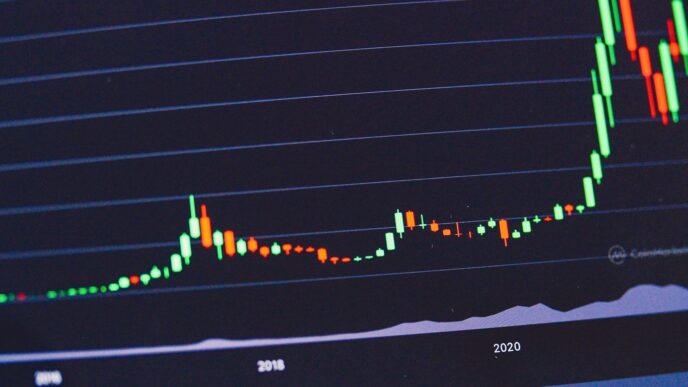

Bitcoin has recently been experiencing a period of consolidation, with its price fluctuating between $94,000 and $100,000. This stability comes amid concerns about low volatility and potential liquidation cascades, raising questions about the future trajectory of the cryptocurrency market.

Key Takeaways

- Bitcoin’s price has stabilized between $94,000 and $100,000 for two weeks.

- Recent volatility is at multi-month lows, raising concerns about liquidation risks.

- Analysts predict potential price movements based on current market conditions.

Current Market Overview

Bitcoin (BTC) has been consolidating in a narrow range, with recent trading activity showing a low of $93,388 before recovering to around $96,300. This consolidation phase follows a significant dip attributed to the repayment of funds by the defunct exchange FTX, which has impacted market sentiment.

The recent K33 report indicates that trading volumes, yields, and options premiums have returned to levels not seen since before the U.S. Presidential election, suggesting a lack of momentum in the market. As of February 13, 37% of the top 100 U.S. companies exhibited greater volatility than Bitcoin, a trend not observed since October 2023.

Price Predictions

Analysts are divided on Bitcoin’s future price movements. Here are some key predictions:

- Short-Term Outlook: If Bitcoin maintains its position above $94,000, it could potentially rise to $100,335, paving the way for a return to $106,000.

- Bearish Scenario: Conversely, if Bitcoin falls below $94,000, it may test support levels around $92,800 and potentially drop to $89,000 or lower.

Volatility Concerns

The current market sentiment is characterized by a risk-averse attitude among traders, with moderate leverage levels indicating less risk of liquidation cascades. However, the low volatility environment suggests that a sudden shift could occur, leading to significant price movements.

Analyst Insights

- James Butterfill, head of research at CoinShares, suggests that Bitcoin could see values ranging from $80,000 to $150,000 in 2025, depending on regulatory developments and market conditions.

- Cathie Wood of ARK Invest remains bullish, predicting Bitcoin could reach $1.5 million by 2030, contingent on broader adoption and market dynamics.

Conclusion

Bitcoin’s current phase of consolidation presents both opportunities and risks for investors. While the market shows signs of stabilization, the potential for volatility remains, driven by external factors and market sentiment. Investors are advised to monitor key price levels closely as the market navigates this uncertain landscape.

Sources

- Palantir Technologies Inc. (PLTR): Among S&P 500 Stocks That Outperformed Bitcoin in 2024, Yahoo Finance.

- Bitcoin Price Forecast: BTC volatility hits multi-month lows, raising concerns of liquidation cascades, FXStreet.

- Bitcoin Stabilizes: Is Volatility on the Horizon? Technical Analysis for February 19, 2025 – Cointribune, Cointribune.

- SEC to Pause Ripple Appeal Soon, Top Official Predicts; Strategy Suddenly Stops Buying Bitcoin, Shiba Inu on Verge of Death Cross: Crypto News Digest by U.Today, U.Today.