Welcome to your daily market update, where we break down the biggest movers and shakers. Today, we’re looking at the top stock gainers today, with a special focus on the tech world’s latest announcements and some interesting developments in energy and crypto. Let’s see what’s making headlines and impacting your portfolio.

Key Takeaways

- Nvidia kicked off CES 2026 with a new AI platform, Vera Rubin, while also hinting at plans for humanoid robots and self-driving tech.

- AMD is also making waves at CES 2026, introducing new AI chips for PCs and updates for its data center lineup.

- The stock market saw a strong start to the year, with the Dow, S&P 500, and Nasdaq all reaching new highs, partly boosted by news from the energy sector.

- Gold prices are climbing, moving above $4,400 as investors look past geopolitical news and focus on upcoming economic data.

- Bitcoin might be showing signs of recovery, with some analysts suggesting the cryptocurrency has hit a bottom.

1. Nvidia’s AI Platform Launch at CES 2026

Alright, so CES 2026 is here, and Nvidia is making some noise. They just rolled out Vera Rubin, their latest AI platform. It sounds like a pretty big deal for anyone deep into artificial intelligence. This launch is happening at a time when the AI chip market is really heating up, and everyone’s watching to see what Nvidia does next.

Nvidia’s CEO, Jensen Huang, has been talking a lot about the future of AI, and this new platform is a big part of that. It’s designed to handle some seriously complex AI tasks, which is good news for developers and businesses looking to push the boundaries of what AI can do. We’re talking about things like advanced robotics and more sophisticated data processing.

Here’s a quick look at what Vera Rubin is supposed to bring to the table:

- Enhanced AI model training: Faster and more efficient ways to train those massive AI models.

- Improved AI inference: Quicker responses and better performance for AI applications in real-time.

- Scalability for data centers: Built to handle the growing demands of large-scale AI deployments.

It’s interesting because there’s a lot of chatter on Wall Street about Nvidia’s AI dominance. Some analysts are wondering if the current boom can last, especially after Huang’s recent talks. You can find some of these discussions about the AI cycle expiration date if you’re curious.

Beyond the AI platform, Nvidia also touched on other areas like self-driving car tech. It seems like they’re trying to cover a lot of ground. We’ll have to wait and see how Vera Rubin actually performs in the wild, but for now, it’s definitely a major announcement from CES 2026.

2. AMD’s New AI PC Chips and Data Center Innovations

Advanced Micro Devices (AMD) is making some serious moves in the AI space, showing off new chips for PCs and updates for their data center tech at CES 2026. It feels like everyone is trying to get a piece of the AI pie right now, and AMD is definitely not sitting on the sidelines.

They’ve rolled out new processors designed to handle AI tasks right on your laptop or desktop. This means your computer could get smarter, faster, and better at things like image editing, voice commands, and maybe even running complex software without needing a super-powerful server. The idea is to bring AI capabilities directly to the end-user’s device.

Beyond the PC, AMD is also pushing forward with its data center solutions. These are the big, powerful computers that companies use for massive calculations and cloud services. They’ve got new chips coming that are supposed to be more efficient and powerful, which is a big deal for companies building out their AI infrastructure. Think faster training for AI models and quicker processing of huge amounts of data.

Here’s a quick look at what they’re focusing on:

- AI PC Chips: New processors for personal computers aimed at improving on-device AI performance.

- Data Center Accelerators: Upgraded chips designed for servers to speed up AI workloads and data processing.

- Software Ecosystem: Continued work on their software tools to make it easier for developers to use their hardware for AI applications.

It’s a competitive market, with companies like Nvidia also making big announcements. But AMD seems to be carving out its own path, focusing on both the consumer PC market and the heavy-duty data center needs. We’ll have to see how these new products perform in the real world, but it’s clear they’re betting big on AI.

3. Hyundai’s Humanoid Robot Race

It looks like Hyundai is really jumping into the humanoid robot game, aiming to get these machines out to the public in a big way. They’re not just tinkering around; they’re talking about mass production, which is a pretty big deal. This puts them right up against some serious players, including Tesla, who’s also been making a lot of noise about their own robot ambitions.

Hyundai’s goal is to make these robots a common sight, not just a futuristic concept. They’re pushing hard to develop robots that can actually do useful things, moving beyond just demonstrations. Think about what that could mean for factories, warehouses, or even helping out around the house.

Here’s a quick look at what’s happening:

- Competition Heating Up: Hyundai is directly challenging companies like Tesla in the race to bring practical humanoid robots to market.

- Focus on Production: The emphasis is on scaling up manufacturing, not just building prototypes.

- Potential Applications: The aim is for robots that can perform tasks in various industries and potentially in homes.

It’s still early days, and there are a lot of hurdles to clear, like making them affordable and safe for everyday use. But it’s clear that the race to build the first truly useful, mass-produced humanoid robot is on, and Hyundai is definitely a contender.

4. Big Oil’s Venezuelan Challenges

It looks like the big oil companies are still facing a pretty tough situation down in Venezuela. Even with some recent political shifts, getting back into the swing of things there isn’t straightforward. The country has, you know, the biggest oil reserves in the world, but making that oil actually usable and accessible is a whole different story.

The road ahead for major oil players in Venezuela is long and complicated.

Here’s a quick look at what’s going on:

- Infrastructure Woes: Decades of underinvestment and neglect have left much of Venezuela’s oil infrastructure in bad shape. Fixing it up will take a ton of money and time.

- Political Uncertainty: While there have been some changes, the political landscape can still be unpredictable. This makes long-term investment decisions tricky for these companies.

- Sanctions and Regulations: Navigating international sanctions and local regulations adds another layer of difficulty. It’s not as simple as just showing up and starting to pump oil.

Companies are watching closely, but it’s going to take a lot to turn things around. The potential is huge, but so are the hurdles. It’s a real test for Venezuela’s oil industry to regain trust and access global markets again.

5. Stock Market Rally: Dow, S&P 500, and Nasdaq Highs

Well, it looks like the stock market is having a fantastic start to 2026. We’re seeing major indexes like the Dow Jones Industrial Average push past the 49,000 mark, and the S&P 500 has hit a new record high. It’s been a pretty strong showing so far.

This surge seems to be fueled by a mix of things. Investors are definitely keeping an eye on upcoming economic data, which could give us more clues about where things are headed. Plus, there’s a lot of buzz around tech, especially with all the AI announcements coming out of CES 2026. Companies like Nvidia and AMD are making big moves, and that’s got the market excited.

Here’s a quick look at how the major indexes are doing:

- Dow Jones Industrial Average: Surging past 49,000 points.

- S&P 500: Reached a new all-time high.

- Nasdaq Composite: Also showing significant gains, reflecting the tech sector’s strength.

It’s not just tech, though. Energy stocks have also seen a boost, partly due to developments in places like Venezuela. It’s a complex global picture, but right now, the market seems to be shrugging off some of those geopolitical concerns. We’ll have to wait and see if this upward trend continues as more economic reports come out later this week. For now, it’s a good day to be invested in US stocks.

6. Gold Price Surge Amidst Economic Data

Gold prices have been on the move lately, climbing past the $4,400 mark and even hitting $4,480 per ounce on Tuesday. It seems like investors are really looking for a safe place to put their money when things feel a bit uncertain globally. This isn’t just a small bump; it’s a noticeable surge that’s got people talking.

What’s driving this? Well, a few things seem to be at play. For starters, the general economic data coming out has been a mixed bag, making traditional safe-haven assets like gold look more attractive. When inflation worries pop up or there’s a hint of economic slowdown, gold often benefits. Plus, with all the geopolitical news swirling around, especially concerning oil markets in places like Venezuela, investors tend to get cautious. This caution often translates into buying gold.

Here’s a quick look at what’s been happening:

- Investors are seeking safety: Amidst global uncertainties, gold is seen as a reliable store of value.

- Economic data influences decisions: Mixed economic reports can push investors towards precious metals.

- Geopolitical events add to demand: International tensions can increase the appeal of gold as a hedge.

It’s interesting to watch how these factors play out. The price of gold can be quite sensitive to these kinds of shifts. For those keeping an eye on their investments, this trend is definitely one to monitor. You can check out the latest on gold prices to stay updated.

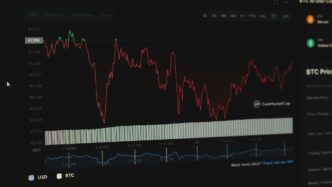

7. Bitcoin’s Potential Bottoming

Alright, let’s talk about Bitcoin. It feels like we’ve been in a bit of a holding pattern, right? But some folks on Wall Street, like the analysts over at Bernstein, are starting to say that maybe, just maybe, the worst is behind us. They’re putting out the word that Bitcoin might have actually hit its bottom.

It’s not just a gut feeling, either. They’re looking at market signals and trying to figure out if this is the start of a comeback. Of course, nobody has a crystal ball, and the crypto world can be pretty wild. But if these analysts are right, we could be seeing a shift.

Here’s a quick look at what might be influencing this idea:

- Investor sentiment: Are people starting to feel more confident about crypto again?

- Market activity: Are we seeing more buying pressure than selling pressure lately?

- Broader economic factors: How do things like inflation or interest rates play into the crypto picture?

It’s still early days, and things can change fast. But for anyone watching Bitcoin, this talk of a potential bottom is definitely something to keep an eye on. It could signal a new phase for the digital currency.

8. Best CD Rates for January 2026

Looking to put some savings to work this year? Certificates of Deposit, or CDs, are still a solid option for a predictable return, especially with interest rates holding steady. As of January 6, 2026, you can find some pretty good deals if you shop around.

The top rates are currently hovering around 4.1% APY. That’s a nice, steady gain without taking on much risk. It’s definitely worth checking out if you have some cash you won’t need for a while.

Here’s a quick look at what’s available:

- High Yield CDs: Several banks are offering rates close to that 4.1% mark for terms ranging from 12 to 18 months. These are great if you can lock your money up for a year or so.

- Shorter-Term Options: If you prefer flexibility, you can still find decent rates, maybe around 3.5% to 3.8% APY, for CDs with terms of 6 to 9 months.

- Longer-Term CDs: For those looking to lock in a rate for longer, say 3 to 5 years, rates might be slightly lower, perhaps in the 3.0% to 3.3% range. It’s a trade-off between locking in a rate for a long time versus potentially higher rates on shorter terms if the market shifts.

Remember, APY (Annual Percentage Yield) includes compounding interest, so it gives you a better picture of your total earnings over a year. Always check the specific terms and conditions, like minimum deposit requirements, before opening a CD. It’s a simple way to grow your money safely in early 2026.

9. Mortgage and Refinance Interest Rates Update

Well, if you’re thinking about buying a home or looking to switch up your current mortgage, today’s rates are hovering just around the 6% mark. It’s a bit of a mixed bag out there, with some lenders offering slightly below 6% and others just a hair above.

This means that while rates aren’t at their absolute lowest, they’re still in a pretty competitive zone for both new mortgages and refinancing existing ones.

Here’s a quick look at what’s happening:

- 30-Year Fixed-Rate Mortgages: These are generally sitting in the 5.8% to 6.2% range. It really pays to shop around, as even a quarter-point difference can add up over the life of the loan.

- 15-Year Fixed-Rate Mortgages: If you’re looking for a shorter term, you might find rates a bit lower, typically between 5.5% and 5.9%.

- Refinancing: For those looking to refinance, the decision often comes down to whether the savings on your monthly payment outweigh the closing costs. It’s worth crunching the numbers to see if it makes sense for your situation.

It’s always a good idea to get quotes from a few different lenders. Things like your credit score, the loan amount, and your down payment can all influence the exact rate you’ll be offered. Don’t just go with the first one you see!

10. Student Loan Borrowers and Wage Garnishment

It looks like things are getting serious for student loan borrowers who have fallen behind on payments. Starting in early 2026, the government is set to resume wage garnishment for defaulted federal student loans. This means if you’re in default, your employer could start withholding a portion of your paycheck to cover the debt.

This isn’t a new tactic, but it’s been on hold for a while. The CARES Act put a pause on most federal student loan collections, including wage garnishment, back in March 2020. However, that pause is ending, and the Department of Education is getting ready to restart these actions. Borrowers who are more than 270 days delinquent are the primary targets for this renewed collection effort.

What does this mean for you if you’re struggling with payments?

- Understand Your Default Status: First, figure out if your loans are actually in default. Federal student loans are typically considered defaulted after 270 days of non-payment.

- Explore Repayment Options: Don’t wait for garnishment to happen. Reach out to your loan servicer immediately. There are options like income-driven repayment plans, deferment, or forbearance that could help manage your payments and keep you out of default.

- Know Your Rights: If wage garnishment does start, there are limits to how much can be taken from your paycheck. Generally, it’s capped at 15% of your disposable pay, or the amount by which your disposable pay exceeds 30 times the federal minimum wage, whichever is less. You also have the right to request a hearing to dispute the garnishment.

It’s a tough situation, and the government is making it clear they intend to collect on these debts. Staying proactive and communicating with your loan servicer is the best way to avoid or deal with wage garnishment.

Wrapping Up Today’s Market Moves

So, that’s a look at what’s moving the markets today. We saw some big jumps, especially with oil stocks after that news out of Venezuela, and tech continues to be a hot topic with all the AI talk at CES. Remember, the market’s always doing something, and keeping up with these daily shifts can help you make smarter choices with your own money. Don’t forget to check back for more updates.

Frequently Asked Questions

What’s new with Nvidia and AMD at CES 2026?

Nvidia is showing off its new AI platform called Vera Rubin and also talking about its plans for robots and self-driving cars. AMD is introducing new computer chips for AI PCs and for data centers. Both companies are making big moves in the AI world.

Why is Hyundai making humanoid robots?

Hyundai is trying to be a leader in making robots that look and act like humans. They are competing with other big companies like Tesla to be the first to make these robots in large numbers.

What’s going on with oil in Venezuela?

Venezuela has a lot of oil, but it’s been hard to get it out and sell it. Even though there’s been a change in leadership, it might still be a challenge for big oil companies to do business there.

Are the stock markets doing well?

Yes, the stock market is having a great start to the year! Major indexes like the Dow, S&P 500, and Nasdaq have reached new highs. This is partly because oil stocks have gone up.

Why is the price of gold going up?

The price of gold is climbing, and it’s now over $4,400. This often happens when people are looking for a safe place to put their money, especially when there’s uncertainty or new economic news coming out.

Is Bitcoin going to get better?

Some experts think that Bitcoin might have hit its lowest point and could start going up again. This is based on their analysis of the cryptocurrency market.