Understanding Boston Dynamics’ Current Ownership and Trajectory

So, Boston Dynamics. It’s a name that really gets people talking when you mention robots, right? For a long time, it felt like they were doing their own thing, pushing the boundaries of what robots could do, especially with those famous videos of their robots dancing or doing parkour. But things have shifted.

Hyundai’s Acquisition and its Implications

Back in 2020, a big change happened: Hyundai Motor Group bought a majority stake in Boston Dynamics. This wasn’t just a small investment; it was a major move that put Boston Dynamics under the umbrella of a huge automotive and industrial giant. What does this mean? Well, for starters, it means access to a lot more resources. Hyundai has deep pockets and a lot of manufacturing know-how. This could really help Boston Dynamics move from making impressive prototypes to actually producing robots at scale, which has always been a bit of a hurdle for them. Think about it: building a few amazing robots is one thing, but churning out thousands for widespread use is a whole different ballgame. Hyundai’s manufacturing experience could be the key to making that happen.

The Role of Government Funding in Robotics Development

It’s also worth remembering where Boston Dynamics got its start. A good chunk of their early development, especially for those agile quadrupedal and bipedal robots, was funded by grants from the U.S. military. Government funding has historically played a big role in pushing the envelope in robotics. It allows companies to take on high-risk, high-reward research that might not have immediate commercial payoff. This kind of support is what helps create the foundational technologies that later get commercialized. Without that initial backing, we might not even be talking about Boston Dynamics today.

Navigating the Competitive Global Robotics Landscape

And let’s be real, the robotics world is getting crowded. Companies like Unitree Robotics are popping up, offering robots that look a lot like Boston Dynamics’ creations, but at a fraction of the price. Unitree’s Go2 robot dog, for example, is available for around $1,600, while Boston Dynamics’ Spot can cost upwards of $74,500. That’s a massive difference. Then you have tech giants like NVIDIA getting heavily involved, providing the ‘brains’ – the AI platforms and computing power – for many of these robots. NVIDIA’s Project GROOT, a foundation model for humanoid robots, shows they’re serious about being central to the future of robotics. This competitive pressure means Boston Dynamics, even with Hyundai’s backing, has to keep innovating and find ways to make their advanced technology more accessible if they want to truly dominate the market.

The Push for a National Robotics Strategy

It’s becoming pretty clear that the United States needs a game plan for robotics. A bunch of big names in the robotics world, like Tesla and Boston Dynamics, have been talking to lawmakers. They’re saying we need a national strategy, and honestly, it makes sense. China is really going all-in on robotics and AI, pouring a ton of money into it. They see it as a way to keep their economy humming, especially with their changing population. We used to be the leaders in industrial automation, but other countries have since taken the lead. Now, with AI powering the next wave of robots, it feels like a real race is on.

US Companies Urge Government Action

Several leading U.S. robotics companies recently met with Congress to push for a national robotics strategy. They’re worried that without government support, the U.S. could fall behind. Think about it: building a cool robot prototype is one thing, but actually making millions of them? That’s a whole different ballgame. Companies need help scaling up their manufacturing. It’s not just about innovation; it’s about production capacity. They’re asking for policies that help with research, development, and getting these robots out into the world. It’s about making sure American companies can compete globally.

Addressing China’s Rapid Advancements in Robotics

China is investing heavily in robotics and AI, viewing them as key to their future. They’ve got a massive market for industrial robots and are backing new ventures with billions. This coordinated effort means they’re not just developing technology; they’re planning to deploy it on a huge scale. If the U.S. doesn’t have a similar focused approach, we risk losing our edge. It’s not just about having smart robots; it’s about having the infrastructure and the manufacturing might to back them up. We need to keep pace with their speed and investment.

The Importance of Scaling Manufacturing Capabilities

One of the biggest hurdles for robotics companies, even ones as advanced as Boston Dynamics, is moving from a working prototype to mass production. It’s one thing to build a few advanced robots for military grants or specialized clients, but it’s another to produce them in the quantities needed for widespread adoption. This is where government support could really make a difference. Think about the future of transportation; by 2030, we might see millions of people sharing robotic cars, which requires massive manufacturing. Without the ability to scale production efficiently, the U.S. risks being outmaneuvered by countries that are heavily investing in both the technology and the factories to build it. It’s a challenge that requires a national commitment to manufacturing innovation and capacity building.

Key Technologies Driving Robotic Innovation

It’s pretty wild how fast robots are getting smarter and more capable, right? A lot of this progress isn’t just about making robots look cooler, but about the tech packed inside them. Think about it, the robots we see today are way beyond the clunky industrial arms of the past.

The Impact of AI on Robot Capabilities

Artificial intelligence is a huge part of this. AI helps robots understand their surroundings, make decisions, and even learn from their mistakes. This means robots can do more complex tasks, like navigating tricky environments or handling delicate objects. The better the AI, the more a robot can do. For example, AI-powered vision systems let robots ‘see’ and interpret what’s happening around them, which is a big deal for tasks like quality control or helping out in warehouses.

Advancements in Collaborative Robots (Cobots)

Remember those big, caged robots that could only do one thing? Well, cobots are changing that. These are robots designed to work safely alongside humans. They use advanced sensors and AI to avoid collisions and adjust their movements. This has opened up a whole new world for manufacturing and other industries where human-robot teamwork is possible. The cobot market is growing fast, and it’s easy to see why – they’re more flexible and can be used in a wider range of applications than traditional robots.

The Role of Simulation and Digital Twins

Before a robot even gets built, engineers often use simulations and something called ‘digital twins’. A digital twin is basically a virtual copy of the robot and its environment. This lets developers test out different scenarios, train the AI, and find potential problems without risking damage to a real robot or causing disruptions. It’s like practicing a complex surgery on a simulator before the actual operation. This speeds up development and makes sure the robots are reliable when they’re finally deployed.

Exploring Boston Dynamics Stock Potential

So, when do we get to buy a piece of Boston Dynamics? It’s the question on a lot of people’s minds, especially with how much buzz their robots like Spot and Atlas generate. Right now, Hyundai owns the company, having bought a majority stake back in 2020. This means you can’t directly buy Boston Dynamics stock on any exchange. But that doesn’t mean the idea of it going public is off the table.

Analyzing the Boston Dynamics Stock Market

It’s tough to put a direct price tag on Boston Dynamics without it being a public company. We can look at similar companies, though. Think about the big players in industrial automation like ABB or FANUC. They’ve been around for ages and have pretty stable valuations. Then you have newer companies focusing on specific areas, like collaborative robots, or cobots. These can sometimes see wilder swings in their market value depending on innovation and adoption rates. NVIDIA, for instance, is making big moves in robotics by providing the ‘brains’ for many of these machines, even launching platforms like Project GROOT for humanoid robots. Their influence is huge, and it shows how interconnected the tech world is. The robotics market is growing, but it’s also complex, with different segments performing differently.

When Will Boston Dynamics Go Public?

Honestly, nobody knows for sure. Companies usually go public when they feel they’re ready for the financial and public scrutiny that comes with it, and when the market conditions are right. Hyundai’s ownership adds another layer; they’d likely be the ones to decide if and when an IPO happens. It’s possible they might spin off a portion of the company or sell it to another entity that then takes it public. We’ve seen companies like Amazon acquire smaller robotics firms, like Kiva Systems, and integrate them. It’s a common path in this industry.

Factors Influencing a Boston Dynamics IPO

Several things would need to line up for Boston Dynamics to hit the stock market. First, they need to show a clear path to profitability. While their robots are amazing, turning those prototypes into mass-market, profitable products is the big challenge. Scaling manufacturing is key here; just building a robot is one thing, but making millions of them affordably is another. Think about the push from U.S. companies for a national robotics strategy – that kind of government support and clear market direction can really help companies grow and prepare for public offerings. Also, the competitive landscape matters. With countries like China investing heavily in robotics and AI, the U.S. is feeling pressure to keep pace. A strong showing from Boston Dynamics could be seen as a win for American innovation. Plus, the business models are changing. Things like Robotics as a Service (RaaS) are becoming more popular, offering a different way for companies to access and use robots without a massive upfront cost. If Boston Dynamics can nail down a successful RaaS model or another scalable business approach, that would definitely make an IPO more attractive. We’re seeing new tech like edge computing payloads, such as the Spot CORE I/O, which uses NVIDIA hardware, allowing robots to process data right in the field. This kind of advancement makes the robots more useful and potentially more profitable, which is exactly what investors look for. You can keep up with general tech news and trends on sites like tech news.

The Evolving Business Models in Robotics

So, how are companies actually making money with all these fancy robots? It’s not just about selling a big, expensive machine anymore. The way businesses approach robotics is changing, and it’s pretty interesting to watch.

Robotics as a Service (RaaS) Explained

Think about software – you probably pay a monthly fee instead of buying a whole program outright, right? Robotics as a Service, or RaaS, is kind of like that for robots. Instead of a company shelling out a massive amount of cash upfront to buy a robot, they can lease it. This makes advanced robotics accessible to more businesses, especially smaller ones that might not have huge capital budgets. It’s a way to get the benefits of automation without the big initial investment. This model is really starting to take off, and it’s a big reason why more factories and warehouses are bringing robots into their operations.

Usage-Based Fee Models in Robotics

Another approach gaining traction is paying based on how much you actually use the robot. It’s like paying for electricity by the kilowatt-hour. Some companies are experimenting with charging customers only for the tasks the robot performs or the hours it’s actively working. This is a bit newer, and people are still figuring out if it can really become a widespread thing, especially for everyday consumers. But for specific industrial uses, it makes a lot of sense. It aligns the cost directly with the value received, which is a smart way to do business.

The Future of Robotics Business Strategies

What’s next? We’re seeing companies that want to offer a complete package – they’ll have their own robots, manage them, and provide the whole service. This means they’re not just selling hardware; they’re selling a solution. It’s a more integrated approach. We might even see companies merging because of these new business models, creating bigger players with a full suite of robotic services. It’s all about making robots easier to adopt and more profitable for everyone involved. The goal is to make robots a standard part of how businesses operate, not just a niche technology. This shift is really important for the future of automation and could lead to a lot of new innovations in how we use robots in our daily lives and workplaces.

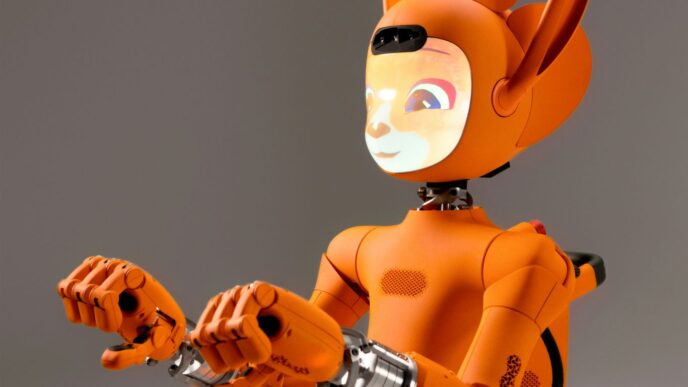

Competitive Analysis: Boston Dynamics vs. Rivals

It’s easy to get caught up in the sheer coolness of Boston Dynamics’ robots, like the famous Spot dog or the Atlas humanoid. They really set a high bar for what we thought robots could do. But the robotics world isn’t just Boston Dynamics anymore; it’s getting crowded, and some new players are making serious waves, often with a different approach to getting their tech out there.

Comparing Boston Dynamics to Chinese Competitors

When you look at the global robotics scene, China is a major force. They’re not just making a lot of robots; their government is putting serious money and strategy behind it. We’re talking about massive state-backed funds aimed at boosting robotics and AI. This kind of coordinated effort is something American companies have been talking about needing for a while. While Boston Dynamics, now under Hyundai, has its own path, the sheer scale of investment and national focus in China means they’re pushing hard to lead in this tech. It’s a different game when the government is a primary driver, and it’s something to watch as these companies scale up.

The Rise of Companies like Unitree Robotics

Then you have companies like Unitree Robotics. They’ve really caught people’s attention, especially with their Go2 robot dog, which looks a lot like Boston Dynamics’ Spot. But here’s the kicker: Unitree’s version is available at a fraction of the price. We’re talking thousands of dollars versus tens of thousands. They’re also making their humanoid robot, the G1, available for mass production at a much lower cost than what you might expect from a cutting-edge humanoid. Unitree is even sharing open-source data, like dance movements, which is a bit of a nod to those viral Boston Dynamics videos. This approach makes advanced robotics much more accessible, and it’s a strategy that could really shake things up.

NVIDIA’s Growing Influence in the Robotics Sector

It’s also impossible to talk about modern robotics without mentioning NVIDIA. They’re not building the robots themselves in the same way Boston Dynamics does, but they’re building the brains. NVIDIA is heavily invested in providing the AI platforms and processing power that make these robots smart and capable. Think of their Project GROOT, a foundation model for humanoid robots. They want to be the go-to for the AI that powers robots in factories, fields, and even hospitals. This makes them a behind-the-scenes giant. If Boston Dynamics is the body, NVIDIA is increasingly becoming the central nervous system for a lot of the robotics industry, and that gives them a huge amount of influence over where the technology goes next.

The Road Ahead for Boston Dynamics

So, what does all this mean for Boston Dynamics and its potential stock market debut? It’s clear the robotics field is booming, with countries like China investing heavily and companies like Tesla pushing the boundaries. Boston Dynamics, with its iconic robots like Spot and Atlas, is right in the middle of this exciting, fast-moving industry. While they’re currently owned by Hyundai, the pressure is on for the U.S. to keep pace, and that might mean more opportunities for companies like Boston Dynamics to go public. It’s not a simple question of ‘if,’ but ‘when’ and ‘how’ this robotics giant will join the stock market. Keep an eye on policy changes, further technological leaps, and how Boston Dynamics continues to evolve its business models, perhaps through robotics-as-a-service, to really scale up. The future is definitely robotic, and Boston Dynamics is poised to play a big part in it.