The tech sector is poised for a significant rebound, according to Goldman Sachs, which predicts that the so-called "Magnificent Seven" tech stocks will outperform the broader market in 2025. This comes after a challenging start to the year, where these stocks faced headwinds from trade tensions and market volatility.

Key Takeaways

- Goldman Sachs anticipates the Magnificent Seven will outperform the S&P 500 in 2025.

- The group includes major players like Tesla, Nvidia, and Microsoft.

- Despite a rough first quarter, earnings growth for these stocks remains strong.

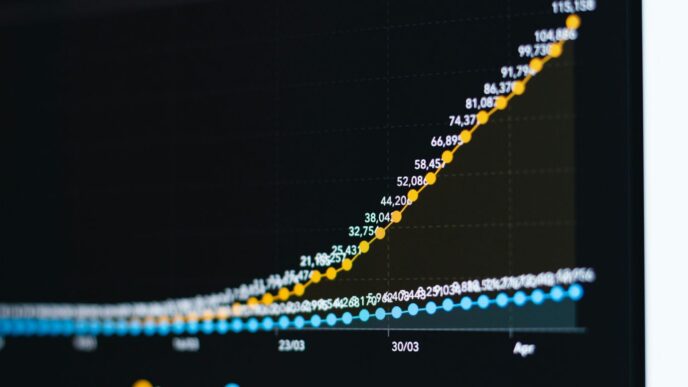

- Short sellers have faced substantial losses as tech stocks have rallied since April.

The Magnificent Seven: Who Are They?

The Magnificent Seven refers to a group of leading tech companies that have dominated the market in recent years. This group includes:

- Tesla

- Nvidia

- Microsoft

- Meta

- Amazon

- Alphabet

- Apple

These companies have been pivotal in driving market trends and investor sentiment.

Recent Performance and Predictions

Goldman Sachs’ chief equity strategist, David Kostin, has expressed optimism about the future performance of these tech giants. Despite a 5% decline year-to-date, Kostin believes that the Magnificent Seven will see a resurgence, driven by superior earnings growth.

- Earnings Growth: The Magnificent Seven is projected to achieve a 28% growth in earnings per share, significantly outpacing the S&P 500’s 9% growth.

- Valuation: The current valuations of these stocks are more attractive compared to previous years, making them appealing for investors looking for growth opportunities.

Impact on Short Sellers

The recent rally in tech stocks has been particularly painful for short sellers, who have seen their positions suffer significant losses. According to S3 Partners, short sellers lost approximately $257 billion from April 8 to May 20, with the Magnificent Seven accounting for nearly $36 billion of that total.

- Key Losses:

- Tesla: $9.7 billion in losses

- Nvidia: $9.6 billion in losses

- Microsoft: $5.1 billion in losses

This trend highlights the volatility and risks associated with betting against these high-performing stocks.

Hedge Fund Strategies Shift

Interestingly, hedge funds have begun to reduce their holdings in the Magnificent Seven while increasing their investments in Chinese companies listed in the U.S. This shift comes amid ongoing trade tensions and reflects a strategic pivot towards perceived opportunities in the Chinese market, despite the risks involved.

Conclusion

As Goldman Sachs forecasts a strong rebound for the Magnificent Seven, investors are closely watching the tech sector for signs of sustained growth. With attractive valuations and robust earnings growth, these tech giants may once again lead the market, providing opportunities for both long-term investors and those looking to capitalize on short-term trends. The coming months will be crucial in determining whether these predictions hold true as the market continues to navigate through economic uncertainties.

Sources

- Tesla, Nvidia Cause Pain for Short Seller As Mag 7 Stocks Soar Since April, Business Insider.

- Stock Market Outlook: Mag 7 Tech Stocks to Have Another Winning Year, GS Says, Business Insider.

- Hedge Funds Cut Magnificent Seven Stocks, Bought China ADRs, Bloomberg.com.