So, the crypto market is taking a hit again. It feels like just when things start looking up, the rug gets pulled out. This article is about digging into why crypto is going down right now, in 2026. We’ll look at what’s causing the big drops, what the charts are saying, and what the smart money thinks. It’s not always easy to figure out what’s going on with digital money, but we’ll try to break it down simply.

Key Takeaways

- The crypto market is seeing a big drop, with Bitcoin and Ethereum losing significant value, and most other coins following suit. This is happening because investors are getting nervous and there’s a lot of uncertainty about the US economy.

- Big economic news, especially from the Federal Reserve, is really affecting crypto. When the Fed hints at higher interest rates or economic slowdown, people tend to pull money out of riskier assets like crypto.

- Technical charts show Bitcoin and Ethereum are in tough spots, with key support levels being tested. High use of borrowed money in trading is making things worse, leading to big losses for traders.

- Even with the market down, big institutions are still showing interest through ETFs, which is a positive sign for the long run. New ETFs for altcoins are also appearing, showing broader acceptance.

- Experts like John Glover and Dom Harz suggest that while there will be more ups and downs, innovation and regulatory progress are still happening. They emphasize that focusing on development and education is key to overcoming these tough times.

Understanding The Current Crypto Downturn

Market Carnage: A Widespread Decline

So, what’s going on with crypto prices right now? It’s not pretty. We’re seeing a pretty big drop across the board. Bitcoin, the big dog of the crypto world, has taken a hit, falling quite a bit from its recent highs. And Ethereum? It’s down too. It feels like almost every coin you look at is in the red. The total value of all cryptocurrencies has shrunk significantly in just a short period. It’s the kind of market movement that makes even seasoned investors a bit nervous.

Key Triggers: Investor Jitters and Economic Signals

Why is this happening? Well, it’s a mix of things. A lot of investors seem to be getting spooked. There’s a lot of uncertainty about where the US economy is headed, and that makes people hesitant to put their money into riskier assets like crypto. When the economic news isn’t clear, people tend to pull back. It’s a bit of a bummer because crypto was supposed to be this independent thing, but it still gets tossed around by what happens in traditional finance and with big economic decisions.

Historical Context: Is This Downturn Unprecedented?

Now, if you’ve been around crypto for a while, you know it’s always been a wild ride. We’ve seen big drops before, like back in 2018 or after certain major project collapses. This current dip, while painful, isn’t necessarily the worst we’ve ever experienced in terms of percentage drop from the peak. Sometimes, these corrections are just part of the cycle. After big run-ups, markets often need to cool off. However, the economic backdrop this time around feels a bit different, which might mean this period of lower prices could stick around longer than some past downturns. It’s a good reminder that while crypto has its own rhythm, it’s not entirely immune to what’s happening in the wider world.

Macroeconomic Headwinds Fueling The Slump

The Fed’s Influence on Risk Assets

It’s tough to ignore how much the Federal Reserve’s actions still sway the crypto market. Even though crypto is supposed to be this decentralized thing, it often acts a lot like other risky investments when the Fed makes big moves. When the Fed signals it might raise interest rates or tighten up its policies, investors tend to get nervous. They often pull their money out of things they see as more speculative, and crypto usually gets hit hard. It’s a bit of a bummer, honestly, because the whole point was to get away from this kind of central control, but here we are.

Uncertainty in US Economic Direction

Right now, there’s just a lot of head-scratching about where the US economy is headed. We’re seeing mixed signals, and nobody seems to have a clear picture. This kind of uncertainty makes people hesitant to put money into anything that feels a bit risky. When the economic outlook is foggy, investors tend to play it safe, and that means less money flowing into assets like Bitcoin and Ethereum. It’s like trying to drive in a thick fog – you slow down and wait for things to clear up.

Tethering Crypto to Traditional Finance

This whole situation really highlights how much crypto is still tied to the old financial system, or TradFi as people call it. We’ve seen big drops in crypto prices happening right after traditional markets react to economic news or Fed announcements. It’s a stark reminder that despite all the innovation, crypto hasn’t completely broken free from the influence of traditional finance. This connection means that when traditional markets get shaky, crypto often follows suit. It makes you wonder how long it will take for crypto to truly stand on its own two feet, independent of these external pressures. It’s a complex dance between the new and the old, and right now, the old is leading the steps.

Technical Analysis and Key Price Levels

Alright, let’s talk charts. When things get rough in crypto, looking at the numbers can give us some clues, even if they’re not always pretty. It’s like checking the weather before a big trip – you want to know what you might be up against.

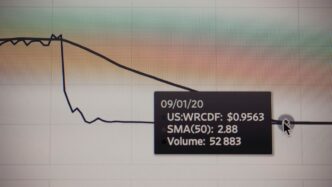

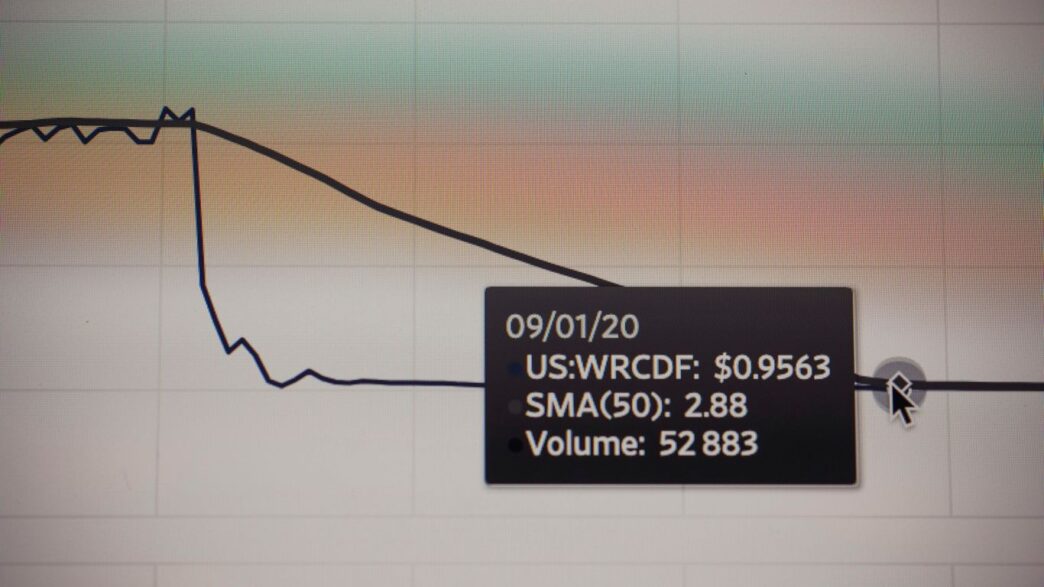

Bitcoin’s Support and Resistance

Bitcoin has been taking a beating, down quite a bit from its recent highs. Right now, the big question is where it might find a floor. We’re watching the $81,030 mark pretty closely. Think of that as a potential safety net. If Bitcoin dips below that, the next big psychological hurdle is the $80,000 level, and nobody wants to see that tested too hard. On the flip side, for any kind of real recovery to start, Bitcoin needs to push past the $98,279 level. That’s a significant climb from where we are now, and it’s going to take some serious buying pressure to get there.

Ethereum’s Vulnerable Position

Ethereum isn’t looking much better, frankly. It’s seen a pretty steep drop from its August peak. The key support level for ETH is currently sitting around $2,632. If that breaks, things could get even more dicey. The resistance level, the price point it needs to overcome to show some strength, is at $3,108. It feels like a long way off right now, given the general market mood. Some analysts are pointing to low stablecoin yields as a sign that the market isn’t completely overhyped, which could be a small glimmer of hope for ETH if sentiment shifts, but that’s a big ‘if’.

The Impact of Leveraged Trading

One of the nastier side effects of these big price drops is what happens to traders using leverage. Basically, they’re borrowing money to make bigger bets. When the market moves against them, even a little, their positions can get automatically closed by the exchange to cover the debt. This is called liquidation. We’ve seen hundreds of millions of dollars worth of these leveraged positions get wiped out recently, especially for Bitcoin and Ethereum. A huge chunk of that was from people betting on prices going up (long positions). This kind of forced selling can really accelerate a downturn, making the drops feel even more dramatic than they might otherwise be. It’s a stark reminder of the risks involved when you’re trading with borrowed funds in such a volatile market.

Institutional Interest Amidst Volatility

Even with all the red across the charts, it’s not like everyone’s packing up and leaving the crypto party. We’ve actually seen some pretty big players, the institutional types, putting their money in. Think about the spot ETFs for Bitcoin and Ethereum that launched recently. Despite the market taking a nosedive, these funds saw decent inflows. For example, on November 28th, Bitcoin ETFs brought in over $71 million, and Ethereum ETFs weren’t far behind, pulling in about $76 million. This tells us that even when retail investors get spooked, the big money managers and hedge funds still see something valuable here for the long haul. It’s like they’re saying, ‘Yeah, it’s down now, but we’re in this for the marathon, not the sprint.’

It’s not just Bitcoin and Ethereum, either. There are whispers about a spot Chainlink ETF potentially coming soon. Chainlink is a pretty important piece of the puzzle for connecting blockchains to real-world information, so an ETF for it would be a big deal. It shows that the interest is spreading beyond the top two coins, which could bring more money into the whole crypto space. It’s a sign that the market is maturing, even if it feels messy right now.

Here’s a quick look at some of the recent ETF activity:

- Bitcoin ETFs: Saw significant inflows, indicating continued institutional belief.

- Ethereum ETFs: Also attracted substantial investment, mirroring BTC’s trend.

- Altcoin ETFs (e.g., Chainlink): Emerging interest suggests a broadening institutional appetite beyond major cryptocurrencies.

This institutional backing is a pretty strong signal. It suggests that despite the current price drops and the general market jitters, these large investors are looking past the short-term noise. They’re betting on the underlying technology and the future potential of these digital assets. It’s a sign that crypto is slowly but surely becoming a more accepted part of the broader financial landscape, even during tough times.

Navigating The Downturn: Expert Perspectives

So, the crypto market’s taken a bit of a beating, huh? It’s easy to get caught up in the panic when prices are dropping, but it’s worth hearing what some of the folks who’ve been around this block a while have to say. They’re not just looking at the day-to-day price swings; they’re thinking about the bigger picture.

Glover’s Volatility Forecast

John Glover, who heads up investments at Ledn, thinks we’re in for more choppy waters for a bit. He’s predicting a lot of "directionless volatility" over the next few months. According to his read on the market, the lowest point might land somewhere between $71,000 and $80,000 for Bitcoin. Once that bottom is firmly in place, he expects a rally to kick off, potentially pushing prices towards $145,000 to $160,000 by late 2026 or early 2027. Of course, this depends on where exactly that bottom forms, but it’s a hopeful outlook for those holding on.

Harz on Regulatory and Technological Progress

Dom Harz, one of the minds behind the BOB blockchain project, wants us to look beyond just the price tags. He reckons that 2025 won’t be remembered for wild price swings, but more for the steady progress in a few key areas:

- Regulatory Clarity: Governments are starting to figure out how to deal with crypto, which can actually be a good thing for long-term stability.

- Institutional Involvement: Big money players are still finding ways to get involved, showing they see lasting value.

- Tech Advancements: The underlying technology keeps getting better, making the whole system more robust and useful.

Harz points out that past downturns, like the one in 2018, weren’t just about falling prices. They were also periods where a lot of important innovations happened in decentralized finance (DeFi) and other areas. These developments paved the way for the next upswing. So, even when prices are down, the builders are still building.

The Importance of Resilience and Education

When markets get rough, it’s easy to get scared or fall for quick-fix promises from people who just want your money. The experts stress that staying calm and informed is key. This means:

- Doing Your Own Research: Don’t just listen to hype on social media. Dig into projects you’re interested in.

- Understanding the Risks: Crypto is volatile. Know how much you can afford to lose and avoid using borrowed money to invest.

- Focusing on the Long Game: Downturns are tough, but they can also be opportunities to learn and strengthen your conviction in the technology’s potential.

Ultimately, the advice boils down to being smart, staying educated, and remembering why you got into crypto in the first place. It’s not just about making a quick buck; it’s about being part of a shift in how we think about finance and technology.

Why Crypto Is Going Down: A Multifaceted Analysis

So, why is the crypto market looking so rough right now, in early 2026? It’s not just one thing, really. It feels more like a perfect storm, with a bunch of different factors all hitting at once. We’ve seen Bitcoin drop significantly from its highs, and Ethereum isn’t doing much better. It’s a bit of a mess, honestly.

The Perfect Storm of Factors

What’s causing this big dip? Well, a lot of it comes down to investor nerves and just general uncertainty about where the US economy is headed. When things feel shaky, people tend to pull their money out of riskier investments, and crypto definitely falls into that category. It’s kind of ironic, isn’t it? We’re building this technology meant to be independent, but it still gets tossed around by decisions from places like the Federal Reserve. Thin trading volumes, especially after holidays, don’t help either – they just make the market more jumpy.

- Investor Jitters: Fear is a powerful force in markets. When people get scared, they sell, and that pushes prices down. The Crypto Fear and Greed Index is showing deep fear right now, which often means people are panicking.

- Economic Signals: Mixed signals from the US economy make investors hesitant. They’re waiting for clear direction, and until they get it, they’re likely to stay on the sidelines.

- Macroeconomic Influence: Decisions about interest rates and inflation from central banks have a big impact. If they signal tighter money, investors often move away from speculative assets like crypto.

Beyond Price: Innovation and Development

Even though the prices are down, it’s important to remember that a lot of work is still happening behind the scenes. The tech itself is still evolving. Think about things like upgrades to Ethereum or new developments in decentralized applications. These things don’t always show up in the price charts immediately, but they’re building the foundation for whatever comes next. It’s easy to get caught up in the day-to-day price swings, but the long-term potential is still there if you look past the current slump.

The Path to True Decentralization

This downturn really highlights how far we still have to go to achieve true financial independence through crypto. We’re still too connected to traditional finance systems and the decisions made by central banks. The goal of decentralization is still a work in progress. It means building systems that can operate without relying on these old structures. This period of volatility, while painful, might actually be a necessary step in shaking out weaker projects and forcing the space to mature. It’s a tough lesson, but maybe one that’s needed for the long haul.

So, What’s the Takeaway?

Look, crypto markets are always going to be a bit wild. We’ve seen big drops before, and history suggests these slumps can sometimes set the stage for future growth. While it stings to see prices fall, especially with all the noise from people promising quick fixes, it’s important to remember the bigger picture. Innovations are still happening, and institutions are still showing interest through things like ETFs. The connection to traditional finance is still a weak spot, no doubt, but the core ideas behind crypto – like financial freedom – haven’t gone anywhere. For now, it seems like patience and a clear head are the best tools we’ve got. Keep learning, stay safe, and don’t let the short-term drama distract you from the long game.

Frequently Asked Questions

Why is the crypto market going down right now?

The crypto market is experiencing a downturn due to a mix of factors. Things like investor worries and unclear signs about the U.S. economy are making people nervous. Also, when big banks like the Federal Reserve make changes, it can affect risky investments like crypto. Sometimes, when trading is slow, like around holidays, prices can drop more easily.

Is this crypto crash worse than previous ones?

While it feels bad, crypto has seen bigger drops before. For example, back in 2018, Bitcoin lost a huge chunk of its value. These ups and downs, or volatility, are pretty normal for crypto. Sometimes, after big events like the Bitcoin ‘halving,’ the market takes a break before going up again.

How do big companies and institutions affect crypto prices?

Even though crypto is supposed to be independent, it’s still linked to the regular financial world. When big banks hint at changing interest rates, it can make investors pull money out of crypto. Also, the launch of new investment products like Bitcoin ETFs shows that big companies are still interested, which can be a good sign for the future, even during a slump.

What are the important price points for Bitcoin and Ethereum?

For Bitcoin, a key support level is around $81,000, meaning if it drops below that, more selling might happen. The resistance level, which is a price it needs to overcome to go up, is around $98,000. Ethereum has support near $2,600 and resistance around $3,100. Watching these levels helps understand if the market might recover or keep falling.

Are there any positive signs for crypto despite the current drop?

Yes, there are some hopeful signs. Even with the market drop, some investment funds (ETFs) that track Bitcoin and Ethereum saw money coming in, showing that big investors still believe in crypto. Also, new types of crypto ETFs are being planned, which could bring more attention and money into the market.

What do experts think will happen to crypto prices next?

Some experts believe the market will continue to be up and down for a while, with prices possibly hitting lower lows before recovering. However, they also predict that in the next year or two, prices could go much higher, potentially reaching new all-time highs for Bitcoin. They stress that innovation and development in crypto technology continue, even when prices are down.