So, you’re looking into cryptocurrency exchanges volume, huh? It’s kind of like checking how busy a store is. More people buying and selling means things are happening, and you can usually get what you want without too much fuss. This article is going to break down why all that trading activity matters, who the big players are, and how you can start looking at the numbers yourself. We’ll also touch on some of the tricky parts, like fake numbers and what the future might hold.

Key Takeaways

- Understanding cryptocurrency exchanges volume is key because it shows how active a platform is and how easy it is to trade. High volume usually means more buyers and sellers, making trades smoother.

- A few big exchanges handle most of the trading. While this makes them important hubs, it also means problems on one of them could affect the whole market.

- Volume isn’t just about how much is traded; it also gives clues about what people are thinking. Big volume when prices go up suggests people are confident, but big volume when prices fall means sellers are taking over.

- There are simple ways to look at volume, like using moving averages or checking volume when prices move up versus down, to get a better idea of what’s really going on.

- Be careful, as some trading volume might be faked. Looking at multiple sources and understanding how volume and price usually move together can help you spot this and make smarter choices.

Understanding Cryptocurrency Exchanges Volume

Alright, let’s talk about trading volume on crypto exchanges. It’s basically the total amount of a specific cryptocurrency that’s been bought and sold over a certain period, usually 24 hours. Think of it like the number of people actively trading a stock. High volume means lots of activity, and low volume means things are pretty quiet.

Why Crypto Exchange Volume Matters

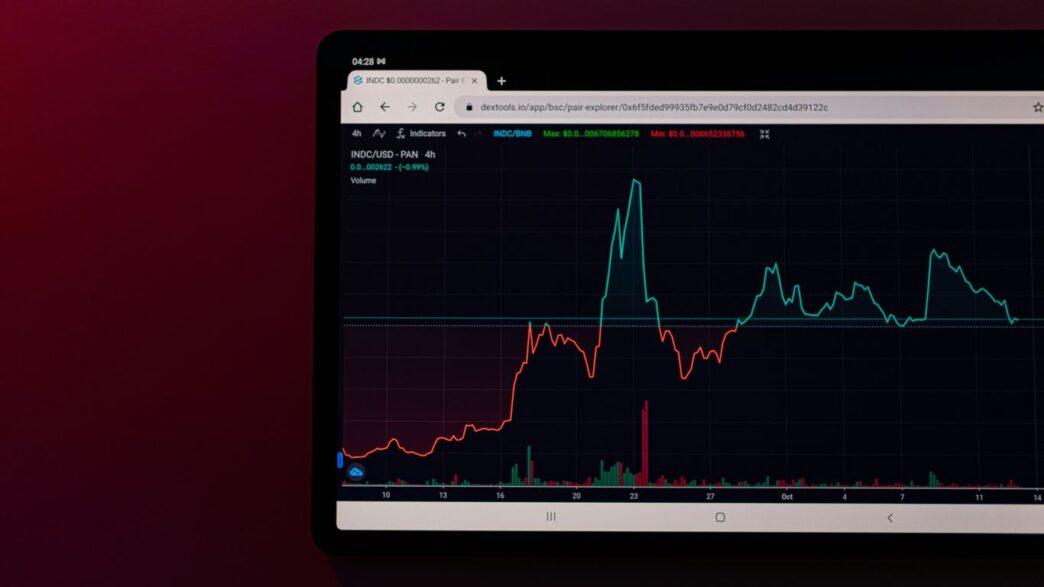

So, why should you even care about this number? Well, volume is a pretty good indicator of how much interest there is in a particular coin or the market in general. When prices are moving, high volume often confirms that movement. For example, if Bitcoin’s price is shooting up and the trading volume is also high, it suggests that a lot of people are buying in, and the trend might continue. On the flip side, if a price is dropping with low volume, it might not be a big deal. But if the price is falling and volume spikes, that’s a sign that a lot of people are selling, and the price could keep dropping. It helps us understand if a price move is genuine or just a blip. You can often find this data on sites like Yahoo Finance.

Interpreting Volume Across Different Exchanges

It’s not just about the total volume; where that volume happens matters too. Different exchanges have different user bases and attract different types of traders. A coin might be super popular on one exchange but barely traded on another. This can happen for all sorts of reasons, like fees, the availability of certain trading pairs, or even just regional popularity. Comparing volume across various platforms can give you a clearer picture of the overall market sentiment and might even reveal opportunities for savvy traders looking to exploit price differences between exchanges.

Volume as an Indicator of Market Sentiment

Ultimately, volume is a way to gauge how people are feeling about the market. When prices are going up and volume is increasing, that’s generally a bullish sign – people are confident. But if prices are falling and volume is high, that’s usually bearish, meaning people are worried and selling off. It’s like reading the crowd’s mood. A consistent, high volume over time can also suggest that a cryptocurrency is gaining wider acceptance and becoming a more established asset. It’s a simple metric, but it tells a story about what traders are thinking and doing.

Key Players in Exchange Volume

When we talk about cryptocurrency trading, a few big names tend to pop up again and again. These are the exchanges that handle the lion’s share of the trading action, and understanding who they are is pretty important for getting a handle on the market.

The Dominance of a Few Key Platforms

It’s no secret that a handful of exchanges really run the show when it comes to trading volume. Think of platforms like Binance, MEXC, and Gate. These giants often process billions of dollars in trades every single day. This concentration means that a lot of the market’s liquidity, or how easily you can buy or sell an asset without messing up the price, is tied up in these few places. It’s kind of like having all the major supermarkets in just a couple of big chains; if something goes wrong with one of them, it affects a lot of people.

Here’s a look at some of the top exchanges by market share, which is basically determined by their total monthly trading volume:

| Exchange | Market Share (Approx.) |

|---|---|

| Binance | 45% |

| MEXC | 10% |

| Gate.io | 8% |

| Bitget | 7% |

| Bybit | 6% |

Note: Market share figures are illustrative and can fluctuate.

Factors Influencing Exchange Volume

So, why do some exchanges get so much more action than others? It’s not just one thing. For starters, where an exchange is based and what rules it follows matters a lot. Exchanges that are properly licensed and follow strict regulations can attract bigger players, like institutional investors, who need that security. Then there are the fees. If an exchange has lower trading fees, it’s naturally going to be more appealing to active traders. But it’s not all about price; people also care about how secure the platform is and what features it offers. A good balance is key to keeping traders happy and coming back.

- Regulatory Environment: Exchanges operating in well-regulated jurisdictions often see higher institutional interest.

- Fee Structures: Competitive trading fees can draw in high-frequency traders.

- Platform Features: User-friendly interfaces, advanced trading tools, and a wide range of available assets attract a broader user base.

- Security Measures: Robust security protocols build trust and encourage users to deposit and trade larger sums.

Niche Exchanges and Their Contribution

While the big players get most of the attention, we shouldn’t forget about the smaller, specialized exchanges. These platforms often cater to very specific needs. Maybe an exchange focuses only on certain types of altcoins, or perhaps it offers unique trading options like high-leverage futures. Some might be the go-to place for trading tokens related to decentralized finance (DeFi) or non-fungible tokens (NFTs). These niche spots can be really important for new cryptocurrencies. They provide a place for these newer assets to gain traction and build initial liquidity, which is a stepping stone to wider adoption. It’s good to keep an eye on these smaller exchanges because that’s often where the next big thing might start. You can find more about how market share is calculated on centralized cryptocurrency exchanges.

Volume’s Impact on Market Dynamics

Trading volume is more than just a number; it’s a real force that shapes how the whole crypto market behaves. It affects how easily you can buy or sell stuff, how much prices jump around, and even what people are thinking about the market.

Volume and Liquidity: A Symbiotic Relationship

Think of liquidity like a busy marketplace. When there’s a lot of trading volume, it means tons of people are buying and selling. This makes it easy to get in and out of trades without messing up the price too much. It’s like a smooth highway for your transactions. On the flip side, low volume means fewer people are trading. This can make prices jump around a lot with just a small order, and you might end up paying more or getting less than you expected when you finally make a trade. This is called slippage, and it’s a pain.

Here’s a quick look at how volume affects liquidity:

- High Volume: More buyers and sellers, easier to trade, less price impact, lower transaction costs.

- Low Volume: Fewer buyers and sellers, harder to trade, bigger price swings, higher slippage risk.

- Consistent High Volume: Often means a healthy, stable market where trades happen quickly and predictably.

Volatility and Volume: A Complex Dance

It’s not always true that more volume means more price swings. Sometimes, high volume during a steady price climb just shows that lots of people are confident and buying. It can actually make the trend stronger and more stable. But, if you see a huge spike in volume at the same time prices are dropping fast, that’s usually a sign of panic selling and things getting wild. So, you really need to look at the price movement alongside the volume to get the full picture.

Volume as a Sentiment Gauge

Volume can tell you a lot about what traders are feeling. If prices are going up and volume is also increasing, it’s a good sign that people are feeling optimistic and the trend is likely to continue. But if prices are falling and volume is high, that suggests a lot of selling pressure and bearish sentiment. Sometimes, you see a price increase on low volume, which might mean the upward move isn’t that strong and could reverse soon. It’s like listening to the market’s mood.

Methods for Analyzing Exchange Volume

Looking at raw trading numbers is just the start. To really get what’s happening, you need to use some specific tools and techniques. It’s like being a detective for market data, piecing together clues to see the bigger picture.

Simple Moving Averages for Volume Trends

One straightforward way to see trends is by using Simple Moving Averages (SMAs) for volume. Basically, you’re averaging out the volume over a set number of days – maybe 20, 50, or even 200 days. This smooths out the daily ups and downs, making it easier to spot the general direction. If the 20-day SMA is going up and prices are also climbing, that often means there’s good buying energy behind the move. On the flip side, if the SMA is dropping and prices are falling, it can confirm a downward trend. It’s a good way to catch shifts in momentum.

Volume Spread Analysis

This method looks at the relationship between volume and price changes. When prices are going up, is the volume high? That suggests strong buying interest. If prices are dropping and volume is also high, it points to a lot of selling. For example, if Bitcoin’s price jumps on big volume, it’s a sign that buyers are really pushing it. But if the price goes up on low volume, that move might not be as solid and could reverse.

On-Balance Volume (OBV) Interpretation

On-Balance Volume, or OBV, is another popular tool. It’s a running total of volume, adding volume on up days and subtracting it on down days. The idea is that volume precedes price. So, if OBV is trending upwards while the price is flat or even slightly down, it could be a sign that smart money is accumulating the asset, and a price increase might be coming. Conversely, if OBV is falling while prices are holding steady, it might suggest selling pressure is building up. Tracking OBV can give you a heads-up on potential price movements before they fully materialize.

Here’s a quick look at how these might play out:

- Rising SMA + Rising Price: Bullish momentum likely building.

- Falling SMA + Falling Price: Bearish trend likely continuing.

- High Volume on Price Rises: Strong buyer conviction.

- High Volume on Price Falls: Strong seller conviction.

- Rising OBV (even with flat price): Potential accumulation, possible future price rise.

- Falling OBV (even with flat price): Potential distribution, possible future price fall.

Risks and Future of Volume Tracking

So, we’ve talked a lot about how volume is super useful for understanding what’s going on in crypto. But, like anything in this space, it’s not all sunshine and rainbows. There are some pretty big pitfalls to watch out for, especially when you’re looking at trading volumes.

The Dangers of Fake Volume

This is a big one. Some exchanges, or even shady groups, might try to make their trading volumes look way bigger than they actually are. They do this through something called ‘wash trading,’ where they basically trade with themselves back and forth. It creates a bunch of fake activity, making it look like there’s way more interest in a coin or token than there really is. This can trick new investors into thinking a coin is popular and about to take off, only for the price to crash when the manipulation is revealed. It messes with all the charts and indicators you might be using, too, making your analysis totally off. It’s why comparing volume across different places is a good idea, and keeping an eye out for weird spikes without any real price movement is smart.

Future of Exchange Volume Tracking

Okay, so the world of crypto never stands still, and neither does how we track volume. Things are getting way more sophisticated. We’re seeing a big push for more openness and standard ways of reporting volume. Right now, it’s kind of a mess, with different exchanges reporting numbers that don’t always match up. That makes it hard to compare apples to apples. But the goal is to get to a point where the data is more reliable, so we can actually trust it for making decisions. It’s all about getting a clearer picture of what’s really happening in the market, not just what someone wants us to see. This move towards better data is happening globally, with countries like India and the United States leading the charge in crypto adoption and analysis [a35c].

Enhanced Data Transparency and Aggregation

Building on that, the future is all about making volume data more transparent and easier to put together. Imagine being able to see all the volume from every major exchange in one place, all standardized. That would be a game-changer for analysis. It means we can get a much better sense of the true market depth and liquidity for any given asset. This aggregation will help cut through the noise and focus on genuine trading activity. It’s about making sure that when you look at volume, you’re seeing the real deal, not just a carefully crafted illusion.

Here’s a quick look at what we can expect:

- Standardized Reporting: Exchanges will likely adopt common methods for reporting volume, reducing discrepancies.

- Cross-Exchange Aggregation: Tools will emerge to combine volume data from multiple platforms into a single, usable view.

- Real-Time Auditing: More sophisticated methods might be developed to flag potentially fake volume in real-time.

- Decentralized Data Sources: We might see volume data coming from decentralized sources, making it harder to manipulate.

Advanced Volume Analysis Techniques

So, we’ve talked about the basics of volume, but what about taking things up a notch? That’s where advanced techniques come in. These methods help us dig deeper than just looking at the numbers on a chart.

AI and Machine Learning for Volume Analysis

This is where things get really interesting. Artificial intelligence and machine learning are starting to change how we look at trading volume. Think about it: these systems can sift through mountains of data way faster than any human ever could. They’re getting pretty good at spotting patterns that we might miss, like those sneaky wash trading schemes where fake volume is pumped up to make a coin look more popular than it is. AI can help filter that out, giving us a clearer picture of what’s actually going on.

Plus, these smart systems can look at historical data and other market signals to try and predict what volume might do next. That’s some serious foresight for traders. They can even crunch data from social media and news to see if public sentiment matches the trading activity. It’s like having a super-powered assistant for market analysis.

Real-Time Volume Tracking and Visualization

Being able to see what’s happening with volume right now is a game-changer. Tools that track volume in real-time are getting way more sophisticated. Imagine seeing a sudden spike in trading volume for a specific coin – that could be a sign that something big is about to happen, like a price breakout. These instant alerts let traders react fast, maybe even catching a quick profit before anyone else notices.

Advanced visualization tools can also show you how volume is flowing between different exchanges. This can help spot opportunities for arbitrage (making small profits from price differences) and give you a better sense of the overall market’s health. It’s all about getting the most up-to-the-minute information possible to make smart moves.

Wrapping It Up

So, we’ve looked at how trading volume on crypto exchanges isn’t just a number; it tells a story. It shows us how active the market is, whether people are buying or selling, and even hints at what might happen next with prices. Keeping an eye on volume across different exchanges helps us see the bigger picture, spot opportunities, and understand which platforms are really the main players. It’s a bit like watching the ebb and flow of a busy port – you can tell a lot about trade just by looking at the ships coming and going. As the crypto world keeps changing, understanding these volume trends will only get more important for anyone trying to make sense of it all.

Frequently Asked Questions

What exactly is crypto trading volume?

Think of crypto trading volume like the number of people buying and selling something at a market. It’s the total amount of a digital coin that got traded on an exchange over a certain time, usually a day. More trading means more people are interested and active.

Why is trading volume important for crypto exchanges?

Volume tells us how busy an exchange is. High volume means lots of trades are happening, which usually makes it easier to buy or sell coins without changing the price too much. It also shows if people are really interested in certain coins or the market in general.

How does volume show if people are feeling good or bad about the market?

When prices go up and the volume is also high, it often means people are excited and confident about buying. But if prices are dropping and volume is high, it suggests many people are selling quickly, showing fear or worry.

Are all exchange volumes the same?

No, different exchanges have different volumes. Some big ones have way more trading than smaller ones. This is because of things like how many users they have, their fees, and if they are popular in certain countries. Comparing them gives a bigger picture.

Can trading volume be faked?

Sadly, yes. Some tricky people might make fake trades to make it look like a coin or exchange is more popular than it really is. This is called ‘wash trading.’ It’s important to be careful and look at volume from different places to make sure it’s real.

What’s new in tracking crypto volume?

People are getting smarter about tracking volume. They are using computers and smart programs (like AI) to spot fake trades better and predict future trends. They also want exchanges to be more open about their numbers so everyone can trust the data more.