Applied Materials Articles: Financial Performance and Market Outlook

Fiscal Q1 2026 Earnings and Revenue Highlights

Applied Materials just dropped its Q1 2026 earnings report, and it looks pretty solid. They pulled in $7.012 billion in sales, with a net income of $2.026 billion. This comes after a bit of a settlement with the U.S. Department of Commerce regarding export controls, which cost them $252.5 million, but thankfully, the Department of Justice and SEC closed their cases with no action. On top of that, the company is guiding for Q2 2026 revenue to be around $7.65 billion, give or take $500 million. It seems like their new tools for making chips that are 2nm and smaller, plus their big $5 billion EPIC R&D center, are really starting to connect with the demand for AI infrastructure.

Analysis of International Revenue Contributions

Looking at where the money comes from is always interesting, especially for a company like Applied Materials that operates all over the globe. For the quarter ending January 2026, total revenue hit $7.01 billion, which was actually a small dip of 2.2% compared to the same time last year. But the international breakdown tells a story:

- China: Brought in $2.1 billion, making up 29.9% of the total. This was actually a bit higher than what analysts were expecting.

- Taiwan: Contributed $2.01 billion, or 26.3% of revenue.

- Korea: Added $1.47 billion, accounting for 19.2%.

- Japan: Generated $539.62 million (7%).

- Southeast Asia: Came in at $242.46 million (3.2%).

- Europe: Provided $221 million (around 3.1%).

It’s clear that international markets are a huge part of their business, and keeping an eye on these numbers is key to understanding how they’re doing.

Projected Full-Year Revenue and Earnings

Looking ahead, Applied Materials is expected to bring in about $30.59 billion in revenue for the full year. That’s a projected increase of 7.8% from the previous year. For 2028, some optimistic forecasts are pointing towards revenues around $32.5 billion and earnings of $9.2 billion. The company’s investment story really hinges on the belief that spending on AI, advanced logic, and memory chips will keep demand high for their equipment and services. The recent Q1 results and the Q2 guidance seem to back this up, showing that current demand is tied to actual customer spending on these new systems and the EPIC Center expansion.

Navigating Geopolitical Risks and Export Controls

Impact of Export Settlements on Investment Narrative

Applied Materials recently settled a significant export control issue with the U.S. Department of Commerce, paying $252.5 million. While this resolves a specific legal entanglement and brings closure from the Department of Justice and SEC, it doesn’t erase the bigger picture of policy risks, especially concerning China. This settlement, while costly, can be seen as removing a cloud of uncertainty that hung over the company’s investment story. Investors can now focus more on the company’s operational strengths and future growth drivers, like AI infrastructure, rather than a pending legal matter. However, the underlying geopolitical tensions and trade policies remain a factor to watch.

Broader Policy Risks and China Exposure

China continues to be a major market for Applied Materials, bringing in a substantial portion of its revenue. In the last reported quarter, China accounted for nearly 30% of total revenue, around $2.1 billion. While this shows the importance of the Chinese market, it also highlights the company’s exposure to potential policy shifts and trade restrictions. The U.S. government’s export controls, aimed at limiting China’s access to advanced semiconductor technology, create a complex operating environment. Applied Materials, like other chip equipment makers, must carefully manage its business in China to comply with regulations while still trying to capture market share. This balancing act is a key part of the investment narrative.

Geopolitical Scrutiny and Its Influence

Global politics and trade relations have a direct impact on companies like Applied Materials. The ongoing scrutiny of international trade, particularly between the U.S. and China, means that export controls and sanctions can change, affecting supply chains and market access. Investors need to keep an eye on these developments. For instance, changes in export rules could alter how much equipment can be sold to Chinese chipmakers, influencing Applied Materials’ revenue and profit forecasts. The company’s ability to adapt to these shifting geopolitical landscapes is a significant factor in its long-term success and stock performance. It’s not just about making great machines; it’s about being able to sell them where the demand is, within the rules of international trade.

Innovation in Chipmaking and AI Infrastructure

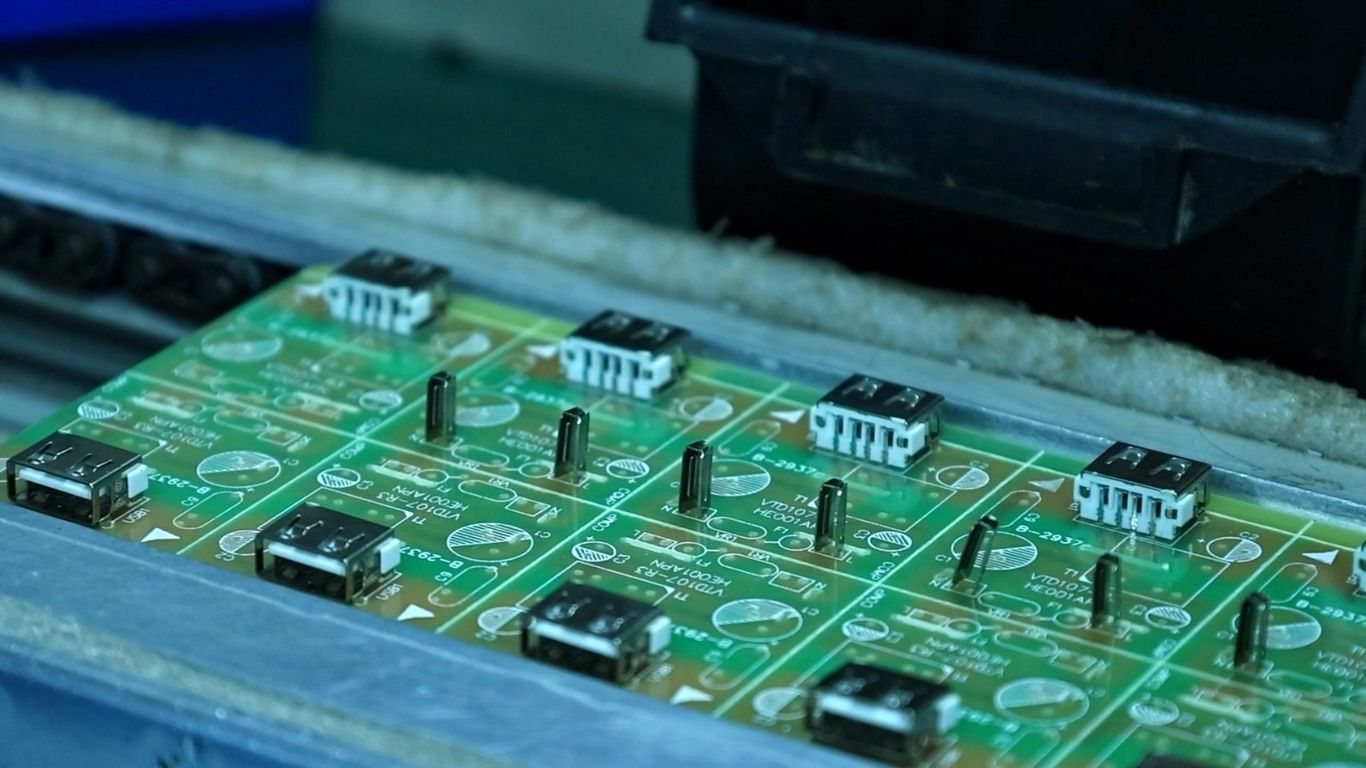

Applied Materials isn’t just sitting back; they’re actively pushing the boundaries in chip manufacturing, especially with the massive demand coming from AI. They’ve got new tools designed for making chips that are 2 nanometers and even smaller. This is pretty wild when you think about how tiny those components are getting.

New 2nm-and-Beyond Chipmaking Tools

These aren’t your average upgrades. We’re talking about equipment that can handle the incredibly complex processes needed for next-generation processors. Think about the kind of precision required to etch circuits that are just a few atoms wide. It’s a huge deal for companies building the brains behind AI, advanced computing, and even future smartphones.

The Role of the EPIC R&D Center

To keep this innovation engine running, Applied Materials has a big R&D setup called the EPIC Center. They’ve even got Samsung involved, which shows how important this collaboration is. This center is where a lot of the future tech is being dreamed up and tested. It’s a significant investment, around $5 billion, and it’s all about staying ahead of the curve in a super competitive market. The company’s commitment to R&D, like the EPIC center, is a big part of why they’re seen as a leader.

Driving Demand Through AI Infrastructure

It’s pretty clear that the boom in artificial intelligence is a major driver for Applied Materials. All those AI models and applications need serious computing power, and that means more advanced chips. Applied Materials is right there, providing the machinery that makes these chips possible. It’s a bit of a symbiotic relationship: AI needs better chips, and better chips need the kind of advanced manufacturing equipment that Applied Materials is developing. This push into AI infrastructure is a key reason for their strong performance and future outlook.

Investment Perspectives and Stock Valuation

So, let’s talk about where Applied Materials stands from an investor’s point of view. To really get behind owning this stock, you’ve got to believe that the demand for AI, advanced logic chips, and memory is going to keep pushing sales for their equipment and services. Right now, the big thing to watch is how well they execute on those AI-related equipment orders. The biggest worry, though? It’s still those export controls and all the geopolitical stuff. They recently settled a big export-control issue for $252.5 million, and the Justice Department and SEC closed their cases too, which is good. It clears some of the legal clouds, but the bigger policy risks, especially concerning China, are still out there.

Recapping the Applied Materials Investment Narrative

Basically, the story for investors is this: Applied Materials is a key player in building the infrastructure for AI. They’ve got new tools for making chips that are 2nm and even smaller, plus they’re putting a lot of money into a new $5 billion R&D center called the EPIC Center, which Samsung is also involved with. This is all tied to what customers are actually spending money on now for AI, not just some far-off promise. Their Q1 2026 results and the guidance for Q2 2026 revenue, which they expect to be around $7.65 billion (give or take $500 million), really back this up. It shows that the growth is coming from real customer spending on these advanced systems and the EPIC Center.

Fair Value Estimates and Upside Potential

Looking at the numbers, some analysts have put a "fair value" on Applied Materials’ stock. One estimate suggests a fair value of about $398.73. If that’s right, it means there’s potentially an 8% upside from where the stock is trading now. Of course, there are other estimates out there, and some think the stock could be worth less than half of its current price. It’s a wide range, and it really depends on how you weigh the risks and the potential.

Key Rewards and Warning Signs for Investors

When you’re looking at Applied Materials, there are definitely some good things and some things to be cautious about.

Key Rewards:

- AI Infrastructure Demand: The ongoing build-out of AI infrastructure is a massive tailwind, driving demand for their advanced chipmaking tools.

- Technological Leadership: Their investment in R&D, like the EPIC Center, positions them at the forefront of next-generation chip technology.

- Strong Financials: Recent earnings reports and revenue guidance show solid performance and execution.

Warning Signs:

- Geopolitical and Export Risks: Tensions and trade policies, particularly concerning China, continue to pose a significant risk to their international business.

- Market Dependence: A large portion of their revenue comes from overseas, making them susceptible to global economic shifts and political instability.

- Analyst Disagreement: The wide range in fair value estimates highlights uncertainty and differing views on the company’s future prospects.

Recent Stock Performance and Analyst Ratings

Let’s take a look at how Applied Materials’ stock has been doing lately and what the analysts are saying. It’s always good to see where things stand, right?

Examining Trends in Applied Materials’ Stock Value

Over the last month, the stock has actually gone up by about 12.9%. That’s pretty decent, especially when you compare it to the S&P 500, which dipped a bit during the same time. The tech sector, where Applied Materials sits, also saw a bit of a downturn. But looking at the last three months, Applied Materials has really climbed, gaining over 48%, while the S&P 500 only managed a small increase. The tech sector, however, was mostly flat over that longer period.

Comparison to S&P 500 and Technology Sector

Here’s a quick snapshot of how things have looked over different periods:

| Period | Applied Materials | S&P 500 | Technology Sector |

|---|---|---|---|

| Last 4 Weeks | +12.9% | -1.3% | -4.1% |

| Last 3 Months | +48.1% | +2.9% | -0.1% |

Zacks Rank and Short-Term Price Movements

Now, for the analyst side of things. Applied Materials currently holds a Zacks Rank of #1, which is a ‘Strong Buy’. This rating is based on how earnings estimates are changing, and it’s a pretty good indicator for predicting short-term stock price moves. Basically, when estimates go up, the stock price usually follows. This suggests that analysts are feeling pretty positive about the company’s near-term prospects.

Looking at fair value, some estimates put the stock at around $398.73, which means there’s a potential upside of about 8% from its current price. Of course, there are other views out there, with some analysts thinking it could be worth less than half that. It’s always a good idea to look at a few different perspectives before making any decisions.

Understanding Applied Materials’ Global Market Dependence

The Criticality of International Revenue Streams

Applied Materials doesn’t just sell its fancy chipmaking gear in the US; a huge chunk of its business happens overseas. It’s like a restaurant that relies heavily on tourists – if those tourists stop coming, the restaurant feels it. For AMAT, these international sales are super important for keeping the money coming in and growing the company. When we look at their financial reports, seeing how much they sell in places like China, Taiwan, and South Korea tells us a lot about how the company is doing overall. It’s not just about making great machines; it’s about getting them into the hands of manufacturers all over the world.

Balancing Domestic Challenges with Global Opportunities

Having a big international presence helps Applied Materials in a couple of ways. First, it means they aren’t putting all their eggs in one basket. If the US market hits a rough patch, sales in other countries can help smooth things out. Think of it as having multiple income streams. Second, some of the fastest-growing tech markets are outside the US. By being there, AMAT can tap into that growth. However, this global reach isn’t without its headaches. Things like different countries’ rules, currency swings, and political stuff can make things complicated. It’s a constant balancing act to take advantage of global chances while dealing with these potential problems.

Monitoring Overseas Revenue Trends for Performance Indicators

So, how do we know if AMAT is doing well internationally? We watch the numbers. Specifically, we look at where their revenue is coming from. For instance, in the quarter ending January 2026, China was a big player, bringing in $2.1 billion, which was about 30% of their total sales for that period. That’s a pretty significant piece of the pie. When these international numbers are strong, it usually means good things for the company’s stock. Analysts pay close attention to these figures because they can signal future performance. If sales in key overseas markets are up, it’s a good sign; if they’re down, it might be a warning. It’s one of the most direct ways to see how the company is performing on the world stage.

Wrapping It Up

So, looking at all this, Applied Materials seems to be in a pretty interesting spot. They’ve got strong earnings, and they’re pushing ahead with new tech for AI chips, which is a big deal. Plus, sorting out that export issue seems to have cleared some air. The company is counting on AI spending to keep things moving, and their recent numbers and future outlook back that up. Of course, there are always risks, especially with global trade stuff, but the big picture shows they’re investing in the future. It’s worth keeping an eye on how their international sales play out, as that really tells a story about where they’re headed. Overall, it looks like a company focused on growth, especially with all the AI buzz, but it’s smart to remember the global market can be unpredictable.