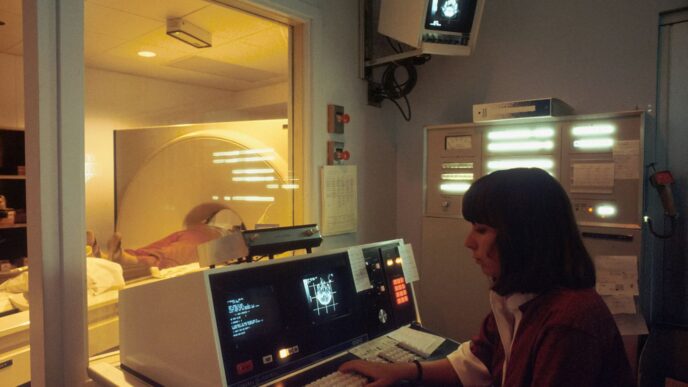

Doctors spend years mastering clinical expertise, yet many receive little formal training in financial management. As a result, even successful medical practices can struggle with cash flow, compliance, and financial clarity. Bookkeeping services for doctors provide the structure needed to manage complex healthcare finances while allowing physicians to focus on patient care.

Medical practices operate in one of the most regulated and administratively demanding environments. Revenue delays, insurance reimbursements, payroll obligations, and compliance requirements create financial pressure that generic bookkeeping systems are not designed to handle. Proper bookkeeping is not a luxury for doctors. It is a necessity.

Why Doctors Face Unique Financial Challenges

Unlike many business owners, doctors often deal with delayed income. Payments may arrive weeks or even months after services are provided due to insurance billing cycles and reimbursement reviews.

Common financial challenges doctors face include:

- Delayed insurance reimbursements

- Managing patient co-pays and deductibles

- High payroll costs for clinical staff

- Ongoing compliance and reporting requirements

Organizations such as the American Medical Association (AMA) consistently highlight the growing administrative burden placed on physicians. Without structured bookkeeping, it becomes difficult to understand what revenue has been earned, what has been collected, and what remains outstanding.

The Importance of Cash Flow Management for Doctors

Cash flow issues are one of the most common causes of financial stress in medical practices. Even profitable practices can struggle to meet payroll or operating expenses if cash inflows and outflows are not tracked carefully.

Accurate bookkeeping helps doctrs:

- Monitor accounts receivable

- Track insurance and patient payments

- Identify delayed or denied claims

- Plan expenses with confidence

Without clear cash flow reporting, physicians may rely on bank balances alone, which often provide a misleading picture of financial health.

Compliance and Financial Accuracy in Medical Practices

Doctors must comply with strict financial and regulatory standards. Government programs and insurance providers require accurate documentation and transparent reporting.

Agencies such as the Centers for Medicare & Medicaid Services (CMS) enforce detailed billing and reimbursement rules. Inaccurate or incomplete financial records can raise red flags during audits, even when patient care is compliant.

Proper bookkeeping supports compliance by:

- Maintaining organized financial documentation

- Supporting billing audits and reviews

- Reducing the risk of penalties

- Demonstrating transparency and accountability

Compliance is not just about avoiding penalties. It is about protecting the reputation and longevity of the practice.

Expense Tracking and Cost Control for Physicians

Medical practices incur significant expenses, many of which increase as practices grow. These include staffing, medical supplies, rent, equipment, technology, and insurance.

Bookkeeping services help doctors

- Track operating costs accurately

- Identify unnecessary spending

- Compare expenses year over year

- Improve budgeting and forecasting

Without structured expense tracking, costs can rise unnoticed, gradually reducing profitability and limiting the ability to invest in better patient care.

Payroll Complexity in Medical Practices

Payroll is typically the largest expense for doctors. Managing compensation for physicians, nurses, technicians, and administrative staff requires precision.

Healthcare payroll often includes:

- Salaried and hourly employees

- Overtime and shift differentials

- Benefits and retirement contributions

- Compliance with labor regulations

Accurate bookkeeping ensures payroll expenses are recorded correctly and reflected accurately in financial reports. This helps doctors understand true labor costs and plan staffing levels appropriately.

How Bookkeeping Supports Better Decision-Making

Many doctors make financial decisions based on intuition rather than data. While experience is valuable, it cannot replace accurate financial reporting.

With professional bookkeeping services, doctors gain access to:

- Profit and loss statements

- Cash flow reports

- Expense trend analysis

- Performance comparisons over time

These insights allow physicians to make informed decisions about hiring, expanding services, purchasing equipment, or adjusting schedules.

Common Bookkeeping Mistakes Doctors Make

Even well-run practices can experience bookkeeping issues, especially when finances are handled internally without specialized expertise.

Common mistakes include:

- Delayed recording of transactions

- Poor tracking of reimbursements

- Mixing personal and practice expenses

- Infrequent account reconciliations

- Incomplete financial reporting

Over time, these issues reduce visibility and increase compliance risk.

The Role of Technology in Doctor Bookkeeping

Technology has improved access to financial tools for medical practices, but software alone is not enough. Accounting platforms can automate transaction imports and reporting, but they still require oversight.

When implemented correctly, technology can:

- Reduce manual errors

- Improve reporting accuracy

- Support multi-provider practices

- Enhance collaboration between teams

Without proper configuration and review, automation can amplify errors instead of preventing them.

Why Doctors Choose Professional Bookkeeping Services

As medical practices become busier, many doctors choose to outsource bookkeeping to professionals who understand healthcare finances. Specialized bookkeeping services ensure that records are accurate, compliant, and actionable.

Doctors who work with providers such as Advanced Professional benefit from bookkeeping systems designed for regulated industries. This approach reduces administrative burden while maintaining financial accuracy.

Professional bookkeeping also introduces consistency. Transactions are recorded promptly, reconciliations are completed regularly, and reports are delivered in a clear, understandable format.

Audit Readiness and Risk Reduction

Audits are a reality in healthcare, particularly for practices that bill government programs. Clean bookkeeping records make audits far less disruptive.

Strong bookkeeping ensures:

- Clear documentation for reimbursements

- Transparent income and expense records

- Faster responses to audit inquiries

- Reduced risk of penalties

Audit readiness is not about expecting problems. It is about maintaining disciplined financial practices.

Choosing the Right Bookkeeping Services as a Doctor

Not all bookkeeping services are suited for medical practices. Doctors should evaluate providers based on healthcare experience, not just cost.

Important considerations include:

- Experience with medical practices

- Knowledge of healthcare compliance requirements

- Familiarity with Internal Revenue Service (IRS) reporting standards

- Clear and timely financial reporting

The right bookkeeping partner acts as a safeguard for the practice rather than just a vendor.

Final Thoughts

Bookkeeping services for doctors are not simply administrative support. They are a critical component of financial clarity, compliance, and long-term stability.

Doctors who invest in professional bookkeeping gain better control over cash flow, reduce regulatory risk, and free up time to focus on patient care. In a demanding healthcare environment, accurate financial management supports both professional success and peace of mind.