Bitcoin and cryptocurrency markets are poised for significant changes as Binance CEO Richard Teng confirms that several countries are seeking to establish their own crypto reserves. This move comes in the wake of U.S. President Donald Trump’s push for a national Bitcoin strategic reserve, which could dramatically influence Bitcoin’s price trajectory.

Key Takeaways

- Binance is advising multiple countries on creating their own crypto reserves.

- U.S. President Trump is prioritizing crypto legislation and a national Bitcoin reserve.

- Predictions suggest Bitcoin could reach unprecedented values due to increased global adoption.

The Global Shift Towards Bitcoin Reserves

In a recent statement, Richard Teng revealed that Binance has been approached by various governments and sovereign wealth funds interested in developing their own cryptocurrency reserves. This trend is largely influenced by the U.S. government’s initiatives under President Trump, who has made it a priority to establish a Bitcoin strategic reserve.

Teng noted, "We have actually received quite a number of approaches by a few governments and sovereign wealth funds on the establishment of their own crypto reserves." This indicates a growing recognition of Bitcoin as a viable asset for national reserves, similar to gold.

The U.S. Influence on Global Crypto Policy

The U.S. is currently leading the charge in cryptocurrency legislation, with Trump’s administration actively working on policies that could set a precedent for other nations. The establishment of a Bitcoin reserve is seen as a strategic move that could encourage other countries to follow suit.

- Key Points of U.S. Strategy:

- Legislation Priority: Trump aims to pass comprehensive crypto legislation.

- Executive Orders: An executive order is in place to create a Bitcoin strategic reserve.

- Global Competition: As the U.S. adopts Bitcoin, other nations may feel compelled to do the same to remain competitive.

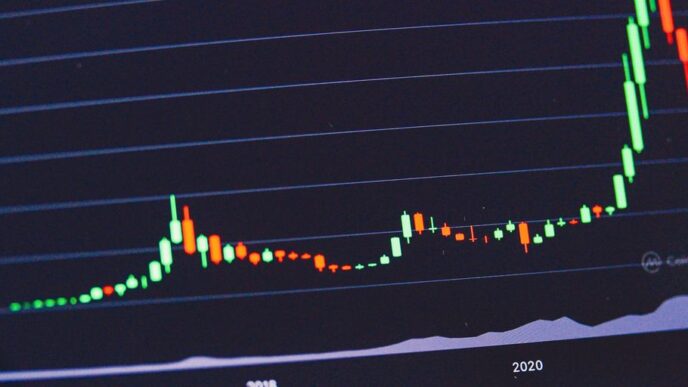

Predictions for Bitcoin’s Future

Experts are optimistic about Bitcoin’s future value, with some predicting it could soar to $500,000 or even $700,000 per coin as more countries adopt it as a reserve asset. Standard Chartered Bank’s Geoff Kendrick has suggested that the creation of a U.S. Bitcoin reserve could lead to such price surges within three years.

- Potential Price Predictions:

- $500,000 within three years (Standard Chartered)

- $700,000 as discussed by BlackRock’s CEO

The Role of Sovereign Wealth Funds

Sovereign wealth funds are increasingly showing interest in Bitcoin, with discussions about potential investments gaining traction. This interest is not limited to the U.S.; countries like Pakistan and Kyrgyzstan are also exploring Bitcoin adoption, with Binance’s guidance on regulatory frameworks.

- Countries Exploring Bitcoin Adoption:

- Pakistan

- Kyrgyzstan

Conclusion

The confirmation from Binance’s CEO about the global interest in Bitcoin reserves marks a pivotal moment for the cryptocurrency market. As countries look to the U.S. for leadership in crypto policy, the potential for Bitcoin to become a mainstream reserve asset is becoming more tangible. This could lead to unprecedented price movements and a new era of financial strategy on a global scale.