Understanding the Quantum Computing ETF List Landscape

Quantum computing ETFs are starting to show up on a lot of investors’ radars in 2025. The industry itself is racing forward, and funds focusing on quantum tech are a way for regular folks to get exposure without having to pick just one winner. Let’s break down why these ETFs are catching interest, what could make them stand out, and what investors should keep in mind.

What Makes Quantum Computing ETFs Unique?

Quantum computing ETFs don’t just track your standard tech sector—they target an area that’s still in its early days, making them different from regular tech-focused funds.

Here’s what typically sets these ETFs apart:

- They mix big names (like IBM or Google) with quantum startups and chipmakers.

- The tech inside is cutting-edge, changing quickly, and the path to profits can be unpredictable.

- They’re one of the few ETF types that include direct quantum hardware developers, not just companies using quantum for other business areas.

This means most quantum ETFs give investors positions in companies trying things that could be massive one day, but aren’t mainstream yet.

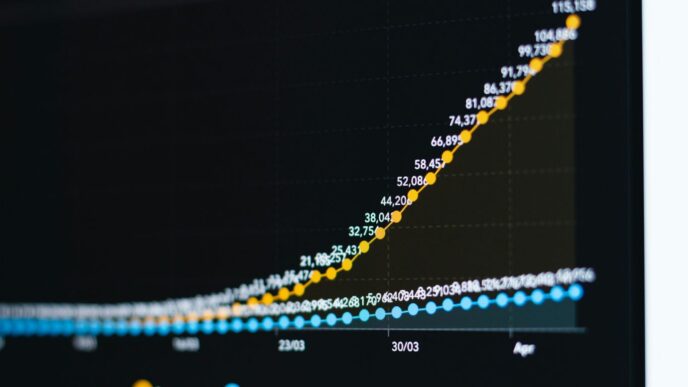

Industry Growth and Market Projections

There’s been a lot of talk about where quantum could go, and some recent forecasts are eye-catching. McKinsey says the revenue from quantum computing could jump from $4 billion in 2024 to as much as $72 billion by 2035. That’s nearly a 20x jump in just over a decade.

Here’s a quick snapshot of those projections:

| Year | Estimated Quantum Revenue (USD) |

|---|---|

| 2024 | $4 billion |

| 2030 | $28 billion (projected) |

| 2035 | $72 billion (projected) |

Those numbers show why so many investors and fund managers talk about quantum as a "next big thing." Of course, there’s no guarantee those projections will hold up—the tech still faces plenty of roadblocks, and profits for most companies are years away. But the upside is clearly on people’s minds.

Diversification Benefits for Investors

Buying shares in just one quantum tech company is risky—it’s like putting all your chips on one square at the roulette table. Quantum ETFs help spread out that risk.

Key diversification perks include:

- Exposure to a range of companies: Some are pure quantum plays, while others are huge tech firms exploring quantum as just one part of their business.

- Protection if a single company flops: If one of the smaller quantum startups stumbles or even goes bust, the ETF’s other holdings might offset those losses.

- Easier access: You don’t have to vet every quantum company yourself.

Investors interested in quantum tech but worried about betting on the wrong horse often see ETFs as the safer way in.

In short, the landscape for quantum computing ETFs is pretty new but already crowded with different strategies. Some are broad, some are very niche, and the industry’s long-term upside and risk are both huge. Anyone interested should keep an eye on how the sector grows, how different funds approach it, and always remember that "cutting edge" also means unpredictable.

Top Quantum Computing ETFs to Watch in 2025

Keeping up with the changing quantum sector isn’t easy, especially when it feels like new funds show up every quarter. If you want broad exposure but don’t want to gamble on a single stock, these ETFs are the most talked about for 2025. Each fund has a slightly different approach, fee structure, and level of focus on quantum technology, so let’s break down what makes each one stand out.

Defiance Quantum ETF (QTUM): Global Breadth and Low Fees

QTUM is one of the best-known funds for pure quantum computing exposure. It takes a global approach with around 78 holdings, including both established giants and newer quantum startups. At 0.40%, it also stands out as one of the lowest-cost quantum ETFs out there.

Key features:

- Tracks companies that benefit from quantum computing, machine learning, and AI advances

- Holds stocks like Alphabet, IBM, and lesser-known pure quantum companies

- Wide sector exposure: finance, logistics, cybersecurity

- Includes D-Wave, one of the few quantum computing-focused firms

| Ticker | Number of Holdings | Expense Ratio | Notable Holdings |

|---|---|---|---|

| QTUM | 78 | 0.40% | D-Wave, IBM, Alphabet |

Invesco Dorsey Wright Technology Momentum ETF (PTF): Momentum Strategy

PTF’s angle is different—it uses a momentum-based strategy that selects tech stocks with strong recent performance. It has about 40 holdings, but as of late 2025, it hadn’t picked up pure-play quantum names like D-Wave (QBTS), mostly because many are volatile and lack steady momentum. Instead, its portfolio is heavy on larger tech firms that are dipping their toes into quantum tech.

Quick facts:

- Focuses on companies outperforming their sector peers

- Doesn’t chase every small quantum stock—stability matters

- Expense ratio is a bit higher than QTUM: 0.60%

Recent performance:

- 4% year-to-date return (YTD)

- 25% return over the last 12 months

| Ticker | Number of Holdings | Expense Ratio | YTD Return | 12M Return |

|---|---|---|---|---|

| PTF | 40 | 0.60% | 4% | 25% |

Spear Alpha ETF (SPRX): Active Management and Quantum Exposure

SPRX is a different beast—it’s actively managed, so the manager picks stocks instead of following an index. The portfolio is tight (less than 25 names) and leans hard into companies developing advanced tech, including quantum computing, AI, and digital transformation.

Highlights:

- Heavier concentration equals higher risk and reward

- Includes quantum contenders like IonQ and Rigetti, but not D-Wave

- Slightly higher fees: 0.75% expense ratio

Performance this year has been impressive:

- Over 45% YTD return

- Around 82% in the past 12 months

| Ticker | Number of Holdings | Expense Ratio | YTD Return | 12M Return | Pure Quantum Stocks |

|---|---|---|---|---|---|

| SPRX | <25 | 0.75% | 45%+ | 82% | IonQ, Rigetti Computing |

Main Points to Consider When Picking a Quantum Computing ETF:

- Check if it holds pure-play quantum stocks or just tech giants

- Compare expense ratios, since fees can eat into returns

- Look at recent performance for signs of volatility

- Review the fund’s sector breakdown and country exposure

Picking the right ETF comes down to your risk comfort, time horizon, and how hands-on you want to be. Some investors want the relative safety of wide exposure (like QTUM), while others want the potential upside of smaller, actively managed portfolios (like SPRX).

Evaluating the Holdings in Quantum Computing ETF Lists

When checking out quantum computing ETFs, what’s inside matters just as much as which fund you pick. These holdings are what truly link your investment to the quantum tech boom. Let’s go a bit deeper by breaking down the kinds of stocks you’ll find, how big tech stacks up against scrappy startups, and how ETFs even decide what companies to add (or leave out).

Major Players Featured in Quantum ETFs

Most quantum computing ETFs cast a wide net, scooping up big names alongside focused up-and-comers:

- Large-cap tech companies (like IBM, Microsoft, and Google-parent Alphabet) often dominate the top spots by weight.

- Mid-sized firms specializing in quantum hardware or algorithms, such as IonQ and Rigetti Computing, might also make the list.

- ETFs sometimes include broader companies linked to quantum research, even if quantum isn’t their main business.

Here’s a quick look at typical top holdings:

| ETF | Top Holdings | Focus |

|---|---|---|

| QTUM | IBM, Alphabet, Microsoft | Broad quantum/AI |

| PTF | Nvidia, Broadcom, Apple | Tech momentum |

| SPRX | IonQ, Rigetti, Palantir | Quantum + AI/Tech |

Role of Tech Giants and Startups

ETFs tend to balance between household names and more specialized companies. There are a few reasons for this:

- Tech giants have resources and established products. Their quantum programs are often large and well funded.

- Startups focus only on quantum, so they’re closer to cutting-edge innovations, even if they’re more volatile.

- Some funds skip certain quantum specialists due to low liquidity, short operating history, or recent poor performance.

So, when you’re investing in a quantum ETF, you’re not just betting on one breakthrough. You’re spreading your money across both the steady players and the riskier, faster-moving startups.

Criteria for ETF Inclusion and Exclusion

Each fund uses its own playbook, but the most common reasons companies are added or left out include:

- Index membership: Some ETFs just copy from published indexes that set rules for what qualifies as a quantum computing stock.

- Financial health: Lack of profits, cash flow, or steady share price can keep companies—especially newer ones—off the list.

- Liquidity: Funds want plenty of shares trading so they can buy and sell easily without moving the price too much.

- Geographic or sector focus: Some ETFs avoid foreign stocks, or limit exposure to just tech or add related fields like AI.

It’s not always about who’s building the best quantum computer—sometimes, it’s just about meeting the checklist! Keep in mind, an ETF’s strategy and its inclusion rules can change over time.

Key Performance Metrics for Quantum Computing ETFs

When you’re looking at Quantum Computing ETFs, it’s not just about picking the fund with the flashiest name. The numbers behind each fund tell the real story. Pay close attention to metrics like returns, fees, and risk to figure out if a fund lines up with your goals. Let’s break down the most important areas to investigate.

Year-to-Date and Long-Term Returns

Returns show you what kind of growth (or loss) a fund has delivered so far. For Quantum Computing ETFs—which are usually newer and super volatile—looking at just one year won’t cut it. Compare year-to-date (YTD) performance versus longer windows, like 3- or 5-year averages, if available. Here’s a quick snapshot (hypothetical example for structure):

| ETF Name | YTD Return | 1-Year Return | 3-Year Return (Annualized) |

|---|---|---|---|

| QTUM | 8.5% | 17.2% | 11.4% |

| PTF | 4.0% | 25.0% | 15.8% |

| SPRX | 45.2% | 82.0% | — |

- Be wary if a fund’s big gains are mostly from a single year, as this could signal boom-and-bust behavior.

- If possible, compare Quantum ETF results with broader tech indexes to see if they’re worth the extra risk.

Expense Ratios and Fee Structures

ETF costs might look small, but over years they really affect your returns. Quantum ETFs can be pricier than most vanilla index funds.

- Check each ETF’s expense ratio. For instance, QTUM sits at 0.40%, while SPRX charges 0.75%.

- Funds that are actively managed (with managers picking and choosing stocks) tend to charge higher fees than those tracking indexes.

- Watch out for trading costs—if you’re buying and selling often, these can add up as well.

| ETF Name | Expense Ratio |

|---|---|

| QTUM | 0.40% |

| PTF | 0.60% |

| SPRX | 0.75% |

Risk Factors Unique to Quantum ETFs

This sector isn’t a safe harbor. Quantum Computing ETFs have their own set of challenges, and it’s different from even regular tech ETFs. Here are a few things that make them tricky:

- Early-Stage Tech: Many companies in quantum are young, with unproven business models and no profits yet. Sudden gains (or losses) can hit hard.

- Lack of Diversification: Some ETFs have only 20-40 holdings. If one stock tanks, you feel it more.

- Volatility: Returns can flip around unpredictably. Funds may shoot up 40% one year, then sink the next.

- Concentration Risks: The success of the fund might hinge on a few small, niche companies that are hard to research.

- Market Timing: Getting in or out at the wrong time can make a big difference given these swings.

Bottom line? Even if the numbers look shiny right now, make sure you’re comfortable with the ride. Quantum Computing ETFs can be super exciting, but they’re a bumpy road for most investors.

Potential Risks and Rewards in the Quantum Computing ETF List

Quantum computing ETFs have become a hot topic among folks looking for future-facing investments. But if you’re eyeing this category, you’ll notice it’s a mixed bag of both potential and pitfalls—especially as the tech is still being worked out in labs and boardrooms. Here’s what you’ll want to seriously consider before putting your money to work.

Early-Stage Technology Considerations

Most companies in these ETFs are working on technology that hasn’t hit mainstream use yet. The promise of quantum computing sounds enormous, but it’s still early days. Here are some things worth knowing:

- The timeline for practical, widespread quantum use could stretch out for the next 5–10 years.

- Products may never make it past pilot solutions or prototypes.

- Quantum computing tech may shift gears a few times before it really sticks.

- Early winners might get leapfrogged if new breakthroughs come up unexpectedly.

Market Volatility and Timing

There isn’t any way around it: quantum ETFs can swing wildly. These funds are full of firms—some tiny, some big tech—that are either unproven or are making big, risky bets. Stuff like sudden regulatory news, funding blowups, or a big announcement from one of the major tech disruptors can send prices zooming in either direction.

| ETF Ticker | 2025 YTD Return | 12-Month Return | Expense Ratio |

|---|---|---|---|

| QTUM | +9% | +33% | 0.40% |

| PTF | +4% | +25% | 0.60% |

| SPRX | +45% | +82% | 0.75% |

- Some ETFs like SPRX are more concentrated, so if one holding takes a dive, it can hit the whole fund hard.

- Even established stocks in these ETFs are not immune to rapid downturns.

Balancing Speculative and Long-Term Growth

If you’re trying to figure out how much to put in quantum, think about this:

- Use quantum ETFs as a tiny, speculative slice of your wider investment plan.

- Don’t count on near-term profits; this is about waiting for those tech breakthroughs.

- Diversify. Even inside a quantum ETF, spreading across different sectors and stocks helps offset blowups from any single bet.

Bottom line: quantum computing ETFs could pay off in a big way, but there’s a major chance things stay bumpy for a while—so patience and low expectations in the short term can be your best friends.

How Quantum Computing ETF Lists Fit into a Portfolio

Asset Allocation Strategies

Figuring out where quantum computing ETFs slot into your mix isn’t always straightforward. They don’t fit neatly into the traditional buckets like broader tech or industrials. Most investors using these ETFs see them as part of the “thematic” or “innovation” slice of a portfolio. For many, that means:

- Limiting exposure to 2%-5% of total portfolio value to manage risk.

- Pairing them with both conventional sectors (like consumer staples) to smooth out ups and downs.

- Regularly rebalancing since performance can be volatile, especially over short periods.

The key thing is not to overweight quantum ETFs just because they sound futuristic—their promise also comes with unpredictability.

Mixing Quantum ETFs with Broader Tech Index Funds

If you’re already holding traditional tech funds—like the S&P 500 Technology Select ETF or NASDAQ-100 trackers—adding quantum ETFs can fill gaps those funds miss. Quantum ETFs often:

- Include early-stage startups alongside big tech (and sometimes non-tech firms dabbling in quantum research).

- Have little overlap with blue-chip ETFs, offering fresh diversification.

- React differently to tech sector swings due to niche focus and less mature companies in their baskets.

Here’s a quick table to show what holding both might look like:

| Portfolio Component | Example ETF/Ticker | Focus |

|---|---|---|

| Core Tech | XLK, QQQ | Broad US tech, big names |

| Quantum/Niche Innovation | QTUM, SPRX, PTF | Quantum, AI, digitalization |

| Defensive/Stable | VIG, SCHD | Dividends, established firms |

This mix spreads out your bets—not all eggs in a single tech basket.

Long-Term Perspectives for Investors

Quantum computing is unlikely to move the needle overnight; think marathon, not sprint. Investors who have done well with this niche are usually the ones who:

- Plan to hold for at least 5–10 years, seeing quantum as a slow-building trend.

- Accept wild price swings along the way.

- Size positions so they can ride out early-stage hype cycles without stress.

If you’re looking for certainty or short-term gains, these ETFs might be frustrating at times. But if you want a shot at what could become a defining tech wave down the line—and you’re patient—these funds could fit right into your long-range plans.

Conclusion

Quantum computing ETFs give investors a way to get in on a fast-changing tech sector without having to pick individual winners. The industry is still young, and there’s a lot of uncertainty about which companies will come out on top. Some funds focus on momentum, others on active management, and a few try to cover the whole field. Each approach has its own risks and rewards. If you’re thinking about adding quantum ETFs to your portfolio, it’s smart to do your homework and keep your expectations realistic. This space could see big growth, but it’s also likely to be bumpy along the way. As always, only invest what you’re comfortable with, and remember that diversification is your friend—especially in a field as unpredictable as quantum tech.