This episode of Startup Savants features Anthony Nitsos, the founder of SaaS Gurus, a fractional chief financial officer (CFO) startup. Talking with podcast hosts Annaka and Ethan, Anthony discusses how fractional CFOs can benefit startups and provides other advice for founders.

What are a CFO and a fractional CFO?

“The chief financial officer is generally the person who’s put in charge of all matters pertaining to money within a corporation or a small company. It doesn’t really matter. They’re usually a very seasoned professional that fully understands both accounting and finance. And those are two very different things. They’re pretty much tasked with protecting the assets and increasing the value of the company.

A fractional CFO is somebody who does that on a part-time basis. And that’s usually how companies can afford a CFO’s skills without the price tag usually associated with somebody like that because it can be quite expensive. And so, we provide fractional CFO services for a number of, basically, tech startups.

There are usually two phases. There’s a ‘get things set up and cleaned up’ phase when we first come in. And then, there’s usually an ‘ongoing retainer’ phase where they’re using us for X number of hours per month — could be on the finance side, could be on the accounting side. But for the CFO piece itself, that’s usually done on a retainer on a monthly basis.”

How did you end up where you are now?

“That transition was very emotional and rocky. So, what happened was I got into medical school and then realized that this was a great big mistake and that I really did not want to be a doctor as badly as was going to be required to do all of that studying and all the other stuff that’s required to do that. So, what do you do when you drop out of medical school?

Well, I was in Michigan, and I’m looking through the want ads because I need to find a job. I need to make a living. And it’s not like I had some grand plan of what I was going to do after I quit medical school. So, the first job that came available to me happened to be in manufacturing. I said, well, they both start with ‘M.’ So, I guess they’re kind of related.

And so, I began work as a logistics and production engineer, if you will, in a manufacturing plant, and realized very quickly that manufacturing companies and human bodies are very similar in the way they operate, in the way that they integrate, in the way that things flow through them. So, I rapidly evolved into a process, reengineer, troubleshooter, fixer person.

And that was basically my first career move was I became a productional logistics specialist in a process reengineer from the get-go. Something would break, there would be a symptom. They’d say, ‘Hey, we’re stocking out of this’ or ‘We have too much stock of this.’ So, it was a typical one. Why? So, let’s give it to Anthony; he’ll go figure it out. So, I would go back through the entire chain of events until I got to the root cause and said, here is the source of the problem. We fix this. All the downstream problems should go away. So, that’s what we would do.”

Is there a difference in personality between someone who is a strong builder versus someone who is a strong fixer?

“I have both of those hats on almost all the time. A lot of times now, I’m going in and creating things that didn’t exist just as much as I’m going in and fixing things that already exist.”

What are some of the signs that a startup needs to bring on a CFO or get a contracted CFO?

“The first sign is when you, as the founder or the CEO, are starting to lose sleep over the fact that you don’t know that the numbers that are being produced by your finance system are correct or that they’re inappropriate to the industry that you’re in. For example, I work almost exclusively with software-as-a-subscription, also known as SaaS companies.

There are certain metrics, measurements, key performance indicators, numbers, financial statements that investors and boards are going to expect. And if you don’t have those set up correctly, you’re going to be in a constant scramble mode to try and get them. And what’s worse, when you put them together, unless you’re a real expert at doing this, you may not have put them together correctly.

So, you, as the CEO or the founder, are standing there with a pile of numbers, not knowing whether they’re correct. That’s not a good position to be in. So, most of the time, people come to us when that pain becomes so excruciating that they’re like, ‘Okay, I need somebody to come in here and make sure that my numbers are right.’ That’s kind of a tactical thing.

The other thing is you are growing. You’ve now gotten your stride. You’ve gotten traction. You’ve gotten market penetration. Things are moving. Where do we go for our next round of money? What do we do with that next round of investment money once we get it? So, that forward-planning piece is the other side of it.

Are there any specific places or times in the startup life cycle that you generally come on board as the CFO? Is there an ideal time?

“The analogy I like to use is [the asteroid] that wiped out the dinosaurs. Now we have a lot of telescopes that are out there scanning the heavens for the asteroids that could potentially off us and take care of us. Would you rather find that asteroid when it’s at the orbit of Pluto or the orbit of the Moon?

So, the further away you can change something, the further upstream you can change it, the more downstream impact there is. When you’re a very fresh startup, it’s a good idea to have your accounting system set up correctly from the get-go so that somebody like me doesn’t have to come in and completely redo it, which can be expensive.

It’s the earlier you get something set up if you’re going to be a software company in particular, or a retail company, or a professional services company, it really doesn’t matter. The last person you want setting up your accounting system is your tax CPA. And the reason for that is they’re going to set it up in order to file your taxes. They’re not going to set it up so that you can run the business. And those are very different uses of your financial statements.

So, I just had a call today with a company that’s pre-revenue, and they wanted me to take a look at their pitch deck, make sure that they’ve got their forecast ready and in line to go in front of investors. They wanted a professional view of the pitch deck to make sure that’s addressing the right things that would make an investor want to be interested in investing. So, that’s a very early-stage company, they’re pre-revenue, and they’re going out and raising their first round of money. We can help somebody at that point.

We also can go all the way up to, ‘We just got our A round. Our books are a mess. All of our investors were screaming at us, and told us we need to fix it if they’re going to give us the money, can you please come in and do that?’ It really spans that pre-revenue pre-seed investment all the way up, probably to about the B round of investment. By that time, you’re hiring a full-time CFO, not contracting with a fractional.”

So, bringing on a full-time CFO as an employee of the company generally happens around the B round?

“I’ve seen it happen even earlier. But that usually happens when there isn’t a resource that can help them, and the board is just demanding that they bring in a full-time [CFO]. But CFOs are expensive. And not only are they expensive from a salary perspective, but in the startup world, you’re also going to award them stock options.

And they usually expect a fairly nice piece of the company to do what they do. That’s why, usually, you see that full-time CFO coming in at the B round or as part of the B round because that’s when A, you can afford it, and B, you really need that full-time capacity to help you. It can come earlier or later – really circumstances dictate how that works. But most of our clients are post-seat, pre-B.”

Is there someone you should bring on to the finance team before the CFO who may not be as senior or as expensive?

“No. I’d say go get yourself a fractional CFO who knows your space and have them set it up because you do need the gray hairs, the experience that goes along with that. I’ve been doing this for about 20 years. I’ve been working with SaaS companies for about 15. I know the space. I know how things should be set up. I’ve had to clean up a lot of messes.

And a lot of them are from other CFOs who put out that, ‘Hey, we know how to do this,’ but they didn’t know SaaS, or they were primarily accountants and not really finance people. Because a lot of fractional CFOs come from an accounting background. And I don’t know if you’ve heard the old adage that the person who has a hammer, all of their problems begin to resemble nails.

Well, if you’re an accountant, you approach finance with an accounting perspective; that’s not the way to approach finance. Finance is forward-looking. Finance is strategic in nature. It’s anticipatory. Accounting is historical by nature. It’s rearward looking. It’s looking through the rearview mirror. It’s something that has already happened.

You cannot use a historical perspective to plan for the future except as a source of information and a data point that might give you useful information. So, that’s why we take care of the accounting first, because we need that base information. But once it’s taken care of, we leave it, and we move on to the fun stuff.”

Once a startup or a founder decides to hire a fractional CFO, how do they find you, and what do the initial conversations and the relationship look like?

“Word of mouth is usually the best way to find somebody who knows the space … A lot of the time, it’s like, ‘Oh, we’ve worked with this company, this board member is familiar with what they do.’ They say, ‘Hey, I’m on the board of this other company. Can you come in and help them?’ Or we worked with a particular DC adventure capitalist who [liked what we do]. Or they heard a podcast and liked what they heard, and they looked us up.

So, that’s usually how people find us, is through word of mouth, through the network. If you are looking for a CFO and you don’t have that network to ask, you’re going to be stuck doing a Google search. And the first thing that’s going to pop up are the ones that are promoted the most, et cetera, et cetera. What I’ve noted about those particular organizations is that they’re very good at telling you what to do, but not how.

There’s also a lot of DIY out there. You want to do your own SaaS finances, here’s our book, here’s our program, et cetera. I look at that and say, what CEO in their right mind is going to want to do that? They’re going to want to spend their time on development. They’re going to want to spend their time on sales. They didn’t found a company unless you’re crazy like me.

They didn’t found a company to do finance. They founded a company to do something else. We founded a company to do finance because that’s the service that we provide. And so, we live it, we breathe it, we know it. You go out and do a Google search, and SaaS CFOs pop up or whatever it happens to be. It’s going to be a bunch of DIY stuff. Is that really what you want?

So … you found, say, a CFO company. The questions you should be asking them are, do you know my industry? Can you tell me specific examples of clients that you’ve worked with without disclosing names or confidentiality and the kinds of problems that you solved? Can you help me with pricing my contracts? Can you help me with valuing my business? Can you give me specific examples?

Those are finance-related questions. You can find all sorts of accounts out there who can do accounting, but can you find somebody who is financially savvy in your industry who can help you strategically? That’s the real value of the CFO. A CFO, when they come into a company, their primary mission is to increase valuation.

That’s what the F of finance stands for, right? It’s finance. So, if they’re not coming in and finding ways to either increase your ARR, increase the quality of that annualized recurring revenue, increase the quality of the annualized recurring revenue, reduce the losses, find cash, find better ways to spend it, those are the kinds of things that a CFO really adds value to a company.”

What do you mean when you say the quality of the ARR?

“The quality of the ARR can come down to things such as we have annual contracts, we invoice them monthly, and they have a 30-day out. Well … they’re immediately going to devalue your ARR, anybody who’s looking at you for investment or acquisition. Why? Because it’s not truly annualized recurring revenue.

Or, we have a refund policy. You can pay upfront, but if you decide to get out early, then we’ll give you your money back. No, that’s not how SaaS should be set up. We have software, and then we have all these really great services that we charge for. Well, I can tell you right now that the valuation of your ARR is going to be about 10 times the valuation of your services revenue.

So, why are you wasting time on services, revenue? Why don’t you just bake that into the ARR? So, those are a real quick list of things that we take a look at. We take a look at the terms and conditions of the contracts to make sure that they are actually protecting the company. We’re going to look at the agreements the same way an investor is going to look at the agreements to make sure that there isn’t some hidden ‘gotcha.’

That there isn’t some way that’s going to make this value, the stream of income, worth less in the future. Because when somebody’s coming in to invest or buy your company, they’re not looking at just the team that they’re buying. They’re looking at the quality of earnings. It’s a big term, quality of earnings. Are those earnings that you put on your financial statement really there? Is it real? Is it substantial? So, that’s where that all comes from. And knowing the industry that you’re in, and knowing how the agreements should be put together, and knowing what the investors are going to want to be looking for. That’s what an experienced CFO brings.”

How does the fractional CFO relationship look?

“From the nuts-and-bolts perspective, there’s no flying anymore. Thank you, COVID. At least for that particular aspect. I’ve been doing virtual, call it virtual non-office-based CFO work for the better part of 15, 20 years. So, long before any COVID hit, we had already taken the model of ‘We don’t need an office. We don’t need a physical structure. We don’t need brick and mortar.

We can do everything remotely’ … There’s no reason other than time differences for us not to do business with somebody who’s not in the United States, for example.

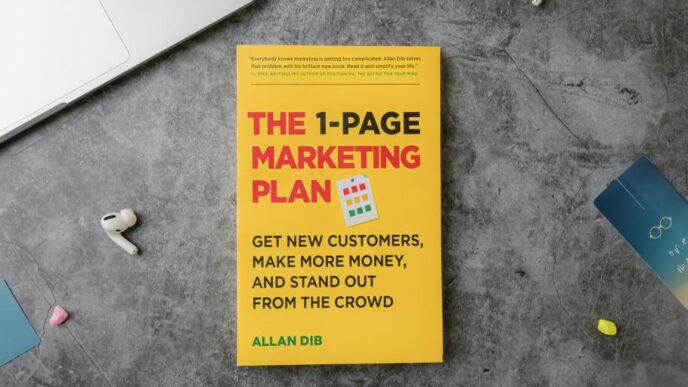

As far as the engagements, typically, there’s an upfront cleanup phase because inevitably, you’re hiring us to come in and clean up your numbers. That means that we’re going to have to do a lot of work in the accounting system, in your budgeting system, in your SaaS metric system as it exists, or if it doesn’t.

So, we call that the financial core cleanup. While we’re doing that, we’re also looking at HR policies. We’re looking at HR operations. We’re also taking a look at sales operations to make sure that everything is flowing into the system correctly. We are looking at the tech pile that most companies create when they put themselves together and turning it into an integrated tech stack.

And that’s something that really benefits the client in the end because you have a single point of data entry. You don’t have a lot of replication. You have a lot of automation, et cetera. That cleanup phase takes weeks or less, depending on how much of a mess we have to clean up and how available the client is to answer questions. We work very fast because we’ve been doing it a long time.

Once that’s done … you’ll have financial statements that will be specific to the industry. You will have a budgeting and forecasting tool that will produce a cash forecast. And that is the most important forecast of all. You cannot spend net income. You can only spend cash. So, I really don’t care what net income looks like. I care very much what your cash balance looks like because you need to know as a startup when you’re going to run out of money. That’s called the runway. That tells you when you need to go for your next round.

You want to be able to anticipate that with plenty of time so that you’re not out there going for a round when you’re about to run out of cash, and the tank is about to go dry, and the car is going to be stopped in the middle of the desert. So, we focus a lot of our efforts on the cash forecast, which means that we have to focus a lot of our effort on the sales forecast because that drives all the cash inbound into the organization. Once we have that, [we focus on] all the metrics that we need, the KPIs, the dashboard, call it what you will. At that point, we have that set. That’s usually a pretty big lift.

But after that, there’s the ongoing retainer with me or the other CFOs to say, okay, we’re going to have you sit in our board meetings. We’re going to have you sit in on our sales planning meetings. We need to stay active in the organization. Otherwise, we become blind, and we don’t know what’s going on. The more information the CFO has, the more effective they’re going to be.

There is not a single decision in your organization that doesn’t have a financial impact, period, bar none. There’s nothing you do in a company that doesn’t eventually show up in the PnL or the balance sheet. So, that’s why the more information the CFO has, the more effective they can be.

That retainer can go anywhere from a few hundred dollars to several thousand dollars a month, depending on the level of support that’s needed. If you’re in a fairly steady state, you’re probably not going to need to talk to the CFO that often. If you’re in the middle of a round and you’re trying to raise money, you’re going to be talking to that CFO a lot.

So, we dial it up and down depending on what the client is doing at that point. But this is where the fit of the CFO to the business really comes into play because an effective CFO doesn’t need as much time as somebody who hasn’t done it before or is trying to figure it out.”

The way that finance happens in businesses is changing. We’re not necessarily going with the huge big banks, and people are reevaluating finance in general. Have you noticed that?

“I don’t know because I’ve never really followed that traditional path. I came to finance by a very different route. I came from medicine, through manufacturing, through IT, then into accounting and finance. So, my view of how things work started from when I was on the shop floor of manufacturing, there’s nobody dressed in these shoes. There’s nobody walking around.

We’re all scrambling to make sure that we’re making deliveries and [getting] the job done.

And that’s the attitude that I’ve taken ever since. I’m here to get a job done. I don’t really think you care how I’m dressed. I don’t think you really care what rules I follow, as long as I’m effective. And we can get you the results that you’re looking for.”

It’s just a very human side to finance that I think that I was not aware of.

“I like to pride myself and the company that I’ve created on the fact that we are here to get results. That is really what we’re doing. The window dressing and all that stuff doesn’t really fit … We are not only in a people business, we’re almost literally the physicians of the company, and we know all of the deepest secrets.

Our clients need to know they can trust us to keep our mouth shut, number one. Number two, that we’re going to treat all that information appropriately, whatever appropriate happens to be. And that we don’t have to be told what that is or isn’t. And that we can deal with engineers. We can deal with marketing. We can deal with sales. We can deal with customer support. We can deal with the accountants.

We have to be able to speak their language and understand their language. We have to be able to meet them where they are in order to be the most effective CFOs we can be. And so, when I bring somebody into the organization, the first thing I’m looking for is how well do you interact with [and] how well do you play with others? Because in the end, I can’t have somebody who’s just really great at crunching numbers. They have to be able to interpret them. They have to be able to deal with the client, ask questions, and not tick the client off with a bunch of annoying questions.

Once you get into a company, is there something that you look for that you’ve just got to change every single time?

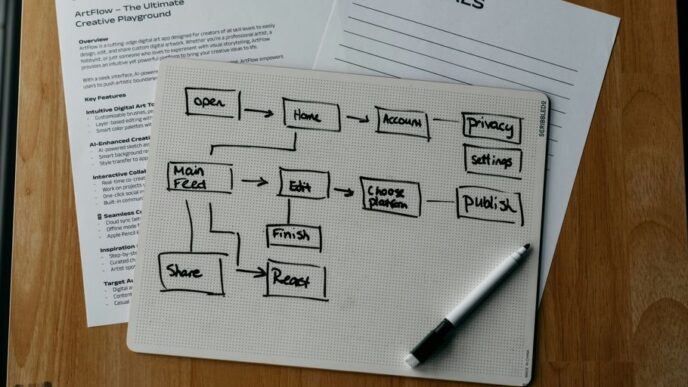

“The charge of accounts, which is what spits out your financial statements, and the financial statements are crucial. I have never come across [a charge of accounts] that was set up yet correctly. And the reason why I go after that, it’s the same reason why you want to make sure your spinal column is healthy. You simply cannot get away from it … That ‘spinal column’ is your accounting system. And if you don’t have that thing aligned properly and correctly, it doesn’t matter what’s hanging off of it. It’s not going to be right.

There are correct financial statements for every industry. SaaS in particular as a set of financial statements. These are based on research investment banks have been doing in the space and continue to do so today that says, ‘here’s how a software company’s balance sheet and profit and loss should look so that we can compare you to others.’”

The easy answer is find somebody who’s done it before and have them show you how to do it. Don’t try and do this or do not do this at home yourself.

“Because what YouTube or the DIY sites [are] really good is telling you what to do, but not how to actually set up QuickBooks to do it, or how to set up Xero to do it, or how to set up so that your QuickBooks marries into your financial forecasting spreadsheet so that you’re not having to translate between the two. There’s a technology tech stack. There is a way that those tech stacks should integrate with each other and talk with each other.

And that’s something that we bring. That’s what we’ve developed over the years that we bring. I cannot find a source out there other than us who says, here’s how you actually set up QuickBooks rules in order to classify things the way that you need them. So, I don’t have an answer like, ‘Hey, you can go out and just find this on the web.’”

This again comes down to, if you’re going to hire a fractional CFO … make sure that person has … primarily has worked in your industry. Because then they’re going to know what the financial statements should look like. They’re going to know what the investors are expecting. They’re going to know what your board of directors is going to want to see. Those are the things that the experience brings. We haven’t gotten AI to the point yet where they can do that. I’m working on it.”

Have you run into where the CEO themselves is a roadblock to implementing your process? How do you get around that?

“Generally, we don’t stay engaged. Mostly because … I’ve realized that leopards cannot change their spots. And if you have the type of CEO, or founder who doesn’t value process, and doesn’t value this information, or how it’s obtained, or how it’s set up, you’re not going to change their mind.”

What happens to that CEO?

“Usually, they fail. I remember Kubler Ross’ seven stages of death and dying … There are seven stages of CEO as well. And in the beginning, as a CEO, and I’m speaking from personal experience, and also observing, you do everything. You are the chief marketer. You are the chief salesperson. You’re the chief accountant. You’re the chief finance person. You’re the chief engineer. You’re doing it all.

The only way that you can grow your company is you have to start taking those parts of you outside of you. And so, marketing needs to go to an expert who knows how to do lead generation. Sales needs go to a salesperson who can professionally close deals. Development should be run by an engineer who understands it. Finance should be run by the CFO. You, as the CEO, your main job ultimately becomes brand, strategy, and brand. You are the face of the company. You’re the face of the company. Good or ill. You’re the one out there being the chief promoter, the chief cheerleader, the evangelical, whatever it is. You’re also setting the strategic direction of the company.

You know your customer base better than anybody else. You need to be able to take that information and give it to the folks in your organization who can then execute on it at scale. There’s no way a CEO can run every aspect of their company. Sooner or later, they have to trust people to run it for them. CEOs that can’t do that won’t scale.

I have clients that are micromanager CEOs. We work with them, but I also know they’re probably not going to go very far because they have to keep their hands on every little thing in the organization. So, they listen to us. It’s not like they don’t understand what they do or value us … As long as you’re continuing to authorize all accounts payable checks, as long as you’re the one who’s doing all the payroll authorizations, you’re the one who’s checking, marketing, and making sure all that [gets done], you’re basically going to not go very far. Or, you’re going to die an early death because you’re overworking yourself.

And I fall into this trap myself if I’m not careful. We have to do everything right. Well, no, you don’t. There are plenty of companies out there that succeed with CEOs that don’t have to do everything. That’s why you have experts that you hire to do it.”

If you could put anything on a to-do list for a founder today to get a handle on their finances, what would that be?

“As a CEO who’s got a company that’s growing, you need to make sure that your accounting system is set up for your industry. You need to make sure that you have a cash forecast that you can use. If you’re a startup, there are two metrics above all else that you need to pay attention to: cash runway and sales growth. That’s it. Everything after that is detail.

“Without sales growth, you’re not going to attract investors. Without a cash runway and knowing when you’re going to run out of cash, it’s like driving your car at night in the dark with no dashboard and no headlights … What happens when the highway takes a turn, or there’s a cow in the road, or whatever? Something happens that you don’t see coming. So, my advice to anybody who’s starting off, number one, is make sure that you have your cash runway and your sales growth understood.

And that sales growth piece means that you have to really understand how to go to market. I can’t tell you how many times I’ve come into a company, we’re fixing all the finances, but hey, we didn’t make our sales target … Well, if you’re not hitting your sales targets, then you have a problem. Either there’s not a market fit for your product, or your marketing [or sales] team is ineffective.

The first thing you should be doing as a CEO, even before you get the finance stuff, is … do you understand who your customer is? Where their watering holes are, what message they will respond to when you bring it to them, and how to get their money out of their pocket into yours? What’s the value proposition? What’s the return on investment? What’s in it for them by buying your product or your service? That’s the kind of stuff where I usually look at the CEO and say, ‘You just didn’t get that.’”