Well, the news from Asia lately has been pretty exciting, especially if you follow the stock markets. We’re seeing some big moves, and it’s got everyone talking. This article, “Asian Markets Surge: A Bloomberg Markets Analysis,” is going to break down what’s happening, why it matters, and what it could mean for investors. It’s a lot to take in, but we’ll try to make it clear.

Key Takeaways

- The Shanghai Composite Index has seen a huge jump, grabbing attention from investors all over the world.

- Strong results from major tech and manufacturing companies in China are a big reason for this market boost.

- There are signs that the Chinese government might be stepping in to support the market, which is also helping investor confidence.

- This surge is causing some ups and downs in other Asian markets and has people watching how China affects the global economy.

- For investors, it’s a time to be careful but also to look for chances, with many suggesting spreading out investments and using smart tools to keep up with changes.

Asian Markets Surge: A Bloomberg Analysis

Shanghai Composite Index Reaches Unprecedented Heights

Well, folks, the Shanghai Composite Index has been on a wild ride lately, hitting levels we haven’t seen before. It’s like the market just decided to take off, and everyone’s looking to see where it’s headed. This isn’t just a small bump; we’re talking about a significant jump that’s got investors around the world paying close attention. It really makes you wonder what’s going on under the hood.

Global Investor Attention Focused on China’s Market

It seems like every investor with a pulse is now glued to what’s happening in China’s market. When a market moves this much, it’s hard to ignore, and frankly, it’s drawing in interest from all corners of the globe. People are trying to figure out if this is a fleeting moment or the start of something bigger. The sheer volume of attention suggests that whatever is happening there, it’s likely to have ripple effects elsewhere.

Understanding the Drivers of the Asian Market Rally

So, what’s actually pushing these Asian markets, especially China’s, to climb so high? It’s not just one thing, but a mix of factors. We’ve seen some really strong reports from big companies, particularly in tech and manufacturing. Plus, there are whispers and some official hints about the government stepping in to support the market. These elements combined seem to be giving investors the confidence they need to jump in. It’s a complex picture, but the upward trend is undeniable right now.

Key Factors Fueling the Asian Market Boom

So, what’s really behind this big jump in Asian markets? It’s not just one thing, but a few major players making moves.

Robust Earnings from Tech and Manufacturing Giants

First off, a lot of the big tech and manufacturing companies in the region have been putting out some seriously good numbers. We’re talking about companies that make everything from the chips in your phone to the cars on the road, and they’ve been beating expectations left and right. This makes investors feel a lot better about putting their money into these companies. It’s like when your favorite band releases a new album and it’s even better than the last one – everyone gets excited.

Government Support Measures Bolstering Confidence

Then there’s the government side of things. There have been whispers, and now more than whispers, about officials stepping in to help stabilize the market. Think of it like a parent giving a kid a little nudge to help them stay on their feet. These support measures, whatever they might be exactly, are making investors feel more secure. When people feel like the government has their back, they’re more likely to invest.

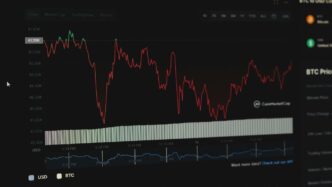

Surge in Trading Volumes Indicating Investor Interest

And you can see this excitement in the numbers. Trading volumes have shot up. That means way more people are buying and selling stocks than usual. It’s like a popular store suddenly getting a huge rush of customers – everyone wants a piece of the action. This jump in activity shows that both local and international investors are paying close attention and are ready to jump in.

Here’s a quick look at how things have been heating up:

- Tech Sector: Companies reporting profit increases of over 20% year-over-year.

- Manufacturing Output: Key industrial indicators showing a 15% rise in production.

- Trading Activity: Daily trading volumes have more than doubled in the past month.

It’s a mix of strong company performance and a feeling of stability that’s really getting things moving.

Impact of the Surge on Global Financial Landscapes

Volatility Across Asian Markets

The sudden jump in Asian markets, particularly in China, has sent ripples of unpredictability across the region. It’s not just a simple upswing; we’re seeing a mixed bag of reactions. Some neighboring markets have caught the positive wave, seeing their own indices climb. Others, however, are feeling the jitters, with increased swings in stock prices as investors try to figure out what this means for their own economies. It’s like a big wave hitting the shore – some boats ride it easily, while others get tossed around a bit. This kind of choppy movement is making things a bit tense for traders.

China’s Influence on International Economic Dynamics

Let’s be real, when China’s economy shifts, the rest of the world tends to notice. This market surge is a prime example. Because China is such a huge player in manufacturing and trade, a booming stock market there often means more spending, more investment, and generally a stronger economic outlook. This can translate into better demand for goods from other countries and potentially more investment flowing into different markets. It’s a clear sign that what happens in one major economy can really shake things up globally.

International Investor Scrutiny of Market Trends

Folks outside of Asia are definitely paying close attention. They’re trying to get a handle on whether this rally is the real deal – something that’s going to last – or just a temporary burst of excitement. This means a lot more eyes are on the data coming out of China, looking for signs of solid growth versus just a short-term spike. It’s a balancing act for international investors, weighing the potential rewards against the risks of jumping in too late or at the wrong time. They’re asking:

- Are the companies reporting good earnings actually doing well long-term?

- Will government support continue, or was it just a one-off?

- Is the overall economic picture strong enough to keep this momentum going?

This careful watch means that decisions made by international investors could significantly influence future market movements, both in Asia and beyond.

Navigating Investor Strategies Amidst Market Volatility

So, the Asian markets are really taking off, especially China’s. It’s exciting, sure, but also a bit nerve-wracking if you’re thinking about putting your money in. When things move this fast, it’s easy to get caught up or, worse, make a hasty decision you’ll regret. The big question on everyone’s mind is how to play this surge without getting burned.

Cautious Optimism in Investor Sentiment

Most folks seem to be feeling a mix of excitement and worry. It’s like seeing a really good sale, but you’re not quite sure if the item will actually last or if it’s just a gimmick. Analysts are saying to keep a close eye on things. The potential for big wins is there, but so is the risk if this rally suddenly fizzles out. It’s a bit of a tightrope walk, honestly.

The Importance of Diversification

This is where spreading your bets comes in handy. Instead of putting all your eggs in one basket, it makes sense to look at different types of investments across various markets. This way, if one area takes a hit, others might hold steady or even go up. It’s a classic strategy for a reason, especially when markets are doing unpredictable things. Looking beyond broad indices and adopting a differentiated approach across Asian markets can help you manage the ups and downs.

Leveraging Advanced Analytics for Informed Decisions

Trying to figure out what’s happening with just headlines can be tough. That’s where tools that crunch numbers and spot patterns can be a lifesaver. They can help you see what’s really going on beneath the surface, maybe even predict what might happen next. It’s about using smart tech to make smarter choices, rather than just guessing.

Here are a few things to keep in mind:

- Watch the Earnings: Keep an eye on how companies are actually performing. Are those big profits real and sustainable?

- Government Signals: Pay attention to what governments are saying and doing. Sometimes their actions can really shift the market.

- Trading Activity: Big jumps in how much people are buying and selling can tell you a lot about confidence levels.

It’s a dynamic situation, and staying informed is key. Remember, this isn’t financial advice, so always do your own homework before making any moves.

Analyzing the Sustainability of the Market Rally

So, the big question on everyone’s mind is: can this rally keep going? It’s easy to get caught up in the excitement when markets are shooting upwards, but it’s smart to take a step back and think about what’s really driving it and if it’s built to last. We’ve seen some pretty impressive gains, especially in Chinese equities, and while that’s great news for investors, it also means we need to be a bit careful.

Identifying Long-Term Trends Versus Temporary Spikes

It’s tough to tell the difference between a real, lasting shift and just a short-term burst of activity. Right now, the surge seems to be fueled by a few key things. Strong earnings from big tech and manufacturing companies are definitely a major factor. When these giants report good numbers, it gives investors confidence. Plus, there are whispers of government support measures, which can really help stabilize things and encourage more buying. We’re seeing trading volumes jump, which usually means people are interested and putting their money in.

However, markets can be unpredictable. Sometimes, a rally can be a temporary spike, driven by hype or short-term factors that don’t stick around. It’s important to look at the underlying economic conditions and not just the daily price movements. For instance, while artificial intelligence is a hot area, we also see opportunities in value-focused consumer sectors, which might offer a more stable path Asia’s recent market rally shows varied returns.

Lessons Learned from Market Shifts

History teaches us a lot about market booms and busts. We’ve seen rallies before that looked strong but eventually faded. What’s important now is to remember that diversification is still your friend. Don’t put all your eggs in one basket, especially when things feel a bit shaky. Spreading your investments across different areas can help cushion any unexpected drops.

Here are a few things to keep in mind:

- Watch the data: Keep an eye on economic reports, company earnings, and any official policy changes.

- Don’t chase: Avoid jumping into investments just because everyone else is.

- Stay informed: Understand what’s happening both locally and globally.

The Enduring Impact on Chinese Equities

Regardless of whether this is a short-term blip or the start of something bigger, the current market activity is already having a significant effect. The sheer scale of the recent gains in Chinese equities is hard to ignore. It’s drawing attention from investors worldwide and forcing a re-evaluation of strategies. Even if the rally cools down, the increased interest and the underlying strengths we’re seeing could lead to lasting changes in how people view and invest in these markets. It’s a dynamic situation, and staying adaptable will be key for anyone involved.

Looking Ahead

So, the Shanghai market really took off today, and it’s got everyone talking. It’s a big deal, no doubt about it. We saw some strong company results and heard whispers about the government stepping in, which seems to have really gotten investors excited. This kind of jump isn’t just a small blip; it’s shaking things up across Asia and even further afield. While it’s tempting to jump in, remember that markets can be unpredictable. It’s smart to stay informed, maybe look at different kinds of investments, and keep an eye on how things develop. What happens next in China could really shape how people invest for a while.

Frequently Asked Questions

Why did the Shanghai stock market jump so much?

The stock market in Shanghai saw a big jump because major companies in technology and manufacturing reported really good profits. Also, there were hints that the government might step in to help keep the market steady, which made investors feel more confident.

How are other countries’ stock markets reacting?

When China’s market moves a lot, it affects other markets around the world. Some Asian markets have become a bit unpredictable, going up and down. This shows how important China’s economy is to everyone else.

What does this mean for people investing their money?

Investors are being careful but also hopeful. It’s smart to spread your money across different types of investments, not just put it all in one place. This helps protect you if the market suddenly changes.

Is this big jump in the market likely to last?

It’s hard to say for sure. While good company profits and government support are positive signs, markets can change quickly. Experts are watching closely to see if this is a long-term trend or just a short-term boost.

What are some ways investors can make smart choices right now?

Investors should stay informed about what’s happening in the market. Using tools that can analyze lots of information quickly can help them make better decisions and understand the risks involved.

What is the role of trading volume in this situation?

The amount of buying and selling, called trading volume, has gone up a lot. This means more people, both in China and from other countries, are interested in buying stocks, which is a sign of strong investor excitement.