Hedge fund analysts face an increasingly daunting challenge: processing vast quantities of unstructured data while maintaining the speed and precision necessary to generate alpha in competitive markets. The volume of information spanning regulatory filings, earnings transcripts, expert call notes, and proprietary research has grown exponentially, creating bottlenecks in traditional research workflows. Financial institutions are turning to artificial intelligence platforms like Hebbia to address these operational constraints, with some firms reporting significant improvements in analytical capacity and decision-making speed.

Leading hedge fund teams now use AI-powered platforms to scale output, accelerate insight generation, and reduce the risk of missing critical signals embedded within massive document repositories. These technological solutions represent a fundamental shift from manual document review toward automated extraction and synthesis, enabling analysts to focus on judgment and strategy rather than information gathering. The transformation affects multiple aspects of hedge fund operations, from initial coverage expansion to ongoing portfolio monitoring.

Accelerating Coverage Expansion Across New Sectors

Establishing coverage of new companies or sectors traditionally required analysts to spend weeks manually reviewing historical filings, transcripts, and internal notes. This process slows coverage initiation and often leaves gaps in understanding, particularly when analysts need to quickly grasp company structure, segment reporting, and historical strategy to form actionable investment theses. The time investment creates opportunity costs, as analysts dedicating resources to foundational research cannot simultaneously pursue active investment ideas.

Hebbia aggregates relevant documents into queryable workspaces where analysts can extract structured insights across multiple years of filings simultaneously. Specific queries might request revenue breakdowns by business line and geography over five-year periods, summaries of management commentary on growth drivers, or comparisons of risk factor disclosures across a decade of annual reports. These capabilities compress research timelines from weeks to days while producing citation-linked outputs that support defensible investment recommendations.

The technology maintains document integrity throughout the analysis process, preserving layout and structure while decomposing content into granular components. Analysts can verify every data point through direct source citations, ensuring that structured intelligence exported into investment memos or presentations rests on verifiable foundations rather than algorithmic interpretation. This verification capability addresses concerns about accuracy that have historically limited AI adoption in financial services.

Mapping Value Chain Exposures Through Cross-Company Analysis

Portfolio companies exist within complex value chains where upstream suppliers and downstream distributors create interconnected exposure networks. Signals about cost pressures, demand shifts, or operational bottlenecks scatter across multiple sources, making manual cross-referencing time-consuming and prone to errors. Understanding these relationships proves essential for identifying both risks and opportunities that affect portfolio positioning.

Advanced platforms enable analysts to ingest filings, transcripts, news articles, and internal research for all relevant companies, then query across these document sets simultaneously to surface cross-company patterns. Queries might identify which suppliers reported rising input costs during specific quarters, highlight downstream distributors mentioning demand softness, or summarize operational concerns among smaller sector participants over multi-year periods. The platform’s ability to maintain unlimited context allows pattern detection across companies and time periods that would require months of manual analysis.

Structured outputs present company-level and sector-level signals in formats ready for portfolio manager review. Every data point traces back to original sources, enabling rapid verification when investment decisions require high confidence. Analysts can quickly understand how disruptions ripple through value chains, generating actionable insights for portfolio allocation, risk mitigation, or trade ideas. This systematic approach to value chain monitoring often reveals opportunities that relationship-driven research methods overlook.

Detecting Management Sentiment Shifts Across Competitive Sets

Subtle changes in management tone, guidance, or strategic emphasis can signal shifting competitive dynamics or emerging business challenges. Traditional transcript review processes make systematic tone comparison difficult, particularly when analysts need to track sentiment evolution across multiple companies over extended periods. Small but meaningful signals frequently escape detection when manual review focuses on major announcements rather than nuanced language shifts.

AI-powered analysis aligns commentary across transcripts, filings, and internal notes, enabling queries that compare confidence levels on pricing power, identify peers emphasizing particular strategic priorities, or highlight changes in management language on specific topics versus previous periods. The technology preserves speaker attribution and formatting while enabling cross-company, multi-year comparisons that surface subtle divergences informing long/short positioning or risk assessment.

Side-by-side tables and narrative summaries with citation-linked excerpts allow analysts to present defensible, evidence-backed insights to investment committees. These outputs can be instantly exported into decks or internal memos, reducing the time between insight generation and actionable portfolio decisions. The capability proves particularly valuable during earnings season when analysts must rapidly assess multiple companies against competitive benchmarks.

Converting Proprietary Research Into Searchable Intelligence

Expert calls, surveys, site visits, and trade newsletters often contain unique insights that drive alpha, but these assets typically exist across inboxes, customer relationship management systems, and personal folders in formats that resist efficient retrieval. This fragmentation means valuable intelligence remains underutilized, with analysts sometimes repeating work or failing to connect proprietary insights with public information during critical decision points.

Modern platforms centralize proprietary research into private workspaces where all content becomes fully searchable while preserving structure and attribution. Analysts can query years of internal notes alongside public filings and transcripts, connecting unique expert insights directly to management disclosures or market commentary. Queries might request summaries of expert perspectives on pricing power within specific industries, comparisons between internal meeting notes and public earnings calls, or the extraction of recurring themes from site visit documentation across extended periods.

Outputs arrive structured, citation-linked, and grouped by source, letting teams trace every conclusion to its original note or transcript. Proprietary insights that once sat isolated in individual files become living knowledge bases that compound in value with each new expert call, survey, or memo. This transformation proves particularly significant for hedge funds using AI to enhance research capabilities, where information advantages directly translate into investment returns.

Maximizing Expert Call Value Through Comprehensive Preparation

Expert calls represent significant expenses, with single consultations sometimes costing thousands of dollars. Maximizing return on these investments requires focusing on net-new questions rather than repeating topics previously addressed, but tracking prior inquiries and responses proves difficult without centralized systems. Duplication wastes both time and money while potentially missing important gaps where additional inquiry could yield valuable insights.

Platforms that index and organize all call transcripts, notes, and internal research enable targeted queries identifying which questions have been answered for specific companies, generating new questions on topics not yet addressed, or highlighting areas where prior guidance diverged from actual outcomes. These capabilities produce structured, citation-linked question lists with highlighted excerpts from previous calls, allowing analysts to generate prioritized, net-new questions ready for export into call preparation documents.

The systematic approach ensures each expert interaction builds on previous conversations rather than retreading familiar ground. Teams maximize the value of each expert interaction while avoiding redundant or low-value queries by leveraging the full knowledge base. This efficiency becomes increasingly important as expert networks expand and hedge funds seek to differentiate through superior information gathering rather than merely broader network access.

Monitoring Sector-Wide Disruptions Through Systematic Signal Detection

Macro or sector disruptions can impact multiple portfolio positions simultaneously, requiring rapid detection of emerging risks or catalysts across diverse information sources. Traditional monitoring approaches depend heavily on analyst attention and institutional relationships, creating coverage gaps as markets expand and information volumes increase. Manual processes struggle to maintain comprehensive surveillance across portfolios containing dozens or hundreds of positions.

Advanced platforms ingest relevant documents while preserving context, chronology, and attribution, enabling queries that identify companies reporting specific exposures during particular quarters, summarize sector-wide cost changes over defined periods, or track recurring risk disclosures across peer groups over time. The technology’s ability to query across decades of information in seconds allows analysts to establish historical context for current developments, distinguishing genuine disruptions from ordinary variance.

Structured outputs present patterns visible across entire portfolios, supporting proactive position adjustments rather than reactive responses to widely recognized developments. Cross-document memory and indexing capabilities enable tracking of longitudinal trends and identification of risk or opportunity clusters that inform portfolio manager decisions. This systematic monitoring provides hedge funds with operational advantages as information generation accelerates and competitive pressures intensify.

Technology Architecture Supporting Comprehensive Analysis

The platforms enabling these capabilities combine multiple technical components designed specifically for financial research requirements. Document decomposition technology preserves complete context while making content queryable, and unlimited context windows allow simultaneous analysis across hundreds of documents without loss of fidelity. This architecture addresses fundamental challenges facing hedge fund analysts: accessing and synthesizing relevant information from vast collections without losing critical nuance or introducing errors through excessive summarization.

Traditional retrieval systems relying on semantic similarity often miss important provisions or misrepresent complex disclosures by stripping context. Full document integrity with precise source linking allows teams to surface individual clauses or specific statements that prove decisive for investment decisions, maintaining confidence that extracted content accurately reflects original material rather than representing system interpretations. This verifiability proves essential in hedge funds, where misunderstanding key details can result in substantial losses.

The technology does not attempt to replace human judgment regarding investment merit. Rather, it automates the extraction and structuring of content so professionals focus on actual investment decisions rather than information gathering. This distinction matters because hedge fund success ultimately depends on making sound judgments about business quality, valuation, and timing rather than merely processing documents efficiently. The platforms function as force multipliers that amplify analyst capabilities without substituting for domain expertise and market intuition.

Market Adoption Reflects Operational Value Recognition

Financial institutions serving over one-third of the largest asset managers by assets under management have adopted AI-powered research platforms, demonstrating that these systems deliver measurable value beyond experimental applications. The shift from pilot programs to production deployments represents recognition that AI capabilities now match requirements imposed by modern financial markets, where information advantages persist for hours rather than days.

Organizations implementing these technologies report that analysts process substantially more investment opportunities while maintaining or improving analysis quality. Efficiency gains manifest not only in faster transaction execution but also in the ability to pursue opportunities that resource constraints would otherwise force firms to decline. This capacity expansion proves particularly valuable as hedge funds compete in increasingly efficient markets where generating alpha requires processing more information faster than competitors.

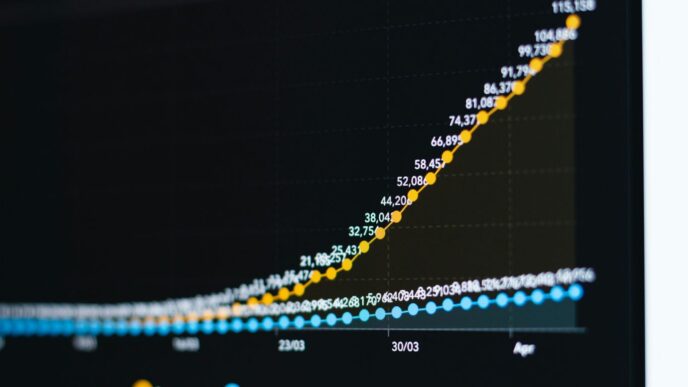

The AI platform recently surpassed one billion pages processed, representing growth from 47 million pages twelve months earlier. At average human reading speeds, this volume equals 1.5 million days of continuous reading compressed into seconds and transformed into actionable intelligence. The milestone demonstrates that financial institutions have moved beyond experimental AI pilots to deploy these systems at a production scale across critical workflows.

Future Implications For Hedge Fund Operations

The adoption of AI-powered research platforms represents an inflection point where technology moves from supporting existing workflows to enabling entirely new analytical approaches. Teams can now ramp coverage, track value chains, compare management sentiment, analyze proprietary research, prepare expert calls, and monitor sector disruptions with structured, citation-linked outputs ready for immediate use in investment processes. This comprehensive capability set transforms how hedge funds generate and validate investment ideas.

As these platforms mature and adoption broadens, competitive advantages will likely shift toward organizations that integrate AI capabilities most effectively into decision-making processes. Hebbia provides tools for extracting and structuring information, but investment success still requires human judgment about what questions to ask and how to interpret results within the market context. Analysts move faster, act with confidence, and make smarter, evidence-backed investment decisions when technology handles information processing while humans focus on strategy and judgment.

The transformation of hedge fund research through AI platforms reflects broader patterns across financial services where document-intensive workflows benefit from automation. Organizations that successfully deploy these capabilities gain advantages in speed, comprehensiveness, and consistency that traditional manual processes cannot match. As information volumes continue growing and markets become more efficient, technology enabling systematic analysis at scale will increasingly separate leading firms from competitors relying on legacy research methods.