If you frequent most DEXs (Decentralized Exchanges) throughout the DeFi landscape, it will only be a matter of time before your fear of rug pulls catches on given the many tales of how DEXs have become prime targets for scammers who often leave investors rekt.

If you are not familiar with the concept, a rug pull is when a project creator decides to exit abruptly, taking all the funds raised with them. This can happen for a variety of reasons, but most often it is due to fraud or malfeasance. They also happen because the project wasn’t as successful as the creators hoped, or because they simply got tired of working on it. Whatever the reason, rug pulls are a major risk to the growth of DeFi (Decentralized Finance) as it paints a picture of an ecosystem rife with scams and bad actors.

Apart from scams and bad actors, another main point of concern about DeFi is the lack of capital efficiency which is common among most DEXs. Capital efficient DEXs are those that allow users to trade with the least amount of slippage, which is the difference between the price you expect to pay for an asset and the actual price you pay. Slippage often occurs because there is not enough liquidity in the market, meaning there are not enough buyers and sellers to match all the trades being made. Consequently, when you want to buy or sell an asset, you often have to pay a higher price than you would if there was sufficient liquidity. This eats into your profits and can even lead to losses.

To onlookers, most of DeFi is full of platforms and projects that mostly neglect the needs of users in favor of high returns to miners, developers, and project creators.

Then comes Mangata Finance with a DEX built on a custom chain and a design set to take on a user-centric approach to solving the problems of slippage, high gas fees, lack of liquidity, and scams that continue to plague the DeFi space.

Mangata’s User-Centric Playbook

Mangata is a custom blockchain built from the ground up to secure the decentralized exchange of digital assets on the Polkadot network and bridged to Ethereum’s network. At its core, Mangata plays by a set of different rules that aims for capital efficiency as a way to establish fairness and trust in a decentralized economy.

With user-centricity as a core tenet, Mangata’s blockchain is built with no gas fee requirements meaning you don’t have to pay anything to transact on Mangata’s network. Mangata calls their gasless swaps a “No-Gas Economy”.

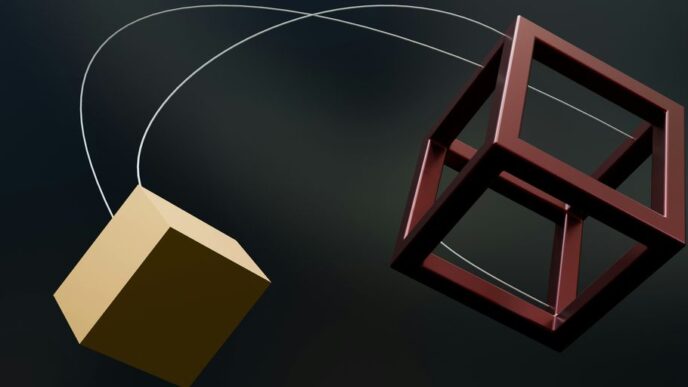

Furthermore, Mangata’s revolutionary Proof of Liquidity mechanisms allows users to stake once and earn twice as their stake is not only used to validate the chain but also to provide liquidity on Mangata’s DEX. This creates deeper liquidity pools throughout Mangata’s ecosystem and ends up increasing capital efficiency while rewarding stakers twice.

Protecting Users With Themis Protocol

While DEXs built on blockchain networks such as Ethereum are rife with front-running and arbitrageur bots that make it difficult for regular users to trade digital assets, Mangata’s DEX is built on the Themis Protocol to protect users from front-running and MEV among other threats. Themis Protocol splits the block production into a two-step process that involves two miners. One miner is tasked with block building and the other is tasked with block execution. A private key is used between the two miners and remains unknown to the block builder and cant be manipulated by the block executor. This two-step process makes it impossible for front running and MEV to happen on Mangata’s DEX.

Mangata also protects users by building its DEX the cutting-edge Substrate tech stack which allows for flexibility in terms of changing the rules of the system to optimize for dynamic user demands. A customizable Substrate chain is built for user protection and it’s a DAO straight out of the box.

Adding to this is tokenomics designed for the long-term growth of the DEX with 50% of the tokens set to be in the hands of the community within 2.5years. By this design, Mangata’s token network acts as a medium to reward users whose behavior supports the ecosystem in the long run.

Already, Mangata’s team has found a way to ensure that the token price is not too negatively affected by early sellers taking profits. Mangata does this by capping supply while still offering infinite rewards through the implementation of an algorithmic buy and burn process.

Conclusion: Building Bridges to a User-Centric DeFi Future

The Mangata team is on a mission to build bridges between different blockchains while still providing all the advantages that come with a user-centric blockchain network. This will eventually lead to a more user-centric form of DeFi where platforms put the needs of users first and foremost.

By incentivizing good behavior, capping supply, and ensuring infinite rewards, Mangata is well on its way to becoming a force for good in the DeFi space. With a user-centric approach that puts users first, Mangata could be DeFi’s saving grace.