Planning for retirement can be a daunting and stressful task. Astonishingly, 81% of households do not know how much money they need to have saved by the time they retire. This uncertainty can lead to significant financial anxiety and risk. However, with proper planning and understanding, you can set yourself up for a secure and comfortable retirement.

Start Saving Early

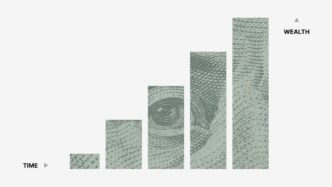

The earlier you start saving for retirement, the better. Time is one of the most powerful tools in building your retirement savings due to the magic of compound interest. Saving small amounts consistently over a long period can lead to substantial growth in your retirement fund. Delaying retirement savings can result in having to save significantly more each month to reach the same goal.

“For Gen Xers and Boomers, it’s critical to understand how much you need for retirement, as the window to save and protect your assets is closing. Without a clear target, gauging whether you’re saving adequately or exposing yourself to undue risk becomes a challenge. As retirement approaches, the focus shifts towards maintaining pace and safeguarding what you’ve already amassed. Knowing the amount you need enables you to manage risks smartly, protecting your portfolio from unnecessary market turbulence,” explains Michael A. Scarpati, CEO of RetireUS.

Understanding Your Retirement Needs

A crucial step in retirement planning is understanding how much you will need to maintain your desired lifestyle. This includes estimating expenses such as housing, healthcare, food, travel, and leisure activities. Many financial advisors suggest aiming to replace 70-80% of your pre-retirement income to maintain your standard of living. However, this can vary based on individual circumstances and goals.

Seeking Professional Advice

You don’t have to navigate retirement planning on your own. Financial experts can provide invaluable assistance in creating a tailored retirement plan. They help you pinpoint your exact financial needs and craft strategies to shield your investments from market fluctuations. Working with a financial advisor can provide peace of mind and confidence in your financial future.

“Working with a financial advisor is essential; they assist in pinpointing your exact financial needs and crafting strategies to shield your investments from market fluctuations,” says Scarpati. Advisors can offer guidance on a range of topics, from investment strategies and risk management to tax planning and estate planning.

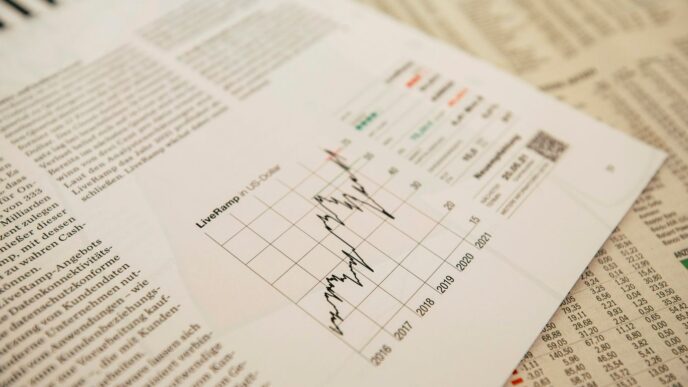

Building a Diverse Investment Portfolio

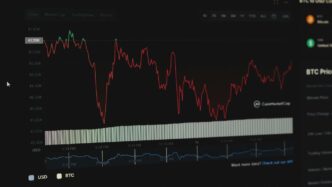

Diversifying your investments is a key strategy in managing risk and ensuring steady growth of your retirement savings. This means spreading your investments across different asset classes, such as stocks, bonds, and real estate, to reduce the impact of market volatility. A well-balanced portfolio can help protect your savings from market downturns and provide more consistent returns over time.

Regularly Reviewing and Adjusting Your Plan

Retirement planning is not a one-time task. It’s important to regularly review and adjust your plan to account for changes in your life circumstances, such as changes in income, expenses, or financial goals. Regular check-ins with your financial advisor can help ensure that your retirement plan remains on track and adapts to any new developments.

The Psychological Benefits of Planning

Having a clear retirement plan can also have significant psychological benefits. It reduces financial anxiety and provides a sense of security, knowing that you are taking proactive steps toward a stable future. Financial stress can have a considerable impact on mental and physical health, so alleviating this stress through careful planning can improve overall well-being.

Planning for retirement is a critical aspect of financial health that should not be overlooked. Starting early, understanding your needs, seeking professional advice, diversifying your investments, and regularly reviewing your plan are essential steps to ensure a secure and comfortable retirement. While the process can be complex, taking these steps can provide peace of mind and set you on the path to financial stability.