In the midst of a global energy transition, clean technology (CleanTech) startups are increasingly gaining traction not just as niche players but as powerful forces reshaping the global energy economy. From novel battery storage systems to AI-driven grid optimisation, these companies are disrupting traditional energy markets, creating new business models, and influencing how industries, consumers and governments think about energy. With mounting investment, evolving policy frameworks and mounting pressure on sustainability, understanding how CleanTech startups are redefining the energy economy has never been more critical.

Technological Breakthroughs Driving the Transformation

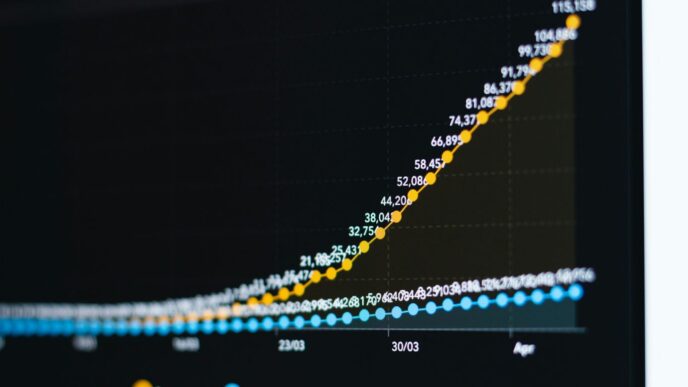

CleanTech startups are unlocking new layers of innovation across the energy sector. One major area is energy storage: companies developing long-duration batteries are enabling renewables to compete more effectively with fossil fuels. According to the Clean Investment Monitor, companies announced more than US $97 billion in clean energy and transport manufacturing investment in the past two years, with a strong focus on storage, solar and hydrogen technologies.

Another breakthrough lies in digital intelligence and grid optimisation. For instance, the International Energy Agency maintains a “Energy Start-up Data Explorer” tool tracking hundreds of energy startups across 40 countries, highlighting how entrepreneurial activity is integral to commercialising the next-gen energy architecture.

A notable real-world case is Exowatt (US), a startup focused on thermal energy storage for AI-intensive data centres. Founded in 2023 and backed by significant venture firms, Exowatt’s modular solar-thermal system aims to deliver up to 24 hours of dispatchable renewable power, an important step toward reducing reliance on traditional baseload generation. These kinds of innovations are critical as demand for data, AI and electrification soars.

Another startup, Verdigris Technologies (US), uses AI and IoT to optimise building energy consumption and reduce waste. Their systems, deployed in commercial buildings globally, show how energy efficiency is no longer just a cost-saving measure but a core value proposition for CleanTech startups.

Collectively, these technological breakthroughs not only improve performance and cost-competitiveness but also shift the value chain toward smarter, leaner, and more flexible energy systems. As traditional utilities face increasing pressure, startups are helping accelerate the shift to distributed, decarbonised systems.

Industries Disrupted by CleanTech Startups

CleanTech startups are making impact across multiple sectors:

- Power generation and utilities – Renewable energy deployment is being complemented by startup-driven storage, grid software and micro-grid systems. A report by the American Clean Power Association indicated that clean power manufacturing currently contributes US $18 billion to GDP and supports 122,000 jobs in the U.S., with projections reaching US $86 billion and 575,000 jobs by 2030.

- Manufacturing and industrial processes – CleanTech startups are entering the decarbonisation of heavy industry. For example, the Clean Investment Monitor shows that investment in decarbonising industrial production jumped 42 % compared to the previous two-year period. This means startups designing solutions for cement, steel, hydrogen and CCUS (carbon capture, usage & storage) are playing a direct role in reshaping industrial value chains.

- Commercial and residential buildings – Startups such as Verdigris are transforming how buildings consume energy via AI-driven monitoring and optimization. Energy efficiency startups are reducing demand peaks, lowering utility costs and improving overall grid resilience.

- Mobility and transport – Though often framed as mobility startups, many CleanTech firms develop power-electronics, battery and EV infrastructure solutions, further disrupting the transport sector and linking it more directly to the energy economy.

These disruptions are not isolated. Rather, they reflect a systemic shift where energy, mobility, manufacturing and digital industries converge creating new ecosystems for startups to thrive.

Economic, Ethical and Policy Implications

The rise of CleanTech startups brings a range of economic, ethical and policy implications.

Economic implications: With billions flowing into the sector, clean energy jobs are growing faster than broader employment trends. According to the Clean Economy Works initiative, clean-energy employment in the U.S. grew three times faster than total employment in 2024. This signals strong cost-competitiveness and market expansion. Startups that scale rapidly may capture significant value, while traditional players face disruption.

Ethical implications: The transition presents questions of access and equity. As renewable and storage technologies become integrated into global markets, startups must ensure solutions do not exacerbate energy inequality. For instance, rural regions and developing economies may lack infrastructure to benefit fully from distributed clean technologies which startups must factor into their business models.

Policy implications: Governments globally are responding. Incentive frameworks like the U.S. Inflation Reduction Act have accelerated startup activity. For example, the Clean Economy Works database tracks announcements of clean-economy projects in America, showing thousands of new projects since 2022. Additionally, global trade dynamics are evolving: Chinese firms have invested an estimated US $109 billion in overseas clean-energy technology projects since 2023, raising concerns about trade imbalances and market dominance.

Startups must operate within evolving regulatory contexts – where standards for grid integration, carbon accounting and supply-chain transparency matter. A notable CleanTech startup in the carbon accounting space is Greenly (France/US), which raised €52 million in 2024 to help businesses track emissions and comply with regulations such as the EU’s Corporate Sustainability Reporting Directive.

Long-Term Outlook & Regional Adaptation

Looking ahead, CleanTech startups are poised to drive a sustained transition of the global energy economy but the pace and pathway will vary across regions:

United States: With strong policy support and a robust startup ecosystem, the U.S. is leading in innovation of storage, grid software and decarbonisation. However, maintaining supply-chain resilience and scaling manufacturing remain challenges.

Europe: The UK’s net-zero economy grew 9 % in 2023, generating £74 billion in goods and services and 765,000 jobs. European startups face advantage in regulatory alignment but must overcome slower investment compared to the U.S. and China.

Asia / China: China is pushing aggressively: Chinese companies committed over US $100 billion to overseas clean-energy projects since 2023. Asia is becoming a manufacturing powerhouse for clean-tech exports and startups are riding that momentum.

Africa & Latin America: While infrastructure gaps persist, startup innovation is emerging. In Latin America the Guardian reported that startups harnessing AI for irrigation and renewable energy are gaining ground in agriculture and rural electrification. These regions can leapfrog older systems with startup-driven solutions tailored to local contexts.

In conclusion, as CleanTech startups continue to scale, they will reshape not only how energy is produced and consumed, but how value is created across industries, economies and societies. For readers of Tech Announcer — CEOs, startup founders, investors and technologists monitoring these startups offers a lens into the future of the energy economy and the opportunities it presents.