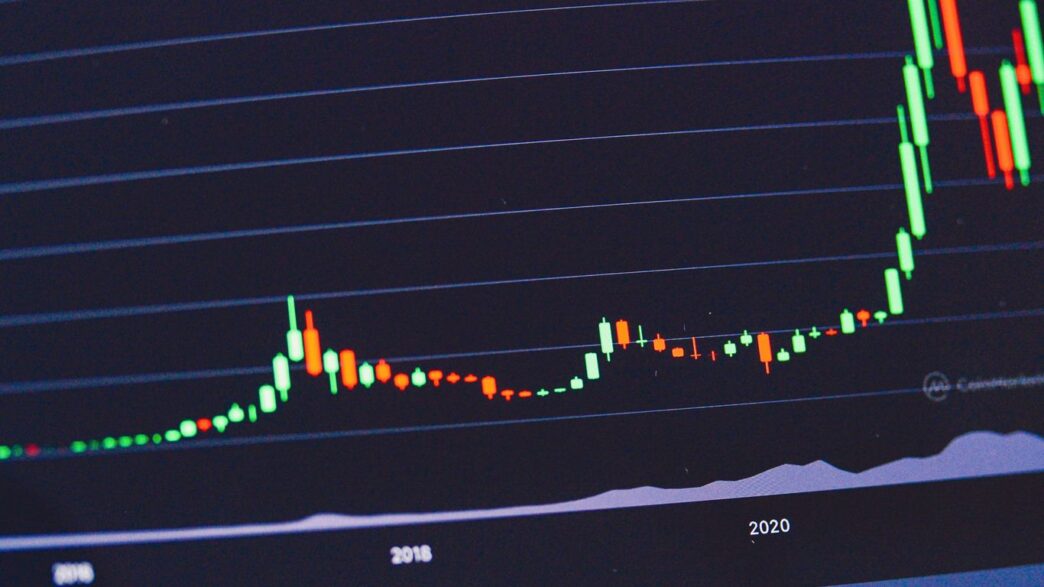

The market can feel a bit wild sometimes, right? One minute things are up, the next they’re down. It makes finding good investments a bit tricky. But sometimes, when everyone else is worried, that’s when the real opportunities pop up, especially with tech companies. We’re talking about undervalued tech stocks here – companies that have solid stuff going on but aren’t getting a ton of attention. These are the kinds of places where you might find some serious growth potential for 2026 and beyond. Let’s check out a few that look pretty interesting.

Key Takeaways

- Constellation Software (TSX:CSU) has seen its stock price drop significantly, making it a potential value play with strong free cash flow growth and a solid balance sheet.

- Topicus.com (TSXV:TOI) is facing AI concerns, but its niche software in stable sectors like government and education offers resilience and a chance for profitable growth.

- Descartes Systems (TSX:DSG) is currently impacted by trade war slowdowns, but its cash reserves and potential to adapt to a changing global supply chain present a long-term opportunity for patient investors.

- Hive Digital Technologies (TSXV:HIVE) is transitioning its data centers for AI, aiming to provide cheaper computing power and positioning itself for the next wave of AI growth.

- FIT Hon Teng (SEHK:6088) and Sino Medical Sciences Technology (SHSE:688108) are among the global stocks identified as undervalued based on cash flow analysis, suggesting potential upside.

1. Constellation Software

Constellation Software (TSX: CSU) has seen some ups and downs lately. While it gained about 6.6% this past week, it’s down 24.7% year-to-date. This kind of volatility might make some investors nervous, but it could also be a chance to get in on a solid company at a lower price.

Constellation is known for quietly acquiring software companies. They focus on businesses where customers tend to stick around and keep paying for maintenance, which usually grows with inflation. It’s a strategy that doesn’t always grab headlines, but it seems to work. The company recently reported a pretty big jump in free cash flow – up 46% year-over-year in the third quarter of 2025. There was a dip in net income, but that was due to a one-time expense related to an investment.

What’s really interesting is their financial health. Constellation has a strong balance sheet with $2.8 billion in cash. They’re currently trading at a valuation based on free cash flow that we haven’t seen since 2014. Considering their free cash flow grew by 27% in the first nine months of 2025, the stock looks pretty discounted right now. It’s a company that has a history of turning investments into significant returns, and the current market conditions might be setting it up for another run.

Here’s a quick look at their recent performance:

- Q3 2025 Free Cash Flow Growth: 46% year-over-year

- Cash Reserves: $2.8 billion

- Recent Stock Performance: Down 24.7% year-to-date, but up 6.6% in the last week.

Despite the recent pullback, Constellation’s business model and financial strength suggest it could be a hidden gem for patient investors looking for long-term growth. You can check out their recent stock performance for more details.

2. Topicus.com

It feels like a lot of software companies have taken a beating lately, and Topicus.com (TSXV:TOI) is no exception. The stock has seen a pretty significant drop over the past year, and you might be wondering why. A big part of the worry seems to be around artificial intelligence and how it might shake things up. But here’s the thing: Topicus operates in a lot of niche markets, especially in Europe, serving industries like government, education, and banking. These sectors tend to move a bit slower when it comes to adopting new tech, and honestly, their customers aren’t exactly looking for disruption.

In fact, Topicus might even benefit from AI. Think about it – they could use AI to build and improve their software, making it easier to adapt to new customers or uses. Plus, AI could help their clients sift through and use their data more effectively. It’s way too early to write this company off.

Here’s a quick look at why it might be worth a second glance:

- Niche Market Focus: Topicus specializes in software for very specific industries and regions, making it less susceptible to broad market shifts.

- Stable Customer Base: Their clients in government, education, and banking are typically slow to change, providing a steady revenue stream.

- Potential AI Tailwinds: The company can use AI to enhance its own products and services, and offer AI-driven tools to its customers.

Right now, the market seems to be focusing only on the potential downsides of AI for software companies, ignoring the upsides. This could be a chance for investors who don’t mind buying when others are selling. The company is expected to see over 20% growth in 2026, and it’s profitable growth with good cash returns. You can currently pick up this stock with an 11% free cash flow yield and an enterprise value to EBITDA ratio of just 11. That looks pretty attractive when you consider its growth prospects.

3. Descartes Systems

Descartes Systems (TSX:DSG) is a company that provides logistics and supply chain solutions. Right now, it’s facing some headwinds because of global trade issues. Basically, when countries aren’t trading as much, it directly impacts Descartes’ business. We saw U.S. container imports drop late last year, and that kind of slowdown puts pressure on their stock price and makes revenue growth a bit sluggish.

The company earns a good chunk of its money from the U.S., which is right in the middle of these trade tensions. This means if things get more complicated with international trade, and countries start working with more suppliers to avoid relying on just one, Descartes might have to adjust. It could take some time for them to expand their operations internationally to take advantage of these shifts.

However, Descartes is being smart about it. They’re holding onto their cash, which is a good move when the economy is uncertain. They’ve got a decent amount saved up, which should help them get through any rough patches. The idea here is that if you’re willing to wait, and you don’t mind buying when things look a bit down, you could benefit when trade picks up again. It’s not a quick fix, though; recovering from something like this usually takes a few years. So, if you’re patient, picking up shares gradually during this downturn might pay off down the road when the supply chain landscape changes and trade volumes increase.

4. Hive Digital Technologies

Hive Digital Technologies is doing something pretty interesting. They’re shifting their focus from just mining Bitcoin to building data centers for artificial intelligence. Think about it, AI is only going to get bigger, and companies that can offer computing power for it at a lower cost are going to do well. Hive is trying to be one of those companies. They’re setting up these AI data centers in places like Paraguay where electricity is cheaper, which is a smart move to keep costs down. What’s also neat is that they’re using their existing Bitcoin inventory to fund this transition, meaning they aren’t taking on new debt. This gives them a lot of flexibility. A single big contract with a major AI player could really move the needle for their stock price.

It’s a bit of a gamble, sure, but the demand for AI is pretty undeniable right now. If Hive can pull off this transition smoothly and offer competitive AI computing services, they could be in a good spot for the next wave of tech growth. It’s a different approach than just holding onto Bitcoin, and it taps into a different, potentially massive, market. The company’s stock price saw a nice bump recently, which is a good sign, even if it’s been a bit of a bumpy ride lately. They’re definitely a company to watch as they pivot their operations.

5. FIT Hon Teng

FIT Hon Teng is a company that makes connectors. You know, those little bits that let you plug things in. They’re involved in making parts for consumer electronics, like smartphones and tablets, and also for cars. It seems like a pretty basic business, but it’s one that’s always needed.

The company is currently trading at a significant discount to its estimated fair value, which could mean it’s a good deal for investors right now. They’ve got a lot of products, and they supply to some big names in the tech world. Think about how many devices we all use every day – they all need these connectors.

Here’s a quick look at how they stack up:

- Product Focus: Connectors for consumer electronics and automotive industries.

- Market Position: Supplies components to major global brands.

- Investment Angle: Trading below estimated fair value, suggesting potential upside.

It’s not the flashiest part of the tech industry, but FIT Hon Teng plays a role that’s hard to replace. If they can keep up with the demand for smaller, more powerful devices and the increasing tech in cars, they could see some solid growth.

6. Nayax

Nayax is a fintech company that’s been quietly building a strong presence in the self-service retail and merchant space. They offer a pretty complete package of solutions, handling everything from payment processing to data management for unattended machines like vending machines, laundromats, and even EV charging stations. It’s one of those behind-the-scenes businesses that makes modern convenience possible.

What’s interesting is how they’re positioned. They operate across a bunch of different regions, including the US, Europe, and Israel, which gives them a good spread. Their main revenue comes from internet software and services, which makes sense given the nature of their business. Nayax is currently trading at a discount to its estimated future cash flow, suggesting it might be a bit undervalued right now.

Here’s a quick look at some of their financial projections:

- Annual Earnings Growth: Expected to be around 31.2%, which is pretty solid and outpaces the Israeli market’s average growth.

- Estimated Discount to Fair Value: Around 13.9%, meaning it’s not drastically overvalued based on cash flow analysis.

- Market Cap: Approximately ₪6.48 billion.

They’ve been making moves, too, with strategic partnerships and product updates aimed at making things smoother for both online and physical retail. It seems like they’re focused on growing their revenue streams and making their operations more efficient. If you’re looking for companies that are enabling the digital and physical retail blend, Nayax is definitely worth a second look. You can find more details about their financial health in their comprehensive financial report.

7. Shenzhen Newway Photomask Making

Shenzhen Newway Photomask Making Co., Ltd. is a player in China’s tech scene, focusing on designing, developing, and making mask products. These are pretty important for making electronic components, which is where most of their money comes from. Right now, the company is trading at CN¥54.5, but based on what they might make in the future, it looks like it’s worth about CN¥81.85. That’s a pretty big difference, suggesting it’s undervalued by about 33.4%.

What’s interesting is that their earnings are expected to jump up by over 35% each year. That’s faster than the rest of the Chinese market, which is a good sign. They’re also trying to raise some money through a new stock offering, which could give them more financial wiggle room. However, the dividend they pay out isn’t super high, and it’s not really covered by the cash they have left over after running the business.

Here’s a quick look at their numbers:

- Current Price: CN¥54.5

- Estimated Fair Value: CN¥81.85

- Estimated Discount: 33.4%

- Projected Annual Earnings Growth: 35.46%

- Market Cap: CN¥9.94 billion

It seems like Shenzhen Newway Photomask Making could be one of those companies that flies under the radar but has solid potential for growth in the coming years.

8. Sino Medical Sciences Technology

Sino Medical Sciences Technology (SHSE:688108) is a company that operates in the medical technology space, focusing on areas like cardiovascular and cerebrovascular diseases. It’s interesting because it seems to be flying under the radar for many investors right now. The company’s stock is currently trading at a significant discount to its estimated fair value, suggesting a potential buying opportunity.

Looking at the numbers, Simply Wall St data from February 2026 shows the stock at CN¥22.42, with an estimated fair value of CN¥44.52. That’s nearly a 50% discount, which is pretty substantial. This kind of gap between price and perceived value often catches the eye of value investors.

Here’s a quick look at some of the data points:

- Current Price: CN¥22.42

- Estimated Fair Value: CN¥44.52

- Estimated Discount: 49.6%

While the exact breakdown of their product lines and revenue streams can be complex, the core idea is that they are developing and marketing medical devices. The market for these kinds of technologies, especially those addressing major health concerns like heart and brain conditions, tends to have steady demand. Investors looking for exposure to the healthcare sector in Asia might find Sino Medical Sciences Technology an interesting prospect, especially given the current market conditions that might be undervaluing Asian stocks. It’s worth keeping an eye on how their product pipeline develops and how their market penetration grows over the next couple of years.

9. Colliers International Group

It seems like Colliers International Group (TSX:CIGI) has been getting lumped in with software companies lately, and its stock price has taken a hit because of it. It’s down about 15% over the last six months, and even dropped 6.3% recently, just like a lot of tech stocks. Maybe some investors are confusing its ticker with a Canadian IT company? But here’s the thing: Colliers isn’t in the tech business at all. They actually operate a pretty diverse range of real estate and infrastructure services all over the world.

Despite the stock’s recent slump, Colliers actually announced some pretty good news. They’re buying a Spanish engineering firm called Ayesa Engineering for around $700 million. This move really beefs up their engineering capabilities in Europe and the Middle East, and it seems like a key piece in building out their engineering side of the business. It’s gotten so big that some people are even wondering if it could eventually be spun off as its own company.

Right now, Colliers is trading at a price-to-earnings ratio of about 17, and its free cash flow yield is sitting at 6%. Considering the company has grown its revenues by 19% and adjusted earnings per share by 22.5% so far this year, it looks like a pretty decent deal from a value perspective. This disconnect between its actual business and its stock performance might be an opportunity for investors who see the real value.

Here’s a quick look at some of their financial highlights:

- Revenue Growth (Year-to-Date): 19%

- Adjusted EPS Growth (Year-to-Date): 22.5%

- Price-to-Earnings Ratio: ~17

- Free Cash Flow Yield: ~6%

10. Exel Composites Oyj

Exel Composites Oyj is a company that makes composite profiles. Think of them as specialized plastic and fiberglass parts used in all sorts of things, from construction to industrial equipment. They’ve been around for a while, and they’re pretty good at what they do, focusing on custom solutions for their clients.

Lately, the market seems to be overlooking Exel Composites. Based on some recent financial data, the stock is trading at a significant discount to its estimated fair value. For instance, it’s been noted that Exel Composites Oyj (HLSE:EXL1V) was trading around €0.536, while its estimated fair value was closer to €1.06. That’s nearly a 50% difference!

Why might this be happening?

- Market Volatility: The broader market has seen some ups and downs, and sometimes good companies get caught in the general sell-off.

- Focus on Niche Markets: Exel Composites operates in specialized areas. While this can be a strength, it might not grab the same headlines as some of the bigger tech players.

- Investor Sentiment: Sometimes, investors just don’t pay enough attention to companies that aren’t the latest hot trend.

Despite these factors, the company’s core business seems solid. They’re involved in materials that are increasingly important for lightweighting and durability in various industries. If they can continue to innovate and secure new contracts, that discount could start to shrink. It’s the kind of company that might not be flashy, but could offer steady returns if the market eventually recognizes its true worth.

Wrapping It Up

So, while the market might seem a bit shaky right now with all the global stuff going on, it actually opens doors for smart investors. It’s like Benjamin Graham said, markets can be a bit wild in the short run, but they tend to sort themselves out over time. We’ve looked at some tech companies that seem to be flying under the radar, maybe because of all the noise about trade or new tech like AI. But these companies have solid foundations. Don’t just chase what’s popular; sometimes the best opportunities are the ones that aren’t getting a lot of attention. Keep an eye on these undervalued players – they could be the ones that really pay off down the road.

Frequently Asked Questions

What makes a tech stock considered ‘undervalued’?

A tech stock is considered undervalued when its current stock price is lower than what its actual worth suggests. This can happen if the market is overlooking the company’s strong performance, future potential, or if there’s temporary bad news that doesn’t affect its long-term value. Think of it like finding a great toy on sale because the store had too many.

Why are some tech stocks going down even if the companies are doing well?

Sometimes, the stock market gets worried about big issues like trade wars or new technologies like AI. This worry can make investors sell stocks, even good ones. It’s like everyone panics because of a rumor, and prices drop for a bit, creating a chance to buy if you believe the company is still strong.

How can I tell if a company is really growing?

You can look at how much money the company is making (revenue) and how much profit it’s keeping (earnings). Companies that are growing well often see these numbers go up year after year. Also, check if they are making more cash than they spend, which is called free cash flow.

What does it mean for a stock to have a ‘strong balance sheet’?

A strong balance sheet means a company has more assets (things it owns) than debts (money it owes). It also means it has plenty of cash on hand. This shows the company is financially healthy and can handle tough times or invest in new projects.

Why is geopolitical uncertainty mentioned in relation to tech stocks?

Geopolitical uncertainty refers to global events like conflicts or trade disputes. These can make markets jumpy. However, sometimes these uncertain times can make certain tech companies, especially those that are essential or less affected by global trade, seem like better deals because investors are focused elsewhere.

What is ‘free cash flow’ and why is it important for investors?

Free cash flow (FCF) is the cash a company has left over after paying for its operations and investments. It’s like the money left in your pocket after buying all your school supplies. Investors like FCF because a company can use it to pay back debt, buy back its own stock, or invest in new growth, which can make the stock more valuable.