So, there’s this thing called the ripple sale happening, and it’s supposed to have some pretty good deals on XRP and other stuff. It’s kind of a big deal because, you know, XRP has been through a lot lately. The SEC lawsuit thing finally wrapped up, and Ripple’s been busy buying up other companies to grow its business. People are watching to see how all this affects XRP’s price, especially with the market being all over the place. We’ll break down what’s going on, what might happen next, and why some folks are still really into XRP for the long haul, even with all the noise out there.

Key Takeaways

- The SEC lawsuit conclusion brought some relief, but it didn’t automatically boost XRP’s price as much as some expected.

- Ripple has been actively acquiring companies, like Ripple Prime and GTreasury, to expand its services and reach.

- Despite a big jump late in 2024, XRP’s performance in 2025 has been mixed, leading to debates about whether dips are discounts or just market corrections.

- Future catalysts like institutional adoption, ETFs, and potential new legislation could influence XRP’s trajectory, though challenges remain.

- Despite market ups and downs and some community confusion, XRP’s long-term potential is still a topic of discussion, influenced by brand strength and broader economic trends.

Navigating the Ripple Sale Landscape

So, the big Ripple sale is here, and everyone’s talking about XRP. But before you jump in, let’s break down what’s actually going on. It’s not just about the price going up or down; there’s a whole story behind it.

Understanding the XRP SEC Lawsuit Conclusion

Remember that whole SEC lawsuit? It finally wrapped up. Basically, a court ruling clarified that selling XRP to regular folks isn’t the same as selling it to big institutions. This was a pretty big deal. The legal dust settling was supposed to be a huge win for XRP, but the price didn’t exactly skyrocket like some expected. Even after the lawsuit’s conclusion in August, which saw both sides drop their appeals, the market reaction was… mixed. While there was a brief rally and a spike in trading volume right after the settlement, the long-term impact on price hasn’t been what many hoped for. Ripple’s CEO even mentioned that the lawsuit caused significant losses for XRP investors, which is a tough pill to swallow.

Impact of Regulatory Wins on XRP Price

Winning a legal battle sounds like it should automatically boost a cryptocurrency’s price, right? Well, with XRP, it’s been more complicated. Despite the SEC lawsuit conclusion and other positive developments, XRP’s price has seen some serious ups and downs. For instance, XRP ETFs launched in November 2025 and attracted a lot of money – over $1 billion in inflows by mid-December. That’s a lot of institutional interest! Yet, even with this demand, XRP was down about 48% from its July peak around that time. It shows that regulatory clarity doesn’t always translate directly into immediate price gains. Sometimes, the market needs more time to digest these wins, or other factors come into play.

Analyzing the Ripple Sale’s Market Reaction

Looking at the market’s response to the "Ripple Sale" and all these events is pretty interesting. XRP had a massive surge at the end of 2024, jumping nearly 300% in November and December. A lot of people thought this was it – the big comeback. But then, as of mid-December 2025, XRP was actually down for the year, while the broader stock market was up. This tells us that the big price jump wasn’t just about people suddenly using RippleNet more. It was more of a speculative frenzy, with investors betting on things like ETFs and regulatory wins happening quickly. When those things didn’t immediately cause another massive price increase, the market corrected. It’s a good reminder that a price drop isn’t always a bargain; sometimes, it’s just the market adjusting after getting a bit too excited.

Ripple’s Strategic Acquisitions and Expansion

Ripple hasn’t just been sitting around waiting for things to happen. They’ve been busy buying up companies and expanding their reach, really trying to build out a whole financial services platform. It’s a pretty big shift from just focusing on payments.

Ripple Prime’s Growth Post-Acquisition

Remember when Ripple bought Hidden Road back in April? They rebranded it as Ripple Prime, and it’s apparently doing pretty well. This move made them the first crypto company to have its own global multi-asset prime broker. Since the acquisition, Ripple Prime has reportedly tripled its business and is now handling over 60 million transactions every day. That’s a lot of activity.

Expanding Enterprise Access with GTreasury

Then, in October, Ripple picked up GTreasury for a cool $1 billion. This acquisition is a big deal because it gives Ripple access to a bunch of Fortune 500 companies. Think big names like American Airlines and Goodyear. It also opens them up to over $12.5 trillion in annual payment flows. That’s a huge market to tap into.

Smaller Acquisitions Fueling Platform Growth

It’s not just the big deals, either. Ripple has also made some smaller acquisitions to fill out their platform. They bought Rail for $200 million in August and also picked up a wallet provider called Palisade. These smaller moves seem to be about building out different pieces of their overall strategy, making the whole Ripple ecosystem more robust.

XRP’s Performance Amidst Market Volatility

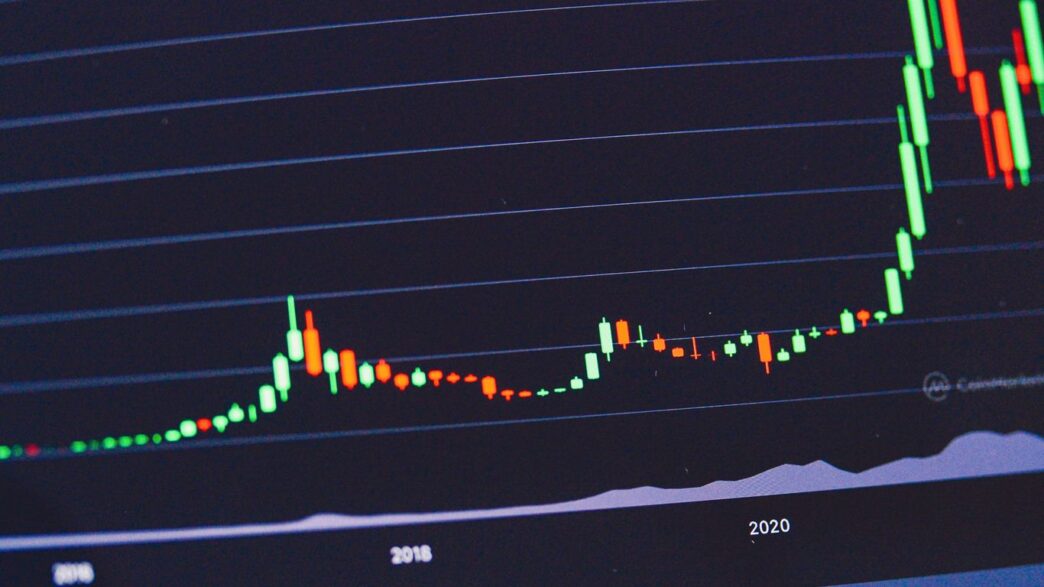

November and December 2024 Surge Analysis

Remember late 2024? XRP had a pretty wild ride, especially in November and December. It shot up by a massive 294% during those two months. A lot of folks thought this was it, the big comeback, especially after the long-running SEC lawsuit finally seemed to be wrapping up. People were expecting things to just keep going up from there, maybe even seeing XRP get included in new investment funds or something similar. It felt like a real turning point.

Year-to-Date Performance in 2025

But then 2025 rolled around, and things didn’t quite play out as many hoped. While the stock market, like the S&P 500, was actually up about 15% for the year, XRP took a different path. As of mid-December 2025, XRP was down 8% year-to-date. It also dropped significantly, about 47%, from its peak earlier in July. It’s a bit confusing when you see positive news, like regulatory wins, but the price doesn’t follow. It makes you wonder what’s really driving the market.

The Discount vs. Speculative Overshoot Debate

So, is this big price drop just a chance to buy XRP on sale, or is it something else? When XRP jumped up at the end of 2024, it wasn’t just because tons of new people started using Ripple’s payment system. It was more of a speculative boost, with people betting on future events like regulatory clarity and potential new investment products. Sometimes, a steep price drop isn’t a discount; it’s just the market correcting itself after getting a bit too excited. It’s important to look beyond just the price chart. We need to see real adoption and increasing activity for XRP to truly justify its value, not just hype.

Here’s a quick look at how XRP stacked up against the S&P 500 in 2025:

| Period | XRP Performance | S&P 500 Performance |

|---|---|---|

| Year-to-Date (as of Dec 16, 2025) | -8% | +15% |

| Peak to Mid-December 2025 | -47% | N/A |

It really highlights how different the crypto market can be, even when there’s positive news. We saw a lot of buying pressure building up recently, with more buyers stepping in than sellers, which is a good sign for short-term movement. But the bigger question remains: what’s the actual, long-term use case driving this demand?

Catalysts and Challenges for XRP Investors

So, what’s really going on with XRP? It’s been a wild ride, right? After that big win against the SEC and the launch of XRP ETFs, you’d think the price would be soaring. But, as of late December 2025, XRP is actually down about 8% for the year. That huge jump in November and December 2024? Turns out, it was more about people hoping for good news than actual widespread adoption of Ripple’s payment system.

Expected Institutional Adoption and ETFs

We saw XRP spot ETFs hit the market in November 2025, and they pulled in a pretty impressive $1.25 billion in assets pretty quickly. The Canary XRP ETF even had a huge first day. But here’s the kicker: even with all that institutional money flowing in, XRP’s price has dropped significantly from its July peak. It makes you wonder if the market got a bit ahead of itself. The launch of these ETFs was a big deal, but it didn’t automatically translate into sustained price growth. It seems like the market might have been a bit too optimistic, expecting a bigger immediate impact than what actually happened.

The Role of the CLARITY Act

There’s this thing called the CLARITY Act that’s supposed to bring more regulatory certainty to the crypto space, which banks really need. It’s been stuck in Congress, though. Ripple’s CEO thinks it’ll pass in the first half of 2026, but some analysts are saying it might just be a ‘buy the rumor, sell the news’ kind of event. Basically, even if it passes, don’t expect a massive price surge just because of it. It’s more about setting the stage for future growth than being an immediate catalyst.

Ripple’s Bank Charter Application

This is another piece of the puzzle. Ripple has been working on getting a bank charter. If they succeed, it could really change things, allowing them to offer more traditional banking services. However, there haven’t been many updates on this front lately, and it’s unclear when or if it will actually happen. It’s a potential game-changer, but for now, it remains a bit of an unknown factor. It’s one of those things that could be huge, but we just don’t know when it might materialize, or even if it will.

Understanding XRP’s Long-Term Potential

Brand Strength in the Crypto Market

XRP has been around for a while, and it’s built a name for itself, especially in the world of international payments. It wasn’t just some random coin that popped up; it was designed with a specific job in mind – making cross-border transactions smoother and cheaper. Think of it as a bridge currency. While newer blockchains might be faster or do more fancy stuff, XRP was one of the first to really focus on getting things done in the real world. This focus has stuck with it, helping it stay a big player, even with all the ups and downs in the crypto space. It’s currently the fifth-largest cryptocurrency, which tells you something about its staying power.

Macroeconomic Factors Influencing Crypto

It’s easy to just look at crypto prices and get caught up in the day-to-day swings. But what’s happening in the bigger economy really matters. Back in 2021, when interest rates were super low and money was flowing everywhere, crypto prices, including XRP’s, shot up. Now, things are different. The Federal Reserve is actually lowering interest rates, which is a big shift. While we might not see the same kind of explosive growth as when rates were near zero, this change in the cost of money could be good for crypto prices going forward. It means there’s more liquidity in the markets, and investors might be more willing to take on assets like XRP.

The Future of XRP Ledger DeFi

Ripple isn’t just sitting still. They’re looking to expand what the XRP Ledger can do. The plan is to bring lending features to the ledger, moving beyond just payments. This could make the XRP Ledger a more complete platform for financial services, not just for moving money but for managing it too. It’s a move that could attract more institutional interest and show that XRP can be a part of the growing decentralized finance (DeFi) world.

Addressing Misinformation in the XRP Community

It feels like every time something big happens with XRP, there’s a wave of confusing messages flying around. It can be tough to sort out what’s real and what’s just noise, especially when it comes to things like token unlocks and sales. Let’s clear up a couple of recent incidents that caused a stir.

The Escrow Release and Fake Memo Incident

So, on January 1, 2026, Ripple did its usual thing: unlocked 1 billion XRP from escrow. This is a regular, predictable event that’s been happening for years. The goal is to keep things transparent and give everyone a heads-up about potential supply changes. But this time, someone attached a fake memo to the transaction. This memo sarcastically claimed Ripple had sold a massive $8 billion in XRP during 2025 and planned to sell even more in 2026.

This message was not from Ripple and was simply a prank.

Here’s how it happened: The XRP Ledger lets anyone add a memo to a transaction. This person paid a tiny fee, like 0.000012 XRP, to add their message to Ripple’s legitimate escrow release. Because the XRP Ledger is public, everyone could see the transaction and the fake memo, leading to a lot of confusion and speculation online. It’s a good reminder that while the blockchain is super transparent about transactions, those memo fields can be used to spread false information if we’re not careful.

Blockchain Transparency and Vulnerabilities

This whole memo situation really highlights a double-edged sword with public blockchains like the XRP Ledger. On one hand, you can see every single transaction, and they’re permanent. That’s great for accountability. But, as we saw, anyone can add a note to a transaction, and those notes stick around too. It means we, as a community, have to be extra vigilant and double-check information, especially when it sounds too wild to be true.

Ripple’s Consistent Token Unlocking Pattern

It’s worth remembering that Ripple has a pretty set schedule for releasing XRP from escrow. Since 2017, they’ve been unlocking 1 billion XRP each month. Most of these tokens are then put back into escrow, with only a portion being sold or used as needed. This pattern is designed to be predictable. So, when you see an escrow release, it’s usually just part of this established process, not a sign of a sudden, massive sell-off.

Here’s a look at the typical monthly escrow process:

- Unlock: 1 billion XRP is released from escrow.

- Distribution: A portion may be used for operations, sales, or other business needs.

- Re-escrow: The remaining, unused XRP is typically returned to a new escrow account.

- Predictability: This cycle repeats monthly, providing a consistent supply schedule.

Wrapping Up the Ripple Sale

So, that’s the rundown on the Ripple sale. We’ve seen some big moves, some ups and downs, and definitely a lot of talk about XRP. While the price hasn’t always gone the way everyone hoped, Ripple itself has been busy, making big acquisitions and pushing forward. It’s a complex market, for sure. Keep an eye on things, do your own research, and decide what makes sense for you. Happy investing!

Frequently Asked Questions

What is the Ripple Sale?

The Ripple Sale refers to special deals and offers related to XRP, the digital currency used by Ripple. These sales often happen when there are significant events or changes in the market, like when Ripple wins a legal battle or makes big business moves.

Why did XRP’s price drop even after the SEC lawsuit win?

Even though Ripple won its lawsuit against the SEC, XRP’s price didn’t immediately skyrocket. Sometimes, the market gets excited before an event, and when it happens, people sell off. Plus, other factors like the overall economy and new regulations can affect the price.

What impact do Ripple’s acquisitions, like Ripple Prime and GTreasury, have on XRP?

When Ripple buys other companies, it helps them grow their services. Ripple Prime, for example, has grown a lot since being bought. These acquisitions make Ripple a bigger player in finance, which could eventually help XRP by increasing its use and demand.

What are some good signs for XRP investors in the future?

Investors are looking forward to big companies using XRP more, possibly through new investment products like ETFs. Also, new laws that make crypto rules clearer, like the CLARITY Act, and Ripple’s effort to get a bank charter could make XRP more trusted and valuable.

How can I tell if news about XRP is true or false?

Be careful of fake news! Recently, a fake message was attached to an XRP transaction, making it seem like Ripple sold a lot of XRP. It’s important to check official sources and understand that anyone can add messages to transactions on the XRP Ledger, which can sometimes cause confusion.

Is XRP a good investment right now?

XRP has seen ups and downs. While it has potential because of Ripple’s growth and upcoming events, it’s also risky like many cryptocurrencies. It’s wise to do your own research and understand that prices can change a lot. Some experts suggest looking at other investments too.