Understanding the Silicon Valley Bank Impact on Astra Space Inc.

SVB’s Role in the Tech and Space Sectors

Silicon Valley Bank, or SVB, was a big deal in the startup world, especially for tech companies. It was known for being more in tune with the culture and needs of these newer businesses compared to older, more traditional banks. Many startups, including those in the space industry, saw SVB as the go-to place to park their cash. This close relationship meant that when SVB ran into trouble, it sent ripples through the entire tech ecosystem, and the space sector wasn’t immune.

The Unfolding Crisis and Depositor Concerns

Things really kicked off in early March 2023. Concerns about SVB’s financial health led venture capital firms to pull their money out fast, causing a bank run. Suddenly, a lot of companies, many of which were startups, couldn’t access the funds they needed for basic operations like paying employees. The government stepped in, promising that depositors would get their money back, which happened by March 13th. However, the situation highlighted how shaky some parts of the financial system were, with other banks like First Republic and even Credit Suisse in Switzerland facing major issues. Credit Suisse eventually failed and was bought out.

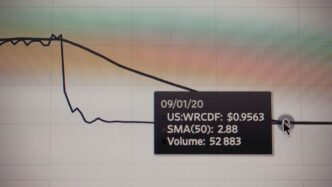

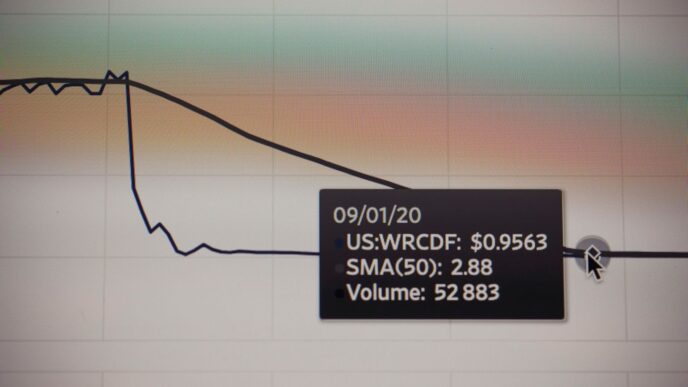

Astra Space Inc.’s Disclosed Exposure to SVB

When the SVB crisis hit, it was natural for investors to wonder how companies like Astra Space Inc. were affected. Public filings showed that Astra did indeed have funds with SVB. Specifically, about 15% of Astra’s total cash and other assets were held at the bank. While this wasn’t the entirety of their holdings, it was a significant enough portion to cause concern during the period when depositor access was uncertain. Other space companies like Rocket Lab also had exposure, though generally a smaller percentage of their overall assets. It’s worth noting that some companies, like BlackSky and Planet, had previously used SVB for loans or investments but had repaid them before going public, which likely lessened their direct impact during the immediate crisis.

Navigating Financial Sector Volatility

The banking world went through a bit of a shake-up recently, and it’s got everyone in the tech and space industries talking. When a big bank like Silicon Valley Bank (SVB) runs into trouble, it’s not just a small hiccup; it can send ripples across the entire financial landscape, especially for companies that rely on that sector for their operations. This kind of instability highlights how interconnected everything is, from startups to established players.

Broader Implications for Technology Startups

For many tech startups, SVB was more than just a bank; it was a partner. They often held significant amounts of cash there, sometimes far exceeding the insured limits. When SVB faced issues, these companies suddenly found their access to funds uncertain. This created immediate problems, like making payroll or paying suppliers. It’s a stark reminder that even seemingly stable financial institutions can face unexpected challenges. The situation also made venture capitalists a bit more cautious, potentially slowing down the flow of new investment money into startups. It’s like a domino effect – one problem in the financial system can quickly affect many others.

Regulatory Responses and Market Stabilization Efforts

Governments and financial regulators don’t just sit back when a bank is in trouble. They step in to try and calm things down. In the case of SVB, regulators took control of the bank to protect depositors. They also made assurances that people would get their money back, which helped stop a wider panic. Similar actions were seen in other countries when their branches of SVB faced issues. These moves are designed to prevent a domino effect, where the failure of one bank causes others to fail. It’s a balancing act, trying to fix the immediate problem without causing new ones. The Federal Reserve, for instance, signaled that their interest rate hikes might be slowing down, partly because they saw the impact on the banking sector. This shows how regulators are watching the economy closely and adjusting their strategies. Adapting to evolving regulations is a constant challenge for technology firms like those in the ride-sharing space.

Lessons Learned for Financial Risk Management

This whole event offers some pretty clear takeaways for how companies manage their money. First off, it’s probably not a good idea to keep all your eggs in one basket, or in this case, all your cash in one bank. Diversifying where you keep your funds, even if it means dealing with multiple banks, can be a smart move. Companies also need to think about what happens if their primary bank has problems. Having contingency plans in place is key. This could involve having backup banking relationships or understanding how to access funds quickly if there’s an issue. It’s about building resilience into your financial operations. The goal is to be prepared for the unexpected, so a financial shock doesn’t completely derail your business. It’s a good time for companies to review their banking relationships and their overall financial strategy.

Astra Space Inc.’s Financial Resilience

When the Silicon Valley Bank situation hit, it definitely caused a stir across the tech world, and the space industry wasn’t immune. For Astra Space Inc., like many other companies, it brought up questions about how solid their financial footing really is, especially when dealing with the banking sector. It’s not just about having money in the bank; it’s about how that money is managed and protected.

Assessing Portfolio Diversification

One of the first things to look at is how Astra spreads its financial assets around. Having all your eggs in one basket, or in this case, all your cash with one bank, can be risky. Diversifying means not putting all your funds into a single institution. This is a smart move for any company, but especially for those in fast-moving industries like space exploration where cash flow is key.

- Spreading Deposits: Keeping funds across multiple banks reduces the impact if one institution faces trouble.

- Investment Mix: Beyond just cash, looking at how investments are spread across different types of assets can also add a layer of safety.

- Cash Reserves: Maintaining healthy cash reserves provides a buffer against unexpected financial shocks.

Strategies for Mitigating Banking Risks

Companies like Astra are always thinking about how to avoid getting caught out by financial hiccups. This means having plans in place before any problems arise. It’s about being proactive rather than reactive.

- Regular Bank Reviews: Periodically assessing the financial health and stability of the banks they work with is a good practice.

- Contingency Banking: Establishing relationships with backup banks, even if they aren’t used regularly, can be a lifesaver in a pinch.

- Understanding Deposit Insurance: Knowing the limits and specifics of deposit insurance (like FDIC in the US) helps in planning how much to keep at any single institution.

Maintaining Operational Continuity Amidst Uncertainty

Ultimately, the goal is to keep the rockets launching and the business running, no matter what’s happening in the financial markets. Astra’s ability to continue its operations without major disruption is the true measure of its financial resilience. This involves having clear communication channels with financial partners and a solid understanding of their own financial health. It’s about having contingency plans that cover not just finances, but also the day-to-day operations that depend on them. For instance, if payroll can’t be processed due to a banking issue, that’s a direct hit to operations. Having alternative ways to handle such critical functions is what resilience is all about.

Investor Confidence in the Space Industry

It’s natural for investors to get a little jumpy when big banks stumble, like what happened with Silicon Valley Bank. The space industry, being pretty capital-intensive, really feels these tremors. But here’s the thing: the overall mood about investing in space is still pretty solid. We’re seeing a lot of interest driven by some big trends that aren’t going away anytime soon.

Identifying Key Investment Drivers

So, what’s keeping the money flowing into space companies? It’s not just about rockets anymore. Think about how space tech is changing things down here on Earth. Climate monitoring from orbit is huge, helping us track environmental changes and manage resources better. Then there’s defense and national security – governments are increasingly looking to space for surveillance, communication, and early warning systems. And don’t forget sovereign wealth funds and large institutional investors; they’re starting to see space as a stable, long-term investment area, especially as it becomes more commercialized.

Here are some of the main reasons investors are still keen:

- Earth Observation: Companies using satellites to gather data about our planet are in high demand. This data is used for everything from agriculture and disaster management to urban planning.

- Satellite Communications: As more people and businesses rely on internet connectivity, especially in remote areas, the demand for satellite broadband continues to grow.

- In-Space Services: This includes things like satellite servicing, debris removal, and even in-space manufacturing, which are all new but growing markets.

- Launch Services: While competitive, reliable and cost-effective access to space remains a core need for all other space activities.

The Role of Venture Capital in Space Exploration

Venture capital firms have been a massive part of the space boom. They’re often the first ones to put serious money into new space startups, taking on a good amount of risk. When a bank like SVB has issues, it can make VCs a bit more cautious, maybe slowing down the pace of new investments for a short while. However, the underlying potential of the space market is so big that VCs are still actively looking for promising companies. They understand that building a space company takes time and significant funding, and they’re generally in it for the long haul.

Long-Term Outlook for Space-Focused Investments

Despite the recent banking hiccups, the long-term outlook for space investments remains positive. The technology is advancing rapidly, costs are coming down, and new applications for space-based assets are constantly emerging. Think about how many industries are now touched by space technology – it’s pretty much all of them. While there might be short-term adjustments due to financial market conditions, the fundamental drivers for growth in the space sector are strong. Companies that can demonstrate a clear path to profitability and a solid business model will likely continue to attract investor interest. The space industry is maturing, moving beyond just government contracts to a more commercial and diversified ecosystem, which is exactly what investors look for.

Comparative Analysis: Canadian Space Sector Exposure

When the Silicon Valley Bank (SVB) situation unfolded, a lot of people were understandably worried about how it might affect companies, especially those in fast-growing sectors like space. For Astra Space Inc., which operates in the U.S., understanding how other markets, like Canada, weathered the storm can offer some perspective. The good news for Canada’s space industry seems to be that the impact was pretty minimal.

Limited Impact on Canadian Companies

From what we’ve gathered, most Canadian space companies didn’t have significant exposure to SVB. Many firms we reached out to either didn’t bank with SVB or had their accounts with the Canadian branch, which regulators stepped in to manage. Sarah McLean from Maritime Launch Services mentioned that their operations, and those of their clients, were moving along as usual. Similarly, Marek Lorenc, who works with many space clients, noted that none of his clients banked with SVB. He pointed out that SVB’s ability to operate in Canada was limited to lending, not taking deposits, so only companies with substantial U.S. operations would likely have had accounts there. While one Canadian space tech company reportedly held some capital in SVB’s U.S. accounts, the overall sentiment suggests that the direct financial fallout for Canadian space firms was quite contained.

Regulatory Frameworks in Canada

Canada’s financial regulators acted swiftly to address the SVB situation. The Superintendent of Financial Institutions took control of SVB’s Canadian branch assets to ensure an orderly transition. This quick action, coordinated with U.S. officials, helped to stabilize the situation for Canadian creditors. Unlike some U.S. startups that struggled with immediate access to funds, Canadian companies generally didn’t face the same level of disruption. This highlights how different regulatory approaches and the structure of international banking operations can influence the impact of a crisis.

Cross-Border Banking Dependencies

It’s clear that for many startups, especially those with international ambitions, banking relationships can become complex. Companies that rely heavily on U.S. financing or have significant operations in the States might find themselves more exposed to U.S. banking issues. For instance, some Canadian startups that Communitech works with found it difficult to make payroll immediately after SVB’s collapse because a large portion of their funding came from south of the border. This dependency underscores the importance of diversifying banking relationships and understanding the specific cross-border implications when choosing financial partners. For companies like Astra Space Inc., managing these cross-border financial connections is a key part of maintaining stability.

Future Financial Strategies for Astra Space Inc.

Exploring Alternative Banking Partnerships

After the recent banking sector jitters, it’s smart for Astra Space Inc. to look at diversifying its banking relationships. Relying too heavily on one institution, even a big one, can be risky. Think about spreading your company’s cash across a few different banks, maybe even some smaller, more specialized ones that focus on tech or aerospace. This way, if one bank runs into trouble, your entire operation isn’t suddenly frozen. It’s about building a more robust financial foundation. We’re seeing a lot of companies re-evaluate their banking partners, and Astra should be no different. It’s a good time to explore options, maybe even look into credit unions or banks with a strong presence in the space industry. This could also open doors to new financial products or services tailored to your specific needs. For instance, some banks might offer better terms on international transactions, which is pretty important for a company with global ambitions like Astra’s. It’s not just about safety; it’s also about finding banking partners that can actively support your growth. You can find out more about new tech communication tools on the Apple store.

Strengthening Financial Planning and Contingencies

Beyond just banking, Astra needs to really shore up its overall financial planning. This means having clear plans for what to do if unexpected things happen, like a sudden drop in revenue or a major unexpected expense. It’s like having a fire extinguisher ready – you hope you never need it, but you’re glad it’s there if you do. This could involve setting aside more cash reserves than usual, or having lines of credit already in place that you can tap into quickly if needed. Think about creating different scenarios – best case, worst case, and somewhere in between – and mapping out how the company would respond financially in each. This kind of preparation makes the company much more resilient. It’s also a good idea to regularly review and update these plans, especially when the economic climate is changing. Having a solid contingency plan shows investors that the company is thinking ahead and is prepared for various challenges.

Adapting to Evolving Economic Conditions

Finally, Astra has to stay flexible and ready to change its financial strategies as the economy shifts. Interest rates go up and down, inflation can be a problem, and global events can impact everything. The company needs to be able to adjust its budget, its investment plans, and even its pricing if necessary. This might mean being more cautious with spending during uncertain times or looking for new ways to bring in money when traditional methods become less effective. It’s about being agile. For example, if borrowing money becomes more expensive due to higher interest rates, Astra might look more closely at equity financing or improving its cash flow from operations. Staying informed about economic trends and being willing to adapt are key to long-term success, especially for a company in a dynamic sector like space exploration.

Wrapping Up: What Astra Investors Should Keep in Mind

So, looking at the whole picture, Astra Space’s move to a private status comes at an interesting time. The banking issues earlier this year showed how shaky things can get, even for big players, and how quickly money can become hard to access. While many space companies, especially in Canada, seemed to dodge the worst of it, the situation highlighted the need for solid financial footing. For investors eyeing Astra, understanding how the company manages its finances, especially during this transition away from public scrutiny, is key. It’s about making sure they’ve got a stable plan for growth and operations, no matter what the wider economic climate throws their way. Keep an eye on how they handle their cash and investments as they settle into this new chapter.