The petroleum sector is navigating a treacherous financial landscape, marked by a sustained global downturn in crude oil prices. This reset in market dynamics has exposed just how fragile hydrocarbon-dependent economies can be, shaking government revenues, unsettling currencies, and forcing banks and operators alike to confront a harsher calculus. In this new reality, the old culture of reactive project management and tolerance for inflated costs has become untenable; survival now hinges on precision, discipline, and the ability to squeeze more value from every unit of capital deployed.

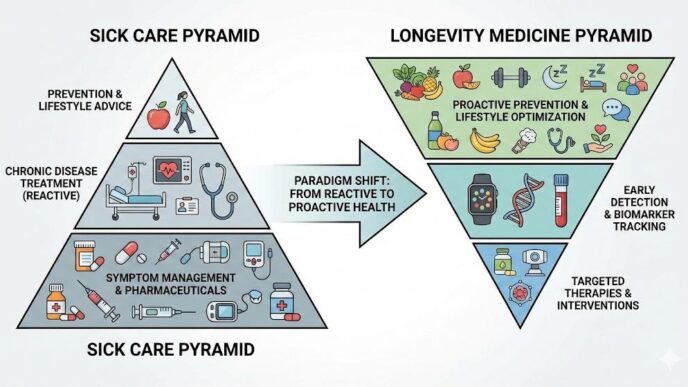

Amid these challenges, engineer and program manager Osazee Onaghinor has built a reputation as one of the quiet architects of a more disciplined way of running oil and gas projects. Far from tinkering at the margins with budget cuts and generic cost controls, he has pushed for a much deeper shift: turning project controls and supply chain management from passive, reporting-oriented functions into proactive instruments of strategy. His work targets the two most stubborn sources of financial bleed in large capital programs, which include logistics inefficiencies and unmanaged scope creep, and replaces them with systems that anticipate problems before they show up on the balance sheet.

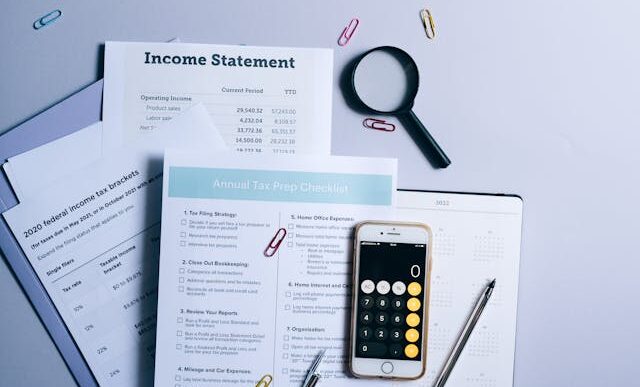

At the center of his approach is a simple, hard-edged premise: most cost overruns are not accidents but failures of foresight and integration. To counter that, he has championed the digitization of project controls as a frontline defense against financial uncertainty. Over years of working on major capital portfolios, he imposed a level of financial rigor more often associated with high-performing financial institutions than traditional project offices. He helped build structures where every major decision is backed by transparent data, including scenario models, risk analyses, and forward-looking forecasts rather than by habit or hierarchy. In practice, that meant managing substantial budgets under strict corporate investment frameworks, creating conditions where projects had to earn their funding with evidence, not assumptions.

One of his signature achievements was streamlining how money moves through the system in the first place. By automating key approval workflows and embedding digital financial models into the funding process, he cut decision turnaround times by around thirty percent, a change that sounds procedural but is anything but. Faster, better-informed approvals meant capital could be redeployed more quickly to high-impact work, and projects were no longer left idling in bureaucratic limbo while costs quietly accumulated. Layered onto this, he pushed for an Agile-inspired cadence in business planning, an iterative budget review instead of static, annual set-and-forget cycles, reducing planning timelines by about fifteen percent and forcing regular, cross-functional conversations about value, risk, and performance.

His earlier work on repairs, upgrades, and logistics shows how these principles play out on the ground. Facing a network of complex, often remote operations, he took direct aim at one of the industry’s least glamorous but most expensive problems: inefficient movement of people and materials. The Decision Support Structure he helped establish did more than centralize data; it rewrote how logistics decisions were made. By mapping routes, consolidating convoy runs, and applying disciplined controls to movements that had long been treated as routine, the effort delivered an estimated twenty-three million dollars in savings while freeing up production capacity that would otherwise have been tied up in delay and rework. This was not a theoretical exercise – it was a practical demonstration that systematic scrutiny of “business as usual” can unlock gains on a scale normally associated with new fields or major discoveries.

Project by project, he built a record of bringing large, complicated jobs in on tight terms. In overseeing major facility upgrades governed by demanding industry standards, he managed to keep budgets in check without diluting technical quality or safety. Directing a sizeable cross-functional team, he drove a project completion rate of roughly ninety-eight percent, an unusually high mark in environments where brownfield constraints, weather, and regulatory hurdles often conspire to derail schedules. When he reworked hydrostatic test execution, he cut project timelines by eight weeks and trimmed costs by about 180,000 dollars, illustrating how attention to a single, high-impact work process can ripple through an entire execution plan.

The second pillar of his method is a relentless focus on supply chain and execution efficiency. Recognizing that downtime is often less about geology and more about parts, paperwork, and planning, he introduced predictive tools and control systems designed to anticipate where the bottlenecks would appear. In managing large capital projects, he coordinated significant man-hours across engineering, procurement, and construction, ensuring that design readiness, material availability, and site execution stayed in sync. The result was not just projects delivered under budget and ahead of schedule, but tangible increases in production and throughput, which is proof that “efficiency” was not a slogan but a measurable outcome.

Even in earlier roles, the pattern is unmistakable. He consistently delivered engineering design phases under budget by around four percent and on schedule, a performance that prevented delays in contracting and mobilization at stages where time lost early typically multiplies into larger overruns later. His risk assessments and compliance reviews on critical infrastructure, including high-stakes assets like helidecks, uncovered opportunities to avoid unnecessary replacement work, sparing roughly 380,000 dollars that might otherwise have been spent on low-yield interventions. In contract administration, he treated agreements not as paperwork but as living instruments of risk management, using disciplined handling of change orders and compliance to reduce disputes and keep delivery on track.

What distinguishes Osazee Onaghinor’s contribution is not just the size of the savings or the percentages of time gained, but the way he has insisted on documenting and sharing the structures behind those results. He has approached his work less as a series of isolated wins and more as a set of repeatable systems that others can adopt and refine. That mindset has made him a significant contributor to the emerging playbook for how oil and gas operators can survive prolonged price pressure: digitized controls, data-driven decision-making, and a supply chain that is treated as a strategic asset rather than a cost center.

Together, his body of work reads like a technical blueprint for recovery in a sector still adapting to life without the cushion of high oil prices. By applying intelligence, data, and disciplined execution to capital projects and logistics, he has shown that financial resilience is not an abstract aspiration but the direct product of engineering excellence and strategic control. The gains are counted in millions of dollars saved, weeks shaved off critical timelines, and a higher standard of transparency brought into rooms where investment decisions are made. As more peers and organizations study and adopt these methods, his influence extends beyond any single project, offering a template for how an entire industry can navigate a harsher, leaner era without surrendering its ability to deliver complex, large-scale energy infrastructure.