The world of crypto has been a bit of a rollercoaster lately, and a lot of that has to do with what happened with FTX. It’s been a rough patch, and people are still trying to figure out what it all means for Bitcoin and the wider market. We’re going to break down the latest news, look at how this compares to past market wobbles, and talk about what investors might want to do next. It’s a lot to take in, but understanding these developments is key for anyone involved in digital assets.

Key Takeaways

- Bitcoin’s current realized losses are hitting levels similar to the FTX collapse, showing just how much market stress there is right now.

- Unlike the FTX situation, which was about exchange failure, today’s market troubles are more tied to big economic issues and how investors are feeling.

- Historically, big drops in Bitcoin’s value have sometimes led to a market bottom, but the current lack of strong buyers makes things tricky in the short term.

- For investors, strategies like buying a little bit regularly (dollar-cost averaging) and keeping a long-term view are important when things are this shaky.

- The FTX mess has put a spotlight on regulation, and while there’s a push for clearer rules, it’s going to take time to sort everything out and put safeguards in place.

FTX News: Market Impact and Investor Sentiment

It’s been a rough ride for crypto lately, and honestly, it feels a bit like we’re reliving some of the worst moments. Recent data shows that Bitcoin realized losses are hitting levels we haven’t seen since the FTX collapse. That’s a big deal, and it’s definitely making people nervous.

Bitcoin Realized Losses Mirror FTX Collapse Levels

When we talk about Bitcoin realized losses, we’re looking at situations where people are selling their Bitcoin for less than they bought it for. It’s a pretty clear sign that the market is under a lot of stress. The fact that these losses are now matching what we saw during the FTX implosion is pretty eye-opening. It suggests we’re dealing with some serious market pain, similar to when the FTX collapse really shook things up. This metric really tells you how much pain investors are in.

Understanding Panic Selling Waves

So, who’s doing all this selling? It seems like a lot of it is coming from short-term holders. These are folks who bought Bitcoin more recently and probably don’t have the same long-term commitment or risk tolerance as older investors. When prices start dropping, they tend to bail out quickly. This can create a domino effect, pushing prices down even further. It’s a cycle driven by:

- Fear of losing more money

- Forced sales due to margin calls

- A general lack of confidence in a quick recovery

Short-Term Holders Driving Market Distress

These short-term holders are really the ones pushing the market down right now. Their quick exits put a lot of pressure on the buy-side, meaning there aren’t enough buyers to soak up all the selling. This imbalance is what causes prices to really struggle. It’s a tough situation, and it’s making it hard for the market to find a stable footing.

Comparing Market Crises: FTX vs. Current Conditions

It’s easy to get caught up in the current market downturn and feel like we’re reliving the FTX collapse all over again. And sure, the numbers might look similar in some ways – like Bitcoin realized losses hitting those same painful levels. But honestly, the reasons behind the chaos are pretty different this time around.

FTX Collapse: Exchange Failure and Counterparty Risk

Remember FTX? That whole situation was a massive blow because it was all about trust and the stability of the exchange itself. When FTX went down, it wasn’t just about prices dropping; it was about people losing access to their funds because the exchange failed. This brought counterparty risk front and center. You had to worry not just about the market, but about whether the platform you were using was even solvent. It was a liquidity crisis tied directly to a major player’s implosion.

Current Downturn: Macroeconomic Pressures and Investor Sentiment

Today’s market feels more like a broader economic hangover. We’re seeing a lot of pressure from things like inflation and rising interest rates, which are affecting all sorts of investments, not just crypto. This wider economic backdrop is a big reason why crypto prices are struggling, and it’s impacting investor sentiment across the board. It’s less about a single exchange failing and more about a general cautiousness in the financial world. People are pulling back because the economic outlook is uncertain, and that spills over into digital assets.

Distinguishing Causes for Informed Decisions

So, why does this difference matter? Because how you react should depend on what’s causing the pain. If it’s an exchange failure, you’re thinking about security and where you hold your assets. If it’s macroeconomic issues, you’re looking at the bigger economic picture and how long these pressures might last. Understanding these distinct causes helps investors make smarter choices about their portfolios and avoid making decisions based on a false comparison. It’s about recognizing that while the pain might feel similar, the underlying issues and potential paths forward are quite different, which is important for making informed decisions.

Bitcoin’s Future Price Action Post-FTX

Historical Precedents of Extreme Realized Losses

When Bitcoin’s realized losses start looking like they did during the FTX mess, it’s a big deal. It means a lot of people are selling their Bitcoin for less than they paid for it. Historically, though, these moments can actually be a sign that the market is hitting a bottom. Think of it like a big shakeout – the folks who are nervous or can’t afford to hold on get pushed out. This can clear the path for more serious investors to come in at lower prices, setting things up for a healthier climb later on.

Challenges Posed by Thin Buy-Side Support

Right now, though, there’s a bit of a snag. The number of people ready to buy Bitcoin isn’t as strong as it used to be. When there aren’t enough buyers to soak up all the selling, prices can keep dropping for a while before they find a stable spot. It’s like trying to sell a lot of stuff when there aren’t many shoppers around – you might have to keep lowering the price.

Clearing the Way for Stronger Investors

So, what does this all mean for Bitcoin’s price? Well, the FTX collapse was a different beast, mostly about trust in exchanges and the companies behind them. Today’s market dip is more about the bigger economic picture and how people are feeling about investing in general. Once the dust settles from this current downturn, and the less committed investors have sold, it could create a more solid base for Bitcoin’s next move upwards. It’s a painful process, for sure, but it often leads to a more sustainable recovery. We’ve seen this pattern before, where extreme selling pressure eventually gives way to renewed interest from those with a longer-term view.

Navigating Volatility: Strategies for Investors

Okay, so the market’s been pretty wild lately, right? Seeing Bitcoin’s realized losses get close to FTX collapse levels can make anyone a bit nervous. It feels like a lot of people are hitting the sell button out of fear. But honestly, this kind of stuff has happened before in crypto. The key is not to panic and to have a plan.

Dollar-Cost Averaging During Downturns

This is a classic strategy, and for good reason. Instead of trying to time the market perfectly – which, let’s be real, is almost impossible – you invest a fixed amount of money at regular intervals. So, if Bitcoin is $30,000 today, you buy a certain dollar amount. If it drops to $25,000 next week, you buy the same dollar amount. This means you end up buying more coins when the price is low and fewer when it’s high. It smooths out your average purchase price over time and takes the emotion out of it. It’s like chipping away at a big task, bit by bit, rather than trying to do it all at once.

Implementing Risk Management Parameters

This is super important. You need to decide beforehand how much you’re willing to lose on any single investment or your portfolio overall. Think of it like setting guardrails. Maybe you decide you won’t let any single crypto position be more than 5% of your total portfolio, or you set a stop-loss order that automatically sells your crypto if it drops by a certain percentage. It’s about protecting yourself from those really bad days where everything seems to go south. Having these rules in place before things get crazy helps you stick to them when emotions are running high.

Monitoring On-Chain Metrics for Recovery Signals

This sounds a bit technical, but it’s basically looking at the actual data on the blockchain to see what’s happening. Things like how many people are moving Bitcoin onto exchanges (which can signal selling pressure) versus how many are moving it off (which can signal holding or accumulation). You can also look at metrics that show how many long-term holders are still around versus short-term traders who might bail quickly. When you start seeing more coins being held for longer periods and less panic selling, it can be a good sign that the market is starting to stabilize. It’s like watching the weather report before deciding if it’s safe to go sailing.

Maintaining a Long-Term Perspective

This is probably the hardest one, especially when you see your portfolio value drop. But remember why you got into crypto in the first place. Most people who have done well in crypto haven’t done it by day trading or trying to catch every little up and down. They’ve held through the tough times because they believe in the technology and its future. Think of these downturns as temporary bumps in the road, not the end of the journey. If you’re investing in projects you genuinely believe in, weathering these storms can pay off down the line. It’s about focusing on the destination, not just the potholes along the way.

Regulatory Outlook Post-FTX Fiasco

The fallout from the FTX collapse has definitely put regulators in the hot seat. Before all that went down, there was some hope that 2022 might wrap up with a clearer picture of crypto rules in the US. Bills like the Digital Commodities Consumer Protection Act were being talked about, and the House Financial Services Committee had put out a version of a stablecoin bill. But then, FTX imploded, and instead of moving forward with new laws, we got a lot of hearings. It’s still really up in the air how all of this will shape future legislation.

On one hand, the FTX mess makes a strong case for needing rules now. It showed everyone how quickly things can go wrong when there aren’t clear guardrails. But on the other hand, lawmakers need time to really dig into what happened, understand all the moving parts, and figure out what changes are actually needed to stop something similar from happening again. It’s a balancing act between speed and thoroughness.

Legislative Hearings Replacing Forward Movement

Instead of seeing progress on new crypto laws, the focus has shifted heavily to investigations and public hearings. These sessions are meant to shed light on the failures that led to FTX’s downfall, but they also slow down the actual process of creating new regulations. It feels like a lot of talking and not enough building right now.

Urgency for Greater Regulatory Clarity

Despite the delays caused by investigations, there’s a growing sense of urgency among many in the industry and among policymakers to get some clear rules in place. The lack of defined regulations has been blamed, at least in part, for the kind of risky behavior that led to FTX’s collapse. Everyone agrees that clearer rules are needed, but the path to getting there is proving complicated.

Unpacking Events for Future Safeguards

Regulators are now tasked with a deep dive into the FTX situation. This involves understanding the complex web of relationships, financial dealings, and alleged mismanagement that contributed to the exchange’s failure. The goal is to identify specific points of failure and use that knowledge to build stronger safeguards into future regulations. This detailed analysis is seen as a necessary step to prevent similar catastrophic events and rebuild trust in the digital asset space.

Macroeconomic Forces Shaping Crypto Markets

It feels like everything that happens in the crypto world these days is tied to what’s going on with the bigger economy. Ever since COVID-19 hit, these big economic trends have been calling the shots, not just for stocks and bonds, but for digital assets too. Even though Bitcoin has its own quirks, you really can’t ignore the global economic picture.

Dominant Influence Since Covid-19

Remember how things were before 2020? Crypto felt like its own little island sometimes. Now? Not so much. The pandemic really kicked off a period where major economic events have had a huge say in how crypto prices move. It’s like the whole financial world got pulled closer together, and crypto got dragged along for the ride.

Elevated Correlations with Traditional Assets

This closeness means crypto, especially Bitcoin, has been moving more in sync with things like the stock market. We saw this connection ease up a bit from its summer highs, but it’s still way stronger than it used to be before the pandemic. So, when the stock market sneezes, crypto often catches a cold.

Navigating Unprecedented Interest Rate and Inflation Environments

We’re in some pretty wild economic territory right now. The current mix of high inflation and rising interest rates is something most people who work in finance today have never really experienced. For decades, falling interest rates made it easier to just buy dips in the market. This new environment, with rates going up and prices still climbing, is a whole different ballgame. It makes predicting market moves a lot trickier because the old rules don’t seem to apply anymore. It’s a tough time for investors trying to figure out what to do next.

Industry Performance Review Amidst Failures

Crypto Equities Outperform Bitcoin in Decline

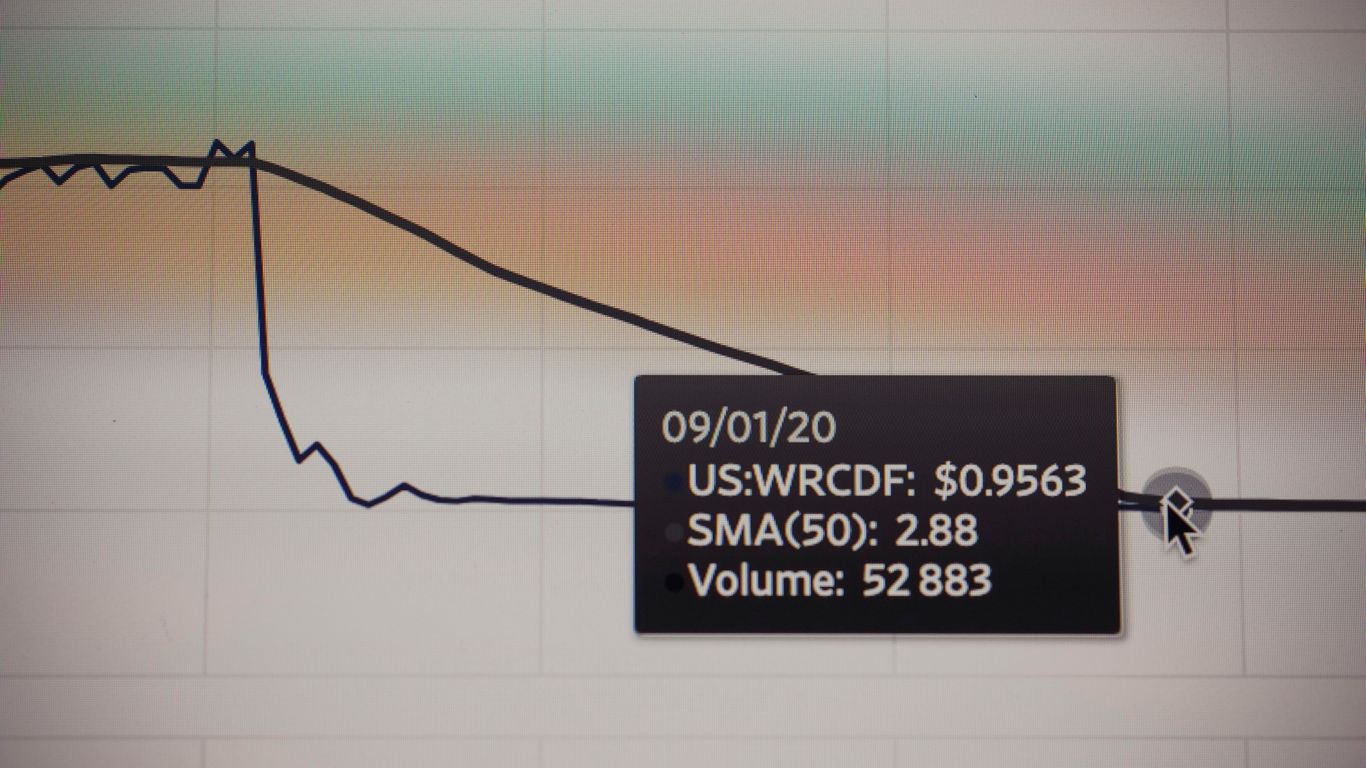

It’s been a rough ride for the crypto space, and not just for the big digital coins. Looking at how different parts of the industry have performed, especially in the wake of major collapses like FTX, tells a story. While Bitcoin saw a notable drop, crypto-related stocks actually performed worse. This isn’t too surprising when you consider how these companies are structured. They often have a lot of what’s called operating leverage, meaning their costs are high relative to their revenue. When the price of digital assets goes down, it hits their bottom line pretty hard. It’s like a domino effect; when the core product falters, companies built around it feel the pinch even more.

Operating Leverage Impact on Digital Asset Companies

Think about it this way: companies that provide services or build products tied directly to crypto prices are more exposed. If Bitcoin or Ethereum prices plummet, their revenue streams can dry up quickly, but their expenses – like salaries, office rent, and development costs – often stay the same. This mismatch is what operating leverage is all about. It can amplify gains when things are good, but it really magnifies losses when the market turns south. We saw this play out significantly in the last quarter of 2022. Even though the broader economic picture was starting to look a bit better, with inflation easing and interest rate hike expectations cooling, the fallout from exchange failures like FTX overshadowed any potential positive market sentiment. It really shows how interconnected the crypto ecosystem is and how the failure of one major player can ripple through the entire industry. The collapse of FTX, in particular, created a crisis of confidence that overshadowed other market factors. FTX’s collapse represents a major failure in the industry.

Declining Stablecoin Supply Reflecting Ecosystem Exits

Another interesting trend to watch is the stablecoin supply. Stablecoins are meant to be, well, stable – pegged to a fiat currency like the US dollar. When the supply of stablecoins starts to shrink, it often signals that people are pulling money out of the crypto ecosystem altogether. It’s not just about moving from one volatile asset to another; it’s about exiting the space. In the past few quarters, we’ve seen a noticeable decline in stablecoin supply. This suggests that investors, spooked by the volatility and the failures of major platforms, are moving their funds out of crypto. While flows into Bitcoin funds have been relatively flat, the shrinking stablecoin market points to a broader trend of people leaving the crypto space, at least for now. It’s a clear indicator that the confidence shaken by events like the FTX implosion is having a lasting effect on overall market participation.

Wrapping It Up

So, looking back at everything that’s happened with FTX, it’s clear the crypto world has been through a rough patch. We’ve seen big drops in prices, and honestly, it feels a bit like the FTX collapse all over again with how much Bitcoin has lost value recently. But here’s the thing: the reasons for today’s market pain are a bit different. It’s less about one company failing and more about bigger economic stuff and how people are feeling about investing right now. Even though it’s tough, history shows that these big drops can sometimes lead to a fresh start for Bitcoin, clearing out the weaker players and making room for new growth. It’s not easy to watch your investments go down, but for those who stick around, there might be opportunities. Just remember to keep an eye on things, manage your risks, and try to think long-term, because this market sure does move fast.

Frequently Asked Questions

Why are Bitcoin losses so high right now?

Bitcoin losses are high because many people are selling their Bitcoin for less than they paid for it. This is happening because some investors are scared about prices dropping further, and others are being forced to sell because they borrowed money to buy Bitcoin and can’t afford to pay it back.

How is the current market situation different from when FTX collapsed?

When FTX failed, the main problem was that the company running the exchange went broke and couldn’t give people their money back. Now, the market is struggling more because of big economic problems, like rising prices and higher interest rates, which make people nervous about investing in risky things like crypto.

Could Bitcoin’s price go up after all these losses?

Sometimes, when a lot of people sell their Bitcoin at a loss, it can actually help the market in the long run. It gets rid of the people who are quick to sell when things get tough, making room for more serious investors. However, right now, there aren’t many buyers, so prices might still go down a bit before they start to recover.

What should investors do when the market is so shaky?

Smart investors often keep buying a little bit of Bitcoin regularly, even when prices are low. They also set limits on how much they’re willing to lose and watch for signs that the market is getting better. Most importantly, they try not to panic and remember they’re investing for the long term.

Are new rules coming for crypto because of what happened with FTX?

Yes, definitely. What happened with FTX has made governments realize that crypto needs more rules. They are holding meetings and looking closely at everything that went wrong to figure out how to create better rules to protect people and prevent similar problems in the future.

How do big economic issues affect crypto prices?

Big economic problems, like high inflation and rising interest rates, make people more worried about their money. This often causes them to sell things they see as risky, like crypto, and move their money to safer places. Crypto prices have been moving more like stocks lately because of these big economic events.