The world of finance in Asia is always moving, and keeping up with it can feel like a full-time job. Things are changing fast, especially with all the new tech coming out. This article looks at some of the big shifts happening right now in the bloomberg asia market, from how trades are done to how companies are managing risk. It’s a lot to take in, but understanding these trends is key if you want to stay ahead.

Key Takeaways

- Electronic trading is taking over in Asia, moving away from phone calls to online platforms and automated systems. This helps make things faster and cheaper for everyone involved.

- New AI tools are helping manage big trades and keep risks in check, especially in busy markets. They can help make trading more accurate, even when things get complicated.

- Emerging markets in Asia are seeing more electronic trading in things like local bonds and currencies. While there are some rules to follow, it’s opening up new ways to trade.

- Companies that provide liquidity, especially those not tied to big banks, are becoming more important. They are helping create more options for trading, particularly in credit markets.

- Trading firms are starting to specialize more, with some focusing on complex deals and others on efficient electronic trading. Using data to make decisions and automate tasks is becoming standard practice.

Navigating Bloomberg Asia Market Trends

The Asia Trade: Daily Market Insights

Getting a handle on what’s happening in Asian markets each day can feel like trying to catch lightning in a bottle. That’s where "The Asia Trade" comes in. It’s basically your daily download, live from Tokyo and Singapore, with hosts Shery Ahn and Avril Hong. They bring in the people who are actually making the news and shaping the markets, giving you a look at the big stories before the rest of the world wakes up. It’s about getting that early edge, understanding the shifts as they happen.

Key Economic Shifts and Geopolitical Uncertainty

Things are always changing, right? The economy does its own thing, and then there’s all the geopolitical stuff that can throw a wrench in the works. Staying on top of these shifts is more important than ever for anyone involved in trading. It’s not just about watching the numbers; it’s about understanding the bigger picture. We’re talking about things like:

- Sudden changes in government policies.

- International relations that affect trade flows.

- Unexpected economic data releases.

- Global events that ripple through local markets.

Trying to predict all this is tough, but being aware of the possibilities helps you prepare.

Leveraging Real-Time Data for Smarter Decisions

This is where technology really steps in. Having access to information the second it happens makes a huge difference. Think about it: if you know about a market move or an economic indicator change instantly, you can react much faster. Bloomberg’s real-time data tools are built for this. They help you deal with:

- Market Volatility: When prices are jumping around, quick data means you can adjust your positions before things get too wild.

- Geopolitical Uncertainty: News breaks fast. Real-time feeds let you see the immediate market reaction and adjust your strategy accordingly.

- Fiscal and Macroeconomic Shifts: Government budgets, interest rate changes, inflation reports – seeing these as they’re released allows for more informed trading.

We’ll show you how these tools work in practice, giving you a better chance to make good calls when it counts.

Electronification in Asian Markets

It feels like just yesterday that a lot of trading in Asia was done over the phone, you know, voice broking. But things are really changing, and fast. We’re seeing a big move towards electronic platforms, and it’s not just for simple trades anymore. Aggregators are popping up, helping to pull together prices and make things more efficient. This shift is pretty important because it means firms can centralize their pricing, cut down on costs, and generally make their workflows smoother. For banks and brokers who were used to the old way, getting onto these electronic systems means they can actually see what’s happening in real-time and manage their risks better. It’s closing some pretty old gaps in how these markets operate.

Shift from Voice to Electronic Platforms

Even with all the new electronic tools, a surprising amount of trading still happens over the phone, especially when brokers are involved. But the trend is clear: moving to electronic platforms and aggregators is the way to go for better efficiency. Think about it:

- Centralized Pricing: Electronic interfaces let you see all your prices in one place.

- Reduced Costs: Automating processes cuts down on manual work and errors.

- Streamlined Workflows: Getting trades done faster and with less hassle.

This transition is key for firms looking to stay competitive. It’s about making things work better and faster.

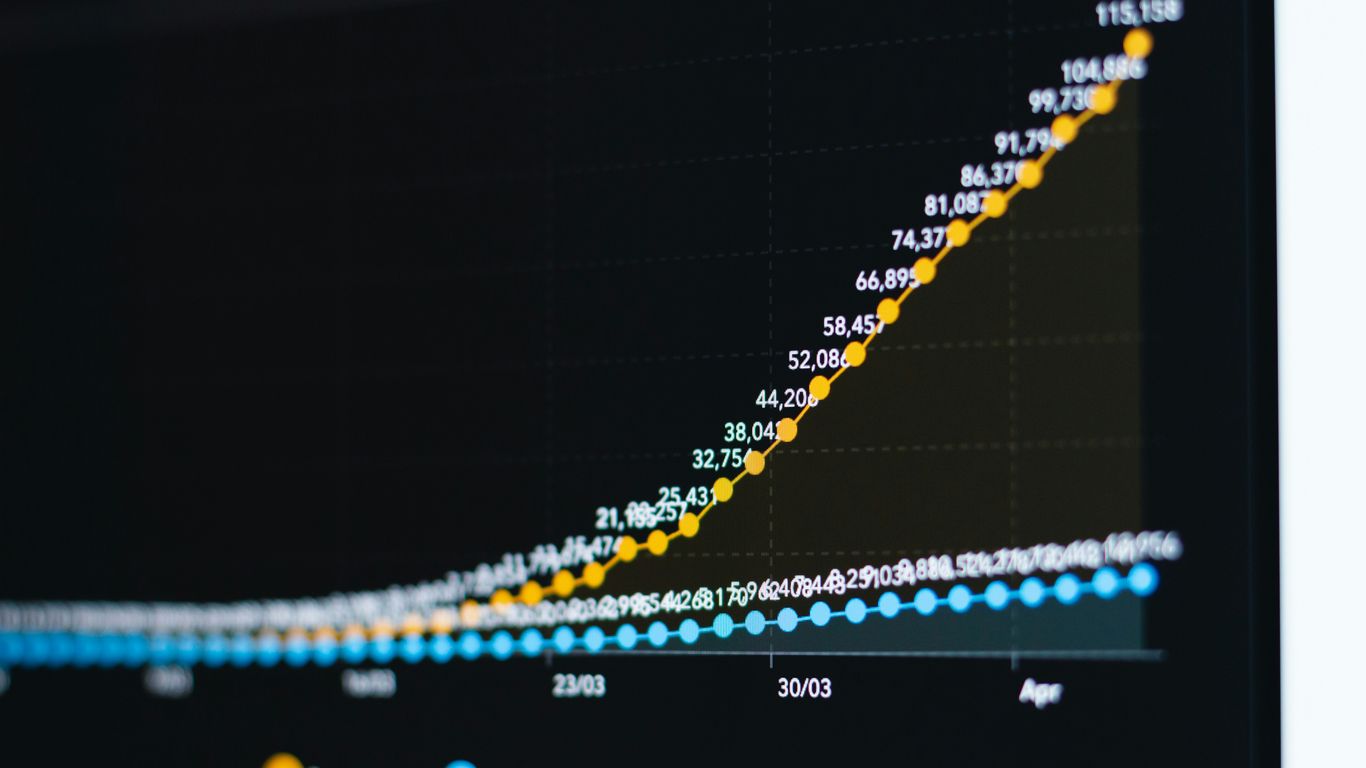

Prospects for Growth in Electronic Trading

So, where is all this heading? Well, the numbers suggest a pretty positive outlook. A poll at a recent APAC Sell-Side Forum showed that a good chunk of people expect more electronic trading in Asian local currency bonds and emerging market currencies. This is where the real growth potential lies. Automation, algorithms, and aggregators are not just buzzwords; they’re changing how trades get done. For sell-side institutions, figuring out how to use these tools effectively is going to be a big part of their success going forward. It’s about serving clients better in a market that’s always moving.

Harnessing Automation and Aggregators

Automation is really starting to make its mark. We’re seeing it in things like auto-pricing for non-deliverable forwards (NDFs) and smart order routing, which are making trade execution much better, especially in emerging markets. These tools help liquidity providers adjust their spreads on the fly and handle a lot more trades without breaking a sweat. For sell-side firms, especially in markets where liquidity can be a bit thin, these algorithmic tools are a game-changer. They offer continuous pricing improvements, which can really boost profits and make trading much more efficient overall. It’s not just about speed; it’s about smarter execution and better results.

AI-Driven Algorithms and Risk Management

Artificial intelligence is changing how trades are handled, especially when there are a lot of them. Think about server-side TWAP algorithms. These tools automatically break down big orders into smaller pieces, finding the right amount of liquidity at just the right time. This is super helpful in fixed income markets where it can take longer to shift risk. These AI tools make managing liquidity better and improve how trades get done. Sell-side firms are using these TWAP tools more and more. It helps them handle bigger client orders and deal with the tricky liquidity situations in markets that don’t move super fast. It looks like AI will keep making trading more precise in complicated market situations.

Emerging AI Tools for High-Volume Trades

AI is stepping in to help manage the sheer volume of trades happening today. Tools like server-side TWAP algorithms are a good example. They take a large order and chop it up into smaller bits, matching them with available liquidity as they go. This is particularly useful in markets like fixed income, where moving large positions can be slow. By using AI, firms can get better execution and manage their liquidity more effectively. It’s a way for sell-side firms to meet client demands for larger trades while also handling the unique liquidity challenges of slower markets.

Improving Liquidity Management with AI

AI is also making waves in how liquidity is managed. For instance, algorithms can dynamically adjust pricing based on real-time market conditions. This means that instead of a static price, you get one that shifts to reflect current supply and demand. This is especially important in fragmented markets where liquidity might be spread across different venues. AI can help connect these different pools and find the best price. It’s about making sure that when a trade needs to happen, there’s a way to get it done efficiently, even if the market is a bit choppy.

Enhancing Trading Precision in Complex Environments

When markets get complicated, precision matters. AI-driven algorithms can help here too. They can analyze vast amounts of data to identify patterns and execute trades with a level of accuracy that’s hard for humans to match consistently. This is particularly true in areas like FX and fixed income in emerging markets. Algorithms can help with things like auto-pricing for non-deliverable forwards (NDFs) and smart order routing. This means trades can be executed more smoothly, and liquidity providers can manage their spreads better. For sell-side firms, these tools are a big deal, especially in markets where liquidity isn’t always abundant. They help keep pricing competitive and make trading more efficient overall.

Challenges and Opportunities in Emerging Markets

Emerging markets in Asia present a really interesting mix of hurdles and potential gains for trading firms. While things are getting more electronic, especially with local currency bonds and currencies, there’s still a lot to figure out. Take South Korea, for example. They’ve really pushed ahead with automating treasury bond trading, making things faster with auto-execution and auto-reporting. India is also getting ready to issue ETP licenses for local currency bonds, which could be a big step forward for electronic trading there. These moves are paving the way for other emerging markets to get on board with electronic trading, potentially opening up new sources of liquidity and making trading more standard. For sell-side firms, this means they can scale up their bond trading across more emerging markets. However, it’s not all smooth sailing, especially in high-yield markets, where strict rules and specific execution needs can make adopting electronification tough.

Electronification of Local Currency Bonds and Currencies

We’re seeing a definite push towards electronic trading in local currency bonds and currencies across Asia. A straw poll at a recent forum showed a good chunk of participants expecting higher adoption in Asian local currency bonds and FX e-trading for emerging market currencies. This shift is driven by the potential for automation and aggregators to streamline operations. Electronic interfaces help firms pull together pricing, cut down on trade costs, and generally make workflows smoother. For banks and brokers used to trading over the phone, moving to electronic systems means getting real-time information and better risk management, which helps fix some long-standing operational issues in these markets. It’s a big change, but one that seems necessary to keep up.

Regulatory Hurdles in South Korea and India

Navigating the regulatory landscape in places like South Korea and India can be quite the task. In South Korea, even with automated treasury bonds, foreign investors still need to provide IRC numbers. Sell-side traders then have to validate these, often through multiple chat channels, before they can even quote a price. While some recent improvements allow banks to automatically check these IRC numbers, it still adds complexity. India’s government bond market has its own set of demands. You’ve got mandatory SEBI registration numbers and reporting to the CCIL within a tight 15-minute window. Sell-side participants also need local custodian IDs and specific dealing system IDs. Getting an approved electronic trading platform (ETP) license could really help ease these burdens and speed up electronic adoption. It’s a lot to keep track of, and getting it wrong can cause significant delays. You can find more information on global markets at Bloomberg.

Unlocking New Liquidity Sources

As electronic trading grows, new avenues for liquidity are opening up. Platforms are making it easier for non-bank liquidity providers to get involved in APAC’s credit markets. These providers can now use request-for-quote (RFQ) workflows and connect directly with market participants. This integration adds more depth to how credit trades are executed and supports a wider range of liquidity options. For traditional banks, this means they get access to more diverse liquidity pools, which makes the market stronger overall and gives sell-side firms alternative ways to find liquidity. It’s a positive development that helps make markets more robust and accessible for everyone involved.

The Evolving Role of Liquidity Providers

Expansion of Non-Bank Liquidity Providers

The landscape of liquidity provision in Asia is changing, and a big part of that is the rise of players who aren’t traditional banks. These non-bank entities are showing up more and more, especially in credit markets. They’re using platforms that let them connect directly with both sell-side and buy-side firms. This is pretty neat because it means more options for everyone and can lead to more flexible pricing. It’s like opening up new lanes on a highway – things can move a bit more freely.

All-to-All Platforms and Credit Markets

These "all-to-all" platforms are a game-changer. They break down some of the old barriers, letting different types of market participants interact more easily. For non-bank liquidity providers, it’s a way to get their offerings out there without needing to go through traditional channels. This adds a different flavor to how credit markets work, bringing in more diversity and potentially making things more robust. Think of it as a potluck dinner where everyone brings a dish – you get a wider variety of food.

Diversified Liquidity Pools for Sell-Side Firms

So, what does this mean for the sell-side firms, like investment banks? It means they’re not just relying on the usual suspects for liquidity anymore. They can tap into these new, diversified pools. Platforms are making it easier for these non-bank providers to plug into existing workflows, like request-for-quote (RFQ) systems. This gives sell-side firms more choices when they need to execute trades, which can lead to better outcomes and a more stable trading environment overall. It’s about having more tools in the toolbox, so to speak.

Market Consolidation and Sell-Side Specialization

Asia’s trading scene is getting pretty crowded, and it feels like only the firms that can really adapt are going to stick around. We’re seeing a trend where sell-side companies are starting to focus on specific areas. Some are really leaning into those complicated, high-touch trades that need a lot of personal attention. Others are doubling down on making their electronic channels super efficient. It’s like a big shift is happening, and it’s changing what jobs look like. Think about it: electronic trading heads might end up managing clients who are really into data, while people handling volatility might focus more on those big, tricky client needs. This mix of being big enough to handle volume but specialized enough to do it well is what’s going to push things forward for the sell side, making the whole market run a bit smoother.

Data-Driven Decision-Making and Workflow Automation

Improving Transparency and Workflow Efficiency

Look, making smart choices in the market these days really comes down to having good information and using it fast. It’s not just about watching prices go up and down anymore. We’re seeing a big push towards making things clearer and smoother in how trades get done. Think about it: when you can see exactly how different trading partners are performing – like their hit-miss rates or how quickly they respond – you can start making better choices about who to work with. Automating these kinds of checks means less guesswork and more solid facts guiding your decisions. This shift helps everyone involved, from the traders to the clients, get a clearer picture of what’s happening. It’s about cutting out the noise and focusing on what actually moves the needle. Using real-time data solutions is a big part of this, letting you react to market changes as they unfold.

Automated Performance Tracking and Strategy Adjustments

So, how do you actually keep track of all this? Well, automation is stepping in here too. Instead of manually crunching numbers after the fact, systems can now automatically track how well your trades are doing. This means you get instant feedback on your strategies. If something isn’t working, you can spot it right away and make changes. It’s like having a constant performance review for your trading desk. This continuous feedback loop is pretty important for staying ahead. It allows for quick adjustments, which can make a real difference in how profitable your operations are. It’s not just about making trades; it’s about constantly refining how you make them based on what the data is telling you.

Reducing Operational Risk with Data Analytics

One of the less flashy but super important benefits of all this data and automation is cutting down on mistakes. When you rely on people to input data or move information from one system to another, there’s always a chance for errors. Automating these processes, especially with good data analytics behind them, significantly lowers that risk. Think about straight-through processing (STP) – it’s designed to move trades from start to finish with minimal manual intervention. This not only saves time and money but also reduces the chances of costly errors that can pop up with manual handling. It’s about building a more reliable system where the data itself helps prevent problems before they even happen. This makes the whole trading operation more stable and predictable.

Wrapping It Up

So, as we’ve seen, the markets in Asia are really changing fast. Electronic trading is becoming a bigger deal, and things like AI and automation are starting to make a real difference in how trades happen, especially in places like South Korea and India. It’s not always easy, with different rules in each country, but firms that can keep up with these tech changes and figure out the local regulations seem to be the ones doing best. Non-bank lenders are also playing a larger role, which is shaking things up too. It looks like the future will involve more specialized firms and smarter use of data to get ahead.

Frequently Asked Questions

What does “electronification” mean in Asian markets?

Electronification means shifting from making trades by talking on the phone to using computer systems and online platforms. It’s like moving from calling a store to order something to buying it directly from their website.

How is AI helping with trading in Asia?

AI, which is like smart computer programs, is helping trade big amounts of money faster and more accurately. It can automatically break down large orders and find the best prices, making trading smoother, especially in busy markets.

What are the main challenges for trading in new Asian markets?

Trading in newer Asian markets can be tricky because of different rules and how markets are set up. It’s harder to get trades done quickly and easily compared to more developed markets.

Who are the “liquidity providers” and why are they important?

Liquidity providers are companies that make it easy to buy and sell things, like stocks or bonds. More and more companies that aren’t traditional banks are becoming these providers, which gives traders more choices and makes the market work better.

Why are some trading companies getting smaller or focusing on specific jobs?

As trading gets more complicated with new technology, some companies are joining forces or focusing on doing just one or a few things really well. This helps them stay competitive and serve their clients better in a fast-changing world.

How does using lots of data help make better trading choices?

By looking at tons of information, like how fast trades happen or how good prices are, trading companies can make smarter decisions. They can also use computers to do more tasks automatically, which saves time and reduces mistakes.