Energy news in 2025 is shaping up to be anything but boring. With new leaders taking office, supply chains still tangled, and technology changing fast, the global energy market is in for another wild ride. Clean energy keeps growing, but so do the challenges—think grid upgrades, storage, and keeping up with all those electric cars and data centers. Meanwhile, big political decisions and climate meetings will steer the direction of policies and investments. From Asia to Europe and everywhere in between, everyone’s trying to figure out how to keep the lights on, cut emissions, and make money. Here’s what’s coming up in energy news this year.

Key Takeaways

- Political changes, especially in the US, will shake up global energy policies and trading relationships in 2025.

- Clean energy like solar, wind, and batteries will keep breaking records, but issues like storage and grid upgrades need attention.

- AI and electric vehicles are driving up electricity demand, putting pressure on power grids and sparking new interest in nuclear energy.

- Trade barriers, tariffs, and local manufacturing are changing how companies invest in energy projects and where they build them.

- Climate talks and new carbon market rules will push countries and companies to rethink their clean energy plans and financing.

Geopolitical Forces Reshaping the Global Energy Market in 2025

Power struggles, policy swings, and resource competition are changing where energy comes from and how it flows around the world this year. In 2025, politics is just as important as technology in shaping energy decisions. Let’s unpack the main ways geopolitics is reshaping global energy markets right now.

Impact of US Political Shifts on International Energy Policy

The US presidential election has changed the direction of both American and global energy priorities. The policies coming from Washington are now tilting the scales in global oil, LNG, and renewables investment. A few things to note:

- There’s been a push to expand domestic crude oil production, though in practice, industry interest hasn’t spiked as much as politicians expected.

- New incentives for building liquefied natural gas (LNG) export infrastructure are being rolled out, but these projects will take years to deliver results.

- The administration’s stance on climate targets and Ukraine sanctions are impacting European and Asian energy security discussions.

Across the Atlantic, this has forced US allies to double down on energy diversification in case long-term partnerships change. That means more LNG deals with US suppliers, and a gradual shift away from risky import dependencies.

Navigating Supply Chain Disruptions Amid Energy Transition

Energy companies are still trying to work around major bottlenecks and hold-ups in 2025. Political tensions and tariffs, especially between the US, China, and EU, are making it tough for energy equipment (from solar panels to drilling rigs) to move smoothly across borders. Here’s what’s changed:

- More local manufacturing—governments want energy tech (batteries, solar PV) built closer to home, even if it costs more

- Rising prices and delays for big offshore oil and gas projects because of shortages in specialty vessels and technical kits

- Overcapacity in clean tech manufacturing—there’s now too much supply in some areas, which has driven costs down, but tariffs are pushing up other costs

A quick snapshot of supply chain effects:

| Sector | Pain Point | Short-Term Impact |

|---|---|---|

| Offshore Oil & Gas | Shipping, FPSOs | Project delays, cost hikes |

| Solar & Battery | Tariffs, Policy Shifts | Price volatility |

| Wind (onshore/offshore) | Rare Earths, Logistics | Slow installations |

Geo-Economic Competition and Its Effect on Energy Security

Energy transition is not just about moving fast—it’s also about controlling resources and technologies. Policymakers are now grappling with energy security in a world where supply reliability and price stability can’t be taken for granted. Competition is growing on several fronts:

- State-backed energy projects—Some countries are ramping up government investment to outpace rivals, especially in critical minerals and clean manufacturing.

- Strategic alliances—Nations are forming new trade blocs for energy, hedging against sudden price swings or sanctions.

- Focus on resilience—Diversification, stockpiling, and new grid connections are all on the rise.

In 2025, no one is taking energy supply for granted. The constant risk of trade wars, sanctions, and conflict—plus ongoing strife in Ukraine and the Middle East—means that every country is hedging its bets, investing in options, and sometimes paying a premium for peace of mind.

Geopolitics isn’t just background noise anymore—it’s front and center for every energy investor and policymaker trying to make sense of a tense, unpredictable year.

Innovations in Clean Energy Driving the Future of Power

Clean energy really took center stage this year. We’ve watched new tech move from flashy press releases right into real-world projects, plus a few setbacks that weren’t so widely advertised. Below, I dig into key changes in solar, wind, batteries, green fuels, and the challenges (and hopes) for hydrogen and carbon capture.

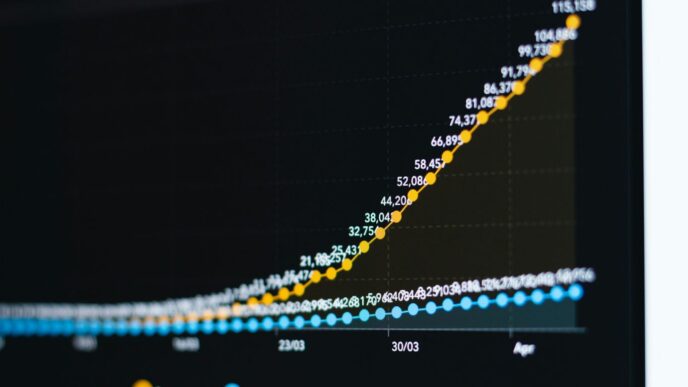

Record Growth in Solar, Wind, and Battery Storage

2025 broke records again, with solar, wind, and battery storage all seeing their highest growth rates yet. There was talk of slowdowns last year, but the numbers tell a different story.

| Technology | Global Growth Rate (2024-2025) |

|---|---|

| Solar PV | 35% increase in installations |

| Wind | 5% increase |

| Battery Storage | 76% jump (MWh installed) |

| EV Sales | 26% rise |

- Solar matched oil’s new primary energy boost for the first time—delivering far more useful energy per unit than crude thanks to higher conversion efficiency.

- Battery storage hit a milestone as the US alone added 18.2 GW—critical for keeping up with all that renewable power and stabilizing the energy grid.

- Wind made gains, though onshore projects outside Asia-Pacific hit some bumps due to permitting and grid connection delays.

Emerging Technologies in Sustainable Aviation Fuels

Planes are a big problem for emissions—so the push for sustainable aviation fuels (SAF) is getting serious. Here are three quick takes on what’s happening:

- Researchers in Australia started turning sugarcane waste into jet fuel, aiming to cut emissions from local flights.

- The EU and US airports are beginning to mandate SAF blending, meaning more airlines are now sourcing green fuel.

- Tech firms are eyeing ways to roll out these fuels at meaningful scale, not just for experimental flights but for busy regional and international routes.

Still, price and feedstock supply remain tough challenges.

Challenges and Solutions in Hydrogen and Carbon Capture

Hydrogen and carbon capture are getting lots of hype, but it’s not all smooth sailing. Here’s what’s going on:

- There’s more green hydrogen production than ever, with projects popping up in Europe, Australia, and the Middle East. Forecasts say we could hit 16 million tons of new green supply by 2030.

- Carbon capture, utilization and storage (CCUS) is slowly moving from pilot to real business—about 200 million metric tons a year in possible capacity by the end of the decade.

- Major hurdles: Funding remains uncertain, the tech can be expensive, and not all governments are moving in step.

Hydrogen and carbon capture may not be the fastest movers, but their breakthroughs could matter most for the sectors that are toughest to decarbonize.

In short, 2025’s clean energy breakthroughs weren’t just hype—they showed up in new projects, grid stats, and market shifts. The industry is moving fast (sometimes messily), and while there are still growing pains, momentum looks set to continue next year.

Energy News Spotlight: The Rise of AI and Electrification Demands

As we step further into 2025, a couple of big shifts keep stealing headlines—the surge in artificial intelligence and the relentless push toward electrification. The world’s energy cravings are changing at a startling pace, shaped by tech and transportation trends that refuse to slow down. This section breaks down how AI demand, electric cars, and even nuclear power are rewriting the rulebook for the global power grid.

AI-Fueled Data Center Boom and Electricity Needs

Let’s be real—AI has gone from buzzword to energy monster. Data centers are multiplying, and they’re hungry for power. The numbers are wild:

| Year | Global Data Center Electricity Use (TWh) |

|---|---|

| 2024 | 450 |

| 2025 | 500 |

| 2030* | 860 |

*Projected by Rystad Energy

- Companies are building data centers close to renewable sources to try and keep things green.

- Power purchase agreements (PPAs) between tech giants and utilities have become standard practice—these folks don’t just want any power, they want clean power.

- In some states, the rush to support all this activity has led to talk of rationing electricity or halting new data center construction until there’s more capacity.

Electric Vehicle Expansion and Grid Readiness

EVs are not a fad—they’re ramping up fast. But it’s putting serious pressure on old grids.

- In 2025, nearly 20 million new EVs are expected to hit the road worldwide.

- Charging infrastructure is popping up everywhere, but not always where it’s needed most.

- Transmission lines and substations in some cities are too old to handle all the new demand. Upgrades take ages—and cost a fortune.

Fixing the bottlenecks is going to need a team effort:

- Utilities will have to get creative about upgrading local infrastructure.

- City planners need to treat charging stations like any other critical transportation need.

- Policy makers must speed up the permitting process for grid projects. No one wants more delays.

Nuclear Power’s Comeback Driven by Digital Transformation

For a while, nuclear was on the back burner. But with AI and electrification growing so fast, nuclear is back in the spotlight. Here’s why:

- Nuclear plants can provide round-the-clock electricity—no sun or wind needed.

- States like Arizona and Wyoming are floating new projects to meet AI-driven demand spikes.

- The federal government finally seems willing to help with those sticky issues like waste storage.

Some hurdles remain, especially when it comes to building and regulating new nuclear plants. But if AI keeps growing, those hurdles might shrink out of sheer necessity.

Bottom line: In 2025, AI and electrification are tag-teaming in ways nobody saw coming—pushing everyone in the energy world to think faster, build smarter, and sometimes, dust off old ideas (like nuclear) for modern problems.

Supply Chain and Market Dynamics Transforming Energy Investments

It’s been a wild year for supply chains. Countries are really starting to look inward, and that’s changed the map for energy gear and materials. Tariffs on imported solar panels and batteries have raised costs and forced companies to think about moving production closer to home.

Key shifts we’re seeing this year:

- More factories for solar panels and batteries popping up in the US and Europe

- Governments offering big subsidies and incentives to local manufacturers

- Energy companies reworking contracts to minimize disruptions

But it’s not all smooth sailing. Protectionist policies can cause higher prices for consumers, and sometimes the parts you need just aren’t available locally. This is one of the driving trends covered in recent tech event analyses.

Mergers are everywhere. Big players are getting bigger as they snap up smaller, specialized firms. On the other hand, some oil companies are selling off their renewable assets to focus back on fossil fuels (or vice versa).

Here’s what’s going on:

- Renewables companies looking for scale are merging to weather shaky markets

- Oil majors are making strategic buys in wind, hydrogen, or battery tech

- Private equity firms are divesting in sectors spooked by slow returns

Here’s a quick table showing Q3 2025 activity in major energy M&A:

| Sector | Deals Closed | Total Value (USD bn) |

|---|---|---|

| Renewables | 11 | 21 |

| Oil & Gas | 6 | 30 |

| Batteries/Storage | 8 | 16 |

Bottlenecks are still a headache. Whether you’re trying to build a wind farm, drill for oil, or set up battery storage, getting the right equipment is harder than it was a few years back. Some common bottlenecks in 2025:

- Delays in specialized vessels for offshore oil

- Not enough workers for clean energy projects

- Shortages and longer wait times for key materials like inverters, chips, and cables

These issues hit the bottom line and slow project rollouts. Project delays have become a standard risk, and investors are pushing companies to get more creative and flexible with how they plan and execute.

Bottom line: if you’re betting on energy investments in 2025, you have to keep tabs on local rules, supplier reliability, and exactly where your stuff is coming from—otherwise, you might find yourself stuck waiting for a ship that’s never coming.

Low-Carbon Market Trends and the Climate Policy Challenge

COP29 and COP30 Outcomes Shaping Global Commitments

There’s no way around it: international climate talks pretty much set the tempo for new energy targets and funding. With COP29, countries put ambitious climate plans on the table—think net-zero goals and coal phase-outs backed by big players like Indonesia, Mexico, and the EU. But there’s a catch. The pledges made, like $300 billion per year for climate finance by 2035, are nowhere near the $1.3 trillion that’s supposed to get us on track.

Looking ahead to COP30 in Brazil, the pressure is on to go from words to actual progress. Next year’s summit will double as a checkpoint, and you can bet there’ll be close attention to whether these promises are more than just headlines. Rules for carbon trading—particularly under Article 6—could finally get ironed out, opening up new markets but also testing how real these commitments are.

Key developments to watch:

- Countries updating their national plans through 2035

- Push to embed climate goals into broader economic policy

- Spotlights on big polluters making or breaking global progress

- Ongoing tension between climate ambition and political or economic hurdles

Evolving Carbon Markets and Border Adjustment Mechanisms

Carbon markets grew up a bit this year, thanks mainly to reforms in the EU system and new moves like the Carbon Border Adjustment Mechanism (CBAM). These are ways for countries to put a price on carbon emissions—either to make polluters pay up or to protect their industries against imports from less strict countries. The CBAM’s rollout puts some real muscle behind the idea that it shouldn’t be easy to skirt climate rules with cheap, carbon-heavy imports.

Here’s a snapshot of where carbon pricing stands:

| Region | Major Policy | Carbon Price (USD/tCO₂) | Notes |

|---|---|---|---|

| European Union | EU ETS, CBAM | 70–90 | Phasing out free allowances quickly |

| North America | State/Province systems | 15–60 | Growth tied to regional policy shifts |

| Asia-Pacific | Emerging exchange pilots | 5–30 | Expanding but fragmented |

There’s good progress, but it’s not uniform. Carbon prices bounce up and down, and many countries haven’t set strong enough penalties to really change behavior. Even so, global trade is now being shaped by these border taxes and offset incentives.

Market Realities for Renewables and Cleantech Finance

This year brought another growth spurt for solar and battery storage—especially with solar set to match oil’s annual primary energy increase for the first time. Despite this milestone, renewables markets are having a rough ride. Shifting policies, uncertain subsidies, and a drop in green energy stock values mean it’s getting harder to raise cheap money for new projects.

Some things that are shaping this:

- Big oversupplies in battery and solar panel manufacturing, making prices fall but also squeezing profits

- Regional rebounds in biofuels as blending rules kick in

- More banks announcing clean energy to fossil fuel financing ratios—JPMorgan, Citi, even BNP Paribas are in the mix, but they’re pushing governments for clearer policy signals

- Slow progress in areas like hydrogen and industrial decarbonization, partly from technical and cost barriers

Investors are watching for stronger policies and dependable returns before putting even more money into the sector. At the same time, cleantech finance is quickly becoming a marker of whether countries are really putting their money where their mouth is when it comes to the energy transition. For a look at how even traditional sectors are adapting, check out smarter, user-friendly vehicles on the rise, a good example of how shifting policies speed up technology change.

In summary, 2025 is shaping up as a mixed bag—lots of targets and massive growth for clean tech, but plenty of policy and funding challenges that still need sorting out. If the rules around carbon markets keep maturing and COP30 can lock in real commitments, the next few years could look very different from the ups and downs we’ve seen lately.

Regional Leaders and Emerging Markets in the Energy Transition

Asia-Pacific’s Storage and Hydrogen Growth

Asia-Pacific is front and center for storage and hydrogen this year. Governments across the region are rolling out bigger and more ambitious battery projects—especially in China, South Korea, and Australia. Hydrogen is also starting to pick up, but it’s a mixed story. Japan and South Korea are talking big about hydrogen imports, while China keeps ramping up domestic electrolyzer capacity. India’s National Green Hydrogen Mission is still in its early days, but developers have already put up megawatt-scale pilot plants. Despite progress, grid upgrades and clear business models are still big hurdles for scaling hydrogen as a fuel, especially in heavy industry.

2025 Snapshot: Asia-Pacific Energy Storage

| Country | Utility-scale Storage Capacity (GW) | Hydrogen Policy Status |

|---|---|---|

| China | 25 | Active (Production incentives) |

| Australia | 8 | Early (Targeted pilots) |

| Japan | 4 | Import-focused, Early stage |

Europe’s Renewable Leadership and Industrial Hurdles

Europe’s big economies—Germany, Spain, Denmark—keep setting the pace for wind and solar. Offshore wind in the North Sea and solar growth in Southern Europe are breaking records like never before. But these gains come with tough problems. Heavy industry in the EU faces high electricity prices, so companies are seeing their costs climb just as carbon rules get stricter. Policymakers are focused on three things:

- Supporting green steel, cement, and chemical production

- Upgrading the grid for more renewables

- Smoothing out permitting and community opposition for new power lines and wind farms

There are no easy fixes for balancing the costs. Investments in storage and cross-border interconnections will take years to pay off, but without them, there’s a real risk of energy shortages during peak periods.

Opportunities and Barriers in Emerging Solar Markets

Emerging markets have become the hotspots for solar in 2025. India, Southeast Asia, the Middle East, and parts of Latin America are all reporting record annual installations. Growth rates above 50% in places like India, Pakistan, Turkey, and Saudi Arabia are turning heads. But scaling up is anything but simple. Regulatory and grid issues remain the biggest sticking points.

Three key barriers popping up in emerging solar markets:

- Auctions and subsidies that can be unpredictable or delayed

- Older grids that aren’t built for lots of decentralized solar

- Access to cheap finance, especially for small and medium projects

Countries that work through these challenges—by streamlining permitting, opening up grid access, and partnering with global companies—will capture the next wave of solar investment. For many governments, figuring out the balance between protecting local industries and letting in foreign technology will shape solar’s future for years to come.

Infrastructure and Technology: The Race to Meet New Energy Demands

The US is adding battery storage to the grid at a rate we’ve never seen before. In 2025 alone, energy storage is set to jump by 18.2 GW, according to projections from the EIA. This new storage is mostly coming online to help handle all the ups and downs from solar and wind farms popping up across the country. Lithium-ion batteries are leading the way, but there’s more talk now about alternatives like flow batteries and even compressed air—which might level up energy reliability. It’s one of those rare tech shifts you can actually see happening if you drive past a big substation; suddenly there’s rows of white shipping containers humming quietly in the background. Still, plenty of folks are asking: will it be enough to deal with growing peaks in demand, or are we just playing catch-up?

Here’s a snapshot of projected growth in battery storage capacity:

| Year | Total US Battery Storage (GW) |

|---|---|

| 2023 | 12.0 |

| 2024 | 16.0 |

| 2025 | 34.2 |

Transforming the grid for renewables isn’t just about plugging in more solar panels or wind turbines. The reality is much messier. Utilities and transmission companies are racing to overhaul power lines, substations, and control centers. Some of the biggest headaches?

- Congestion on old transmission routes slows down new wind and solar projects.

- Permits for new high-voltage lines drag on for years and cause delays everywhere.

- Grid operators are scrambling to handle electricity that swings wildly hour-to-hour as the sun sets or the wind drops.

Folks in the industry say that without serious upgrades, some of the clean power we’re generating could go to waste—like pouring water into a leaky bucket. More advanced control software, smart meters, and even microgrids are on the table, but the price tag and regulatory hurdles remain stubborn challenges.

Some days there’s so much wind and sun that electricity prices actually turn negative in parts of the country—other times, there’s not enough supply to go around. This wild back-and-forth is reshaping how utilities and grid planners think about energy management. Here’s what’s popping up as practical solutions:

- Demand response programs, where companies or homes agree to use less energy at peak times for a reward on their bill.

- Flexible power plants (like some natural gas facilities) that can ramp up fast when the grid is stressed.

- Virtual power plants, which pull together lots of small batteries or smart devices to act like one giant power plant.

Getting these flexible solutions right could be the difference between smooth sailing and rolling blackouts as the energy mix keeps shifting. Everyone from start-ups to big utilities is hustling to figure out how to balance supply and demand in real time. The stakes are high—not just for keeping the lights on, but also for squeezing every bit of value out of our new clean energy investments.

Conclusion

So, looking ahead to 2025, it’s clear the energy world isn’t slowing down. There’s a lot going on—new tech, political shakeups, and a real push for cleaner power. Some things are moving fast, like solar and battery storage, while others, like hydrogen and carbon capture, are still finding their feet. The big players are shifting strategies, and even smaller countries are making moves that could change the game. But it’s not all smooth sailing. Supply chains are still a headache, and the global economy isn’t exactly stable. Plus, with elections and new leaders, policies could change overnight. Still, the main takeaway is that the energy transition is happening, even if it’s messy and sometimes confusing. Companies, governments, and regular folks all have a part to play. The next year will bring surprises, but one thing’s for sure: energy will stay at the center of the world’s attention.