Trying to get funding for your startup can feel like a total maze. There are so many venture capital firms, and they all seem to have their own secret sauce for what they’re looking for. You’ve probably heard the name tcv velocity fund tossed around, especially if you’re in the tech world. If you’re running an early-stage company, you might be scratching your head, wondering what they’re really about and if your startup is what they want. This article is meant to clear things up. We’ll look at what the tcv velocity fund is focused on, so you can get a better idea of whether they’re the right partner for you.

Key Takeaways

- The tcv velocity fund mainly invests in early-stage technology companies that are already showing signs of rapid growth.

- Having your numbers in order is a big part of their process; they pay close attention to metrics like Total Contract Value (TCV) and your LTV to CAC ratio.

- They look for more than just a good idea—they want to see a strong founding team and real evidence that you have achieved some product-market fit.

- Your pitch needs to tell a clear story about how your company can grow big and why your product is different from what’s already out there.

- Getting an investment isn’t just about the cash; partnering with them also means getting access to their network and operational support for your business.

Understanding The Core Thesis Of The TCV Velocity Fund

The Fund’s Focus On Early-Stage Technology Companies

TCV’s Velocity Fund zeroes in on early-stage tech companies. They’re not looking at just any startup; they want businesses that show real promise in using technology to disrupt existing markets or create entirely new ones. It’s about finding those companies that are on the cusp of something big, where a strategic investment can really boost growth. They are interested in companies that have a clear vision and a plan to execute it.

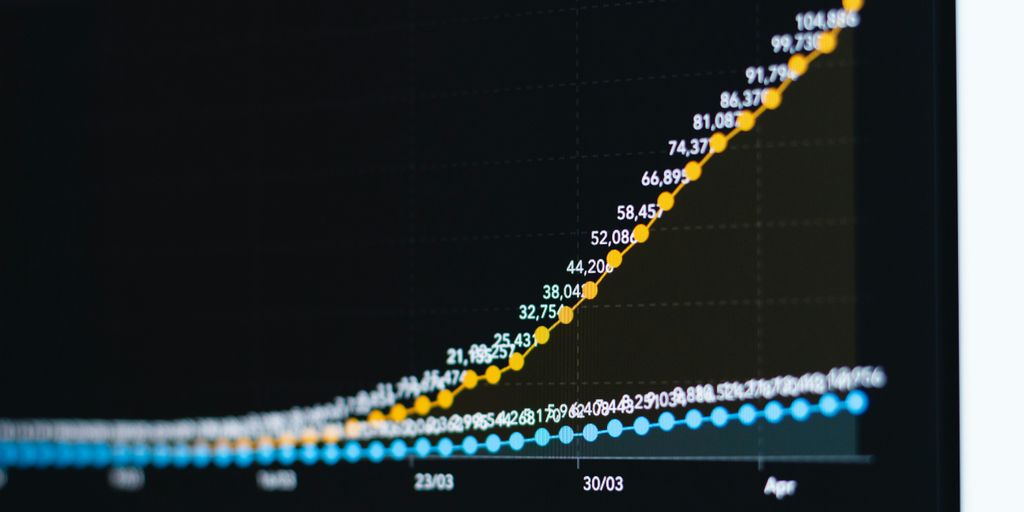

What ‘Velocity’ Signifies In Their Investment Strategy

The name ‘Velocity’ isn’t just a cool branding choice. It reflects the fund’s core strategy: accelerating growth. They aim to inject capital and resources to help companies scale quickly and efficiently. This means they’re looking for startups that already have some momentum and are ready to ramp things up. It’s not just about providing money; it’s about providing the fuel to reach escape velocity. They want to see how quickly a company can grow its user base, revenue, and market share with the right support.

Key Industries And Markets On Their Radar

While TCV might not limit themselves to a hyper-specific niche, they do have areas of particular interest. These often include:

- SaaS (Software as a Service) platforms: Companies offering innovative solutions for businesses. They like recurring revenue models.

- Fintech: Startups revolutionizing financial services through technology.

- E-commerce: Businesses creating unique online shopping experiences or solving problems in the e-commerce space.

They also pay attention to emerging markets and technologies, always looking for the next big thing. They want to see companies that are not just following trends, but setting them. They are looking for companies that can demonstrate a clear understanding of their target market and a plan to capture it. They also consider the total contract value (TCV) of potential investments.

The Ideal Startup Profile For The TCV Velocity Fund

Defining The Early-Stage Sweet Spot For Investment

TCV Velocity Fund zeroes in on startups that are past the initial idea phase but haven’t yet reached the hyper-growth stage. Think of it as the ‘Series Seed’ or ‘Series A’ territory. They’re looking for companies that have a functional product, some early customer validation, and a clear vision for scaling. It’s not just about having a cool idea; it’s about showing that the idea can actually work in the real world. They want to see that you’ve already started building something real, not just a PowerPoint presentation. The Rule of 40 is a good indicator of a company’s potential.

Qualities They Seek In A Founding Team

It’s not just about the idea; it’s about the people behind it. TCV Velocity Fund wants to see a team that’s not only smart but also resilient, adaptable, and passionate. They look for founders who have a deep understanding of their market, a clear vision for the future, and the ability to attract and retain top talent. They also value teams that are coachable and open to feedback. A strong founding team is able to navigate the inevitable challenges of building a startup. Here’s what they look for:

- Domain Expertise: Do you really get the problem you’re solving?

- Execution Skills: Can you actually build the solution?

- Leadership: Can you inspire others to join your mission?

Demonstrating Product-Market Fit And Early Traction

Product-market fit is everything. It’s the point where your product solves a real problem for a specific group of customers, and they’re willing to pay for it. TCV Velocity Fund wants to see evidence that you’ve achieved this. This could be in the form of:

- Strong early adoption rates

- Positive customer feedback

- Growing revenue

Early traction is key. It shows that you’re not just building something that you think is cool, but something that people actually want and need. They want to see that you’re on the right track and that you have the potential to scale your business. Think about how venture investment trends are shaping the market and how your startup fits into that picture.

Mastering The Metrics That Matter To The TCV Velocity Fund

The Critical Role Of Total Contract Value (TCV)

TCV, or Total Contract Value, is a big deal. It’s not just about the immediate cash; it’s about the entire value a customer brings over the life of their contract. Think of it as the big picture. For example, if someone signs up for two years at $30,000 per year, the TCV definition is $60,000. TCV helps TCV Velocity Fund see the long-term potential of your customer relationships.

Proving A Scalable Business Model With LTV To CAC Ratios

LTV to CAC is where the rubber meets the road. It shows if your business model is actually sustainable. LTV is the Lifetime Value of a customer, and CAC is the Customer Acquisition Cost. You want your LTV to be significantly higher than your CAC. A good ratio signals that you’re not just acquiring customers, but you’re acquiring profitable customers. If it costs you $1,000 to get a customer who’s only worth $500, that’s a problem. A ratio of 3:1 or higher is often seen as a good sign.

Understanding The Nuances Of ACV And ARPA

ACV (Annual Contract Value) and ARPA (Average Revenue Per Account) are important pieces of the puzzle. ACV focuses on the value of a contract over a year, while ARPA looks at the average revenue generated by each account, usually on a monthly basis. These metrics help to understand the revenue streams. Here’s a quick breakdown:

- ACV: Useful for understanding yearly revenue commitments.

- ARPA: Gives insight into the average revenue generated per customer.

- Both: Help project future revenue and assess business health.

For example, a company with a $10,000 ACV and 100 customers has $1,000,000 in annual revenue. These metrics, when viewed alongside TCV and LTV/CAC, provide a complete picture of your company’s financial health and growth potential. Understanding ARPA nuances is key.

Navigating The TCV Velocity Fund’s Investment Process

From The Initial Pitch To The Term Sheet

So, you’ve got your pitch deck ready and you’re aiming for the TCV Velocity Fund. What’s next? First, getting your foot in the door usually starts with an introduction – ideally, a warm one from someone already in their network. Cold emails can work, but they need to be seriously compelling. Once you’ve made contact, expect an initial call to gauge basic fit. If that goes well, you’ll likely present your full pitch. If TCV sees potential, they’ll move towards a term sheet, which outlines the proposed investment terms. This isn’t the finish line, but it’s a big step.

What To Expect During The Due Diligence Phase

Due diligence is where TCV really digs in. They’ll want to validate everything you’ve presented. This means opening up your books, providing customer data, and answering a lot of questions. Be prepared for scrutiny of your financials, market analysis, and team. They’ll also likely speak with your customers and other investors. It can feel intense, but it’s a standard part of the process. Think of it as them confirming their initial excitement with hard data. They might look into venture investment trends to see how you stack up.

Typical Check Sizes And Equity Stakes

TCV Velocity Fund focuses on early-stage companies, so the check sizes usually reflect that. While specific numbers can vary based on the startup’s stage and valuation, expect investments typically in the seed to Series A range. This translates to equity stakes that can range quite a bit, depending on the pre-money valuation TCV assigns. It’s a negotiation, of course, but understanding typical ranges for private equity funding at your stage is key. Remember, it’s not just about the money; it’s about the partnership and what TCV brings to the table beyond capital. Understanding metrics like Total Contract Value (TCV) is important, so you can show them how you plan to grow. For example, a customer’s 24-month contract can show them your potential.

Crafting A Winning Pitch For The TCV Velocity Fund

How To Articulate Your Market Disruption Potential

Okay, so you’re trying to get the attention of the TCV Velocity Fund? You need to show them you’re not just another startup. You have to clearly explain how you’re shaking things up in your market. Don’t just say you’re innovative; prove it. What problem are you solving that no one else is? How is your approach different and better? Think about the future of travel venture capital and how your company fits into that picture.

Building A Compelling Narrative Around Your Growth Metrics

Numbers talk, but a story sells. You can’t just throw a bunch of stats at them. You need to weave those metrics into a narrative that shows your company’s journey and potential. For example, instead of just saying your customer acquisition cost (CAC) is low, explain how you achieved that, what it means for your scalability, and how it compares to industry benchmarks. Here’s a simple example:

| Metric | Value | Explanation |

|---|---|---|

| Customer Growth | 30% MoM | Demonstrates strong market demand and effective marketing strategies. |

| CAC | $50 | Shows efficient customer acquisition, indicating a scalable business model. |

Showcasing A Clear Path To Scalability

TCV Velocity Fund wants to see that you’re not just a flash in the pan. They want to know you can grow, and grow big. You need to show them a clear, realistic plan for scaling your business. This means:

- Demonstrating a scalable business model: Explain how your unit economics work and how they improve as you scale. Show that your total contract value is increasing.

- Having a solid go-to-market strategy: Outline your plans for expanding your customer base and entering new markets.

- Building a strong team: Highlight the expertise and experience of your team and how they can handle the challenges of rapid growth.

Beyond Capital: The Strategic Value Of A TCV Velocity Fund Partnership

It’s easy to only think about the money when you’re talking about venture capital, but that’s really just the beginning. A partnership with a fund like TCV Velocity can bring a whole lot more to the table than just a check. It’s about getting access to resources and knowledge that can seriously boost your startup’s growth.

Leveraging TCV’s Extensive Network And Resources

TCV isn’t just throwing money at companies; they’re actively connecting them. Their network is vast, spanning different industries and stages of growth. This means introductions to potential customers, partners, and even future investors. Think of it as an instant expansion of your reach, opening doors that might have taken years to find on your own. They can provide insights into travel venture capital trends, which can be useful even if you’re not in that specific sector.

Accessing Operational Expertise And Mentorship

Money is great, but knowing how to use it is even better. TCV brings a team of people who’ve seen it all before. They can help you with everything from refining your sales strategy to optimizing your marketing spend. It’s like having a team of experienced advisors in your corner, ready to offer guidance and support. This mentorship can be invaluable, especially when you’re facing tough decisions or navigating uncharted territory. They can help you understand metrics like Total Contract Value (TCV) and Customer Lifetime Value (LTV).

Building A Foundation For Future Funding Rounds

Getting that first round of funding is a huge win, but it’s rarely the end of the road. Partnering with TCV can set you up for success in future funding rounds. Their backing adds credibility to your company, signaling to other investors that you’re a serious player. Plus, they can help you prepare for the due diligence process and craft a compelling pitch that resonates with later-stage investors. Think of it as building a solid foundation that will support your company’s growth for years to come.

So, What’s the Takeaway?

Alright, so that’s the rundown on the TCV Velocity Fund. The main thing to remember is that they’re pretty specific about what they want. It’s not just about having a big idea; they really look at your business metrics. I mean, ‘TCV’ is in their name for a reason. Before you even think about sending an email, you should have a solid grip on your Total Contract Value, customer lifetime value, and all that stuff. It might feel like a lot of homework. But really, it just helps you figure out if you’re a good match for them. Finding the right investor is a two-way street, and knowing if you fit their model can save everyone a lot of time.

Frequently Asked Questions

What kind of companies does the TCV Velocity Fund look for?

The TCV Velocity Fund is looking for young technology companies that are starting to grow quickly. They focus on businesses that use tech to solve problems, especially in areas like software, internet services, and financial technology. They want to see a company that’s already moving fast and has the potential to become a major player in its market.

What does “Velocity” mean in the fund’s name?

“Velocity” is all about speed and fast growth. TCV isn’t just looking for a good idea; they want to see that a startup is already picking up speed, like a snowball rolling downhill. This means you’re getting new customers quickly and your sales are growing month after month. They invest in companies that are ready to use the new money to grow even faster.

How early is “early-stage”? Do I need to have everything figured out?

For the TCV Velocity Fund, “early-stage” usually means you’ve moved past just having an idea. You should have a real product that customers are already using and paying for. You don’t need to be a huge company, but you do need to show that people want what you’re selling. They want to see some proof, or “traction,” that your business is working and has a strong team to lead it.

What are the most important numbers I need to show them?

They really care about numbers that show your business is healthy and can grow. A key number is the Total Contract Value (TCV), which is the total amount of money a customer agrees to pay you over their entire contract. It’s also vital to show a good ratio between your Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC). This basically means you need to prove that you make much more money from a customer than it costs you to find them. A good rule of thumb is to make at least three times more than you spend.

How much money does the TCV Velocity Fund typically invest?

The amount of money they invest can change depending on the startup’s needs and how much it has already grown. While there’s no single fixed number, their investments are designed to give an early-stage company a significant boost. This money helps you hire more people, improve your product, and expand your marketing to reach more customers. The exact amount is figured out during their review process.

What do I get from TCV besides just the investment money?

Partnering with the TCV Velocity Fund is about more than just getting a check. They provide a lot of extra help to make sure your company succeeds. You get access to their huge network of contacts, which can help you find new customers or partners. They also have a team of experts who can give you advice on everything from selling your product to managing your finances. Think of them as experienced coaches who are there to help you build a strong foundation for the future.