So, Oracle Cloud. It’s been making some noise lately, hasn’t it? We’re looking at where Oracle stands in the whole cloud computing scene, especially as we get into 2025. It’s a big market, and Oracle is trying to grab its piece. We’ll check out how they’re doing against the big players, what’s driving their growth, and what the future might hold for their cloud services. It’s all about the oracle cloud market share, really.

Key Takeaways

- Oracle Cloud Infrastructure (OCI) is growing fast, with revenue up over 50% year-over-year, though it still holds a smaller piece of the overall cloud market compared to giants like AWS and Azure.

- Oracle is pushing hard into AI, embedding it into its cloud applications and building out its AI infrastructure, aiming to be a major player in AI services.

- The company is focusing on a multi-cloud strategy, making its services available on other cloud platforms to give customers more options and avoid being locked into one provider.

- In the enterprise applications space, Oracle has become the top ERP vendor by revenue, showing strength with offerings like Oracle Fusion Cloud ERP and NetSuite.

- While Oracle faces tough competition, its focus on integrated cloud solutions, AI, and specific industries like healthcare positions it for continued growth and a stronger market presence.

Oracle Cloud Market Share Dynamics

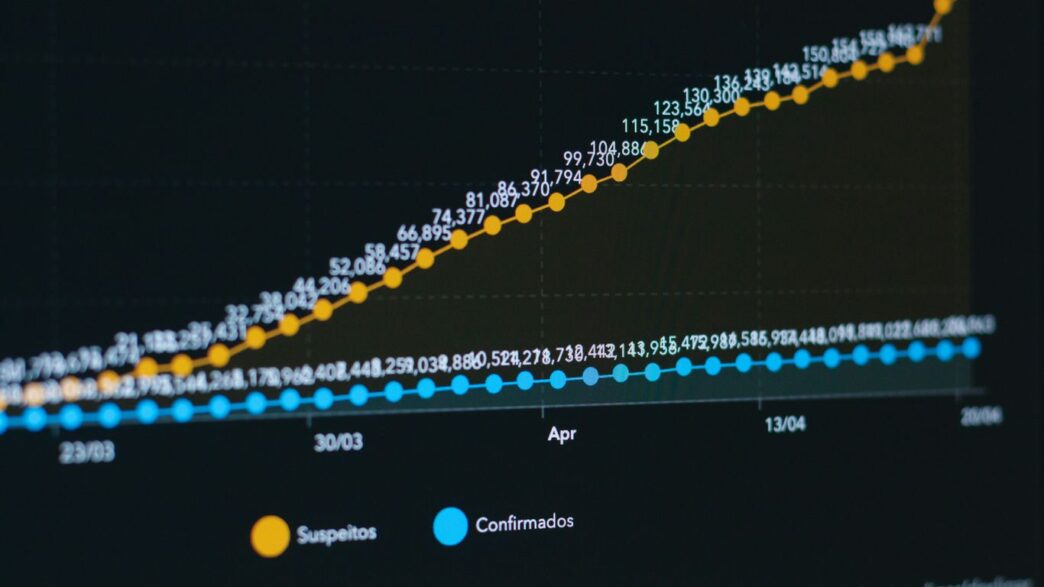

So, where does Oracle stand in the big cloud picture as of late 2025? It’s a bit of a mixed bag, honestly. While they’re not exactly duking it out with the top three hyperscalers for the biggest slice of the pie, Oracle Cloud Infrastructure (OCI) is definitely making some noise. They’re showing some really impressive growth numbers, which is pretty exciting to see.

Understanding Oracle Cloud Infrastructure (OCI) Position

Right now, OCI holds a smaller chunk of the global cloud infrastructure market, somewhere around 3%. That might sound tiny compared to giants like AWS or Azure, but don’t let the percentage fool you. The key thing here is the rate of growth. OCI has been growing faster than many expected, often seeing increases well over 20% year-over-year. This suggests they’re gaining traction, especially with businesses already invested in Oracle’s other software.

Key Growth Drivers for Oracle Cloud

What’s fueling this expansion? A few things stand out:

- Existing Customer Base: Many companies already use Oracle’s databases or enterprise applications. For them, moving to OCI feels like a natural next step, offering better integration and potentially simpler management.

- Enterprise Application Strength: Oracle has a strong reputation in areas like ERP and CRM. As businesses move these critical applications to the cloud, OCI is a natural fit.

- Performance and Cost: Oracle has been pushing OCI as a high-performance, cost-effective option, particularly for demanding workloads like databases and analytics.

- AI and High-Performance Computing: With the surge in AI, OCI’s focus on high-performance computing and specialized hardware is attracting new types of workloads.

Oracle’s Cloud Revenue Segmentation

When we look at Oracle’s cloud revenue, it’s not just about the infrastructure (IaaS). It’s a blend of different services. Their cloud revenue generally breaks down into a few main categories:

- Infrastructure as a Service (IaaS): This is the core OCI part, providing computing power, storage, and networking.

- Platform as a Service (PaaS): This includes services like databases, middleware, and development tools that run on OCI.

- Software as a Service (SaaS): This is where Oracle’s well-known enterprise applications like Fusion Cloud ERP, HCM, and NetSuite fit in. This segment is a huge part of their overall cloud success.

It’s this combination, especially the strong performance in SaaS applications, that really bolsters Oracle’s overall cloud presence, even if OCI itself is still growing into its market share. The company is aiming to become one of the world’s largest cloud infrastructure providers, and these growth rates certainly point towards that ambition [b721].

Competitive Landscape Analysis

Oracle isn’t playing in a quiet corner of the tech world; it’s right in the thick of it, facing off against some serious heavyweights. When we talk about cloud infrastructure, the big three hyperscalers – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) – are the usual suspects. They’ve got massive scale and a wide array of services that many businesses rely on. Oracle’s own Oracle Cloud Infrastructure (OCI) is making its play, often by focusing on performance for specific workloads and offering competitive pricing, especially for enterprise customers already invested in Oracle’s ecosystem.

Oracle Versus Hyperscale Cloud Providers

It’s a tough fight in the general cloud market. AWS still holds a significant chunk of the market share, around 29% as of Q3 2025, but it’s not the runaway leader it once was. Microsoft Azure is a strong contender, particularly appealing to businesses already deep in the Microsoft software world, thanks to its hybrid cloud capabilities. Google Cloud Platform (GCP) is carving out its niche, often highlighted for its strengths in data analytics and AI. Oracle’s strategy here seems to be about offering a different kind of value, aiming for high-performance computing and database services that are often integrated tightly with its other enterprise software. They’re not necessarily trying to be everything to everyone like the hyperscalers; instead, they’re focusing on areas where they believe they can win, like running Oracle databases at scale or providing robust infrastructure for their existing enterprise application customers.

Competition in Enterprise Applications

Beyond just the infrastructure, Oracle is also a giant in enterprise applications, especially with its Fusion Cloud ERP and HCM suites. Here, the competition gets even more crowded. SAP is a long-standing rival, particularly in the ERP space, with its own suite of cloud-based solutions. Salesforce remains a dominant force in CRM, though Oracle also competes in this area. Smaller, more specialized vendors also pop up, offering solutions for specific business functions or industries. Oracle’s advantage often lies in its ability to offer an integrated suite of applications that work together, from financials to human resources, all running on its own cloud infrastructure. This integration can be a big selling point for companies looking to streamline their operations and avoid the complexities of managing multiple, disparate systems.

Database Market Share and Rivals

This is Oracle’s historical stronghold. For decades, Oracle Database has been the go-to for many mission-critical applications. While it still commands a huge presence, the database landscape is evolving. Cloud providers like AWS (with RDS and Aurora), Azure (with Azure SQL Database), and GCP (with Cloud SQL and Spanner) offer managed database services that are very attractive, especially for cloud-native applications. However, Oracle’s Autonomous Database is its answer to this challenge – a self-driving, self-managing database designed for the cloud era. It aims to reduce the operational burden and costs associated with traditional database management. Other database technologies, like NoSQL and in-memory databases, also present competition, but Oracle continues to invest heavily in its core database technology, recognizing its importance to its overall cloud strategy.

Strategic Imperatives and Market Trends

AI Integration in Oracle’s Cloud Strategy

Oracle’s really leaning into AI these days. It’s not just a buzzword for them; they’re actively building AI capabilities right into their cloud infrastructure. Think about it – faster databases, smarter applications, all powered by AI. They’re putting a lot of effort into making their cloud a go-to place for companies that want to use AI without a huge headache. This means things like specialized hardware for AI tasks and tools that make it easier for developers to build AI-powered stuff. It’s a big bet, but with AI becoming so important, it makes sense.

Multi-Cloud Adoption and Oracle’s Role

Most big companies aren’t putting all their eggs in one cloud basket anymore. They’re using a mix of cloud providers, and Oracle is trying to be a part of that. They’ve been working on partnerships, like with Microsoft Azure, to make it simpler for customers to run Oracle services alongside other clouds. This is pretty smart because it means they don’t have to win every single workload. Instead, they can focus on where they’re strongest, like databases and enterprise apps, and still get business from customers who are using multiple clouds. It’s about being flexible and meeting customers where they are.

Industry-Specific Cloud Solutions

Oracle is also getting more focused on specific industries. Instead of a one-size-fits-all approach, they’re building cloud solutions tailored for sectors like healthcare, finance, and retail. This means their cloud services come with pre-built features and data models that are relevant to those industries. For example, a healthcare cloud solution might have built-in tools for managing patient data or complying with regulations. This makes it easier for businesses in those sectors to adopt cloud technology because it addresses their unique needs right out of the box. It’s a way to stand out from the more general cloud providers.

Oracle’s Financial Performance and Cloud Growth

Let’s talk about how Oracle’s been doing financially, especially with all the buzz around their cloud services. It’s been a pretty interesting time for them, honestly. They’ve really leaned into the cloud, and it seems to be paying off.

Revenue Breakdown by Business Segment

Oracle breaks down its revenue into a few key areas, and the cloud side is definitely the star of the show lately. For the first quarter of fiscal year 2026, which wrapped up in September 2025, they reported total revenues hitting $14.9 billion. That’s a solid 12% jump from the year before. But the real story is their cloud business, combining infrastructure (IaaS) and applications (SaaS). This part alone brought in $7.2 billion, growing a hefty 28%.

Here’s a quick look at the numbers from Q1 FY2026:

- Total Revenue: $14.9 billion (+12% year-over-year)

- Cloud Revenue (IaaS + SaaS): $7.2 billion (+28% year-over-year)

- Software Revenue: $5.7 billion (-1% year-over-year)

It’s clear where the growth is coming from. The older software business isn’t shrinking dramatically, but it’s not the engine driving things forward anymore.

Cloud Infrastructure (IaaS) Growth Trajectory

When you look specifically at Oracle Cloud Infrastructure (OCI), the numbers are even more impressive. This is their core cloud computing service, and it’s been growing like crazy. In that same Q1 FY2026 report, OCI revenue shot up by 55% to $3.3 billion. That kind of growth is pretty rare in the cloud space these days, especially for a company of Oracle’s size. They’re investing a ton in data centers, which is a big reason for this surge. This rapid expansion in IaaS is a major signal of their commitment to competing directly with the biggest cloud players.

Enterprise Applications Revenue Performance

Oracle’s enterprise applications, often referred to as Software-as-a-Service (SaaS), are also doing well, though not at the same explosive pace as their infrastructure. In Q1 FY2026, this segment brought in $3.8 billion, an 11% increase year-over-year. This includes their popular Fusion Cloud applications for things like ERP, HCM, and SCM, as well as NetSuite for smaller businesses. The steady growth here shows that businesses are continuing to adopt Oracle’s cloud-based software solutions, which often integrate tightly with their database offerings. It’s a good, consistent performer that complements the high-flying IaaS business.

Future Outlook and Market Positioning

So, where is Oracle Cloud headed? It’s a pretty interesting picture, honestly. As of late 2025, Oracle is really pushing hard into the cloud and AI space. They’ve made some big bets, and it looks like they’re paying off, at least in terms of growth projections. The company is aiming to become a major player, not just a runner-up, in the cloud infrastructure game.

Projected Oracle Cloud Market Share Growth

Oracle’s own forecasts are pretty ambitious. They’re expecting their Cloud Infrastructure (OCI) revenue to keep climbing at a really fast clip. Think over 70% growth for fiscal year 2026, and they’re talking about OCI revenue hitting something like $34 billion by FY27. Looking further out, they’re projecting OCI to reach $166 billion by FY2030. If that happens, OCI would make up more than 70% of Oracle’s total income and could be as big as Google Cloud by then. That’s a huge jump from where they are now.

Here’s a rough idea of what they’re aiming for:

| Year | Projected OCI Revenue | % of Total Revenue (Est.) |

|---|---|---|

| FY26 | ~$18 billion | N/A |

| FY27 | $34 billion | N/A |

| FY29 | $129 billion | N/A |

| FY30 | $166 billion | >70% |

Challenges and Opportunities in the Cloud Market

It’s not all smooth sailing, though. Oracle is up against some serious competition. The big hyperscale cloud providers aren’t just sitting around. Plus, there are always regulatory hurdles and geopolitical stuff to deal with, especially with AI and international trade. Data sovereignty is a big deal too, and Oracle needs to keep showing customers they can handle data safely and according to local rules.

But the opportunities are massive. The whole world is moving to the cloud, and AI is changing everything. Oracle’s existing customer base, especially in enterprise applications and databases, gives them a solid foundation to build on. They’re also landing some pretty big government contracts, which is a good sign.

Key areas to watch:

- AI Integration: How well they integrate AI into their cloud services will be a big differentiator.

- Government Contracts: These provide stable, long-term revenue and a stamp of approval.

- Data Sovereignty Solutions: Meeting diverse global data regulations is a must.

- Competition: Staying competitive against AWS, Azure, and Google Cloud requires constant innovation.

Oracle’s Long-Term Strategic Vision

Oracle’s strategy seems pretty clear: double down on cloud and AI. They’re investing heavily in their infrastructure, trying to make OCI more attractive to businesses of all sizes. They’re also leaning into their strengths, like their database technology and enterprise applications, and making sure they work well in the cloud. The goal is to be seen not just as a software company, but as a top-tier cloud provider. They want to capture a significant chunk of the growing cloud market, especially with the AI boom. It’s a bold move, and it’ll be fascinating to see if they can pull it off over the next few years.

Wrapping It Up

So, looking at everything in late 2025, Oracle’s really pushing hard into the cloud and AI space. They’re making big moves, especially with their cloud infrastructure, OCI, and trying to get AI baked into everything. It’s not like they’re the only game in town, though; AWS, Azure, and Google are still major players, and Oracle’s playing catch-up in some ways. But with their database background and how they’re linking up with other clouds, they’ve got a solid plan. The next few years will show if all these investments pay off and if they can really grab a bigger piece of the cloud pie, especially against those bigger competitors.

Frequently Asked Questions

What is Oracle Cloud Infrastructure (OCI) and how is it doing in the market?

Oracle Cloud Infrastructure, or OCI, is Oracle’s way of offering computer power and storage over the internet. Think of it like renting computing resources instead of buying your own big machines. While it’s still smaller than giants like Amazon’s AWS or Microsoft’s Azure, OCI is growing really fast, with its sales going up by over 50% recently. People expect it to grab a bigger piece of the cloud market in the next few years.

Who are Oracle’s main competitors in the cloud world?

Oracle is up against some big names in the cloud business. The biggest rivals are Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These companies have been in the cloud game for a while and have a lot of customers. Oracle also competes with other software companies for business applications.

How is Oracle using Artificial Intelligence (AI) in its cloud services?

Oracle is putting AI right into its main software that businesses use, like for managing finances or customer relationships. Instead of just offering AI as a separate tool, they’re building it into things like their Oracle Fusion Cloud Applications. They are also building lots of powerful computer centers specifically designed to handle AI tasks, showing they want to be a major player in AI technology.

Is Oracle only focusing on its own cloud, or does it work with others?

Oracle is taking a ‘multi-cloud’ approach. This means they are making their services available on other cloud platforms like AWS and Google Cloud, not just their own OCI. This gives customers more choices and flexibility, so they aren’t locked into just one provider.

How is Oracle doing financially with its cloud business?

Oracle’s cloud business is growing strong! Their cloud services, which include both the infrastructure (like OCI) and applications (like ERP software), are bringing in a lot more money. The company expects its total cloud business to grow by over 40% in the near future, which is a big jump from its previous growth.

What is Oracle’s strategy for competing in the cloud market?

Oracle’s strategy is to grow its cloud business rapidly, especially its cloud infrastructure (OCI). They are investing heavily in building more data centers, including ones made for AI. They are also making sure their cloud services work well with other clouds and are adding lots of AI features into their existing business software. Plus, they are focusing on providing special cloud solutions for specific industries like healthcare.