Mergers and acquisitions are on the rise, as bigger companies look to buy talent and technology, and older startups seek ways to exit.

- There’s a growing focus on AI that can be explained and is safe, alongside advancements in voice AI and its use in health technology, with cybersecurity also seeing a funding boost thanks to AI.

AI Startup Funding News: A Robust Year Ahead

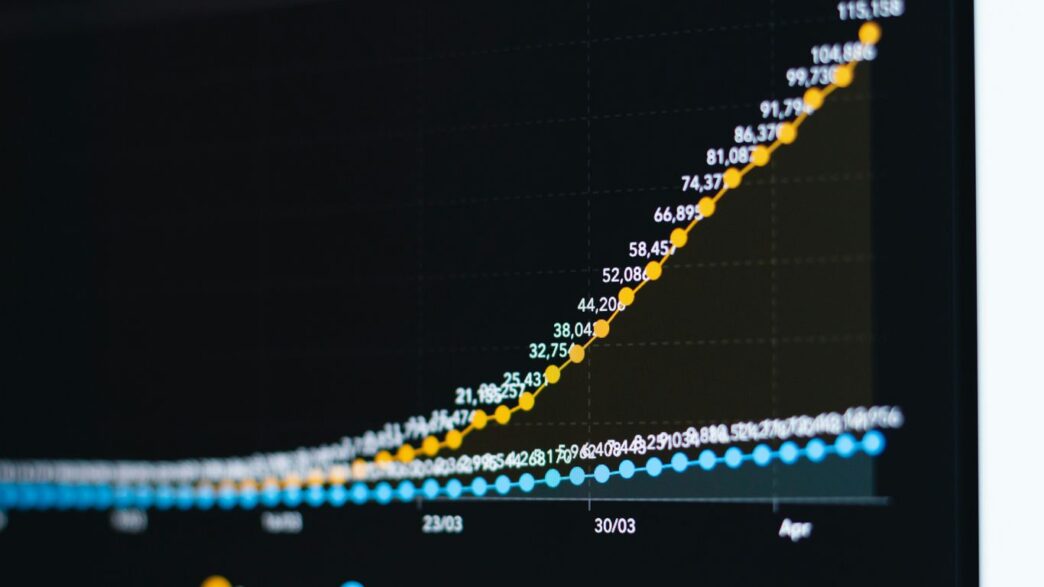

Global Venture Funding Trends for 2026

It looks like 2026 is shaping up to be a really strong year for startup investment, building on the momentum from last year. We saw the third-best year on record for global venture funding in 2025, only beaten by the absolute peaks of 2021 and 2022. This positive trend seems set to continue, with many industry insiders expecting another solid year for funding, acquisitions, and companies going public. It’s not all smooth sailing though; there’s a growing worry about where all this money is going. A lot of venture capital is ending up with just a small group of companies, many of which are based in the San Francisco Bay Area. This concentration could have wider effects.

Investor Confidence and Market Expectations

Investor confidence appears to be on the rise again. After a bit of a cautious period, the market is showing renewed enthusiasm, especially for companies with a clear AI angle or a solid plan for how AI will boost their business. This optimism is reflected in the types of companies attracting attention and the size of the rounds being closed. We’re seeing a lot of interest in firms that can demonstrate a clear path to profitability or have a compelling narrative around future growth, often powered by AI advancements.

The general feeling is that while the market can be unpredictable, the underlying drive for innovation in AI is creating significant opportunities for well-positioned startups. This is leading to a more active investment landscape than many anticipated.

Capital Concentration Concerns

One of the main talking points this year is the increasing concentration of capital. It’s becoming noticeable that a large chunk of venture funding is flowing into a relatively small number of companies. This isn’t necessarily a bad thing for those specific companies, but it does raise questions about the broader ecosystem and whether smaller or newer startups will find it harder to secure funding. This trend is particularly evident in the AI sector, where the potential for massive returns can draw significant investment.

Here’s a snapshot of how some of these mega-rounds are shaping up:

| Company | Funding Amount | Stage | Announcement Date | Valuation |

|---|---|---|---|---|

| Anthropic | $30 Billion | Series G | February 12 | $380 Billion |

| ElevenLabs | $500 Million | Series D | February 4 | $11 Billion |

| Runway | $315 Million | Series E | February 10 | $5.3 Billion |

| Goodfire | $150 Million | Series B | February 5 | $1.25 Billion |

| Fundamental | $255 Million | Series A | February 5 | $1.4 Billion |

| Simile | $100 Million | Series A | February 12 | N/A |

The Resurgent IPO Market in 2026

AI Companies Eyeing Public Listings

After a bit of a quiet spell, the stock market is starting to look more inviting for tech companies again. Last year, we saw a noticeable jump in the number of companies going public, especially those with a strong AI angle. It seems investors are keen to get in on the ground floor of the next big AI innovation. This renewed interest means that many AI startups, which might have put their public listing plans on hold, are now dusting them off and preparing for an IPO. It’s not just about having a good idea anymore; companies need to show a clear path to profitability and how AI will genuinely boost their business. Think of it as a more mature market, where solid business fundamentals are just as important as cutting-edge tech.

Here’s what’s making the IPO window feel more open:

- Increased Investor Appetite: There’s a growing demand for tech stocks, particularly those involved in AI, which is seen as a major growth area.

- Stronger Financial Performance: Companies that can demonstrate consistent revenue and a clear strategy for scaling are finding more favour.

- Market Maturation: The overall market seems more stable, making it a better environment for new companies to enter.

The shift towards AI has really changed the game. Companies that can clearly articulate their AI strategy and its impact on their bottom line are the ones attracting the most attention from potential public investors. It’s a sign that the market is looking for tangible results, not just future promises.

Fintech Unicorns and IPO Prospects

Fintech has always been a hot sector, and it’s no different in 2026. Many of these financial technology companies, often referred to as ‘unicorns’ due to their high valuations, are now looking at the public markets as their next step. They’ve spent years building impressive platforms and customer bases, and now they’re ready to cash in. Companies like Plaid and Revolut are frequently mentioned as potential candidates for a public offering this year. Their success could pave the way for others in the fintech space.

Navigating the IPO Window’s Volatility

While the outlook for IPOs is generally positive, it’s important to remember that the market can be unpredictable. The ‘IPO window’, as it’s often called, can open and close quite rapidly. A few high-profile, successful listings can create a wave of confidence, encouraging more companies to go public. However, if market conditions change, or if a few new public companies don’t perform as expected, that window can slam shut just as quickly. This means companies need to be prepared to act decisively when the time is right, as opportunities might not last long. It’s a bit like trying to catch a train – you need to be at the station when it arrives, because it might not wait around for long.

Mega-Rounds Dominate AI Startup Funding News

Early 2026 Mega-Round Activity

It’s barely two months into 2026, and we’re already seeing a flood of massive funding rounds in the AI space. We’re talking about companies pulling in hundreds of millions, sometimes billions, of dollars. It really feels like the pace set in 2025, where US AI startups alone raked in over $76 billion through these huge deals, is not just continuing but perhaps even accelerating. It’s a bit wild to think about, honestly. This early surge suggests investors are still very keen on AI, maybe even more so than before. It’s a clear sign that the big money is flowing, and it’s flowing fast, into a select few companies that are seen as leaders in the field. We’ve seen nearly 20 US-based AI startups secure funding rounds of $100 million or more already this year. This concentration of capital is something to watch.

Record-Breaking Funding Rounds in AI

This year has already produced some truly eye-watering funding rounds. We’re seeing companies announce deals that were almost unthinkable just a few years ago. For instance, Anthropic’s recent Series G round, a staggering $30 billion, has put them in the history books as the second-largest venture deal ever. This kind of capital injection is not just about growth; it’s about solidifying market dominance and pushing the boundaries of what’s possible in AI research and development. It’s not just the very top players either; companies like Runway, a media-generation platform, have secured $315 million, and voice AI specialist ElevenLabs brought in $500 million. These aren’t small sums by any stretch of the imagination.

Here’s a snapshot of some of the big hitters so far:

- Anthropic: $30 billion Series G

- ElevenLabs: $500 million Series D

- Runway: $315 million Series E

- Fundamental: $255 million Series A

- Goodfire: $150 million Series B

Valuations in the AI Startup Landscape

With these mega-rounds comes a significant increase in company valuations. It’s becoming common to see AI startups valued in the billions, even at very early stages. This trend is partly driven by intense competition among investors and the perceived potential for AI to reshape entire industries. However, it also raises questions about sustainability and whether these valuations are grounded in realistic market potential or a speculative bubble. The sheer amount of capital being poured into AI research labs and infrastructure providers is unprecedented, with some frontier AI labs now valued on par with nation-sized economies. It’s a dynamic and, frankly, a bit dizzying landscape to follow, especially for those looking to invest or even just understand the market. The focus seems to be on companies with strong foundational models or those building critical infrastructure, as seen with the significant investment in AI infrastructure and energy demands.

The concentration of funding into a few dominant players and the sky-high valuations suggest a market that is both incredibly dynamic and potentially volatile. Investors are betting big on AI’s future, but the long-term economic viability of some of these valuations remains to be seen.

Key Sectors Attracting Significant Investment

Physical AI and Autonomous Systems

This year, we’re seeing a real surge in investment for AI that interacts with the physical world. Think robotics, drones, and self-driving systems. It’s not just about software anymore; investors are keen on AI that can actually do things in the real world. This area is getting a lot of attention because it promises to change how we manufacture goods, move things around, and even how we live day-to-day. The potential for efficiency gains and new services is massive.

- Robotics: From advanced manufacturing arms to warehouse automation.

- Autonomous Vehicles: Progress continues in self-driving cars, trucks, and delivery bots.

- Drones: Expanding applications in logistics, inspection, and agriculture.

The push towards physical AI is driven by a desire for tangible results and a recognition that true AI integration involves more than just digital processes. It’s about creating systems that can perceive, reason, and act within our physical environment, leading to significant productivity boosts and novel solutions across industries.

Frontier AI Labs and Record Valuations

Some of the biggest headlines in AI funding are coming from the ‘frontier’ AI labs – those pushing the boundaries of what AI can do, often with large language models and generative AI. These companies are attracting enormous sums of money, leading to some eye-watering valuations. It seems investors are betting big on the next generation of AI capabilities, even if the exact applications are still being figured out. The sheer scale of investment here is a testament to the perceived future impact of these advanced AI models.

AI Infrastructure and Energy Demands

It’s becoming increasingly clear that all this advanced AI needs a serious amount of power and the right infrastructure to run on. Consequently, there’s a growing focus on companies providing the backbone for AI development and deployment. This includes everything from specialised chips and data centres to, perhaps surprisingly, energy solutions. The energy demands of training and running large AI models are substantial, making energy infrastructure and efficiency a hot topic for investors looking to support the AI revolution at its most fundamental level.

Mergers, Acquisitions, and Strategic Deals

It’s been a busy time for companies looking to buy or be bought in the AI space this year. We’re seeing a definite uptick in mergers and acquisitions, and it’s not just about grabbing the latest tech. A lot of it comes down to talent and strategic positioning.

Increased M&A Activity in 2026

This year, the trend of larger companies acquiring smaller AI startups is really picking up steam. It’s a smart move for these big players to bring in fresh ideas and skilled teams without having to build everything from scratch. We’ve seen around 2,300 deals involving venture-backed startups last year, and the word on the street is that this pace is set to continue, maybe even speed up a bit.

The dual-track strategy, where companies prepare for both an IPO and a potential sale simultaneously, is becoming more common. This gives sellers more options and can lead to better deal terms.

AI Acqui-Hires and Talent Acquisition

One of the biggest drivers for these acquisitions is the hunt for talent. It’s no secret that finding experienced AI engineers and researchers is tough. So, instead of a long, drawn-out hiring process, some big corporations are opting to buy smaller companies that already have these teams. These ‘acqui-hires’ are often for teams of fewer than 100 people, but the exits can be quite substantial, sometimes over $100 million. It’s a quick way to get specialised skills on board.

Here’s a look at some recent activity:

- Lawhive: This UK-based company, which uses a mix of human lawyers and AI for legal services, secured $60 million in Series B funding. A significant portion of this is earmarked for expanding into the US market, showing confidence in their hybrid model’s scalability.

- Varaha: Focusing on nature-based carbon removal, Varaha raised $20 million. Their AI is used to verify carbon sequestration from satellite data, a key component for high-integrity carbon credits, especially as the Asia-Pacific market grows.

- Accrual: This AI-native accounting automation firm for banks and lenders picked up $75 million. They’re aiming to modernise an area that’s often stuck with older systems, highlighting the demand for AI in financial services.

Exit Opportunities for Stalled Unicorns

Beyond talent grabs, there’s another group of companies looking for exits: the ‘stalled unicorns’. These are startups that reached a billion-dollar valuation a few years back, perhaps during the funding boom, but haven’t managed to go public. With the IPO market showing signs of life but still a bit unpredictable, many of these companies are now actively seeking acquisition offers. It’s a way for their early investors to get a return on their investment, even if it’s not through a public listing. This situation is creating more opportunities for potential buyers who are looking to acquire established, albeit private, AI businesses.

Emerging Trends in AI Investment

It feels like every week there’s a new headline about AI, and the investment world is certainly paying attention. Beyond the mega-rounds and the established players, some really interesting shifts are happening in where the money is flowing. It’s not just about building bigger models anymore; it’s about making AI more practical, understandable, and secure.

AI Interpretability and Safety Gains Traction

This is a big one. As AI systems become more complex and integrated into critical areas, people are rightly asking: ‘How does it work?’ and ‘Can we trust it?’. This growing demand for transparency is pushing investment into companies focused on AI interpretability and safety. Think about it – if a company is using AI for medical diagnoses or financial advice, they need to know why the AI made that decision. Regulators are also starting to pay attention, which is a huge driver for this trend. We’re seeing more funding go towards tools and platforms that can explain AI’s decision-making process and ensure it operates safely and ethically.

- Auditable AI: Tools that allow businesses to track and understand AI outputs.

- Bias Detection: Systems designed to identify and mitigate unfair biases in AI models.

- Robustness Testing: Development of methods to ensure AI systems perform reliably under various conditions.

The push for AI that can be understood and trusted is moving from a niche academic concern to a mainstream business requirement. This shift is being accelerated by the increasing complexity of AI applications and the growing awareness of potential risks.

Voice AI and HealthTech Innovation

Voice AI is quietly becoming a much bigger deal. It’s moving beyond simple commands to more sophisticated interactions, powering everything from customer service bots to personal assistants. In parallel, HealthTech is seeing a surge, especially in areas where AI can tackle high-cost, high-pain points. Imagine AI helping to streamline hospital administration, improve diagnostic accuracy, or even personalise patient care plans. The combination of voice interfaces and AI-powered health solutions is creating a fertile ground for innovation and investment.

Cybersecurity Funding Boosted by AI

It might seem counterintuitive, but as AI gets more powerful, so does the need for robust cybersecurity. AI can be used to detect threats more effectively, but it can also be used by malicious actors. This arms race is driving significant investment into cybersecurity firms that are developing AI-native defence mechanisms. Companies are looking for solutions that can not only identify current threats but also predict and prevent future ones, making AI-driven cybersecurity a hot area for venture capital right now.

The Impact of AI on the Workforce

AI-Driven Tech Layoffs

It’s becoming pretty clear that AI is changing the job market, and not always in ways that feel good for workers. We’ve seen a noticeable trend of companies, especially in the tech sector, cutting staff. Some reports suggest that around 55,000 jobs in the US were affected last year, with AI being a big reason. Companies like Salesforce have openly talked about needing fewer people for customer service roles because AI can handle a lot of that work now. This isn’t just a one-off; it looks like more companies will be looking at AI as a way to cut costs and, frankly, replace some of the jobs people used to do.

Shifting Workforce Needs

This whole AI shift means the skills people need are changing too. It’s not just about jobs disappearing; it’s about the kind of work that’s left and what’s needed to do it. Think about it: if AI is taking over repetitive tasks, then the jobs that remain will likely require more complex problem-solving, creativity, and skills that AI can’t easily replicate. This could mean a big push for training and education in new areas. We might see more demand for people who can work with AI, managing it, developing it, or using its outputs in new ways. It’s a bit of a reshuffle, really.

AI as a Substitute for Human Roles

Let’s be honest, AI is getting good at doing things that people used to do. From customer support to writing basic reports, AI can step in. This isn’t just about efficiency; it’s about economics for businesses. If an AI can do a job cheaper and faster than a person, companies will consider it. This raises some big questions about the future of work and what roles will be left for humans. It’s a complex picture, and figuring out how we all fit into this new landscape is going to be a major challenge for everyone involved.

The rapid integration of AI into business operations is prompting a significant re-evaluation of human roles. While AI excels at automating routine tasks and processing vast amounts of data, the demand for uniquely human skills such as critical thinking, emotional intelligence, and complex strategic planning is likely to grow. Adapting to this evolving landscape will require a proactive approach to skill development and a thoughtful consideration of how humans and AI can best collaborate.

Looking Ahead: What 2026 Holds for AI Startups

So, what does all this mean for AI startups as we move through 2026? It looks like the big money is still flowing, especially into companies that are really pushing the boundaries with artificial intelligence. We’ve seen some massive funding rounds already, and it seems like the trend of large investments isn’t slowing down. While some sectors might see less attention, AI and related fields like robotics are definitely getting a lot of investor focus. It’s going to be interesting to see which companies manage to grab the biggest pieces of the pie and how the market continues to change. Keep an eye on this space, because it’s certainly not standing still.

Frequently Asked Questions

What’s the general outlook for AI startup funding in 2026?

Experts believe 2026 will be a strong year for AI startup funding, continuing the positive trends seen in previous years. We’re expecting a lot of investment, with some companies getting very large amounts of money.

Are many AI companies planning to go public in 2026?

Yes, the stock market (IPO market) is expected to be lively for AI companies in 2026. Several well-known AI firms and fintech companies are looking to sell shares to the public, though the market can change quickly.

What are ‘mega-rounds’ in AI startup funding?

Mega-rounds are very large funding deals, usually $100 million or more. Many AI startups are raising these huge amounts, showing that investors are putting a lot of money into promising AI businesses.

Which types of AI are getting the most investment?

AI that works in the real world, like self-driving cars and robots (physical AI), is attracting a lot of attention. Also, big AI research labs and the technology needed to run AI (like computer power and energy) are seeing significant investment.

Are companies buying up other AI startups more often in 2026?

Yes, we’re seeing more companies buying other startups, sometimes just to get their talented employees (acqui-hires). Also, older startups that couldn’t go public are now being bought.

What new AI trends are attracting money?

Investors are increasingly interested in AI that can be explained and is safe to use. Also, AI that understands voice and AI used in healthcare are growing areas. Cybersecurity companies using AI are also getting more funding.