The world of computer chips is always changing. In 2024, we’re seeing some big shifts in who’s on top and what kinds of chips are most important. From companies like Arm trying to get a bigger piece of the data center pie, to Intel figuring out its next moves, and Nvidia becoming a huge player because of AI, there’s a lot happening. We’ll also look at how important TSMC is in making all these chips and what’s going on with the PC and smartphone markets. It’s all about understanding who’s winning and why in the cpu market share 2024.

Key Takeaways

- Arm is really pushing to get a lot more of the data center processor business, aiming for 50% by the end of 2025. This could seriously shake up Intel and AMD’s long-standing dominance in that area.

- Intel is working hard to stay relevant, focusing on making its own chips better and offering its manufacturing services to other companies. They are trying to get back some of their past leadership.

- Nvidia is a huge force now, especially because of AI and graphics chips. Their success shows that specialized AI accelerators are becoming just as important, if not more, than traditional CPUs.

- TSMC is still the leader in making chips for everyone else, holding a big chunk of the market. This means most of the world’s advanced chips come from them, which is a big deal for the whole industry.

- The market for making chips, called the wafer foundry market, is growing fast. This growth is driven by things like AI, cloud computing, and chips for cars, and it looks like it will keep going up.

Arm’s Ambitious Data Center Goals

Challenging x86 Dominance

Arm Holdings, a UK-based chip designer, has its sights set high, aiming for a whopping 50% of the data center CPU market by the close of 2025. That’s a huge leap from their estimated 15% share in 2024, and it puts them squarely in competition with giants like Intel and AMD. The increasing demand for artificial intelligence (AI) is a major factor driving this push. If Arm succeeds, it could really shake up the digital infrastructure landscape. This competitive threat will likely force Intel and AMD to respond strategically, possibly with faster product development, a renewed emphasis on power efficiency and performance-per-watt metrics, and potential price adjustments.

Financial Implications of Arm’s Growth

Arm’s data center ambitions have big financial implications. As of early April 2025, Arm shares were trading around $108. The stock’s persistently high valuation multiples, with a trailing price-to-earnings P/E ratio around 142, a forward P/E near 119, and a price-to-sales ratio exceeding 30, indicate the market’s expectation of substantial future growth. Success in the data center market is crucial to justifying these metrics. The analyst community maintains a moderate buy consensus rating, with an average twelve-month price target of $163.41, suggesting a potential upside of roughly 51%. Arm’s fiscal third-quarter results cited increased usage of Arm chips in data centers as a contributor to record royalty revenue.

The Data Center Power Shift

The increasing demand for AI is really driving Arm’s data center push. Training and running AI models requires substantial computational power, which strains existing data center infrastructure and increases energy consumption. Arm’s architecture is power-efficient, which lowers operating costs and provides a sustainable solution for scaling AI infrastructure. Arm must consistently prove performance leadership and cost-effectiveness. For instance, NVIDIA incorporates Arm’s designs into its data center products. Beyond the direct impact on Intel and AMD, Arm’s growth could also reshape the AI hardware ecosystem, potentially accelerating the trend toward greater diversity in chip designs and customized solutions.

Intel’s Strategic Realignments

Maintaining Market Position Amidst Competition

Intel is facing a lot of pressure. It’s not just AMD anymore; now, there’s Arm making waves, especially in data centers. To stay competitive, Intel is making some big changes. They’re trying to hold onto their market share by focusing on what they do best and adapting to the new landscape. It’s a tough balancing act, but they’re trying to stay ahead.

Focus on Foundry Services and AI Chips

Intel’s betting big on two key areas: foundry services and AI chips. They want to become a major player in manufacturing chips for other companies, challenging TSMC’s dominance. At the same time, they’re pouring resources into developing AI chips to compete with Nvidia. This dual focus is a major shift for Intel, and it’s going to be interesting to see if it pays off. Intel’s restructuring is a strategic reallocation of assets.

Intel’s Restructuring and Future Outlook

Intel has been restructuring its business to streamline operations and free up cash. This includes selling off some non-core assets and reorganizing different divisions. The goal is to become more efficient and focus on high-growth areas like AI and data centers. The big question is whether these changes will be enough to revitalize Intel and position them for long-term success.

Here are some key aspects of Intel’s restructuring:

- Asset Monetization: Intel sold its NAND business to SK hynix and a stake in Altera (FPGA) to Silver Lake, raising $8.75 billion.

- Resource Centralization: They are focusing resources around AI/data center chips and client computing.

- Financial Goals: Intel aims to improve cash flow and margins, potentially reaching levels similar to Nvidia’s in the data center business. They are trying to become a cash flow machine.

Nvidia’s Ascendance in the Semiconductor Landscape

Nvidia’s been making serious waves, and it’s not just about graphics cards anymore. They’re becoming a major player in the whole semiconductor game. It’s interesting to watch how they’re shaking things up.

The Rise of AI and GPU Technologies

Nvidia’s success is closely tied to the explosion of AI. Their GPUs are perfect for AI workloads, and that’s driving huge demand. It’s not just gaming anymore; data centers and AI training are big business for them. They don’t even manufacture their own chips, relying on TSMC, but their designs are what everyone wants.

Impact on Traditional CPU Dominance

With Nvidia’s rise, we’re seeing a shift away from traditional CPUs. More companies are designing their own AI accelerators, which means less reliance on CPUs for certain tasks. It’s a sign of the times, really. The AI and GPU technologies are becoming more important than ever.

Shifting Towards Specialized AI Accelerators

This trend towards specialized AI chips is only going to continue. Companies want chips optimized for specific tasks, and that’s where Nvidia shines. It’s a whole new world compared to the old days of CPU dominance. It will be interesting to see how Intel and AMD adapt to this new landscape. The semiconductor industry is definitely undergoing a seismic shift.

TSMC’s Unrivaled Foundry Leadership

TSMC’s position in the semiconductor world is something to behold. They’re not just a big player; they are the game for many companies. It’s like they’ve built the stadium and everyone else is just trying to get a good seat. Let’s break down why they’re so dominant and what it means for everyone else.

Dominance in Global Semiconductor Manufacturing

TSMC’s market share is a huge deal. In Q3 2024, TSMC led the global semiconductor foundry market with a whopping 64.9% share. That’s more than half of all outsourced chip production running through them. This kind of control gives them a lot of influence over pricing, supply chains, and where the industry is headed. They’ve built a reputation for getting things done, being reliable, and having the best tech – all things that matter a lot as demand for chips keeps growing, especially for AI, cars, and high-performance computing.

Projected Market Share in 2024 and 2025

Looking ahead, TSMC is expected to keep growing. Projections show them hitting 64% of the global foundry market in 2024 and potentially reaching 66% in 2025. This isn’t just about numbers; it shows how well they’re doing compared to everyone else. They’re investing big in new tech, like their push into 2nm technology, which helps them stay ahead. Plus, big names like Apple, Nvidia, and AMD are signing long-term deals, locking in TSMC’s revenue and solidifying their place at the top.

Strategic Implications of TSMC’s Market Grip

TSMC’s dominance has big implications for the whole industry. For companies that need cutting-edge chips, whether it’s for AI, consumer electronics, or cloud computing, TSMC is often the go-to choice. They lead in advanced nodes, like 3nm and the upcoming 2nm, making them the top pick for high-end chip production. However, relying so much on one company also brings risks. If something goes wrong with TSMC, it can cause problems across the industry. Companies might need to think about using multiple suppliers to protect themselves from things like geopolitical issues or unexpected production delays. Samsung is trying to catch up, but Samsung Foundry still has a ways to go.

Growth in the Wafer Foundry Market

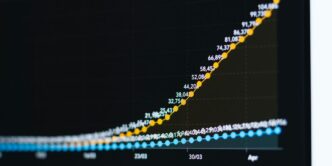

Significant Revenue Increase in Q2 2024

Okay, so the wafer foundry market is doing pretty well, like, really well. In Q2 2024, we saw a revenue jump of about 9% compared to the previous quarter, and a whopping 23% increase year-over-year. That’s a lot! This revenue growth shows that there’s a big demand for semiconductors right now. It’s a good time to be in the chip-making business, I guess.

Driving Factors: AI, Cloud, and Automotive Chips

So, what’s making all this growth happen? Well, it’s a few things. First off, AI is huge. Everyone wants AI chips, and that’s driving up demand. Then you’ve got cloud computing, which needs a ton of chips to keep everything running. And don’t forget about cars! Modern cars are basically computers on wheels, so they need a lot of semiconductors too. These three things – AI, cloud computing, and automotive – are really pushing the market forward. It’s kind of crazy how much chips are needed for everything these days.

Anticipating Continued Growth and Investment

Looking ahead, it seems like this growth is going to keep going. Companies are going to need to invest more in R&D and make sure they have enough production capacity. Securing production capacity in advance will be critical. TSMC’s projected 66% market share in 2025 is a clear indication of its industry dominance. The computer graphics market is projected for significant growth by 2026, with key players like Autodesk, Intel, and Microsoft driving this expansion. It’s a good idea to keep an eye on TSMC’s production capacity. If the demand for AI chips and other stuff keeps going up, we might see some supply problems. So, yeah, expect more growth and more investment in the wafer foundry market. It’s going to be interesting to see what happens next!

The Evolving PC Market Dynamics

Windows 11 Refresh Cycle Impact

Okay, so the PC market is still trying to figure things out, but it looks like the Windows 11 refresh is going to be a big deal. Most people in the know think that the end of life for Windows 10 will really push customers to upgrade, probably sometime between now and early next year. This refresh cycle is expected to significantly boost PC sales. It’s like everyone’s been waiting for an excuse to get a new computer, and now they have one. I know I’ve been putting it off, but my old laptop is starting to show its age. Maybe it’s time to look at some new PC demand.

Top PC Vendor Performance in Q2 2024

Let’s talk about who’s winning in the PC game right now. Lenovo is still on top, shipping a ton of units and growing a bit. HP is right behind them, also doing pretty well. Dell is the only one in the top three that saw a drop, mostly because they didn’t do so hot in the US. Apple is hanging in there, grabbing a decent chunk of the market. And then there’s Asus…

Here’s a quick rundown:

- Lenovo: Still the king, growing steadily.

- HP: Right on Lenovo’s heels.

- Dell: Had a rough quarter, especially in the US.

- Apple: Making gains, especially with their latest models.

- Asus: Big growth, thanks to gaming PCs.

Asus’s Growth in Gaming PCs

Speaking of Asus, they’re killing it in the gaming PC market. They grew like crazy in the last quarter, and it’s all because of their gaming rigs. People are clearly willing to spend money on a good gaming experience, and Asus is delivering. It makes sense, right? Gaming is huge, and if you’re serious about it, you need a powerful PC. Plus, all the cool RGB lighting and fancy designs probably help too. I’ve been thinking about getting one myself, but my wallet is crying already. Maybe I should check out some Copilot+ PCs first.

Smartphone Applications Processor Market Trends

Unit and Revenue Growth in Q2 2024

Okay, so the smartphone applications processor (AP) market had a pretty good Q2 2024. We’re talking about a 9% jump in unit shipments compared to last year. And get this, revenue went up even more – like 17%! It looks like people are buying more expensive phones, which is driving up the average selling price of these processors. It’s not just more phones being sold; it’s better phones.

Mobile Generative AI’s Defining Role

Mobile generative AI is becoming a big deal. It’s not just a gimmick anymore; it’s actually shaping what people want in their phones. Think about it: better cameras, smarter assistants, all that stuff needs serious processing power. The latest silicon is what’s making all this possible. It’s like the engine under the hood – you might not see it, but it’s what makes the car go fast. The success of mobile generative AI will really define the smartphone market going forward. It’s not just about having the coolest features; it’s about having the smartest features, and that all comes down to the AP.

Importance of Latest Silicon in Smartphones

So, why is the latest silicon so important? Well, it’s not just about speed. It’s about efficiency, security, and all sorts of other things. Here’s a quick rundown:

- Performance: Newer chips are just faster. They can handle more complex tasks without slowing down.

- Power Efficiency: Better chips use less power, which means longer battery life. And who doesn’t want that?

- AI Capabilities: The latest silicon has dedicated AI cores, which makes things like image recognition and natural language processing way better.

Basically, if you want a phone that can keep up with the times, you need the newest silicon. It’s that simple. And as mobile AI gets even more advanced, this is only going to become more important. It’s a race to have the best smartphone apps, and the silicon is the engine that drives it.

Conclusion: What’s Next for the CPU Market?

So, what does all this mean for the CPU market as we head into the rest of 2024 and beyond? It’s pretty clear things are changing fast. We’re seeing new players pop up, and the old guard is having to really step up their game. Companies are trying out different ways to make chips, and that’s good for everyone because it means more choices and better stuff. It’s going to be interesting to watch how these companies keep pushing each other to come up with the next big thing. The market is definitely not standing still, and that’s exciting.

Frequently Asked Questions

What is Arm trying to do in the chip market?

Arm is a company that designs chips, and they are trying to get a big piece of the market for chips used in huge computer centers. They want to reach 50% of this market by the end of 2025. This is a big deal because right now, other companies like Intel and AMD mostly control this market.

How is Intel changing its business?

Intel is changing its plans to stay strong in the chip business. They are focusing more on making chips for other companies and on chips that help with artificial intelligence (AI). They are also making some big changes to how their company works to get ready for the future.

Why is Nvidia so important now?

Nvidia is becoming very important because of the growing need for AI and powerful graphics chips. While they don’t make their own chips, they design them, and these designs are used in gaming, big computer centers, and for training AI. This means that regular computer chips might not be as important as these special AI chips.

What is TSMC’s role in making chips?

TSMC is the biggest company in the world that makes chips for other companies. They are expected to have a huge part of this market in 2024 and 2025, around 64% to 66%. This means many big tech companies rely on TSMC to make their chips, which gives TSMC a lot of power in the industry.

Why is the chip-making market growing?

The market for making chips (called wafer foundries) is growing a lot. In the middle of 2024, the money made in this market went up quite a bit. This is happening because more people need chips for AI, cloud computing (like online storage and services), and cars. Experts think this growth will continue.

What’s happening with the computer market right now?

The computer market is changing. Many people might buy new computers because Windows 11 is coming out. In the middle of 2024, some computer companies like Lenovo, HP, and Apple sold more computers. Asus also did very well, especially with their gaming computers.