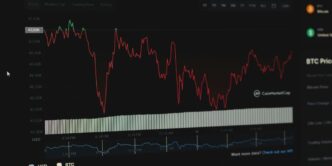

Bitcoin has recently experienced significant price fluctuations, influenced by various economic factors, including rising U.S. Treasury yields and inflation concerns. After reaching an all-time high of $108,200, Bitcoin’s price has dipped below $95,000, raising questions about its future trajectory.

Key Takeaways

- Bitcoin’s price peaked at $108,200 before falling below $95,000.

- Rising U.S. Treasury yields are contributing to market volatility.

- Analysts suggest potential for further price gains despite recent corrections.

- Economic policies and inflation fears are impacting investor sentiment.

Current Market Dynamics

Bitcoin’s recent price movements have been closely tied to the performance of the U.S. bond market. The surge in bond yields, particularly the 30-year and 10-year yields, has raised concerns among investors. As yields climb, the Federal Reserve’s hawkish stance on interest rates is expected to persist, which could further influence Bitcoin’s price.

The cryptocurrency market has seen a sell-off, with Bitcoin dropping sharply as traders react to economic indicators. The recent job vacancy data has also played a role in shaping market expectations, leading to a cautious approach among investors.

Technical Analysis

Despite the recent downturn, technical indicators suggest that Bitcoin may be poised for a rebound. Analysts have identified a cup-and-handle pattern on the weekly chart, indicating potential bullish momentum. Additionally, Bitcoin remains above its 50-day moving average, which is often seen as a positive sign for future price movements.

However, the market is also showing signs of volatility, with some analysts predicting a possible drop to $95,000. A break below key support levels could signal a deeper correction, while a sustained move above $100,000 may lead to new all-time highs.

Economic Influences

Several economic factors are currently influencing Bitcoin’s price:

- Inflation Concerns: Ongoing inflationary pressures are causing investors to reassess their portfolios, leading to increased volatility in the cryptocurrency market.

- Government Actions: Reports of the U.S. government potentially liquidating a significant amount of Bitcoin seized from the Silk Road darknet marketplace have added to market uncertainty. The sale of approximately 69,370 Bitcoin could trigger further price fluctuations.

- Institutional Interest: Despite the volatility, institutional interest in Bitcoin remains strong. Companies like MicroStrategy continue to accumulate Bitcoin, signaling confidence in its long-term value.

Future Outlook

Looking ahead, Bitcoin’s price trajectory will likely be influenced by upcoming economic data releases, including the Federal Reserve’s minutes and nonfarm payroll numbers. These indicators will provide insight into the Fed’s monetary policy direction and its potential impact on the cryptocurrency market.

In conclusion, while Bitcoin faces short-term challenges due to economic factors, the overall sentiment remains cautiously optimistic. Investors are advised to monitor key support levels and market trends as they navigate this volatile landscape.

Sources

- Bitcoin price is still bullish despite recent weakness: legendary trader, crypto.news.

- Bitcoin Price Dips After Reaching $102K: Is $95K Next?, Coinpedia.

- Red alert for Bitcoin price as 30-year Treasury yield forms risky pattern, crypto.news.

- Bitcoin Price Today: Inflation Fears, Trump Tariff Concerns Drive Price Below $93k, Finance Magnates.

- Bitcoin price slides amid fears US government could sell more of Silk Road stash, Yahoo.

- Bitcoin Price Outlook: BTC Flashes Mixed Signals, $100,000 in Focus | FXEmpire, FXEmpire.