The world of trading in Asia is changing fast. Electronic platforms and smart tools are becoming more common, and it’s affecting how everyone does business. This article looks at some of the big shifts happening in the bloomberg asia market, from new technology to the rules everyone has to follow. We’ll also talk about where the money is coming from and what might happen next.

Key Takeaways

- Trading in Asia is moving more towards electronic systems, with aggregators helping to bring things together, though voice trading is still around.

- New tools using AI are popping up to help manage trades and risks, especially for things like FX and fixed income.

- Getting trades done electronically in places like South Korea and India comes with its own set of rules that can be tricky to deal with.

- More money is coming from places other than big banks, and new types of trading places are making it easier for everyone to trade.

- The future looks like more electronic trading across Asia, with some companies getting bigger and others focusing on specific areas.

The Growing Role Of Automation In Bloomberg Asia Market Trading

Things are changing fast in Asian markets, and automation is a big part of that. We’re seeing a definite move away from just picking up the phone to trade. Electronic platforms and aggregators are becoming more common, helping firms pull together prices and make trading smoother. It’s not just about speed, though. For banks and brokers used to the old ways, switching to electronic systems means they can actually see what’s happening in real-time and manage their risks better. This is closing gaps that have been around for ages in some of these markets.

Shift From Voice To Electronic Platforms With Aggregators

Even with all the new tech, a lot of trading in Asia still happens over the phone, especially when brokers are involved. But for markets that are all over the place, using aggregators and electronic platforms can really help. It means firms can get all their pricing in one spot, cut down on costs, and just make their day-to-day work flow better. It’s a big change, but one that’s making things more efficient.

Emerging AI-Driven Algorithms And Risk Management Tools

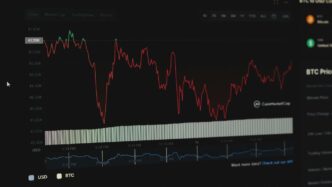

Artificial intelligence is also stepping into the trading arena, especially for handling lots of trades at once. Think about algorithms that can break down big orders automatically and find the right liquidity. In areas like fixed income, where trades can take longer, these AI tools are a game-changer for managing liquidity and getting better execution. It’s pretty clear that AI is going to keep making trading more precise, even in tricky market conditions.

Algorithmic Trading For FX And Fixed Income

When it comes to foreign exchange and fixed income in Asia’s developing markets, algorithmic trading is really taking off. Things like auto-pricing for non-deliverable forwards and smart order routing are changing how trades get done. Liquidity providers can now adjust their spreads on the fly, match trades across different pools of buyers and sellers, and handle a lot more volume. For sell-side firms, these tools are super helpful, especially in markets where there isn’t always a lot of liquidity. They help keep prices moving and make trading more profitable.

Data-Driven Decision-Making And Advanced Workflow Automation

Firms in Asia are also starting to use data more to pick who they trade with, which makes things more open and their work processes much slicker. By looking at things like how often trades go through, how fast people respond, and how accurate prices are, they can track performance and tweak their strategies. Automating these workflows means less manual work, which cuts down on mistakes and helps them use their resources better. This move towards automation and data analysis is key to staying ahead in markets that are changing so quickly. It also helps improve transparency and liquidity, which encourages more people to trade. Features like auto-quoting and straight-through processing speed up settlements and save money. Automated systems help firms handle more trades and react to market changes fast and accurately. Currency volatility is reportedly decreasing due to advancements in electronic trading.

Navigating Regulatory Hurdles In Asian Markets

Dealing with the rules and regulations across Asia’s markets can feel like trying to solve a Rubik’s Cube blindfolded. It’s not always straightforward, and things change. For instance, South Korea has made strides in automating its treasury bond trading, which is great, but foreign investors still need to jump through hoops like getting an Investor Registration Certificate (IRC). Sell-side traders then have to check these IRC numbers, often through multiple chat windows, before they can even quote a price. While there are some workflow improvements now that let banks auto-check these numbers, it’s still an extra step that wasn’t there before. This kind of requirement adds a layer of complexity that can slow things down.

Then you look at India’s bond market, and it’s a whole other ballgame. You’ve got mandatory Securities and Exchange Board of India (SEBI) registration numbers and a tight 15-minute window for reporting to the Clearing Corporation of India Limited (CCIL). On top of that, you need local custodian IDs and specific IDs for the negotiated dealing system. It’s a lot to keep track of, and any approved electronic trading platform license can help ease some of these burdens and speed up electronic adoption.

Complex Regulatory Requirements In South Korea And India

- South Korea: Foreign investors need IRC numbers for treasury bond trading. Sell-side traders must validate these, adding manual steps to the quoting process.

- India: Strict compliance includes SEBI registration and CCIL reporting within 15 minutes. Local custodian and NDS-OM IDs are also necessary.

- General Impact: These requirements can create delays and increase operational risk, especially when trying to scale electronic trading.

Challenges With Electronification Of Emerging Markets Local Currency Bonds And Currencies

Getting more electronic trading going in emerging markets’ local currency bonds and currencies presents its own set of challenges. While South Korea’s treasury bond market is automating, and India is looking at ETP licenses, these are often specific to certain markets. For other emerging markets, especially those with high-yield debt, the regulatory frameworks are still quite strict. This makes it harder to get the same level of electronification we see in more developed markets. It’s a bit of a patchwork quilt across the region. The progress in Asia’s crypto space, for example, shows a willingness to adapt, but traditional fixed income and FX markets still face unique hurdles. We’re seeing a push for more electronic trading, and platforms like Bloomberg Bridge are helping non-bank liquidity providers get more involved, but the regulatory side still needs to catch up in many places. This is where understanding the local rules becomes really important for any firm looking to expand their electronic trading operations in Asia.

The Evolving Liquidity Landscape

It feels like just yesterday that trading was all done over the phone, right? Well, things are changing, and fast. In Asia’s credit markets, we’re seeing a big shift. Non-bank players are stepping up, and they’re not just hanging around the edges anymore. They’re actively participating, thanks in part to these all-to-all platforms that let everyone connect more directly. This means more options for everyone, from big banks to smaller investment firms, and it’s shaking up how prices are set.

Role of Non-Bank Liquidity Providers and All-to-All Platforms

These non-bank liquidity providers are becoming a really important part of the picture. Think of them as new sources of capital ready to trade. Platforms that allow for ‘all-to-all’ trading are key here. They break down some of the old barriers, letting these non-bank entities interact directly with traditional market participants. This isn’t just about adding more players; it’s about creating more dynamic ways to price trades and find counterparties. It adds a layer of flexibility that wasn’t really there before.

Expansion of Non-Bank Liquidity Providers’ Role

So, what does this expansion actually look like? Well, platforms are making it easier for these non-bank providers to get involved. They can now use request-for-quote (RFQ) systems, which is a pretty standard way to ask for prices, and connect directly with others in the market. For the banks, this means they’re not just relying on their usual sources. They can tap into these new pools of liquidity, which can make the whole market a bit more stable and robust. It’s like opening up new lanes on a busy highway – things can flow a bit better.

Here’s a quick look at how this is playing out:

- More Choices: Investors have a wider range of firms to get quotes from.

- Dynamic Pricing: Competition among more providers can lead to better pricing.

- Market Depth: Increased participation generally means deeper markets, making it easier to trade larger volumes.

- Innovation: New platforms and providers often bring new ideas and technologies to the table.

It’s a pretty interesting time to watch how these new dynamics play out across the Asian markets.

Future Trends In Bloomberg Asia Market Evolution

Looking ahead, the trading scene in Asia is set for some big shifts. We’re seeing a trend where firms are either getting bigger and more specialized, or they’re focusing on specific areas. It’s like a market sorting itself out, with some players handling the really complicated trades and others becoming super efficient at electronic execution.

Market Consolidation and Growing Specialization Within the Sell-Side

This isn’t just about getting bigger for the sake of it. As technology gets more complex and the demands from clients grow, it’s becoming harder for every firm to do everything. So, you’ll likely see more companies merging or focusing on what they do best. Think of it like this:

- High-Touch Specialists: Some firms will really lean into handling those tricky, bespoke trades that need a lot of human interaction and deep market knowledge. They’ll be the go-to for clients with unique needs.

- Electronic Efficiency Experts: Others will double down on making their electronic trading platforms as smooth and fast as possible. They’ll be all about data, algorithms, and getting trades done quickly and cheaply.

- Hybrid Models: Of course, there will be firms that try to balance both, but even they will likely have distinct teams for different types of trading.

The sell-side is really being reshaped by these forces, pushing towards a more streamlined market structure.

Prospects for Further Growth in Electronic Trading Across Asia

Despite the complexities, the move towards electronic trading in Asia is only going to speed up. We’ve already seen significant progress in areas like South Korea’s bond trading and the ongoing electronification in India. This progress is paving the way for other emerging markets to adopt similar electronic systems. It’s not just about keeping up; it’s about tapping into new sources of liquidity and making trading more predictable. Expect to see more automated pricing, smarter order routing, and better ways to manage risk, especially in markets that have traditionally been harder to trade electronically. This expansion means more opportunities for firms to scale their operations and serve a wider range of clients more effectively.

Wrapping Up: The Road Ahead for Asian Trading

So, what’s the takeaway from all this? Asia’s trading scene is definitely changing fast. Electronic platforms and smart tools are becoming more common, which is pretty exciting. But it’s not all smooth sailing. Firms still have to deal with different rules in different countries and figure out how to make all these new technologies work together. It looks like the ones who can adapt, use data smartly, and keep up with the tech will be the ones who do well. It’s going to be interesting to see how everything shakes out.

Frequently Asked Questions

How is trading changing in Asia with new technology?

Trading in Asia is becoming much more digital. Instead of just talking to brokers on the phone, many trades are now done through computer systems and apps that help manage prices and orders. This makes things faster and often cheaper.

What is algorithmic trading and why is it important?

Algorithmic trading uses computer programs to make trades automatically. These programs follow specific rules to buy or sell at the right time, which is especially helpful for large orders or in markets where prices change quickly. It helps make trading more precise.

How does AI help with managing risks in trading?

Artificial Intelligence (AI) is helping traders manage risks better. AI tools can automatically break down big trades into smaller ones to find the best prices. They also help keep track of potential dangers in the market, especially in areas like bonds where trades can take longer.

Are there special rules traders need to follow in Asian countries?

Yes, each country in Asia has its own set of rules. For example, places like South Korea and India have specific requirements for traders, like needing special ID numbers or reporting trades very quickly. These rules can make trading more complicated.

Who provides trading money (liquidity) in Asia now?

Besides the usual big banks, more companies that aren’t banks are now providing money for trading. They use special online platforms that let everyone trade with each other, not just with traditional banks. This adds more options and can make it easier to find buyers and sellers.

What’s next for trading in Asia?

Trading in Asia will likely see more companies using digital tools. Some trading firms might join together, while others will focus on doing one type of trading really well. Overall, expect more trading to happen electronically, making the markets more efficient.