Cognition AI’s Rapid Ascent and Financial Milestones

Unveiling Cognition’s Generative Coding Assistant

Cognition AI has really made a splash lately, especially with their coding assistant, Devin. It’s not just another tool; it’s designed to handle complex software engineering tasks from start to finish. Think of it as an AI that can actually plan, execute, and review code, which is a pretty big deal in the development world. This kind of capability is what’s getting a lot of attention.

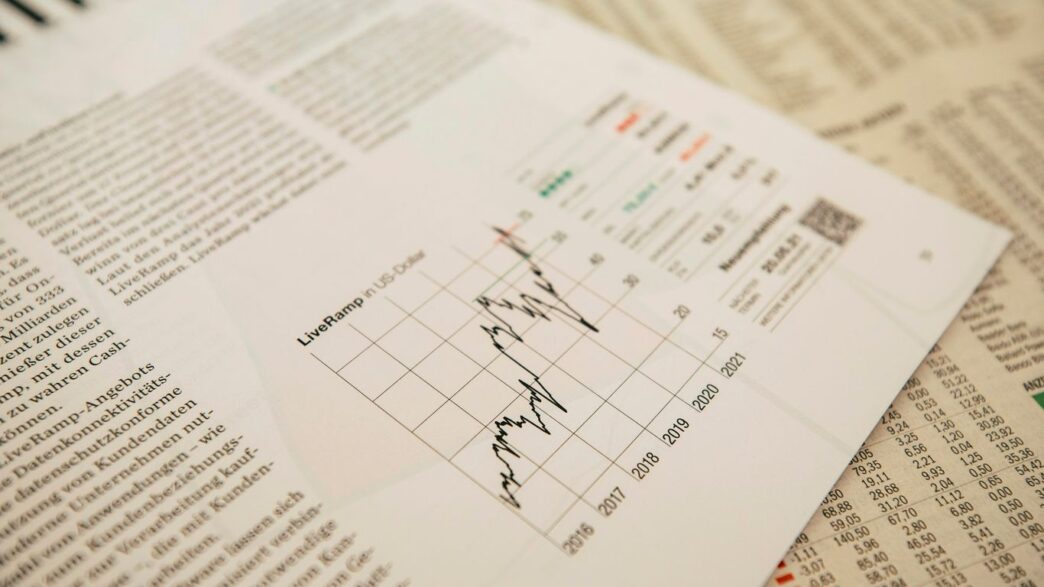

Significant Funding Rounds Fueling Expansion

This rapid growth hasn’t happened by accident. Cognition AI has been busy securing some serious investment. They recently closed a massive funding round, reportedly raising over $300 million. This puts their valuation at a staggering $10 billion. The backing from major players like Founders Fund and Khosla Ventures shows a lot of confidence in their vision. This influx of cash is clearly meant to speed up their development and expand their reach.

Achieving Substantial Revenue Growth

While specific revenue figures for Cognition AI aren’t always public, the buzz around their funding and product suggests strong market traction. Companies like this are often seeing their revenue climb quickly as businesses look for ways to automate and improve their software development processes. The demand for AI tools that can genuinely assist developers is high, and Cognition AI seems to be hitting that mark. It’s a sign that the market is ready for advanced AI solutions in coding.

Strategic Funding Rounds Powering AI Innovation

It’s pretty wild how much money is flowing into AI companies these days. Cognition, the folks behind that coding assistant Devin, just pulled in a massive amount of cash – over $300 million. And get this, they’re looking at a $10 billion valuation. That’s a huge number, showing just how much investors believe in what they’re building.

This kind of funding isn’t happening in a vacuum. Big names like Founders Fund and Khosla Ventures are putting their money down, which usually means they see something really special. It’s not just Cognition, either. We’re seeing other AI companies snagging big investments, too. Take Hadrian, for instance, a defense manufacturing startup using AI and robots; they raised $260 million. Then there’s Ambience Healthcare, which uses AI for medical documentation and coding, bringing in $243 million. It seems like investors are really keen on AI applications that can solve big problems or make existing processes way more efficient.

Here’s a look at some of the recent big funding rounds:

- Hadrian: $260M Series C (Founders Fund, Lux Capital)

- Ambience Healthcare: $243M Series C (Oak HC/FT, Andreessen Horowitz)

- Lovable: $200M Series A ($1.8B valuation)

- Perplexity: Significant round at $18B valuation (Nvidia, SoftBank, NEA)

- Reka: $110M round (Nvidia, Snowflake)

This influx of capital is what allows these companies to really push the boundaries. They can hire more people, build out their technology, and scale up their operations much faster than they could otherwise. It’s a competitive landscape, and having strong financial backing is definitely a major advantage.

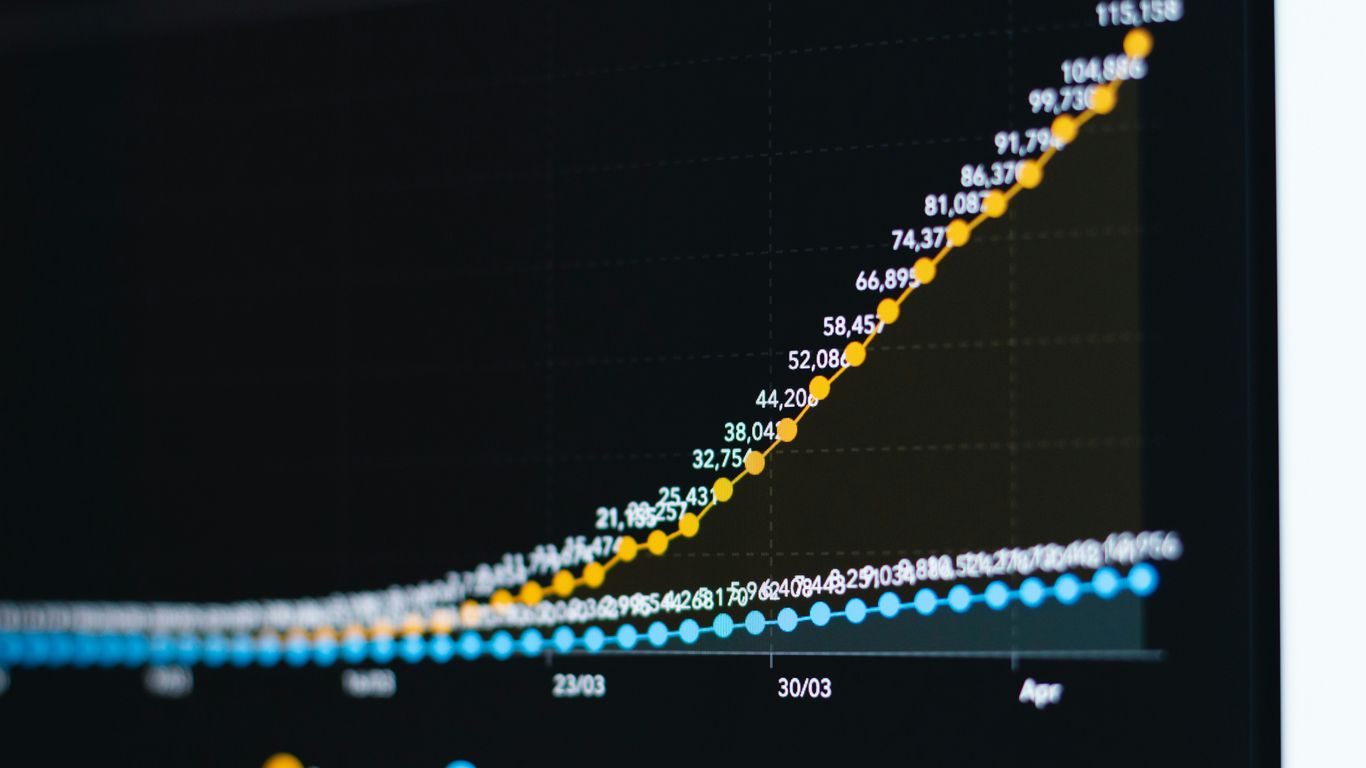

The Evolving Landscape of AI Revenue Streams

It’s pretty wild how fast AI is becoming a money-making machine. Companies that were just ideas a few years ago are now pulling in serious cash. We’re seeing a big shift from just research and development to actual commercial products that businesses are willing to pay for.

OpenAI and Anthropic’s Impressive Revenue Trajectories

OpenAI, the folks behind ChatGPT, are reportedly hitting an $12 billion annual revenue run rate. That’s a massive number, and it shows how much people and companies are using their tools. They’re also planning to spend a ton on training and running their AI models over the next few years, which means they’re betting big on continued growth. Anthropic, another major player, is apparently close to a $5 billion run rate. Their AI, Claude, is apparently doing really well in areas like law and finance. It seems like businesses are finding real uses for these advanced AI assistants.

Enterprise Adoption Driving Commercial Success

What’s really pushing these revenue numbers up is businesses actually using AI. It’s not just a novelty anymore. Companies are moving past the trial phases and fully integrating AI into their operations. This means AI is becoming a core part of how businesses work, whether it’s for customer service, data analysis, or creating content. The demand from enterprises is what’s really fueling the commercial success we’re seeing across the board.

Microsoft’s Internal Savings with Copilot Deployment

It’s not just about selling AI services to others; some companies are seeing benefits internally too. Microsoft, for example, reported saving over $500 million by using their own AI tool, Copilot, across their employees and products. This shows that AI can also lead to cost reductions and efficiency gains within a company, which is another way AI is proving its worth. It’s a double win: they sell AI and also save money using it themselves.

Infrastructure Demands and GPU Market Dynamics

Building and running advanced AI models isn’t cheap, and it’s putting a huge strain on computing power, especially graphics processing units (GPUs). Think of it like needing a massive amount of electricity to power a whole city – AI needs a similar kind of energy, but in the form of processing power. Companies are scrambling to get their hands on as many high-end GPUs as possible.

Massive GPU Deployments for AI Training

AI companies are talking about needing hundreds of thousands, even millions, of GPUs. OpenAI, for instance, plans to have over a million GPUs running by the end of the year. They’re building out huge data centers, some in partnership with companies like Oracle, to handle this. It’s not just about having the hardware; it’s about having the infrastructure to connect and manage it all efficiently. This involves specialized data center designs, advanced cooling systems, and high-speed networking.

CoreWeave’s Power Expansion to Meet Demand

Companies that provide this computing power are seeing a big boom. CoreWeave, a cloud provider focused on AI and graphics, is significantly increasing its power usage in places like Texas. This is a direct response to the overwhelming demand from AI developers who need more processing capacity. The electricity grid is feeling the pressure too, with increased demand leading to higher prices in some areas.

Meta’s Strategic Data Center Investments

Tech giants are also making big moves. Meta is investing billions in building out its own data center capabilities. They’re not just sticking to traditional builds; they’re experimenting with temporary structures to get capacity online faster while their permanent, massive facilities are under construction. These new data centers are designed from the ground up for AI, with features like liquid cooling and super-fast internal connections. It’s a race to secure the necessary hardware and the space to house it.

Key Players in the AI Unicorn Ecosystem

Prominent AI Companies Achieving Unicorn Status

The world of artificial intelligence is seeing a huge surge in companies hitting the "unicorn" status, meaning they’re valued at over a billion dollars. It’s pretty wild how fast some of these companies are growing. We’re talking about businesses that are building everything from advanced coding assistants to AI that can help with scientific research. It feels like every week there’s a new AI company popping up and getting serious funding.

Some of the big names you’ll see in this space include OpenAI, which has been in the news a lot lately. Then there’s Anthropic, another major player in AI research and development. We’re also seeing companies like xAI, founded by Elon Musk, making big moves. These companies aren’t just theoretical; they’re developing real products and services that are starting to change how we work and live.

It’s not just the super-famous ones, though. There are tons of other AI startups that have quietly reached that billion-dollar valuation. Think about companies working on specialized AI for things like drug discovery, or those creating better ways for computers to understand and generate human language. The list keeps growing, and it shows just how much investment and belief is going into AI right now.

Investment Trends in Artificial Intelligence Startups

When you look at where the money is going, it’s clear that investors are really excited about AI. We’re seeing massive funding rounds happening all the time. Venture capital firms are pouring billions into these startups, hoping to get in on the ground floor of the next big thing. It’s a bit of a gold rush, honestly.

One trend is the sheer size of the funding rounds. Companies aren’t just raising a few million anymore; we’re talking hundreds of millions, sometimes even billions, in a single round. This allows these startups to scale up incredibly fast, hire top talent, and build out their infrastructure, like massive GPU clusters. This level of investment is what’s really fueling the rapid advancements we’re seeing in AI.

Another thing is the focus on specific AI applications. While general AI research is still important, a lot of the investment is going into companies that have a clear product or service. This could be AI for healthcare, AI for finance, or AI for creative tools. Investors want to see a path to making money, and these specialized applications seem to be a good bet.

Here’s a quick look at some recent funding activity:

- Anaconda: Raised over $150 million in Series C funding.

- Harmonic: Secured $100 million in Series B funding, valuing the company at $875 million.

- Mariana Minerals: Brought in $85 million in Series A funding.

- Nudge: Completed a $100 million Series A round.

The Role of Venture Capital in AI Growth

Venture capital firms are basically the engine behind a lot of this AI growth. They provide the money that allows these startups to take big risks and develop groundbreaking technology. Without VC funding, many of these companies wouldn’t be able to get off the ground or scale to the point where they can make a real impact.

It’s not just about the cash, though. Many VCs also bring valuable connections and expertise. They can help startups find customers, recruit employees, and navigate the tricky business side of things. Some firms even have their own AI researchers and engineers who can offer technical advice. It’s a partnership, really.

This has led to a situation where AI companies are getting funded at an unprecedented rate. The competition among VCs to invest in promising AI startups is fierce. This is great for the startups, as they can often get better terms and more support. But it also means that only the most innovative and well-positioned companies are likely to get the biggest checks. It’s a dynamic ecosystem, for sure.

The Strategic Importance of AI Compute Resources

It’s becoming really clear that having access to powerful computing hardware, especially GPUs, is a huge deal for AI development. Think of it like this: you can have the best recipe in the world, but without a good oven, you’re not baking anything. The same goes for AI. Companies and even countries are realizing that compute power isn’t just a nice-to-have; it’s a core part of their strategy.

Government Initiatives for Sovereign Compute

Governments are getting involved because they see AI compute as a national asset. The US, for example, has an AI Action Plan. It’s all about making sure the country can build and use advanced AI without relying too much on others. This includes things like setting up national AI research resources, which gives researchers access to shared computing power and data. They’re also pushing for more semiconductor manufacturing within the US and offering incentives for energy-efficient data centers. It’s a big push to re-industrialize the economy around AI.

Global Competition in AI Development

This isn’t just a US thing, though. China has its own plans, focusing on international AI governance and building its own influence. They’re pushing open-source models and getting government support for compute subsidies. It’s a race to see who can develop and control the most advanced AI. We’re seeing major players like OpenAI and xAI planning for massive GPU deployments, with OpenAI aiming for over a million GPUs and xAI building out its own substantial fleet. This competition is driving a lot of investment and innovation, but also raising questions about who gets to set the rules for AI.

The Rise of GPU Empires

Because of all this, companies that can provide or control large amounts of GPU power are becoming incredibly important. We’re talking about companies like CoreWeave, which is expanding its operations significantly to meet the demand. Even tech giants like Meta are investing billions in building out their own massive data centers, some using temporary structures to scale up quickly while permanent ones are built. It’s like a new kind of empire is being built, not on land or traditional resources, but on processing power. This has real-world effects, too, like driving up electricity prices in some areas due to the sheer amount of power needed.

Looking Ahead

So, Cognition AI’s big revenue number shows they’re really onto something. It’s clear that companies are spending serious money on AI tools that actually help get work done, like their coding assistant. With all this investment and the general buzz around AI, it feels like we’re just at the start of what’s possible. It’ll be interesting to see how Cognition and others keep growing and what new AI tools pop up next.