Artificial intelligence (AI) is changing things fast, and it feels like it’s everywhere now. You see it in apps, in how businesses work, and even in things you might not expect. With all this buzz, a lot of people are wondering how to invest in AI. It’s a big area, and figuring out where to put your money can seem a bit much at first. This guide is here to break it down, explaining what AI really is, how companies are using it, and what your options are for getting involved.

Key Takeaways

- AI is a rapidly growing technology that’s changing many industries.

- You can invest in AI by buying ETFs that focus on AI, shares of companies building AI tech, or stocks of businesses that use AI.

- Investing in AI can lead to big rewards, but it also carries significant risks.

- New rules and ethical questions are still developing around AI, which can affect companies.

- Think about your own money goals and how much risk you’re okay with before investing in AI.

Understanding The AI Investment Landscape

What Artificial Intelligence Entails

Artificial intelligence, or AI, is basically about making computers smart enough to do things that usually require human thinking. Think problem-solving, learning from experience, and even understanding language. It’s not just one thing; it’s a whole bunch of technologies working together. We’re seeing AI pop up everywhere, from the apps on our phones to the complex systems running factories. It’s moving pretty fast, and honestly, it feels like we’re just scratching the surface of what it can do.

The Economic Impact of AI

The economic ripple effect of AI is expected to be huge. Some analysts are throwing around numbers like $19.9 trillion globally by 2030, which is a pretty big deal. This isn’t just about tech companies getting richer; AI is changing how almost every industry operates. It can speed up processes, find new solutions, and create efficiencies we haven’t seen before. This widespread adoption is happening faster than with previous big tech shifts, like the internet. It’s like a new kind of electricity, powering all sorts of innovations.

Key Takeaways for AI Investors

So, what does all this mean if you’re thinking about putting your money into AI? Here are a few things to keep in mind:

- AI is a rapidly growing and disruptive field. It’s changing how we live and work.

- There are multiple ways to invest. You can look at specific AI companies, funds that focus on AI, or even companies that are just really good at using AI in their business.

- High growth potential comes with high risk. It’s exciting, but it’s not a sure thing. You need to be aware of the potential downsides.

It’s a bit like the early days of the internet. Lots of hype, lots of companies, and not all of them made it. The ones that did usually had a solid plan, real customers, and a business that could actually grow. Finding those durable companies is probably the name of the game for AI investors too.

Navigating Investment Avenues For AI

So, you’re thinking about putting some money into the AI craze. That’s smart. But where do you actually put your cash? It’s not like you can just walk into a store and buy a piece of artificial intelligence. There are a few main ways people are doing this, and they all come with their own set of pros and cons. Let’s break them down.

Investing in AI Exchange-Traded Funds

Think of an ETF, or Exchange-Traded Fund, as a pre-packaged basket of stocks. Instead of picking individual companies, you buy a share of the ETF, and it holds a bunch of different AI-related businesses. This is a pretty straightforward way to get some exposure without having to do a ton of research on each company. It’s like buying a mixed bag of AI goodies.

- Diversification: You’re spreading your risk across many companies, so if one stumbles, others might pick up the slack.

- Simplicity: It’s generally easier to buy an ETF than to research and buy dozens of individual stocks.

- Accessibility: ETFs are traded on major stock exchanges, making them easy to buy and sell.

Direct Investment in AI Companies

This is where you get more hands-on. You’re picking specific companies that are either building AI technology from the ground up or are heavily involved in its development. This could mean investing in the big tech giants that are pouring billions into AI research, or it could mean looking at smaller, more specialized AI startups. This route often has the potential for bigger rewards, but also comes with higher risk.

- Venture Capital (VC): This is typically for very early-stage companies. It’s high-risk, high-reward, and usually requires a significant amount of capital and connections. Think of it as betting on the next big thing before anyone else knows about it.

- Private Equity (PE): This involves investing in more established private companies that are using AI to transform their business. These companies usually have revenue and customers already, making it a bit less of a gamble than VC.

- Public Stocks: Buying shares of publicly traded companies that are leaders in AI development or infrastructure. This is the most common way for individual investors to participate directly.

Exploring Companies Leveraging AI

This is a bit different from investing in the AI creators themselves. Here, you’re looking at companies in any industry that are using AI to get better at what they do. Think about a drug company using AI to find new medicines faster, or a farming company using AI to make crops grow better with less waste. These companies aren’t necessarily building AI, but they’re using it to gain an edge.

- Drug Discovery: Companies like Pfizer are using AI to speed up the long and expensive process of developing new medications.

- Agriculture: John Deere, for example, is employing AI to help farmers be more efficient, reducing the need for things like herbicides.

- Customer Service: Retailers and service providers are using AI to understand customers better, personalize experiences, and streamline operations. Nike uses it to improve how they interact with shoppers and manage their inventory.

Identifying Promising AI Opportunities

So, where are the real chances to make some money with AI? It’s not just about picking the flashiest tech company. We need to look at where AI is actually making a difference and creating value. Think about it like this: AI isn’t just one thing; it’s a whole system. There’s the hardware that powers it, the software that runs it, and all the applications that use it. Finding the sweet spot means understanding these different parts.

The real gold is often found where AI directly solves a problem or makes something significantly better.

Let’s break down a few areas that look particularly interesting:

AI’s Role in Drug Discovery and Development

This is a big one. Developing new medicines is incredibly slow and expensive. AI can speed this up dramatically. It can sift through massive amounts of data to find potential drug candidates, predict how they might work, and even help design clinical trials. This means getting life-saving treatments to people faster and potentially at a lower cost. Companies working on AI platforms for drug discovery or those using AI to accelerate their own research pipelines are worth a close look.

AI Applications in Agriculture and Transportation

Farming might not seem like the first place you’d think of for AI, but it’s a huge opportunity. AI can help farmers optimize crop yields, manage resources like water and fertilizer more efficiently, and even detect diseases early. In transportation, think self-driving vehicles, yes, but also smarter logistics, traffic management, and predictive maintenance for fleets. These aren’t just futuristic ideas; they’re becoming practical realities that can save money and improve safety.

Enhancing Customer Experience with AI

Every business wants happier customers, right? AI is a powerful tool for this. Chatbots that actually understand what you’re saying, personalized recommendations that hit the mark, and systems that can predict what a customer might need before they even ask – these are all AI-driven. Companies that are using AI to build better customer relationships and provide smoother service are likely to see strong results. It’s about making interactions easier and more relevant for everyone.

Assessing Risks and Rewards in AI

When we talk about investing in Artificial Intelligence, it’s easy to get caught up in the excitement of all the new possibilities. But like any investment, especially in a fast-moving tech area, there are definitely two sides to the coin: the potential for big wins and the possibility of significant setbacks.

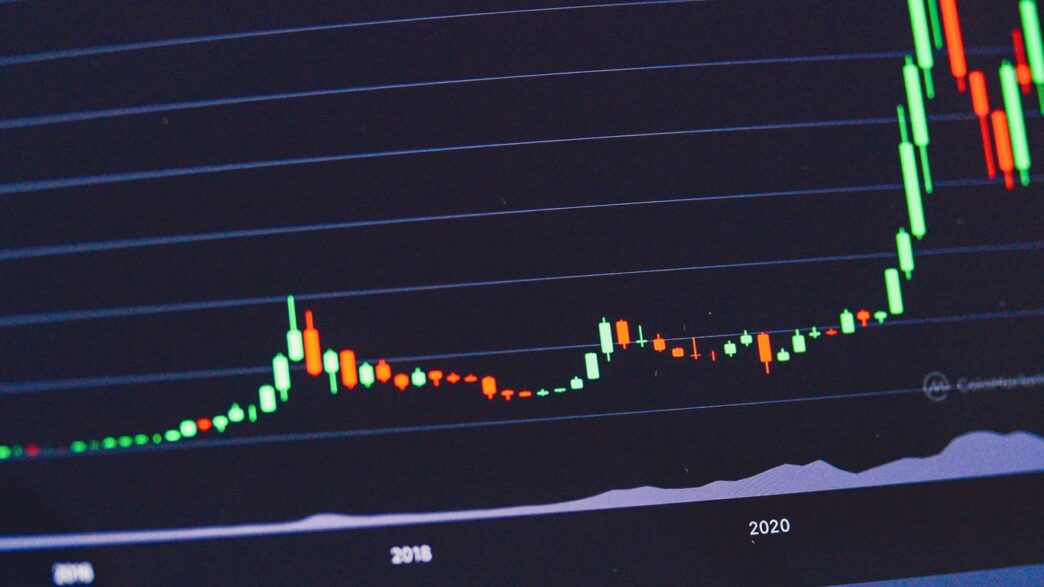

Potential for High Growth and Volatility

AI is a field that’s exploding right now. Companies making AI tech or using it in smart ways could see their value shoot up pretty quickly. Think about it – new breakthroughs happen all the time, and the demand for AI solutions across different industries is huge. This can lead to some really impressive stock price jumps. However, this rapid growth often comes with a good dose of volatility. Stock prices can swing wildly, sometimes in just a few days. What goes up fast can also come down fast. It’s a bit like riding a roller coaster; thrilling, but you need to be prepared for the drops.

Regulatory and Ethical Considerations

Beyond just market swings, there are other factors to keep an eye on. Governments around the world are still figuring out how to regulate AI. New rules could pop up that help certain companies or, conversely, put a damper on others. Imagine a company that’s doing great today because of how it uses data, but a new law comes out tomorrow that restricts that practice. That’s a real risk. Then there are the ethical questions. Things like how AI models are trained, data privacy, and potential job displacement are all being debated. These aren’t just academic discussions; they can lead to legal challenges and public backlash, which can impact a company’s reputation and its bottom line.

The Dot-Com Bubble Parallel

It’s worth remembering history. Back in the late 1990s, we saw a similar kind of frenzy with the dot-com boom. Lots of internet companies went public with sky-high valuations, fueled by hype. Many of them didn’t have solid business plans or real customer demand, and when the bubble burst, they disappeared. Some people worry that we might see something similar with AI today. There are companies out there that might be calling themselves AI innovators but are really just putting a thin layer on top of existing technology. It’s important to look past the buzzwords and see if there’s real substance – a strong business model, actual customers, and a clear path to making money. The companies that survived and thrived after the dot-com crash were those with strong fundamentals, not just a flashy idea.

Building Your AI Investment Strategy

So, you’ve looked at the AI landscape, checked out the different ways to put your money into it, and maybe even spotted a few companies that seem like winners. Now what? It’s time to get serious about how you actually build this into your investment plan. This isn’t just about picking a few hot stocks; it’s about making sure your AI investments fit with what you want to achieve overall.

Aligning AI Investments with Business Goals

Think of it like planning a trip. You wouldn’t just start driving without knowing where you’re going, right? Investing in AI is similar. You need to know what your financial destination is. Are you looking for steady, long-term growth, or are you willing to take on more risk for potentially bigger, faster returns? Your personal financial goals – like saving for retirement, buying a house, or just growing your wealth – should be the compass guiding your AI investment choices. If your main goal is stability, maybe you lean more towards established companies using AI, or ETFs that spread the risk. If you’re okay with more ups and downs for a shot at higher gains, you might consider newer AI companies.

Developing a Strategic AI Roadmap

Once your goals are clear, you need a plan, a roadmap. This isn’t a rigid set of rules, but more like a guide. It helps you figure out how much of your portfolio you’re comfortable putting into AI, and how you’ll adjust as the market changes. Here’s a simple way to think about it:

- Start Small and Learn: Don’t go all-in at once. Begin with a smaller portion of your investment funds. This lets you get a feel for the AI market without risking too much.

- Diversify Within AI: Just like you wouldn’t put all your money into one stock, don’t put it all into one type of AI investment. Mix it up – maybe some AI software companies, some hardware, and some ETFs.

- Regular Check-ins: The AI world moves fast. Schedule times, maybe quarterly, to review your AI investments. See how they’re doing, check if the companies are still on track, and decide if you need to make any changes.

- Stay Informed: Keep up with AI news and trends. Understanding what’s happening helps you make smarter decisions about your investments.

Understanding Market Landscape and Risks

It’s easy to get caught up in the excitement around AI, but it’s super important to keep your feet on the ground. Remember the dot-com bubble? Lots of companies seemed like sure bets, but many didn’t make it. AI is a rapidly changing field, and while the potential is huge, so are the risks. Regulations can change, new technologies can pop up and disrupt existing ones, and sometimes, companies might just not live up to the hype. It’s vital to do your homework on any company or fund before investing. Look beyond the buzzwords and understand the actual business, its competition, and its long-term prospects. Think about what could go wrong and how that might affect your investment. This realistic view helps you build a strategy that can handle the inevitable bumps in the road.

The Future of AI and Investment Value

AI’s Ecosystem: From Hardware to Applications

Thinking about where AI is headed and how that translates into investment opportunities is a bit like looking at a complex machine. It’s not just one part; it’s a whole system. You’ve got the foundational stuff – the chips, the processors, the specialized hardware that makes AI run. Companies building these components are essential, kind of like the engine of a car. Then there’s the software layer. This is where the magic happens, where algorithms are developed and refined. Think of it as the car’s operating system and navigation. Finally, you have the applications – the actual tools and services that use AI to do things, like helping doctors diagnose illnesses or making farming more efficient. The real long-term value often comes from how these layers connect and work together.

The Growing Importance of AI Software

While the hardware gets a lot of attention, the software side is where a lot of the ongoing innovation and value creation is happening. It’s the software that allows AI to learn, adapt, and perform increasingly complex tasks. We’re seeing a shift towards what’s called ‘agentic AI’ – software that can act with minimal human input. This kind of AI has the potential to generate significant economic gains. For investors, keeping an eye on software companies that control their data and have a deep understanding of specific industries is smart. These are the companies that can turn AI technology into real productivity gains for businesses.

Capturing Long-Term Value in the AI Economy

So, how do you actually make money from all this? It’s not as simple as just picking the company with the flashiest AI demo. Remember the dot-com bubble? Lots of hype, but many companies didn’t have solid business plans. The same caution applies to AI. We need to look for companies that are building durable businesses, not just riding a trend. This means looking at:

- Real Customer Demand: Are businesses actually using and paying for these AI solutions?

- Scalable Business Models: Can the company grow its operations without costs spiraling out of control?

- Data Control and Defensibility: Companies that manage their own data and have unique AI models are often in a stronger position.

The companies that combine technological smarts with practical business sense are the ones most likely to succeed over the long haul. It’s about finding those that can translate AI’s potential into consistent returns, much like how the internet eventually reshaped entire industries.

Wrapping It Up

So, we’ve looked at how AI is changing things and how you might be able to get a piece of the action. Remember, this isn’t like picking up a lottery ticket; it’s about making smart choices. AI is a big deal, no doubt about it, and it’s going to keep growing. But like anything that moves fast, there are risks. Don’t just jump in because everyone’s talking about it. Do your homework, figure out what makes sense for your own money goals, and maybe chat with someone who knows finances really well. Investing is a marathon, not a sprint, and with AI, it’s no different. Keep learning, stay cautious, and you’ll be in a better spot to make good decisions for your future.

Frequently Asked Questions

What exactly is Artificial Intelligence (AI)?

Think of AI as making computers smart enough to do things that usually require human brains. It’s about teaching machines to learn, solve problems, and make decisions, often much faster and more accurately than we can.

Why is AI considered a big deal for the economy?

AI is like a super-powered tool that can change how almost every business works. Experts believe it could add trillions of dollars to the world’s economy by helping companies be more efficient, create new products, and solve big challenges.

What are the main ways someone can invest in AI?

You have a few choices! You can buy special investment funds called ETFs that hold lots of AI-related companies. Or, you can buy stocks directly in companies that are building AI technology or companies that are using AI in smart ways to improve their business.

Are there any big risks when investing in AI?

Yes, there are. Because AI is new and exciting, its stock prices can jump up and down a lot. Also, new rules or ethical questions could affect how well companies do. It’s a bit like the early days of the internet – lots of excitement, but some companies didn’t make it.

Can you give an example of a company using AI for good?

Sure! Companies like Pfizer use AI to help find new medicines faster. John Deere uses it in farming to use less weed killer and give farmers better information. Nike uses AI to make better products and manage how they get them to stores.

Is investing in AI a good idea for everyone?

It really depends on you! If you’re okay with the possibility of big ups and downs for the chance of big rewards, AI investing might be for you. But it’s super important not to put all your money into just one thing and maybe talk to a financial expert before you decide.