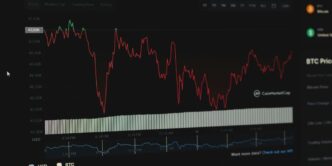

Bitcoin has recently experienced significant volatility, dropping below the $90,000 mark after reaching an all-time high of $108,000. This decline has raised concerns among investors, particularly in light of shifting economic indicators and Federal Reserve policies. Experts are weighing in on potential future movements for the cryptocurrency, with predictions ranging from further declines to eventual recoveries.

Key Takeaways

- Bitcoin fell below $90,000, reaching a low of $89,800.

- Economic data and Fed policy shifts are influencing market sentiment.

- Analysts predict potential retracements and recovery opportunities.

Bitcoin’s Recent Price Movements

Bitcoin’s price fluctuations have been dramatic, with the cryptocurrency hitting a peak of $108,000 in December before experiencing a sharp decline. As of January 14, 2025, Bitcoin was trading around $95,300, reflecting a significant drop from its previous highs. The recent dip has been attributed to various factors, including:

- Economic Data: The U.S. Bureau of Labor Statistics reported stronger-than-expected job growth, leading to speculation about the Federal Reserve’s interest rate policies.

- Market Sentiment: Investor confidence has been shaken by rising bond yields and concerns over the Fed’s hawkish stance.

- Technical Levels: Analysts are closely monitoring the $90,000 support level, which is seen as critical for Bitcoin’s price stability.

Expert Predictions

Tom Lee, a prominent cryptocurrency analyst, has suggested that Bitcoin could drop to as low as $50,000 before potentially rallying again. He emphasized that the current market correction is typical for such a volatile asset and that investors should view this as an opportunity to buy the dip.

Conversely, Standard Chartered’s Geoff Kendrick warned that a clean break below the $90,000 support could lead to a further 10% retracement, pushing Bitcoin into the low $80,000s. This scenario could trigger panic selling among investors, particularly those involved in spot exchange-traded funds (ETFs).

Market Reactions

Despite the recent downturn, some institutional investors remain optimistic. MicroStrategy, for instance, has continued to accumulate Bitcoin, purchasing $243 million worth during the price drop. This indicates a belief in Bitcoin’s long-term potential, even amidst short-term volatility.

Looking Ahead

The upcoming release of key economic indicators, including the Consumer Price Index (CPI), will be crucial in shaping market expectations. Analysts are particularly focused on how these reports will influence the Federal Reserve’s policy direction and, consequently, Bitcoin’s price trajectory.

In summary, while Bitcoin’s recent volatility has raised concerns, it also presents opportunities for investors willing to navigate the market’s ups and downs. As the cryptocurrency landscape continues to evolve, staying informed and adaptable will be essential for those looking to capitalize on future movements.