The recent easing of tariffs between the U.S. and China has led to significant volatility in the Bitcoin market. After reaching a peak of over $105,000, Bitcoin’s price has since dipped below $102,000 as investors react to the shifting geopolitical landscape and its implications for risk assets.

Key Takeaways

- Bitcoin surged to over $105,000 following positive trade talks between the U.S. and China.

- The announcement of a 90-day tariff truce led to a sell-off as investors took profits.

- Altcoins like Ethereum and Dogecoin also experienced notable gains during this period.

- Market sentiment remains sensitive to geopolitical developments, impacting Bitcoin’s price dynamics.

Bitcoin’s Initial Surge

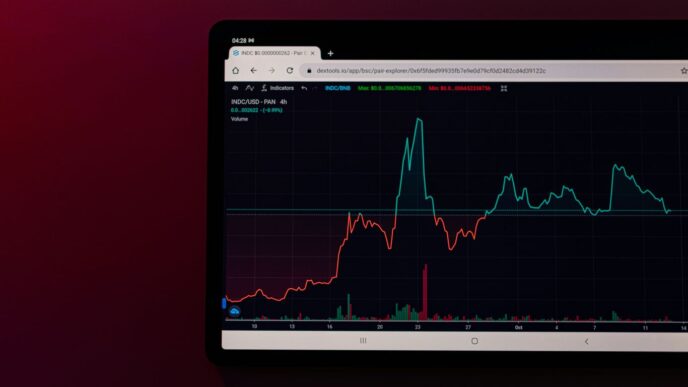

The price of Bitcoin soared to $105,720 on May 12, marking its highest level since February. This surge was largely attributed to a temporary truce in the ongoing U.S.-China trade war, where both nations agreed to cut tariffs significantly for 90 days. This announcement injected optimism into global markets, leading to a risk-on sentiment that benefited cryptocurrencies and equities alike.

The Pullback

Despite the initial excitement, Bitcoin’s price quickly retreated below $102,000 as traders began to take profits. This behavior aligns with the classic market adage of "buy the rumor, sell the news." The rapid rise in Bitcoin’s value had outpaced that of traditional equities, prompting some investors to cash in on their gains.

Broader Market Implications

The easing of tariffs has broader implications for the cryptocurrency market. As traditional markets react positively to the news, Bitcoin’s correlation with stocks has increased, with a noted 83% correlation over the past month. This shift suggests that Bitcoin is increasingly viewed as a risk asset rather than a safe haven, which could lead to heightened volatility in the future.

Altcoin Performance

Alongside Bitcoin, major altcoins have also seen significant price movements. Ethereum surged to nearly $2,600, while Dogecoin experienced a remarkable 21% increase, reflecting a broader altcoin season. This resurgence in altcoins indicates a growing interest in the cryptocurrency market as a whole, driven by optimism surrounding trade relations and institutional investments.

Future Outlook

Looking ahead, the market remains cautious. While the 90-day tariff pause is a positive development, the underlying trade issues between the U.S. and China remain unresolved. Analysts warn that this could lead to renewed volatility as the deadline approaches. Additionally, the recent gains in Bitcoin have been accompanied by low trading volumes, which could signal potential instability in the near term.

In conclusion, while the recent tariff cuts have provided a temporary boost to Bitcoin and the broader cryptocurrency market, the sensitivity to geopolitical developments suggests that traders should remain vigilant. The interplay between traditional markets and cryptocurrencies will likely continue to shape price movements in the coming weeks.

Sources

- China Bends the Knee to Trump: Bitcoin Price Breaks $104K, 99Bitcoins.

- Bulls Take Profits After U.S./China Breakthrough, CoinDesk.

- Bitcoin Price Hits $100,000 for First Time Since February in Shift to Risk-on, Business Insider.

- Bitcoin price sells off after Trump’s US-China tariff deal — Here is why, Cointelegraph.

- Bitcoin Sinks and Stocks Rise After US, China Scale Back Tariffs, Decrypt.