So, you’re curious about the crypto order book, huh? It sounds fancy, but it’s really just a list of buy and sell orders for a specific digital currency on an exchange. Think of it like a marketplace notice board where people post what they’re willing to pay and what they want to sell for. Understanding this crypto order book is pretty important if you want to trade crypto without feeling completely lost. We’ll break down what makes it tick, how to read it, and why it matters for your trades.

Key Takeaways

- The crypto order book shows all the buy (bids) and sell (asks) orders for a particular cryptocurrency on an exchange.

- You can see the price people want to buy at and the price people want to sell at.

- Looking at the crypto order book can give you clues about where the price might go next.

- The difference between the highest bid and lowest ask is called the spread, and it affects trading costs.

- A busy crypto order book with lots of orders means it’s easier to buy or sell quickly without changing the price much.

Understanding The Crypto Order Book Fundamentals

What Is A Crypto Order Book?

So, what exactly is this "crypto order book" everyone talks about? Think of it like a big, digital list at a stock exchange, but for cryptocurrencies. It shows all the buy and sell orders that people have placed for a specific digital coin, like Bitcoin or Ethereum, on a particular trading platform. It’s basically a real-time snapshot of what buyers are willing to pay and what sellers are asking for. This list is the heart of how crypto trading actually happens. Without it, you wouldn’t know who wants to buy your crypto or who’s selling the crypto you want to buy.

Key Components Of The Crypto Order Book

An order book isn’t just a jumbled mess of numbers. It’s organized into a few key parts:

- Bids (Buy Orders): This section lists all the prices people are willing to pay for a cryptocurrency, along with the quantity they want to buy at that price. The highest bid is usually at the top, showing the most someone is willing to pay right now.

- Asks (Sell Orders): This is the flip side, showing all the prices people are asking to sell a cryptocurrency for, and the amount they have available. The lowest ask is typically at the top, representing the cheapest price someone is willing to sell at.

- Price: This is the actual value of the cryptocurrency being traded.

- Quantity: This tells you how much of the cryptocurrency (usually in terms of the coin itself, like 1 BTC or 0.5 ETH) is available at a specific price point.

Here’s a quick look at how it might appear:

| Type | Price (USD) | Quantity (BTC) |

|---|---|---|

| Bid | 40,000 | 2.5 |

| Bid | 39,950 | 1.8 |

| Ask | 40,100 | 3.1 |

| Ask | 40,150 | 2.0 |

How The Crypto Order Book Facilitates Trading

The order book is what makes trading possible. When you place an order to buy or sell, it gets added to the book. If your order matches someone else’s – meaning you want to buy at a price they want to sell, or vice versa – the trade happens automatically. This matching process is what determines the current market price. It’s a constant back-and-forth. Buyers try to get the best price they can, and sellers do the same. The prices where the most activity happens often become important levels for the market. It’s all about supply and demand, played out in real-time on this digital ledger.

Navigating The Depths Of The Crypto Order Book

So, you’ve got a handle on what an order book is, right? Now let’s talk about actually using it to figure out what’s going on in the crypto market. It’s not just a list of numbers; it’s a live snapshot of what traders are thinking and doing.

Analyzing Buy And Sell Orders

Think of the order book as two sides of a coin: the buyers (bids) and the sellers (asks). The bid side shows all the buy orders, listed from the highest price someone is willing to pay down to the lowest. The ask side shows all the sell orders, starting with the lowest price someone is willing to sell at, going up. When a trade happens, it’s because a buyer and seller agreed on a price. A buyer willing to pay more than the lowest seller’s price, or a seller willing to accept less than the highest buyer’s price, will get their order filled.

- High volume on the bid side at a certain price might suggest strong buying interest, potentially pushing the price up.

- Lots of sell orders stacked up on the ask side could indicate resistance, meaning it might be tough for the price to go higher.

- A thin order book (not many orders) means it’ll be easier for a single large trade to move the price significantly. This is common in less popular coins.

Interpreting Bid And Ask Prices

The bid price is the highest price a buyer is currently offering. The ask price is the lowest price a seller is currently offering. The difference between the highest bid and the lowest ask is called the spread. A tight spread usually means there’s a lot of trading activity and the market is pretty liquid for that particular crypto. A wide spread, on the other hand, can signal lower liquidity or a market that’s a bit uncertain.

| Side | Price | Quantity |

|---|---|---|

| Bid | $40,000 | 5 BTC |

| Bid | $39,950 | 10 BTC |

| Ask | $40,050 | 7 BTC |

| Ask | $40,100 | 12 BTC |

In this little example, the highest bid is $40,000 and the lowest ask is $40,050. The spread is $50. If you wanted to buy right now, you’d likely pay at least $40,050. If you wanted to sell, you’d get at most $40,000.

Spotting Market Trends Through Order Flow

Watching how orders come in and get filled over time, known as order flow, can give you clues about where the market might be headed. If you see a lot of buy orders being executed (hitting the ask) and the ask prices are getting eaten up, it suggests buyers are aggressive and the price might be going up. Conversely, if sell orders are filling (hitting the bid) and bid prices are dropping, sellers are pushing, and the price could be falling. Paying attention to the size and speed of these order fills is key. It’s like watching a tug-of-war; you can see which side is gaining momentum.

Advanced Strategies Using The Crypto Order Book

Leveraging Order Book Depth For Liquidity

Okay, so you’ve got the basics down. Now let’s talk about how to actually use the order book to your advantage, especially when things get busy. Think of the order book depth as a snapshot of how much buying and selling interest there is at different price points. A deep order book means there are lots of buy and sell orders stacked up. This is generally good because it means you can buy or sell larger amounts without drastically moving the price. It’s like a big, calm lake versus a shallow puddle – easier to make waves in the puddle, right?

When you’re looking at the depth, you’ll see a long list of bids (buy orders) and asks (sell orders) with their quantities. A really thick wall of buy orders below the current price might suggest strong support, meaning the price could bounce off that level. Conversely, a big wall of sell orders above the current price could act as resistance. Traders often look for these ‘walls’ to gauge potential price action. It’s not a crystal ball, but it gives you clues.

Identifying Potential Price Movements

Beyond just looking at the big walls, you can also watch how the order book changes in real-time. If you see a lot of smaller buy orders getting filled quickly, and the bid price starts creeping up, that’s a sign of buying pressure. The opposite is true for selling pressure. Sometimes, you’ll see large orders appear or disappear suddenly – these are often called ‘iceberg orders’ where only a small part is visible, but the trader is trying to move a big chunk without showing their hand. Watching these subtle shifts can help you anticipate short-term price moves. It’s a bit like watching a crowd – you can sometimes tell which way it’s going to surge before it actually does.

Understanding Spreads And Slippage

Two other things to keep in mind are the spread and slippage. The spread is simply the difference between the highest bid price and the lowest ask price. A tighter spread usually means more liquidity and less cost to trade. A wider spread means it’s more expensive to get in and out of a trade. Slippage happens when your order doesn’t get filled at the exact price you wanted, especially in fast markets. If you place a market order, you’re essentially accepting whatever the best available price is. This can lead to slippage if the market moves against you between the time you place the order and when it’s executed. Understanding these concepts helps you set realistic expectations for your trades and avoid nasty surprises.

The Role Of The Crypto Order Book In Market Dynamics

The order book isn’t just a list of buy and sell orders; it’s a living, breathing snapshot of market sentiment and a key driver of how prices move. Think of it as the heartbeat of the exchange, showing you exactly what traders are willing to pay and accept at any given moment. This constant flow of information directly impacts how prices are discovered and how volatile the market becomes.

Impact On Price Discovery

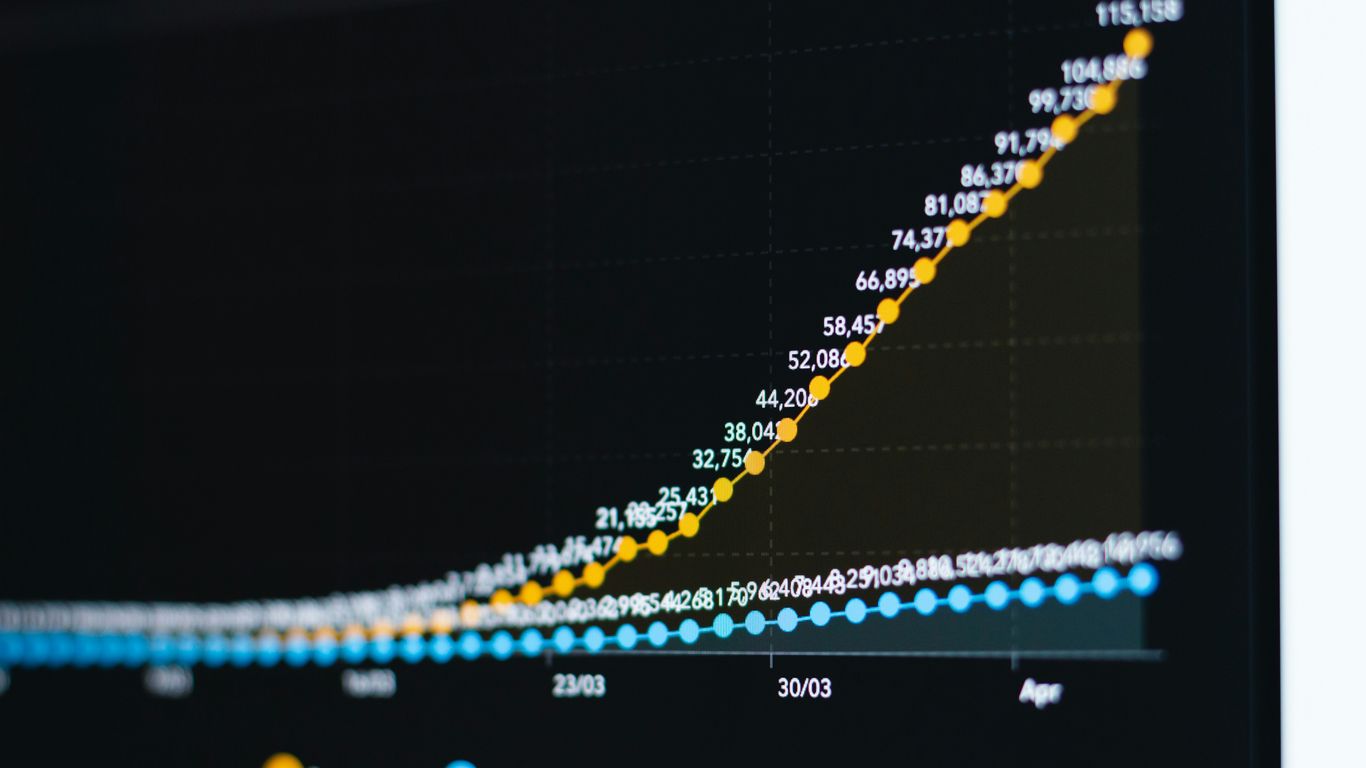

Price discovery is basically how the market figures out what an asset is worth. The order book plays a massive role here. When there are lots of buy orders at higher prices and sell orders at lower prices, it shows strong interest and helps push the price up. Conversely, if sell orders start piling up below the current price, it signals a potential downturn. The interaction between buyers and sellers in the order book is what ultimately sets the market price. It’s a continuous negotiation happening in real-time. For instance, if a large buy order comes in, it can quickly absorb the available sell orders, causing the price to jump. This is a direct result of the order book’s mechanics. Understanding this process is key to grasping how crypto prices are formed, and it’s something you can observe by looking at resources that track market depth.

Influence On Market Volatility

Volatility, or how much prices swing, is also heavily influenced by the order book. Thin order books, meaning there aren’t many orders at various price levels, can lead to wild price swings. A single large trade can have a big impact when there’s not much depth to absorb it. This is why exchanges with more traders and more orders tend to be less volatile for a given asset. Here’s how it can play out:

- Low Liquidity: When there are few buy or sell orders, even a small trade can cause a significant price change. This is often seen with less popular altcoins.

- High Liquidity: With many orders spread across different prices, larger trades can be executed without drastically altering the price. Bitcoin and Ethereum markets usually exhibit this.

- Sudden Order Influx: A large number of buy or sell orders appearing suddenly can trigger rapid price movements, increasing short-term volatility.

Relationship With Trading Volume

Trading volume and the order book are closely linked. High trading volume usually means there are many active participants placing orders, which generally leads to a deeper and more robust order book. A healthy order book with lots of activity indicates a liquid market where trades can happen easily. When volume is low, the order book might become sparse, making it harder to trade without affecting the price. It’s a bit of a feedback loop: more volume leads to a better order book, which in turn can attract more traders and volume. You can often see this relationship by comparing the number of orders at different price points with the reported trading volume for a specific cryptocurrency.

Practical Applications Of The Crypto Order Book

So, you’ve been reading about order books, understanding bids, asks, and all that jazz. But what does it all mean when you’re actually trying to trade crypto? It’s not just some abstract concept; the order book is a live, breathing tool that can really help you out.

Real-Time Trading Decisions

When you’re looking at an order book, you’re seeing what people are willing to buy and sell right now. This information is gold. If you see a huge wall of buy orders at a certain price, it might mean that price will be hard to break through. Conversely, a big sell wall could signal resistance. This immediate feedback loop helps traders decide whether to enter or exit a trade. It’s like looking at the weather forecast before you go out – you get a sense of what might happen next.

For example, imagine you’re looking at the order book for Bitcoin (BTC) against USD. You notice a massive cluster of sell orders just above the current market price. This suggests that many people are looking to sell their BTC at that level, potentially preventing the price from going higher in the short term. You might decide to hold off on buying or even consider selling if you already own some.

Risk Management Techniques

Using the order book isn’t just about finding opportunities; it’s also about protecting yourself. By watching the order flow, you can get a better idea of potential price swings. If you see orders being placed and then quickly canceled, it might indicate manipulation or uncertainty, which are signals to be cautious.

Here are a few ways the order book helps with risk:

- Setting Stop-Loss Orders: You can use the visible buy orders to help determine a sensible level for your stop-loss. If the price is approaching a significant cluster of buy orders, it might act as a support level. Placing your stop-loss just below this could limit your losses if the support fails.

- Avoiding Over-Leveraging: Seeing how much liquidity is available at different price points can inform how much you’re willing to risk. If the order book is thin (meaning fewer orders), a large trade could cause significant price movement, increasing your risk, especially if you’re using leverage.

- Identifying ‘Whipsaws’: Sometimes, the price can quickly move in one direction and then reverse just as fast. Observing rapid changes in order book depth and the cancellation of large orders can sometimes give you a heads-up about these volatile ‘whipsaw’ movements, allowing you to stay out of the way.

Choosing the Right Exchange for Your Needs

Not all exchanges have the same order book. The depth and activity you see can vary wildly. Some exchanges are known for having very deep order books, meaning there are lots of buy and sell orders at many different price levels. This is great for traders who need to execute large orders without causing a big price impact.

Other exchanges might have thinner order books, which can lead to wider spreads and more slippage, especially for less popular cryptocurrencies. When you’re choosing an exchange, consider:

- Liquidity: How many orders are typically present? A liquid market is generally better for most traders.

- Spread: The difference between the highest bid and lowest ask. Thinner order books often mean wider spreads, costing you more on each trade.

- Trading Volume: High volume usually correlates with a more active and deeper order book.

If you’re a day trader looking to make quick, small profits, you’ll want an exchange with tight spreads and lots of activity. If you’re a long-term investor planning to buy a large amount of a less common coin, you’ll need to find an exchange where that coin has enough orders so your purchase doesn’t drastically alter its price.

Wrapping It Up

So, we’ve gone through what an order book is and why it matters in the crypto world. It’s not just a bunch of numbers; it’s a live look at what people are willing to buy and sell. Understanding this can really help you get a better feel for the market. It might seem a bit much at first, but the more you look at it, the more sense it makes. Keep an eye on those buy and sell orders, and you’ll start to see the bigger picture a lot clearer. Happy trading!

Frequently Asked Questions

What exactly is a crypto order book?

Think of a crypto order book like a big list at a stock market, but for digital money like Bitcoin. It shows all the buy and sell orders that people want to make. It’s basically a record of who wants to buy a certain crypto at a certain price and who wants to sell it at a certain price.

What are the main parts of an order book?

The two main parts are the ‘bids’ and the ‘asks’. Bids are the prices people are willing to pay to buy a crypto, and asks are the prices people want to get when they sell it. You’ll also see the amounts of crypto people want to trade at those prices.

How does the order book help people trade?

It helps traders see what’s happening in the market right now. By looking at the bids and asks, they can figure out if more people want to buy or sell, which can help them decide when to make their own trades.

Can I tell if the price will go up or down by looking at the order book?

You can get clues! If there are a lot more buy orders than sell orders, the price might go up. If there are more sell orders, it might go down. It’s not a crystal ball, but it gives you an idea of the market’s mood.

What’s the difference between a bid price and an ask price?

The bid price is the highest price a buyer is willing to pay right now. The ask price is the lowest price a seller is willing to accept right now. The difference between these two is called the ‘spread’.

Why is ‘liquidity’ important in an order book?

Liquidity means how easily you can buy or sell something without causing a big price change. A liquid order book has lots of buy and sell orders close to each other, making it easy to trade quickly without paying too much extra.