As we step into 2025, Bitcoin is at a pivotal moment, with predictions suggesting a potential price surge to $500,000. Despite facing challenges, the cryptocurrency’s fundamentals and institutional adoption are showing promising signs for the year ahead.

Key Takeaways

- Bitcoin’s price could reach $500,000 by the end of 2025.

- Institutional adoption is increasing, with significant investments in Bitcoin ETFs.

- Macroeconomic factors and potential regulatory changes may influence Bitcoin’s trajectory.

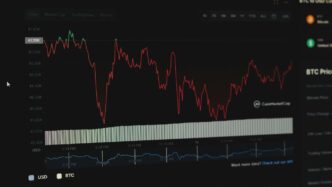

Bitcoin’s Technical Indicators

Recent analyses reveal that Bitcoin’s technical indicators are leaning towards a bullish outlook. The MVRV-Z score, which assesses the relationship between price and market capitalization, indicates that we are still far from a peak, suggesting that the current bull run is not yet over. Historical comparisons to previous cycles, such as May 2017, show that Bitcoin has substantial growth potential.

The Pi Cycle indicator, which monitors moving averages, also signals a resurgence in bullish momentum. After a consolidation phase in 2024, Bitcoin appears to be entering a vigorous growth phase that could last several months.

Institutional Adoption and ETF Growth

The launch of Bitcoin ETFs has significantly impacted market dynamics. In November 2024, ETFs absorbed 75,000 Bitcoins while only 13,500 were mined, creating unprecedented buying pressure. Currently, only 2.25 million Bitcoins remain on exchanges, indicating a strong accumulation trend among long-term investors.

BlackRock’s Bitcoin ETF has recently surpassed its gold fund in assets under management, marking a significant shift in institutional investment strategies. This trend suggests that Bitcoin is increasingly viewed as a credible alternative to gold, further solidifying its position in institutional portfolios.

Macroeconomic Context

The macroeconomic landscape is also favorable for Bitcoin. Despite a strong U.S. dollar in 2024, Bitcoin’s price has shown resilience. Analysts predict that a potential weakening of the dollar in 2025 could amplify Bitcoin’s price increase. Other indicators, such as high-yield credit cycles and the global money supply, suggest improved conditions for Bitcoin.

Political Influence and Future Scenarios

The upcoming political landscape, particularly with President-elect Donald Trump, could play a crucial role in Bitcoin’s future. Trump’s pro-crypto policies may lead to significant regulatory changes that could further legitimize Bitcoin. Speculation about a potential "Bitcoin Act" could create a strategic reserve of one million Bitcoins, intensifying competition among nations for Bitcoin accumulation.

Expert Predictions

Experts like Peter Brandt have outlined three possible scenarios for Bitcoin’s price in 2025:

- Price Drop to $76,000: If the current Head and Shoulders pattern completes, Bitcoin could see a significant decline.

- Bear Trap: A sudden price drop could lead to a quick reversal, catching short-sellers off guard.

- Extended Consolidation: The market may experience prolonged indecision before making significant moves.

Conclusion

The year 2025 holds immense potential for Bitcoin, driven by solid fundamentals, increasing institutional adoption, and favorable macroeconomic conditions. As the cryptocurrency landscape evolves, investors and analysts alike will be closely monitoring Bitcoin’s price movements and market sentiment to navigate the opportunities and challenges ahead.

Sources

- Bitcoin (BTC): $500,000 In 2025? – Cointribune, Cointribune.

- BlackRock’s Bitcoin ETF Lands on Canadian Markets With Dual-Currency Trading – Decrypt, Decrypt.

- Pantera Capital Forecasts Bitcoin Surge in 2025, Driven by Trump’s Inauguration and Pro-Crypto Policies, Yahoo Finance.

- Crypto Daybook Americas: Massive Selloff Doesn’t Stop BTC Institutional Adoption, CoinDesk.

- Bitcoin’s Future in 2025: 3 Possible Scenarios According to Expert Peter Brandt, The Currency analytics.