Bitcoin’s price has surged above $97,000, driven by optimism surrounding U.S.-China trade negotiations and speculation about Federal Reserve policies. This significant increase marks a pivotal moment for the cryptocurrency, as it approaches its all-time high, reflecting a growing confidence among investors.

Key Takeaways

- Bitcoin’s price reached $97,200, a 3% increase amid positive trade talk news.

- The cryptocurrency’s dominance in the market has hit a four-year high at 64.89%.

- U.S. Treasury Secretary Scott Bessent is set to engage in trade discussions with China, signaling potential easing of tariffs.

- Bitcoin’s resilience is attributed to its limited supply and favorable regulatory environment compared to altcoins.

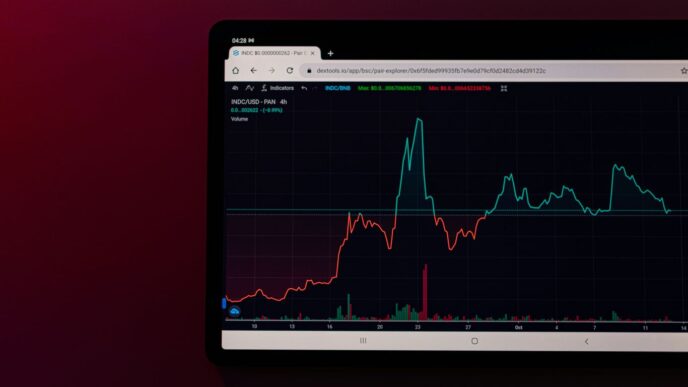

Bitcoin’s Price Surge

The recent surge in Bitcoin’s price can be attributed to a thawing in trade relations between the U.S. and China. U.S. Treasury Secretary Scott Bessent announced plans to meet with Chinese officials in Switzerland to discuss tariff adjustments. This news has sparked optimism in the markets, leading to a notable increase in Bitcoin’s value.

- Current Price: $97,200

- Percentage Increase: 3% since the announcement

Market Dynamics

Bitcoin’s rise is not occurring in isolation. The cryptocurrency’s dominance has reached 64.89%, the highest level since January 2021. This dominance reflects Bitcoin’s market capitalization as a percentage of the total cryptocurrency market, which has increased from 57.90% at the beginning of the year.

- Bitcoin Dominance: 64.89%

- Market Cap Increase: From 57.90% to 64.89% in 2025

Factors Influencing Bitcoin’s Growth

Several factors are contributing to Bitcoin’s current market performance:

- Tariff Negotiations: The potential easing of tariffs between the U.S. and China is encouraging risk assets, including Bitcoin.

- Regulatory Environment: Bitcoin’s relatively favorable regulatory stance compared to altcoins has bolstered investor confidence.

- Institutional Demand: Increased interest from institutional investors is driving demand, with Bitcoin ETFs seeing significant inflows.

Future Outlook

As Bitcoin approaches its all-time high of $108,786, analysts are closely watching the developments in U.S.-China trade relations. Should negotiations yield positive results, it could further enhance investor sentiment and potentially lead to a broader rally in the cryptocurrency market.

- All-Time High: $108,786

- Current Price: $97,200

- Potential for Further Growth: Analysts suggest that if trade talks progress positively, Bitcoin could see even higher valuations.

In conclusion, Bitcoin’s recent price surge is a reflection of both macroeconomic factors and its inherent market dynamics. As the cryptocurrency continues to gain traction, it remains a focal point for investors looking for stability and growth in an uncertain economic landscape.

Sources

- UK Treasury Secretary Says No To National Bitcoin Reserve, Bitcoin Magazine.

- Jumps Above $97K on Tariff Talk Optimism, CoinDesk.

- Bitcoin Price Is Beating the Stock Market. The Unusual Reason Behind the Rally <!– –>, Barron’s.

- Bitcoin Price, XRP, and Other Cryptos Rally. Is $100K Next?<!– –>, Barron’s.

- Bitcoin Dominance Hits Four-Year High As BTC Price Tops $97,000, Decrypt.