Artificial Intelligence (AI) has rapidly grown into a cornerstone technology across industries, and its role in finance and capital markets is nothing short of revolutionary. From reshaping the way trades are executed to enhancing customer experiences, AI’s ability to process vast amounts of data and make informed decisions in real time is redefining the sector as demonstrated by various reports. This feature looks into the specific ways AI is impacting the sector, with Solvent.Life emerging as a prime example of AI innovation in action.

Algorithmic and High-Frequency Trading

AI’s impact is perhaps most visible in algorithmic and high-frequency trading. By analyzing real-time market data, AI-driven algorithms can execute trades in milliseconds. These systems optimize profits by identifying patterns and trends invisible to the human eye.

Machine learning models play a key role in predicting price movements using historical and current market data. Companies like Solvent.Life are setting the standard here, employing sophisticated AI to ensure traders can make split-second decisions based on actionable insights. Their platform integrates predictive analytics with real-time data streams, giving traders an edge in fast-moving markets.

Market Insights and Decision Support

AI-powered platforms are revolutionizing the way traders and analysts make decisions by turning complex datasets into actionable insights. Advanced tools enable the visualization of data in a way that highlights key trends, risks, and opportunities, empowering users to act with greater precision.

Solvent.Life stands out as a prime example. Its platform integrates machine learning and real-time analytics, providing users with a comprehensive view of market dynamics. The system can identify patterns that signal potential price movements, enabling traders to anticipate and respond to market fluctuations. Additionally, the platform uses AI to simulate “what-if” scenarios, helping users evaluate the potential outcomes of different trading strategies.

Other platforms in this space combine historical data analysis with predictive models, offering insights into both long-term investment trends and short-term market opportunities. These tools also alert traders to anomalies or sudden shifts in market behavior, ensuring no opportunity or risk goes unnoticed. The result is a smarter, more informed decision-making process.

Operational Efficiency

AI’s ability to automate repetitive tasks has transformed back-office operations in finance. Processes like clearing trades, settling transactions, and reconciling data—once labor-intensive and prone to errors—are now executed efficiently and accurately by AI systems.

Platforms employing AI in operations use algorithms to validate and process thousands of transactions in seconds, significantly reducing costs and minimizing human error. For example, automated reconciliation tools compare internal records with external data sources, flagging discrepancies for human review only when necessary.

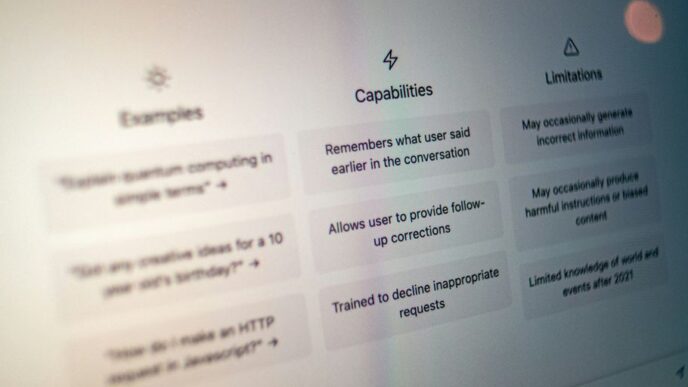

On the customer-facing side, AI-driven chatbots and virtual assistants have revolutionized how institutions handle client interactions. These tools provide instant responses to queries, guide users through services, and even troubleshoot issues. Unlike traditional systems, modern AI assistants learn from interactions, improving their responses over time. This has led to enhanced customer satisfaction and reduced workload for human support teams.

Additionally, AI systems play a critical role in fraud prevention within operational frameworks, monitoring for unusual transaction patterns and enabling rapid intervention to protect both institutions and clients.

Impact on Market Accessibility

The financial markets, once dominated by institutional players with access to sophisticated tools and resources, are becoming more inclusive thanks to AI. Platforms like Solvent.Life are at the forefront of this shift, providing retail investors with the same level of market intelligence traditionally reserved for large firms.

Solvent.Life’s platform uses advanced analytics to provide actionable insights tailored to individual users, leveling the playing field. For example, retail investors can access data visualizations and sentiment analyses that were once the domain of seasoned analysts. The platform’s crowd-sourced strategy model aggregates insights from a diverse user base, allowing individuals to leverage collective wisdom to inform their trading decisions.

Further, the democratization extends to tools like robo-advisors, which provide personalized investment strategies at a fraction of the cost of traditional advisory services. As a result, a new generation of investors can participate in and benefit from the financial markets, transforming accessibility and inclusivity in the sector.

Risk Management

Managing financial risks has always been challenging, but AI offers a powerful toolset to tackle this critical task. AI systems can identify potential risks before they escalate as they can analyze large datasets that include both traditional financial metrics and alternative sources like news sentiment and geopolitical trends.

Predictive analytics is a standout capability, enabling institutions to foresee and mitigate financial crises or market anomalies. AI-powered models offer an unprecedented level of accuracy in assessing credit risk and market vulnerabilities, allowing firms to act decisively and protect their portfolios.

Portfolio Management and Robo-Advisors

AI has democratized portfolio management, making professional-grade investment strategies accessible to everyone. Robo-advisors use AI to craft personalized strategies, taking into account an individual’s risk tolerance, financial goals, and current market conditions.

These platforms automatically rebalance and optimize portfolios, eliminating human biases and reducing operational inefficiencies. Investors, both novice and experienced, benefit from tools that provide data-driven recommendations, ensuring their financial goals are met with precision.

Fraud Detection and Prevention

AI has redefined how financial institutions combat fraud. Machine learning algorithms excel at spotting unusual patterns in transactions, helping identify fraudulent activities early. Real-time monitoring systems enhance security, safeguarding not just institutions but also their customers.

The ability to act quickly on fraud detection is a significant advantage, as it minimizes financial losses and protects sensitive information.

Sentiment Analysis and Market Predictions

AI is now integral to understanding market sentiment. By analyzing vast amounts of data, including news articles and social media trends, AI helps gauge the mood of the market and predict its future direction.

Natural language processing (NLP) extracts actionable insights from corporate earnings calls, financial reports, and even public speeches by influential figures. Solvent.Life’s AI systems stand out in this area, providing users with a detailed sentiment analysis that goes beyond the basics, helping traders anticipate market shifts and make well-informed decisions.

Risk and Compliance Automation

Staying compliant in a heavily regulated sector is a challenge, but AI offers robust solutions. Automated systems monitor regulations, ensuring financial institutions adhere to them in real time.

AI tools also streamline reporting and auditing processes, reducing the risk of errors and ensuring institutions remain transparent and accountable. These advancements free up resources and allow firms to focus on growth and innovation.

Thanks to AI financial and capital markets are transforming. From enhancing trading precision to democratizing market access, the technology has unlocked new possibilities for institutions and individual investors alike. Companies like Solvent.Life are leading the charge, proving that the integration of AI in finance is not just a trend—it’s the future.