Looking at Bloomberg Asian Markets in 2025, there’s a lot going on. New rules, tech changes, and political shake-ups are keeping investors and companies on their toes. From fresh tariffs to new ways of trading, everyone’s trying to figure out what’s next. Some sectors are booming, while others face more risk. For anyone watching Asia’s financial scene, it’s a mix of challenges and new chances. Here’s what’s shaping the market this year.

Key Takeaways

- Geopolitical changes and shifting policies are making Bloomberg Asian Markets less predictable, so companies are planning with more caution.

- Electronic trading and AI are changing how trades happen and how risks are managed, but older systems still play a part.

- Investors are spreading their bets across more types of assets and watching for new rules that could affect deals and strategies.

- Sectors like semiconductors are seeing strong growth, but alternative investments come with higher risks and need careful review.

- Keeping up with new regulations, especially around AI and cross-border trades, is tough, and finding the right talent to handle these changes is a big focus for financial firms.

Geopolitical Climate and Policy Shifts Impacting Bloomberg Asian Markets

Asia’s markets are never far from the political headlines these days. If you’ve been watching, you know policy changes and unpredictable politics are making waves in everything from supply chains to investor confidence. Here’s what’s really happening in 2025.

Tariff Realignments and Trade Disputes

Trade tensions haven’t faded away. Asia’s trade flows are being reshaped by ongoing tariff battles, especially between the US and China. Even countries like India, South Korea, and Vietnam have started redrawing their own playbooks to benefit from production shifts.

- Tariff rates on electronics and automotive parts zigzagged between 8% and 15% across the region this year.

- Firms are tweaking where they source and build products due to new duties and uncertain customs rules.

- New alliances (think RCEP and CPTPP) are giving some markets a leg-up, but these deals come with their own rules and red tape.

Here’s a quick look at recent tariff changes:

| Country | Recent Tariff Change | Affected Sector |

|---|---|---|

| China | +5% | Advanced Electronics |

| Vietnam | -3% | Textiles, Footwear |

| India | +4% | Auto Components |

Navigating Regulatory Complexity

Let’s be honest: it’s getting harder for banks and brokers to keep up with new rules. Governments are racing to put their own stamp on financial regulation, often at the last minute or without much warning.

- Regulators in Singapore and Hong Kong are competing to attract fintechs—each has rolled out strict but different compliance frameworks.

- Cross-border investment now comes with a thicket of disclosure, tax, and anti-money laundering requirements.

- International firms keep teams on call just to parse new announcements from Beijing, Tokyo, or Jakarta.

Adapting to Political Volatility

Unpredictable politics are now part of the daily equation for investors and companies working in Asia. Elections, leadership shakeups, and protests aren’t rare, and they squeeze corporate planning tighter than ever.

- Political risk is factored into most investment models; it’s not an afterthought anymore.

- Firms are spending on risk-scenario modeling and insurance just in case of sudden policy reversals.

- It’s common to hear executives say, “There’s no such thing as a ‘normal’ year for us now.”

So in 2025, the smart money isn’t just following market trends—it’s watching government press conferences and reading the fine print on new trade deals before making any moves.

Technological Innovations and Their Influence on Asian Financial Markets

Out here in Asia, 2025 doesn’t look much like the old days on the trading floor. Tech has slipped into every corner of the markets—sometimes quietly, and sometimes making a real racket. Let’s run through what’s changed, what’s still hard, and how folks are getting creative.

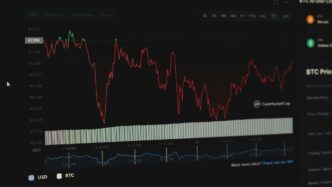

Rise of Electronic Trading Platforms

Electronic trading isn’t just a big deal in New York or London—it’s caught on in Asia in a major way. Now, it’s not just the big banks putting orders through lightning-fast networks; even mid-sized firms are moving to digital. What’s driving this shift is more than just speed—it’s also cost, reach, and the rise of fintech challengers. In places where regulations allow, local startups and non-bank liquidity providers are giving traditional banks a run for their money.

Here are some ways electronic trading is shaking things up:

- Wider access means smaller firms can play alongside giants.

- Fees keep falling as the tech improves.

- Volume and market depth are both up, but there’s more scrutiny on odd-lot and algorithmic trades.

A key factor in this surge is the growing influence of fintech platforms and digital wallets, which make everything easier and more accessible.

AI and Automation in Risk Management

It’s not all shiny dashboards and instant execution. AI and automation are now baked into risk management for many Asian institutions. Forget those old spreadsheets—now you have systems watching trades, scanning for problems, and popping out alerts in real time. But let’s be honest: plugging AI into legacy tech is no walk in the park, and the need for real, human oversight hasn’t disappeared.

Some practical impacts you’ll notice:

- Algorithms can flag sketchy trades or weird price moves within seconds.

- Routine tasks—like reconciliation—are now nearly hands-free.

- Firms can personalize client advice by crunching mountains of historical data overnight, not in weeks.

But, this fast-paced adoption also means strict local rules and global regulations can hold things back, slowing rollout in some countries more than others.

Data Governance and Compliance Solutions

It sounds pretty dry, sure, but ask any trading desk—bad data or lax compliance is just waiting to cost you. With regulators paying close attention, strong data governance is not an option anymore. Companies are investing in tools just to make sure they’re on top of every change, every rule tweak, and every flagged transaction.

Look at some 2025 priorities:

- Cross-market trading means stricter privacy checks and storage practices.

- New solutions are springing up for instant reporting and audit trails.

- Harmonizing standards between neighbors (think: Singapore, Tokyo, Seoul) is still a work in progress.

| Focus Area | Top Priority | 2025 Challenge |

|---|---|---|

| Electronic Trading | Fast, safe transactions | Staying ahead of hackers |

| AI Risk Management | Real-time alerts | Integration with old tech |

| Data Governance | Regulatory compliance | Keeping up with new rules |

In short, technology has rewritten Asian financial markets—not always smoothly, not without problems, but definitely for keeps. The next few years will probably see even more tweaks and headaches, but there’s no going back.

Evolving Investment Strategies Amid Market Uncertainty

In 2025, investors in Asian markets are feeling the pressure from all sides—unpredictable politics, new regulations, and technology changes popping up every few months. It’s not a time for bold leaps. Instead, managers are sticking to more cautious, steady moves and rethinking how they spread money around. Let’s look at some of the main shifts happening right now.

Diversification Across Asset Classes

Nobody wants all their eggs in one basket, especially with random shocks hitting equities, bonds, or even commodities overnight. Investors are spreading their bets:

- More are putting money into multiple asset types—stocks, bonds, real estate, and even private deals.

- There’s renewed interest in emerging-market products, but with tighter controls due to higher risks and currency swings.

- Alternative assets like infrastructure or hedge funds are still on the table, but only for those ready to accept bigger risks and longer waiting periods. If you want to keep up with technology sector trends, you can see how much these play into broader strategies nowadays.

Sample Allocation Table

| Asset Class | 2024 Avg. Allocation (%) | 2025 Avg. Allocation (%) |

|---|---|---|

| Equities | 42 | 38 |

| Fixed Income | 28 | 31 |

| Real Assets | 12 | 13 |

| Alternatives | 13 | 14 |

| Cash | 5 | 4 |

The table above shows a slow drift toward bonds and alternatives, highlighting a move to stability and away from market swings.

The Role of Capital Discipline

Throwing money after big ideas has fallen out of fashion for now. Here’s what’s in:

- A focus on clear returns: Before anything else, investors want to see a path to positive results.

- Slower, stepwise investments, instead of all-in bets.

- More detailed review processes before signing on the dotted line—nobody wants to be caught out by fast-changing policies or surprises in supply chains.

What’s interesting is that leaders are treating every major investment decision like a process, not a one-time event. Sometimes deals sit in waiting for months, with teams double- and triple-checking the math until the wider market calms down.

Shifting Trends in Mergers and Acquisitions

Deals haven’t gone away, but they look different from even two years ago:

- Valuation gaps are making negotiations longer—buyers aren’t willing to pay what sellers expect, especially with uncertain earnings.

- Many mergers are focused on tech upgrades or building scale to survive market bumps, not just easy expansion.

- Cross-border deals are more common, but they face roadblocks with new regulations and local government moves.

Here’s a quick look at what’s slowing down M&A:

- Ongoing trade disputes between Asian countries.

- Policy signals from large economies like China, Japan, and India.

- Unclear regulatory approval timelines.

Investors who stay sharp and patient might still find wins, but they’re bracing for longer timelines, more paperwork, and lots of back-and-forth.

Overall, 2025 isn’t about chasing the next shiny thing. It’s about staying grounded, being methodical, and keeping an eye on risk—because market uncertainty isn’t fading anytime soon.

Sector Spotlights: Equities, Semiconductors, and Alternative Investments

Asian markets have changed a lot in 2025. Let’s look closer at three major sectors getting the most attention right now: equity indices, semiconductors, and alternative assets. These industries, although different, are all dealing with uncertainty in their own way.

Performance of Major Asian Equity Indices

Even regular investors can’t help but notice the wild rides in Asia’s leading equity markets. Key indices like the TOPIX in Japan, Hang Seng in Hong Kong, MSCI China Index, and the CSI 300 in mainland China have faced some noticeable swings this year. This is mainly due to ongoing policy changes, uncertain global growth, and political twists across the region.

| Index | YTD Change (%) | Main Drivers |

|---|---|---|

| TOPIX | +4.3% | Yen weakness, tech rebound, central bank moves |

| Hang Seng | -7.1% | Slow recovery, regulatory shifts, IPO droughts |

| MSCI China Index | -2.6% | Mixed earnings, property sector uncertainty |

| CSI 300 | +1.8% | Domestic demand, stimulus, foreign outflows |

Strong points to remember:

- Regional indices have shown mixed returns in 2025.

- Currency changes and policy tweaks have a big effect.

- Investors are quick to move money at any hint of instability.

Boom in the Semiconductor Sector

This year, hardly anything is getting as much talk as chips—literally, semiconductors. Asian firms are rushing to scale up in response to demand for artificial intelligence, electric vehicles, and data centers. South Korea, Taiwan, and China are at the front of this charge. But here’s the kicker: the sector’s growth isn’t smooth. Supply issues pop up, and chip prices swing around just as fast as investor mood.

Three reasons the semiconductor sector stands out:

- Governments are pouring money and support into domestic production.

- Export controls and trade fights are making sourcing tricky but also pushing local development.

- Asian chipmakers are setting the standards for next-gen tech.

| Metric | 2023 | 2024 | 2025E |

|---|---|---|---|

| Asian Semiconductor Market Value (USD bn) | 557 | 604 | 659 |

| % of Global Chip Output from Asia | 77% | 78% | 80% |

Opportunities and Risks in Alternative Assets

Alternative investments—like real estate, hedge funds, and private equity—have gotten more popular as investors react to unpredictability in traditional markets. But they’re not for the faint of heart. Prices don’t always move as you’d expect. Access can be tough, and these deals often come with extra layers of risk.

What people are watching for in alternatives:

- Liquidity risk: Sometimes you simply can’t get your money out when you want it.

- High fees and lack of transparency: Returns often look good on paper, but costs can eat them up fast.

- Changing regulations: As governments catch up, rules get tighter, impacting how funds work and report results.

Overall, the trend in 2025 is clear: investors are cautious but curious. They’re hungry for returns but insist on knowing the risks first. The big challenge is figuring out where the next solid opportunity will appear—and making sure you don’t get stuck if things turn quickly.

Managing Market Volatility and Risk in Bloomberg Asian Markets

Anyone tracking Bloomberg Asian Markets these days knows just how jumpy things can get. Some mornings it feels like a coin toss—markets swing on everything from sudden policy statements to shifts in global supply chains. Managing the risks and wild swings isn’t just about having a plan: it’s staying alert, adjusting quickly, and accepting that the unexpected will happen more than we’d like.

Volatility Drivers and Macro Trends

Global events, shifting tariffs, and political standoffs are constantly stirring up Asian markets. A few of the big factors fueling volatility right now:

- Trade disputes between major economies, especially around tech and manufacturing

- Quick moves in energy prices and raw materials

- Domestic policy changes in countries like China, Japan, and India

- Ongoing uncertainty from interest rate changes worldwide

Here’s a quick table showing some of the headline drivers and their recent impact:

| Driver | Recent Impact | Notable Region |

|---|---|---|

| Tariff realignments | Tech stock selloffs | Greater China |

| Currency swings | Exporter profit pressure | South Korea, Taiwan |

| Political elections | Short-term volatility | India, Indonesia |

| Supply chain reshuffles | Manufacturing setbacks | Southeast Asia |

Bloomberg’s Asia Trade coverage often highlights how some of these factors—especially policy and trade changes—are affecting day-to-day trading activity. For an up-to-the-minute market view, see essential updates and analysis.

Strategies for Hedging and Asset Protection

When every week brings new risks, big investors try not to get caught off guard. Common steps include:

- Diversifying across equities, fixed income, and real world assets instead of piling into just one market or sector

- Using options and futures to hedge against surprises, like sudden market drops

- Shifting toward more liquid positions to move quickly when it matters

- Keeping some cash ready for quick buys or emergencies

Staying flexible has gone from smart to absolutely necessary. Even banks are now balancing fast, algorithmic trades with old-school relationship deals for higher-value and less predictable transactions.

Currency and Liquidity Considerations

Asia’s markets have a reputation for sharp currency moves, and 2025 has not disappointed. People are watching:

- The dollar’s impact on emerging Asian currencies

- Constraints from differing accounting, tax, and market rules

- Sudden liquidity crunches, especially for smaller markets or alternative assets

It isn’t just about making money but also about avoiding outsized losses. Past performance is no guarantee, especially in places where political or economic stability can shift quickly. Investors trading regionally or in cross-border deals do well to remember these risks, particularly with currency mismatches or thinly traded assets.

In short, handling volatility in Bloomberg Asian Markets has become part instinct, part strategy, and part watching your back.

Regulatory Evolution: AI, Electronic Trading, and Cross-Border Rules

In Asia, financial markets are dealing with regulatory changes that have picked up speed, especially as technology gets smarter. Regulators now focus on how AI, faster trading, and international rules fit together. Here’s what’s happening and what could matter most in 2025.

Regulatory Challenges of AI Adoption

- Policymakers in Asia want to encourage AI, but there’s caution. They don’t want new tech to mess with market stability or fairness.

- Most countries in the region still lack unified standards for AI. Japan, Singapore, and South Korea, for example, have each taken different approaches to AI testing, risk controls, and explainability.

- A big issue: how to handle bias, trace decisions, and resolve errors. Human checks on AI systems remain required, especially on trading desks and for compliance.

Main barriers to AI adoption in Asian financial markets:

| Regulation Issue | Impact Level | Countries Most Affected |

|---|---|---|

| Ambiguous Compliance | High | China, India |

| Implementation Costs | Moderate | Indonesia, Vietnam |

| Data Privacy Standards | High | Japan, South Korea |

| Human Oversight Mandates | Moderate | Singapore, Malaysia |

Cross-Border Compliance in Asian Markets

- Cross-border investment in Asia means firms must align with several rulebooks at once. Regulatory differences between China, ASEAN, and global standards often create headaches.

- Market participants deal with:

- Varied reporting demands (trade, tax, risk)

- Delays because of approval bottlenecks

- Uncertainty from shifting sanctions and foreign investment restrictions

- Asia’s market harmonization efforts—like the ASEAN Capital Markets Forum—are moving slowly, but most firms still need local compliance teams for each jurisdiction.

Data-Driven Operating Models

- Data is now at the center of staying compliant. Firms are setting up systems that track transactions, risk, and client details in real time.

- Authorities in Singapore and Hong Kong push firms to explain their AI-driven decisions and processes, especially during audits or market disruptions.

- There’s more reliance on specialized vendors to provide regulatory technology—tools that flag issues and automate reports.

Key advantages for firms adopting data-driven models:

- Quicker regulatory reporting

- Better visibility into market risks

- Reduced human error during compliance checks

Still, legacy systems and the pressure to keep up with constant rule changes mean that not everyone’s moving at the same pace. Compliance isn’t getting easier—but those who invest early in smart data solutions are seeing fewer headaches and more flexibility for 2025.

Institutional Responses: Resilience and Adaptation in 2025

As we move further into 2025, sell-side institutions in Asia are embracing rapid change, sometimes more out of necessity than by choice. They’re facing shifting policies, technology upgrades, and mounting regulatory complexity all at once. The challenge right now is to become more resilient while also keeping up with unpredictable disruptions. For many firms, this means treading carefully, planning step-by-step, and watching markets for abrupt shocks—no easy task.

Operational Flexibility and Leadership

It’s tempting to think bold moves win the day, but institutions are choosing patience instead. Here’s what stands out in their approach:

- Streamlining decision-making to respond quickly when new trade rules or regulations pop up

- Emphasizing internal transparency so everyone can spot risks or opportunities early

- Shifting resources as needed, for example, moving capital toward stable assets during uncertainty

Senior leaders are choosing steady progress over big bets. With so much volatility in the mix, they’re more likely to focus on clarity and smooth operations rather than risk unpredictable outcomes. As discussed during the Sell-Side Leaders Forum, transparency and adaptability are turning into non-negotiable traits.

Role of Human Oversight in Tech Integration

Even though AI and automation are taking over some tasks, human judgment is not getting left behind. Organizations have learned the hard way that letting algorithms run wild just doesn’t cut it. Instead, here’s how banks are balancing things:

- Compliance: Humans double-check AI output to avoid regulatory trouble

- Customer service: Staff steps in when clients need nuance AI can’t deliver

- Ethical checks: Oversight teams look for biases or unintended effects in automated decisions

The move toward pairing automation with skilled supervision allows processes to stay efficient but safe and trustworthy.

Talent Acquisition and Skill Gaps

The final piece of the puzzle is talent—finding and keeping the right mix of people as job roles evolve.

| Top Skill Gaps Most In-Demand Skills (2025) | Hiring Focus |

|---|---|

| AI/ML Engineering | Regulatory/compliance experts |

| Data Science & Analytics | Cybersecurity pros |

| Cross-cultural management (for regional compliance) | Client-facing relationship managers |

Hiring is getting trickier because firms need both digital skills and real-world market savvy. Many are offering training, upskilling programs, and targeting new talent pools. But the pressure is on: talent shortfalls can slow down tech adoption and leave gaps in regulatory response.

Building resilience in 2025 isn’t about chasing the next big trend; it’s about moving intentionally. With the right mix of flexibility, prudent tech use, and refreshed skill sets, Asian institutions are staying one step ahead, even when surprises keep coming.

Conclusion

So, looking at Asian markets in 2025, it’s clear that change is the only constant. There’s a lot going on—tariffs, new tech, and shifting regulations are all making things more complicated. Banks and brokers are trying to keep up, and everyone’s a bit more careful with their money these days. AI is popping up everywhere, but it’s not magic; it still needs people to keep it in check. The big takeaway? Flexibility and patience seem to matter more than ever. Investors and business leaders are moving slowly, watching for new risks, and not rushing into anything. It’s not the most exciting approach, but in a world that keeps throwing curveballs, slow and steady might just be the way to go.

Frequently Asked Questions

What are the main factors affecting Asian financial markets in 2025?

In 2025, Asian financial markets are shaped by ongoing political issues, changing trade rules, new technology, and different regulations in each country. Tensions between countries like the U.S. and China, along with changing tariffs and rules, make things uncertain for investors and companies.

How is technology changing the way Asian markets work?

Technology like electronic trading platforms and artificial intelligence (AI) is making trading faster and more efficient. Banks and brokers use AI to better manage risks, follow rules, and help customers. However, they still need human experts to watch over these systems and make important decisions.

Why are investors choosing different types of investments now?

Because markets are less predictable, investors are spreading their money across many types of investments like stocks, bonds, real estate, and even things like art or private companies. This helps lower their risk if one area does badly.

What sectors are doing well in Asian markets right now?

The semiconductor industry is growing quickly because of high demand for chips in electronics. Major stock indices in Asia, like the Hang Seng and CSI 300, are also closely watched. Some investors are looking at alternative assets, but these can be risky and aren’t right for everyone.

How do investors and companies handle market ups and downs?

They use different strategies to protect their money, like hedging and holding cash. Watching currency changes and making sure they have enough money to trade or invest is also important. Many use technology and expert advice to help manage risks.

Are there new rules for using AI and trading technology in Asia?

Yes, rules are changing as more companies use AI and electronic trading. Governments want to make sure these tools are safe and fair. Companies must keep up with these new rules, especially when doing business in more than one country. This means they need good systems for following rules and protecting data.