It’s been a pretty wild year for ai startups news, huh? It feels like every other week there’s a new company announcing they’ve pulled in a huge amount of cash. We saw a ton of companies, especially here in the US, get serious funding. It wasn’t just a few big players either; the money really spread out, showing that investors are looking at a lot of different ideas in the AI space right now. This whole AI thing is definitely not slowing down, and it looks like it’s going to change a lot of how we do things.

Key Takeaways

- A significant number of US ai startups, 55 in total, successfully raised over $100 million in venture capital during 2025, indicating strong investor confidence.

- While fewer mega-rounds exceeding $1 billion occurred, the trend shifted towards companies securing multiple large funding rounds throughout the year.

- Investment was widespread across various sectors, with AI infrastructure, healthcare, enterprise solutions, and generative AI platforms being major recipients.

- Leading venture capital firms and strategic tech investors actively participated, providing not only capital but also industry partnerships and market access.

- The surge in funding led to high valuations, creating new unicorns and decacorns, which allows for extended research but also brings increased scrutiny on revenue generation.

AI Startups News: A Record-Breaking Year for Funding

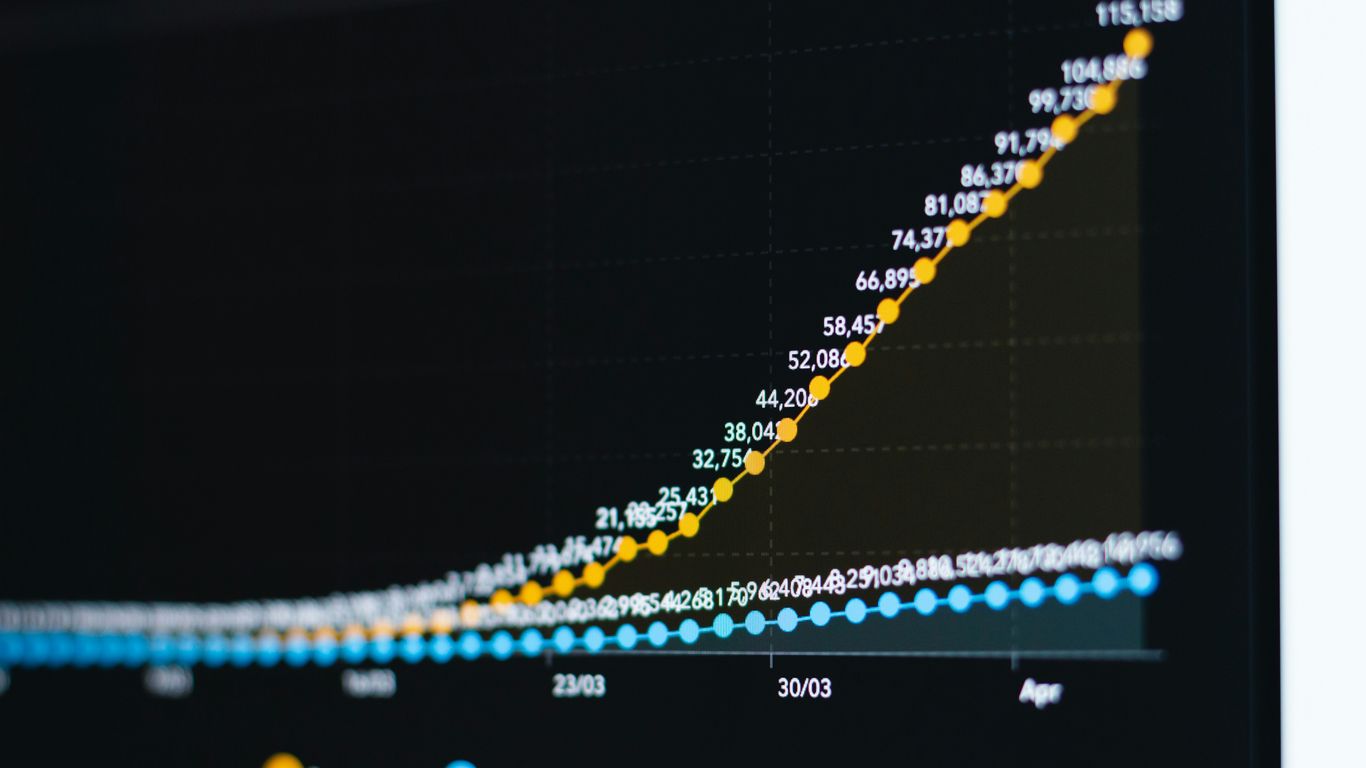

Wow, 2025 was something else for AI startups, wasn’t it? It feels like just yesterday we were talking about big numbers, and now we’re looking back at a year that absolutely shattered expectations. We saw a huge wave of investment, with a significant number of companies bringing in serious cash. Fifty-five U.S.-based AI companies managed to pull in funding rounds of $100 million or more. That’s a pretty big deal and shows just how much faith investors have in AI’s ability to change pretty much everything.

55 US Companies Secure Over $100 Million in Venture Capital

So, the big headline is that 55 American AI companies hit that $100 million+ mark in funding. This isn’t just a few companies getting all the attention; it’s a broader trend. It means more startups are finding ways to get substantial backing, which is great for innovation. It’s a clear sign that investors are spreading their bets across the AI landscape, not just putting all their eggs in one basket. This widespread investment is what really fuels the next wave of AI advancements.

Mega-Rounds Increase Amid Shifting Investment Strategies

While the total number of companies hitting that $100 million threshold went up, the way the money was distributed saw some interesting shifts. We saw fewer of those absolutely massive, billion-dollar-plus single rounds compared to the year before. Instead, a different pattern emerged: a lot more companies were able to secure multiple large funding rounds within the same year. Think about it – eight companies managed this feat in 2025, a big jump from just three in 2024. This suggests a strategy of getting more frequent, substantial cash injections to keep up the pace in a really competitive market. It’s like they’re building momentum with several strong pushes rather than one giant leap.

Investor Confidence Remains High in AI’s Transformative Potential

Even with these shifts, the overall message from investors is loud and clear: they still believe in AI. The sheer amount of money flowing into these startups, across so many different areas, shows a deep confidence in AI’s power to transform industries. It’s not just hype; it’s a calculated bet on technology that’s already proving its worth and has even more potential down the line. This sustained interest means startups have the resources to push boundaries, experiment, and develop the next generation of AI tools and applications that will shape our future.

Sector Spotlight: Where AI Investment Flowed in 2025

Alright, so where did all that money actually go in 2025? It wasn’t just spread out randomly; investors put their chips down in some pretty specific areas. It’s like they knew exactly what they wanted to build.

AI Infrastructure and Hardware Receive Billions

This was a huge one. Think of it as the plumbing and wiring for the whole AI world. Companies building the actual chips, the servers, and the cloud platforms that AI runs on got a massive chunk of change. We’re talking about places like Cerebras Systems and Groq, who raised over a billion dollars combined just to make the computers faster and more efficient for AI tasks. It’s the backbone, you know? Without this stuff, nothing else works.

Healthcare and Biotech AI Attract Significant Capital

This sector always gets attention because, well, it’s about health. Startups here are using AI for everything from helping doctors with paperwork to discovering new medicines. Companies like Abridge and Hippocratic AI pulled in big investments, showing that AI can really make a difference in serious fields. It’s not just about making cool apps; it’s about solving real-world problems that affect people’s lives.

Enterprise Solutions and Developer Tools See Strong Demand

Businesses and the people who build software are also big on AI. Companies that make it easier for businesses to use AI, like Glean for searching company info, or tools that help developers build AI faster, saw a lot of investor interest. Anysphere and Cognition AI, for example, got huge funding rounds for their coding assistants. It seems like everyone wants to make AI more accessible and useful for everyday work.

Generative AI and Creative Platforms Continue to Draw Funding

And of course, the flashy stuff. The AI that creates images, videos, and text is still a hot ticket. Platforms like Runway and Luma AI, which let people make cool visual content, kept getting money. It’s clear that investors see a future in AI-powered creativity, whether for artists, designers, or just for fun. This broad investment across infrastructure, health, business tools, and creative applications paints a picture of a maturing AI market. The total AI investment in 2025 reached a staggering $202.3 billion, with AI accounting for nearly half of all global investments [e000].

Here’s a quick look at where the money went:

- AI Infrastructure & Hardware: Building the physical and digital foundations.

- Healthcare & Biotech AI: Improving health outcomes and drug discovery.

- Enterprise & Developer Tools: Making AI easier to use and build with.

- Creative & Generative AI: Powering new forms of digital content.

- AI Research Labs: Pushing the boundaries of what AI can do.

Key Funding Rounds and Innovations Shaping the AI Landscape

This year saw some truly massive investments pour into AI companies, and it wasn’t just a few big names getting all the attention. We’re talking about serious cash flowing into companies building the very foundations of AI, as well as those putting it to work in practical ways. It’s a sign that investors are really seeing the potential for AI to change how we do things across the board.

Cerebras Systems and Groq Lead AI Infrastructure Funding

When you think about AI, you need the hardware to run it. That’s where companies like Cerebras Systems and Groq come in. Cerebras Systems, for example, pulled in a huge $1.1 billion. They’re focused on building massive chips designed specifically for AI tasks. Then there’s Groq, which grabbed $750 million. Their specialty is making AI run super fast, especially when it needs to make decisions in real-time. These aren’t small amounts of money; they show how important it is to have the right physical tools for AI to work its magic. It’s all about building that next generation of computing power.

Applied AI in Medicine and Law Showcases Commercial Viability

It’s not just about the chips, though. We’re seeing AI make real inroads into complex fields like medicine and law. Companies like Abridge and Harvey are getting significant backing. Abridge is working on AI for healthcare, potentially making things like doctor’s notes much easier. Harvey is applying AI to legal work, which is a field known for its detail and heavy workload. These companies are showing that AI isn’t just a futuristic idea; it’s something that can solve real problems and make money doing it. This is a big deal because it proves AI has a clear path to becoming a standard tool in these important professions.

OpenAI and Anthropic Command Largest Checks for Foundational Research

Then you have the giants pushing the boundaries of what AI can do. OpenAI and Anthropic are in a league of their own when it comes to securing funding for pure research. Anthropic, for instance, had a record-breaking Series F round, bringing in $13 billion. OpenAI also secured a massive $40 billion round earlier in the year. These companies are focused on the big questions, like developing more advanced AI models and thinking about AI safety. The sheer size of these investments highlights the high-stakes race to develop what some call artificial general intelligence, or AGI. It’s a bet on the future of AI itself, and investors are placing it with enormous sums.

The Investor Perspective: Backing AI’s Future

Venture Capital Firms Drive Multiple Deals

It’s pretty clear that venture capital firms are all-in on AI. We saw the usual suspects – think Andreessen Horowitz, Lightspeed, Sequoia – showing up again and again. They weren’t just dipping their toes in; many of these firms were involved in multiple funding rounds for the same companies, sometimes even across different stages of growth. This isn’t just about spotting a good idea; it’s about building long-term relationships and seeing these AI ventures through their development.

Strategic Investors Align with Ecosystem Growth

Beyond the traditional VCs, a lot of big tech players got involved too. Companies like Nvidia, AMD, and Microsoft weren’t just writing checks; they were actively investing in the AI ecosystem. It makes sense, right? They’re building the platforms and hardware that AI runs on, so they want to make sure the companies using their tech are successful. This kind of investment is a bit different – it’s about securing partnerships and ensuring their own technologies remain central to the AI revolution.

The Blend of Financial and Strategic Capital

So, what does this all mean for the startups? Well, getting money from these strategic investors is more than just a cash infusion. It often comes with industry connections, a stamp of approval, and help with getting their products out into the world. It’s a smart move for startups to bring on these kinds of partners. It’s not just about the money anymore; it’s about the whole package that helps them grow and compete. This mix of pure financial backing and strategic alignment seems to be the winning formula for many AI companies right now.

Valuation Dynamics and Market Impact of AI Startup Funding

Unprecedented Valuations Create New Unicorns and Decacorns

Wow, the money pouring into AI startups this year has been wild. We’re seeing companies that are barely out of the gate getting sky-high valuations. It’s created a whole bunch of new "unicorns" – those are startups worth over a billion dollars – and even a few "decacorns" hitting the $10 billion mark. This isn’t just about bragging rights; these massive valuations mean companies can afford to take their time with research and development. They don’t have to rush to make a profit right away, which is pretty cool for pushing the boundaries of what AI can do.

Extended Runway for Research and Development

Because these companies are so well-funded, they have a lot more breathing room. Think of it like having a really long runway before you need to take off. This allows them to invest heavily in complex, long-term projects that might not pay off for years. It’s a big shift from the old days where startups had to show profits much sooner. This extended runway is a direct result of the massive investment rounds we’ve seen, like Anthropic’s $13 billion Series F or OpenAI’s huge $40 billion deal. It really changes the game for how innovation happens in AI.

Increased Scrutiny on Revenue Generation and Exit Opportunities

But here’s the flip side: all these high valuations mean the pressure is on later. Investors are watching closely to see if these companies can actually make money and eventually provide a good return. Whether that’s through an IPO or being bought by a bigger company, the exit needs to justify that massive valuation. It’s a delicate balance. We’re seeing more focus now on how these AI companies plan to generate real revenue, not just potential. It’s a bit like building a really fancy house – it looks amazing, but you still need to make sure it’s a practical place to live and eventually sell.

Here’s a quick look at some of the big funding rounds that contributed to this valuation boom:

- December 2025: Mythic ($125 million) and Unconventional AI ($475 million seed round, valuing them at nearly $4.5 billion).

- November 2025: Anysphere ($2.3 billion) and Luma AI ($900 million).

- September 2025: Anthropic ($13 billion Series F) and Cognition AI ($400 million).

Notable Funding Rounds Across Different AI Sub-Sectors

December 2025: Mythic and Unconventional AI Secure Major Investments

The year wrapped up with some eye-popping funding news. Mythic, a company working on AI chips that use less power, brought in $125 million. But the real shocker was Unconventional AI. This startup, barely a year old, landed a massive $475 million seed round. It’s wild to think they’re already valued at nearly $4.5 billion. Also, Fal, which makes tools for creating media with AI, managed to close its third funding round of the year, adding another $140 million to its coffers.

November 2025: Anysphere and Luma AI Highlight Developer Tools and Creative Applications

November was a big month for companies building tools for developers and creators. Anysphere, the folks behind the AI coding assistant Cursor, pulled in an incredible $2.3 billion. That’s a huge amount of money for a coding tool. Then there’s Luma AI, which is focused on making visual content using AI. They secured $900 million. These deals show that investors are really interested in anything that helps people build with AI or create new kinds of digital stuff.

September 2025: Anthropic’s Record Series F and Cognition AI’s Coding Agent

September was a landmark month, especially for AI safety research. Anthropic announced a massive $13 billion Series F funding round. This put their valuation at a staggering $183 billion, making it one of the largest funding rounds ever for an AI company. It wasn’t just Anthropic, though. Cognition AI, which is developing an AI agent named Devin to help with software coding, raised $400 million. Sierra also got $350 million for its AI customer service solutions. And let’s not forget Cerebras Systems, which continued its strong showing by raising another $1.1 billion for its AI infrastructure hardware.

Wrapping Up 2025’s AI Boom

So, looking back at 2025, it’s pretty clear that AI startups had a massive year. We saw a lot of money flowing into these companies, with 55 of them in the US alone pulling in over $100 million each. It wasn’t just about a few big names getting huge checks, though. The trend showed more companies getting multiple big funding rounds, which suggests they’re growing fast and need that cash to keep up. From the chips that power AI to the apps we use every day, investment was spread out. It feels like we’re building a really solid base for whatever comes next in AI, and honestly, it’s going to change a lot of things.

Frequently Asked Questions

How many U.S. AI companies got over $100 million in funding in 2025?

In 2025, a total of 55 companies in the United States that focus on artificial intelligence successfully raised more than $100 million in venture capital. This shows a lot of people believe AI will be important for the future.

Which types of AI businesses got the most money?

Companies that build the basic tools and hardware for AI, like special computer chips and servers, received huge amounts of money. Also, businesses using AI for health care and those creating AI tools for other companies and software developers saw a lot of investment. Creative AI and platforms for making new things with AI also attracted significant funding.

Were there big differences in funding compared to the year before?

Yes, there were some shifts. While more companies got large funding amounts in 2025 than in 2024, there were fewer of the super-huge single investments over $1 billion. Instead, many companies raised big amounts multiple times throughout the year, suggesting a strategy to grow faster in a competitive market.

Who were the main investors in these AI companies?

Big venture capital firms, which are companies that invest in new businesses, were very active. Also, large tech companies like Nvidia and Google were important investors. They invested not just money, but also helped these startups by forming partnerships and giving them advantages in reaching customers.

How did all this funding affect how much these companies are worth?

The large amounts of money led to very high company values, creating many new ‘unicorns’ (companies worth over $1 billion) and even ‘decacorns’ (companies worth over $10 billion). This gives these companies more time to work on new ideas and research without immediately needing to make a lot of profit, but it also means they will be watched closely to see if they can make real money.

Which specific companies had major funding rounds in late 2025?

Towards the end of 2025, companies like Mythic, which works on efficient AI computer power, and Unconventional AI, a startup focused on fundamental computing, received large investments. The generative media platform Fal also closed another big funding round.