Hey everyone, let’s talk about what’s been happening in the Asian stock markets lately. Bloomberg has been keeping a close eye on things, and we’ve got some updates on how major indexes are doing. It’s always interesting to see the trends and how different regions are performing. So, let’s get into the latest from the asian stock market bloomberg reports.

Key Takeaways

- The Nikkei 225 and Topix Index in Japan have shown specific trends, with recent data indicating their performance.

- Hong Kong’s Hang Seng Index has experienced its own movements, reflecting market conditions in the region.

- Key Chinese indexes like the CSI 300, alongside Australia’s ASX 200, are showing their latest performance figures.

- Bloomberg’s reports cover a wide range of Asian equities, providing real-time data and analysis on market trends.

- Updates are available for South Korean and Indian markets, offering a broader view of regional economic activity.

Key Asian Stock Market Performance Insights

Looking at the major Asian stock markets, things have been a mixed bag lately. It’s always interesting to see how different economies are doing based on their stock performance. We’ve seen some solid gains in certain areas, while others are showing a bit more caution.

Nikkei 225 and Topix Index Trends

The Japanese market, represented by the Nikkei 225 and the Topix Index, has been showing some resilience. The Nikkei 225, a widely watched index, has seen fluctuations but generally points towards a positive trend over the past year. Similarly, the Topix Index, which includes a broader range of companies listed on the Tokyo Stock Exchange, has also been on an upward path. These movements suggest investor confidence in Japanese businesses.

Here’s a quick look at recent performance:

- Nikkei 225: Saw a slight dip recently, but year-to-date performance remains strong.

- Topix Index: Continues to show steady growth, reflecting a wider market health.

- Investor Sentiment: Generally positive, though subject to global economic shifts.

Hang Seng Index Movements

In Hong Kong, the Hang Seng Index has experienced its own set of ups and downs. While it has seen some recovery, its performance can be quite sensitive to geopolitical events and economic policies affecting mainland China. Tracking the Hang Seng is key to understanding the broader sentiment towards the Greater China region.

CSI 300 and ASX 200 Performance

Moving to China, the CSI 300, which tracks A-shares from Shanghai and Shenzhen, has shown some upward momentum. This indicates growing interest in the Chinese domestic market. Meanwhile, the Australian market, represented by the S&P/ASX 200, has also been active. Its performance often reflects commodity prices and the health of the Australian economy, which has its own unique drivers. You can find more details on Asia-Pacific stock indexes to get a fuller picture.

Regional Market Updates and Bloomberg Data

Let’s take a look at what’s happening across some of the major Asian markets, pulling in some data that Bloomberg has been tracking. It’s always interesting to see how different economies are performing and what factors are influencing their stock exchanges.

Shanghai Composite and Shenzhen Component Analysis

The Chinese markets have shown some mixed signals lately. The Shanghai Composite Index, a broad measure of stocks traded in Shanghai, has been experiencing fluctuations. Meanwhile, the Shenzhen Component Index, which tracks stocks in Shenzhen’s tech-heavy exchange, is also on our radar. Bloomberg’s data suggests a slight upward trend in the CSI 300 Index, which represents A-shares from both Shanghai and Shenzhen, indicating some investor confidence.

Here’s a snapshot of recent performance:

| Index | Value | Change | % Change |

|---|---|---|---|

| CSI 300 Index | 4,723.07 | +4.19 | +0.09% |

| Shanghai Composite | (Data not provided) | (Data not provided) | (Data not provided) |

| Shenzhen Component | (Data not provided) | (Data not provided) | (Data not provided) |

Hong Kong Stock Exchange Performance

Over in Hong Kong, the Hang Seng Index has been a point of focus. This index is a good indicator of the broader market sentiment in the region. We’ve seen some back-and-forth movement, but overall, it’s been holding its ground. It’s worth noting that the correlation between regional stock performance and currency movements has shifted recently, with the 30-day correlation between the MSCI Asia Pacific Index and the Bloomberg Asia Dollar Index falling below zero for the first time since September 2024. This suggests a decoupling between how stocks are doing and how the local currencies are faring [a94e].

South Korean and Indian Market Trends

Looking at South Korea, the KOSPI 200 index is what we’re watching. It’s been relatively stable, with some minor ups and downs. For India, the Nifty 50 and Sensex are the key benchmarks. Both have seen some volatility, but the overall picture is one of resilience. These markets are often influenced by global economic trends as well as domestic factors, making them dynamic places to watch.

Key trends to keep an eye on include:

- Global economic outlook impacting export-driven economies.

- Domestic policy changes and their effect on local businesses.

- Investor sentiment towards emerging markets in Asia.

- Commodity prices and their influence on resource-rich economies.

Major Asian Indices Overview

Let’s take a look at how some of the biggest stock markets in Asia have been doing lately. It’s always interesting to see the numbers, and Bloomberg gives us a good way to track them.

Nikkei 225 and Topix Index Performance

Japan’s Nikkei 225 and Topix indices are key indicators for the Japanese market. The Nikkei 225, which tracks the 225 largest companies listed on the Tokyo Stock Exchange, has seen some movement. Similarly, the Topix Index, representing a broader range of companies, also shows the pulse of the Japanese economy. These indices provide a snapshot of the health of Japanese industry.

Here’s a quick look at some recent figures:

| Index | Value | Change | % Change |

|---|---|---|---|

| Nikkei 225 | 52,774.64 | -216.46 | -0.41% |

| Topix Index | 3,589.70 | -35.90 | -0.99% |

Hang Seng Index and CSI 300 Analysis

Moving over to Hong Kong, the Hang Seng Index is a major benchmark. It reflects the performance of companies listed on the Hong Kong Stock Exchange. Meanwhile, the CSI 300 index covers the largest companies traded on the Shanghai and Shenzhen stock exchanges in mainland China. These two indices give us a view into two of Asia’s most significant economies.

Some recent data points:

- Hang Seng Index: Showed a slight uptick, indicating some positive sentiment.

- CSI 300 Index: Also saw a small gain, suggesting a steady performance in the Chinese market.

S&P/ASX 200 and Other Regional Indices

Australia’s S&P/ASX 200 is another important index to watch in the region. It represents the top 200 stocks by market capitalization on the Australian Securities Exchange. Beyond these, various other indices across Asia, like those in South Korea and Southeast Asia, contribute to the overall picture. Keeping an eye on these different markets helps paint a clearer image of regional economic activity. You can find more details on major world stock indexes.

It’s a lot to keep track of, but these indices are our guideposts for understanding how things are going in Asian markets.

Bloomberg’s Coverage of Asian Equities

When it comes to keeping tabs on the fast-moving Asian stock markets, Bloomberg is a go-to source for many. They provide a constant stream of information, helping investors stay informed about the latest shifts and trends across the region.

Tracking Major Asian Stock Market Trends

Bloomberg’s reporting covers a wide array of Asian markets, from the bustling exchanges in Tokyo and Shanghai to the dynamic markets in Seoul and Mumbai. They focus on providing timely updates that matter to traders and analysts alike. This includes detailed breakdowns of index performance, sector-specific movements, and macroeconomic factors influencing investor sentiment. Keeping up with these trends can be a challenge, but Bloomberg aims to simplify it.

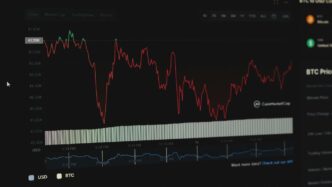

Real-time Data and Analysis from Bloomberg

One of the key aspects of Bloomberg’s coverage is its real-time data. They offer up-to-the-minute figures on major indices, allowing for quick reactions to market changes. Here’s a snapshot of some key Asian indices as reported:

| Index Name | Value | Change | % Change | 1 Year Performance |

|---|---|---|---|---|

| Nikkei 225 | 52,774.64 | -216.46 | -0.41% | +35.22% |

| Topix Index | 3,589.70 | -35.90 | -0.99% | +32.29% |

| Hang Seng Index | 26,585.06 | +97.55 | +0.37% | +32.22% |

| CSI 300 | 4,723.07 | +4.19 | +0.09% | +24.39% |

| S&P/ASX 200 | 8,782.87 | -32.98 | -0.37% | +4.53% |

Beyond just numbers, Bloomberg provides analysis that helps put these figures into context. This includes commentary on:

- Geopolitical events impacting regional stability.

- Corporate earnings reports and their market implications.

- Shifts in monetary policy from central banks.

- The flow of foreign investment into and out of key markets.

Performance of Key Asian Indices

Bloomberg’s reporting highlights the varied performance across Asia. For instance, while some markets might be experiencing dips, others, like Chinese stocks, are showing notable resilience. Their coverage helps investors understand these divergences and identify potential opportunities or risks. They track not only the headline indices but also sector-specific performance and the impact of global economic shifts on Asian markets. This detailed approach is what makes their updates so useful for anyone watching the region.

Asian Stock Market Bloomberg Report

Japanese Market Performance

Looking at Japan, the Nikkei 225 and Topix indices have shown some interesting movement. The Nikkei 225, for instance, saw a slight dip of 0.41%, closing around 52,774.64. Meanwhile, the broader Topix Index experienced a 0.99% drop, settling near 3,589.70. These figures suggest a bit of caution in the Japanese market right now, though year-to-date performance still looks pretty solid for both.

Chinese Market Dynamics

China’s markets present a different picture. The Shanghai Composite Index managed a small gain, ticking up by 0.08% to 4,116.94. The Shenzhen Component Index also saw a positive move, climbing 0.70% to 14,255.13. It seems like there’s a bit more upward momentum here, with strong year-to-date returns reported by Bloomberg.

Hong Kong Market Trends

In Hong Kong, the Hang Seng Index showed a bit of resilience, adding 0.37% to reach 26,585.06. This indicates a steady, if not spectacular, performance for the region’s financial hub. The market seems to be holding its ground, with Bloomberg data showing a decent uptick over the past month and year.

Navigating the Asian Stock Market with Bloomberg

So, you’re looking to get a handle on what’s happening in Asian stock markets? It can feel like a lot, with different countries and indices all doing their own thing. That’s where having a good source of information really helps, and Bloomberg is definitely one of those go-to places for market data. They provide a ton of information that can make things clearer.

Key Asian Index Performance

When you’re trying to track performance, looking at the major indices is a good starting point. These are like the big players that give you a general idea of how things are going in different regions. For example, you’ve got:

- Nikkei 225 (Japan): This index tracks the 225 largest Japanese companies listed on the Tokyo Stock Exchange. It’s a pretty well-known benchmark for the Japanese economy.

- Hang Seng Index (Hong Kong): This one represents the performance of the largest companies listed on the Hong Kong Stock Exchange. It’s a key indicator for the financial hub of Hong Kong.

- CSI 300 (China): This index tracks the top 300 stocks traded on the Shanghai and Shenzhen exchanges. It gives a broad view of the Chinese mainland market.

- S&P/ASX 200 (Australia): This is the main index for the Australian stock market, covering about 200 of the largest companies by market cap.

Keeping an eye on these can give you a quick snapshot of the market’s direction.

Regional Market Trends and Data

Beyond just the headline indices, Bloomberg also provides data that helps you see the trends within specific regions. It’s not just about the numbers, but also about understanding what’s driving them. For instance, you might see:

- Japanese Market Dynamics: Looking at the Nikkei and Topix, you can see if certain sectors are performing better than others. Are tech stocks leading the way, or is it more about traditional industries?

- Chinese Market Movements: The Shanghai Composite and Shenzhen Component indices show the activity in mainland China. Bloomberg’s data can help break down performance by industry, giving you a sense of where the growth is.

- South Korean and Indian Market Trends: These markets have their own unique drivers. Tracking indices like the KOSPI (South Korea) and Nifty 50 (India) can reveal different economic stories unfolding.

It’s this kind of detailed data that helps paint a fuller picture, moving beyond just the daily ups and downs.

Insights from Bloomberg’s Market Coverage

What makes using a service like Bloomberg really useful is the combination of real-time data and analysis. They don’t just give you the numbers; they often provide context. This can include:

- Tracking Major Asian Stock Market Trends: Bloomberg’s platform allows you to see how different indices are performing over various timeframes – daily, monthly, or yearly. This helps in spotting longer-term patterns.

- Real-time Data and Analysis: When news breaks or economic data is released, Bloomberg is usually quick to update its figures and provide commentary on what it might mean for the markets. This immediate feedback loop is pretty important for traders and investors.

- Performance of Key Asian Indices: They offer detailed breakdowns, often showing which stocks or sectors are contributing most to an index’s movement. This level of detail helps in understanding the ‘why’ behind the numbers.

Wrapping Up

So, that’s a look at how things are shaking out in Asian markets, based on what Bloomberg’s been reporting. It’s a mixed bag out there, with some areas showing gains and others seeing dips. Keeping an eye on these trends is pretty important if you’re involved in any of this. Things can change fast, so staying informed is key. We’ll keep watching and bring you more updates as they come.

Frequently Asked Questions

What are the main stock markets in Asia that are being talked about?

The article mentions several important markets like Japan’s Nikkei 225 and Topix, Hong Kong’s Hang Seng Index, China’s CSI 300 and Shanghai Composite, and Australia’s ASX 200. It also touches on markets in South Korea and India.

Where can I find the latest news about Asian stocks?

Bloomberg is a great source for this kind of information. They provide up-to-date news, data, and analysis on how these Asian stock markets are doing.

How are these markets performing lately?

The performance can change daily, but the report looks at recent trends. Some markets might be going up, while others might be going down. It’s important to check the latest numbers for the most current picture.

What does Bloomberg do to help people understand the markets?

Bloomberg offers real-time data, expert analysis, and covers the major trends happening in Asian stock markets. This helps investors and interested people make sense of the market movements.

Are there specific examples of market performance mentioned?

Yes, the article discusses how markets like the Nikkei 225, Hang Seng, and CSI 300 are performing. It gives a snapshot of their recent activity based on Bloomberg’s reports.

What’s the main point of this article about Asian stocks?

The article is like a news update, using information from Bloomberg to explain what’s happening with major stock markets across Asia. It covers their performance and the latest trends.