Keeping up with the stock market these days can feel like a full-time job. There’s always something new happening, from economic shifts to tech breakthroughs. This article pulls together some of the latest buzz and expert thoughts you might find useful, especially if you’re trying to make sense of the CNBC stock market today.

Key Takeaways

- CNBC offers insights into current market events and expert opinions to help investors make better choices.

- Understanding economic data is important for making smart investment decisions.

- Learning about different investment strategies, like ETFs and private company growth, can help shape your portfolio.

- CNBC covers specific markets, including bonds, sports deals, and cryptocurrencies, providing focused information.

- New technologies like AI are changing businesses and creating new investment possibilities.

Navigating The CNBC Stock Market Today Landscape

Key Market Updates and Analysis

Keeping up with the stock market can feel like trying to catch a greased pig, right? One minute things are chugging along, the next, a headline drops and everything shifts. That’s where CNBC comes in, trying to make sense of the daily whirlwind. They’re looking at what’s moving the needle, whether it’s a big company announcing earnings or some new economic data that makes everyone scratch their heads.

Here’s a quick look at what’s usually on the table:

- Major Index Performance: How are the Dow, S&P 500, and Nasdaq doing today? Are they up, down, or just sort of… there?

- Top-Moving Stocks: Which companies are making big waves, for better or worse? This could be anything from a tech giant to a smaller, unexpected player.

- Sector Spotlights: Sometimes, it’s not the whole market but specific industries that are grabbing attention. Think energy, healthcare, or tech – what’s happening in those areas?

- Economic Data Drops: Things like inflation reports, job numbers, or interest rate hints can really shake things up. CNBC breaks down what these numbers mean for your money.

The goal is to give you a clear picture of what’s happening right now, without all the confusing noise. It’s about understanding the immediate forces shaping the market so you can react, or just know what’s going on.

Expert Insights for Informed Decisions

It’s one thing to see the numbers, but it’s another to figure out what they actually mean for your investments. That’s where the talking heads on CNBC come in. They bring in folks who spend their days thinking about this stuff – fund managers, analysts, economists – to share their thoughts.

These experts often talk about:

- Future Outlooks: Where do they see the market heading in the next few weeks or months? Are they feeling optimistic or cautious?

- Specific Stock Picks: Sometimes they’ll point to companies they think are good buys, or ones to avoid.

- Risk Assessment: What are the big dangers out there? Are there geopolitical events, policy changes, or economic slowdowns to worry about?

- Investment Themes: They might highlight trends, like the growth in certain technologies or shifts in consumer behavior, that could create investment opportunities.

It’s not always about getting a crystal ball prediction, but more about getting different perspectives. Hearing from these pros can help you connect the dots between market movements and your own financial goals.

Understanding Economic Indicators

Economic indicators are basically the vital signs of the economy. They’re like the doctor checking your pulse and blood pressure, but for the whole country’s financial health. CNBC often breaks down these reports because they have a direct impact on how stocks and bonds perform.

Some of the key indicators you’ll hear about include:

- Inflation Rates (CPI/PPI): How fast are prices going up? High inflation can eat into profits and make consumers spend less.

- Unemployment Figures: How many people have jobs? A strong job market usually means people have money to spend, which is good for businesses.

- Gross Domestic Product (GDP): This is the total value of everything produced in the country. A growing GDP is generally a sign of a healthy economy.

- Interest Rates: Set by the Federal Reserve, these rates affect how much it costs to borrow money. Higher rates can slow down spending and investment.

When these numbers come out, they can cause immediate reactions in the market. CNBC’s coverage helps explain why these figures matter and what they might signal for the future. It’s about understanding the bigger economic picture that influences all those individual stock prices.

Investment Strategies and Expert Advice

Optimizing Your Investment Portfolio

Thinking about how to make your money work harder for you? It’s a common question, and honestly, there’s no single answer that fits everyone. But getting your portfolio in shape is a smart move. We’re talking about making sure your investments are set up to meet your goals, whether that’s saving for retirement, a down payment, or just building wealth over time. It’s about finding that right mix of stocks, bonds, and maybe other things too.

Here are a few things to consider:

- Diversification: Don’t put all your eggs in one basket. Spreading your money across different types of investments can help reduce risk. If one area takes a hit, others might hold steady or even grow.

- Risk Tolerance: How much risk are you comfortable with? Some investments have the potential for big gains but also big losses. Others are more stable but might grow slower. Knowing yourself is key.

- Time Horizon: When do you need the money? If it’s for retirement decades away, you can probably afford to take on more risk. If you need it in a few years, playing it safer might be the way to go.

The goal is to build a portfolio that aligns with your personal financial situation and what you want to achieve.

Actionable Advice from Top Market Experts

Sometimes, you just need a little guidance from people who really know the markets. We’ve seen a lot of smart folks share their thoughts on what’s happening and what might be coming next. They often talk about looking beyond the day-to-day noise and focusing on the bigger picture. For instance, some experts are pointing to the steady growth in certain sectors, while others are warning about potential bumps in the road due to economic shifts.

Here’s a look at some common themes:

- Long-Term Perspective: Many seasoned investors stress the importance of not getting too caught up in short-term market swings. They advise sticking to a plan even when things look a bit shaky.

- Understanding Value: It’s not just about buying what’s popular. Experts often talk about finding investments that are genuinely undervalued, meaning their price doesn’t reflect their true worth.

- Staying Informed: Keeping up with economic news, company reports, and global events is a must. This helps in making smarter choices about where to put your money.

Navigating Financial Life with Advisory Firms

For many people, managing their finances can feel like a full-time job. That’s where financial advisors and advisory firms come in. They can help you sort through all the options and create a plan that makes sense for your life. Think of them as guides who can help you steer clear of common money mistakes and make progress toward your financial goals. They look at your whole financial picture, not just one piece of it.

What can an advisory firm do for you?

- Personalized Financial Planning: They help create a roadmap tailored to your specific needs, like retirement planning, college savings, or estate planning.

- Investment Management: Advisors can help select and manage investments, aiming to grow your wealth while managing risk.

- Behavioral Coaching: Sometimes, the hardest part of investing is managing your own emotions. Advisors can provide a steady hand during market ups and downs, helping you stick to your plan.

Working with a good advisor can bring a sense of calm and confidence to your financial journey.

Emerging Trends in the Financial World

The financial world is always shifting, and keeping up can feel like a full-time job. But paying attention to what’s new is how you spot opportunities. One big area getting a lot of attention is exchange-traded funds, or ETFs. They’ve become super popular because they’re easy to trade and can cover a wide range of investments, from stocks to bonds. It’s a way to get broad market exposure without picking individual companies. ETFs offer a flexible way to adjust your portfolio quickly.

Then there’s the private company sector. It used to be that only big, public companies were easily investable. Now, with more platforms and ways to access them, private companies are becoming more interesting for investors looking for different kinds of growth. It’s a bit more complex, sure, but the potential rewards can be significant.

And let’s not forget real estate. It’s not just about buying a house anymore. We’re seeing new ways to invest, like through real estate investment trusts (REITs) or even fractional ownership. These methods make it easier for more people to get a piece of the property market without needing a massive down payment. It’s about finding creative ways to build wealth.

Here are a few things to keep in mind:

- ETFs: Think of them as baskets of investments. They trade on exchanges just like stocks.

- Private Companies: These are companies not listed on public stock exchanges. Investing here can be riskier but potentially more rewarding.

- Real Estate Innovations: Look into REITs and crowdfunding platforms for new ways to invest in property.

It’s a lot to take in, but staying informed about these trends can help you make smarter choices with your money. For more on how these shifts might affect your investments, you might want to look into market analysis.

CNBC’s Focus on Specific Markets

CNBC doesn’t just cover the big, broad stock market. They also dig into some more specialized areas that might be important for certain investors or just interesting to follow. It’s like looking at the different neighborhoods in a city instead of just the skyline.

Insights into the Municipal Bond Market

When cities and states need money for projects – think new schools, roads, or hospitals – they often borrow it by selling what are called municipal bonds. CNBC’s "Muni Money" segment looks at what’s happening with these bonds. They talk about the good and bad sides for people who buy them. It’s about figuring out if lending money to a town or state is a smart move right now, especially when you consider how they plan to pay it back and what their financial health looks like.

Coverage of Sports Industry Deals

The world of sports is a huge business these days, and CNBC keeps an eye on it. They report on big money moves like media rights deals – that’s what TV networks pay to show games. They also look at how much sports teams are worth and when big investment firms buy into them. It’s not just about the game on the field; it’s about the money behind the scenes.

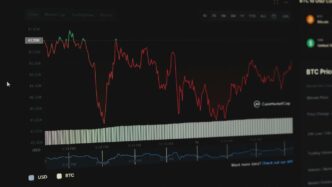

Understanding the Latest in Cryptocurrency

Cryptocurrencies are still a pretty new and sometimes wild part of the financial world. CNBC provides coverage on this. They try to explain what’s going on with different digital coins, the technology behind them, and how they might fit into your investment picture. It’s a space that moves fast, so staying informed is key.

Here’s a quick look at what they might cover:

- Municipal Bonds: Assessing the financial health of states and cities.

- Sports Business: Tracking team valuations and media rights.

- Cryptocurrencies: Explaining new digital assets and market shifts.

Leadership and Business Transformation

Trends Influencing Chief Executive Officers

CEOs today are dealing with a lot. It’s not just about the bottom line anymore. Things like sustainability and how a company treats its employees are big topics. We’re seeing a shift where leaders have to think about the bigger picture, not just quarterly profits. This means making tough calls that balance profit with purpose.

Here are some key areas CEOs are focusing on:

- Global Economic Shifts: Keeping up with changes in international markets and trade policies.

- Technological Advancements: Figuring out how to use new tech, like AI, without falling behind.

- Workforce Dynamics: Managing remote teams, attracting talent, and keeping employees happy.

- Environmental, Social, and Governance (ESG) Factors: Integrating sustainability and social responsibility into business plans.

Adapting to the Ever-Changing Workplace

The way we work has changed, and it keeps changing. Companies are trying to figure out the best mix of in-office and remote work. It’s a puzzle that involves technology, company culture, and employee needs. Some businesses are finding that a flexible approach helps them attract and keep good people. Others are sticking to more traditional models. It really depends on the industry and the specific company.

Consider these points:

- Hybrid Models: Many companies are experimenting with hybrid work setups, allowing employees to split time between home and the office.

- Employee Well-being: There’s a growing focus on mental health and work-life balance to prevent burnout.

- Digital Tools: The right software and communication platforms are key to making remote and hybrid work effective.

Global Industries Transforming with World-Changing Ideas

Big ideas are shaking up industries all over the world. Think about how renewable energy is changing the power sector, or how new materials are impacting manufacturing. It’s not just about one or two big companies; it’s a widespread change. These transformations often come from unexpected places, like startups or research labs, and then spread across the globe. It’s exciting to watch, and it means businesses have to stay alert and ready to change themselves.

Some examples of these transformations include:

- The Green Revolution: Shifting towards sustainable energy sources and practices across many sectors.

- Digitalization: Moving more business processes and customer interactions online.

- Biotechnology: Advances in medicine and agriculture are creating new possibilities and challenges.

The Impact of Artificial Intelligence

AI Technologies for Innovation and Productivity

Artificial intelligence is no longer just a buzzword; it’s actively changing how businesses operate and how we get things done. Think about it – AI tools are popping up everywhere, helping with everything from writing emails to analyzing complex data sets. Companies are really starting to see the benefits, using AI to automate repetitive tasks, which frees up people to focus on more creative and strategic work. It’s like having a super-efficient assistant for your whole team. This push for AI integration is a big part of why we’re seeing so much investment in tech companies right now, even as some external investors pull back. It shows a real belief in the future of these technologies. For instance, AI can sift through mountains of information in minutes, something that would take humans days. This speed and accuracy are game-changers for research and development.

Risks, Opportunities, and Investment Potential of AI

Of course, with all this excitement, there are also things to watch out for. The potential for AI is huge, opening up new markets and ways of doing business. We’re seeing AI being used in everything from healthcare diagnostics to personalized education. But there are also risks. Job displacement is a concern, as AI takes over tasks previously done by humans. Then there’s the question of who controls this powerful technology and how it’s used. For investors, this presents a mixed bag. There are clear opportunities in companies developing AI or using it to gain an edge, but it’s also important to understand the potential downsides. The market is still figuring out the long-term value and the true impact of AI across different sectors. It’s a space that requires careful consideration before putting money down.

Ethical AI and Regulatory Challenges

Beyond the business side, there’s a whole other layer to AI: the ethical and regulatory side. As AI systems become more sophisticated, questions about bias in algorithms, data privacy, and accountability become really important. Who is responsible when an AI makes a mistake? How do we ensure AI is used fairly and doesn’t perpetuate existing societal inequalities? Governments and international bodies are starting to grapple with these issues, trying to create frameworks to guide AI development and deployment. This regulatory landscape is still very much in flux, and it will likely shape how AI evolves. Companies that can navigate these ethical and regulatory hurdles effectively might find themselves in a stronger position. It’s a complex puzzle that involves technologists, policymakers, and the public all working together.

Wrapping Up Today’s Market Buzz

So, that’s a look at what’s been happening in the markets today. We’ve seen a bit of everything, from ups and downs to some interesting expert takes. It’s a lot to keep track of, for sure. Remember, the market doesn’t stand still, and what’s important today might shift tomorrow. Keep an eye on those big stories and the advice from folks who really know their stuff. It’s all about staying informed, even when things get a little wild out there. We’ll be back with more updates soon.

Frequently Asked Questions

What’s happening in the stock market today?

Today’s stock market is seeing a lot of action! We’re looking at important news that could affect prices, and experts are sharing their thoughts on what might happen next. Think of it like watching a big game where everyone is trying to guess the next play.

Where can I find advice on investing my money?

You can get great tips from smart people who know a lot about money. They can help you pick the best places to put your money so it can grow, kind of like a coach helping you build a winning team for your savings.

Are there new ways to invest money?

Yes, there are always new and cool ways to invest! Things like special baskets of stocks called ETFs are getting really popular. Also, companies that aren’t on the big stock market yet are becoming interesting places to invest.

What kind of markets does CNBC talk about?

CNBC covers a lot of different money areas. They talk about city and state bonds, big deals in sports, and even the exciting world of digital money like Bitcoin.

How is technology changing businesses?

Technology, especially smart computer programs called AI, is changing everything! It’s helping businesses work faster and come up with new ideas. It’s like giving companies superpowers to do even better.

What should I know about AI and investing?

AI is a big deal for investing. It can help find new chances to make money, but there are also things to be careful about, like making sure it’s used fairly. It’s a powerful tool that needs smart handling.