To build a robust real estate investment portfolio, start by defining clearly your investment goals using the SMART criteria. Go through comprehensive market research to anticipate trends and secure appropriate financing, exploring options like conventional loans and joint ventures. Identify profitable properties focusing on rental yield and location potential. Implement a solid management strategy to track performance and address risks proactively. Diversify your portfolio by investing in varied property types and locations to mitigate risk. Maintain open communication with tenants to ensure satisfaction and retention. Strategic insight into these steps ensures a profitable, sustainable investment path awaits.

Define Your Investment Goals

When starting to build your real estate investment portfolio, it’s crucial to first define your investment goals with clarity and precision. Without a clear roadmap, you’ll find it challenging to make informed decisions that align with your aspirations.

Start by considering your risk tolerance. Ask yourself how much risk you’re willing to take on. Are you comfortable with high-risk investments that might offer substantial returns, or do you prefer a safer, more predictable path?

Next, reflect on your time horizon. How long are you planning to hold onto your investments? If you have a long-term perspective, you can afford to ride out market fluctuations and benefit from property appreciation over time. On the other hand, if your goal is to generate quick returns, you’ll need a different strategy, perhaps focusing on properties that promise short-term rental income or quick resale potential.

Establishing these parameters will help you tailor your investment strategy. Being clear on your risk tolerance and time horizon allows you to filter out unsuitable opportunities and concentrate your efforts on properties that meet your criteria. This approach not only saves time but also aligns your actions with your financial planning goals, ensuring you don’t get sidetracked by appealing yet inappropriate options.

Your investment goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, you might aim to acquire three rental properties within five years, generating a 10% annual return. By defining such precise goals, you’ll maintain focus and motivation, navigating the real estate landscape with confidence and strategic insight.

This clarity paves the way for a successful and liberating investment journey.

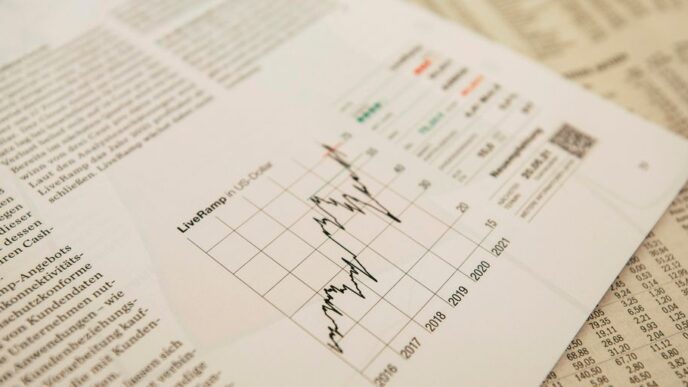

Research Market Trends

Staying informed about market trends is essential to making savvy real estate investment decisions that maximize your returns. To build a robust portfolio, you need to engage in thorough market analysis and trend forecasting. This means understanding current market conditions, predicting future movements, and identifying the best investment opportunities.

Start by analyzing both macro and microeconomic factors. Look at national economic indicators, such as GDP growth, unemployment rates, and interest rates, which can provide context for the broader market. On a more localized level, focus on factors like population growth, job market conditions, and local government policies. These elements can significantly impact property values and rental demand.

Trend forecasting is your next crucial step. Use historical data and advanced analytics tools to identify patterns and predict future market behavior. Keep an eye on emerging neighborhoods that show signs of economic revitalization or infrastructure development. These areas often offer substantial appreciation potential before they become saturated.

Networking with local real estate agents, attending industry seminars, and subscribing to market reports can also give you an edge. These resources provide timely insights and expert opinions that can refine your investment strategy. Always cross-reference information from multiple sources to ensure its accuracy and reliability.

Understanding and interpreting market trends allows you to make informed decisions, reduce risks, and seize lucrative opportunities. This strategic insight not only helps you grow your portfolio but also grants you the freedom to pivot and adapt as market conditions evolve.

Secure Financing

To effectively build your real estate investment portfolio, securing financing is a crucial step that requires strategic planning and thorough understanding of your financial options. You need to be well-versed in various credit options and loan types available to make informed decisions that align with your investment goals and risk tolerance.

First, assess your creditworthiness. Your credit score plays a significant role in determining the interest rates and terms you’ll qualify for. Aim to improve your credit score by paying down existing debts and correcting any errors on your credit report. A strong credit profile grants you access to more favorable loan terms, giving you a competitive edge.

Next, explore different loan types. Conventional loans are a popular choice due to their generally lower interest rates and flexible terms. However, they often require significant down payments and higher credit scores. For more flexibility, consider government-backed loans like FHA or VA loans, which typically have lower down payment requirements and are more forgiving on credit scores.

If you’re looking for creative financing solutions, private lenders and hard money loans might be worth exploring. While these options often come with higher interest rates, they offer faster approval times and less stringent qualification criteria, making them ideal for investors seeking quick funding.

Additionally, investigate partnerships and joint ventures as alternative credit options. By pooling resources with other investors, you can leverage combined financial strength to secure more substantial and potentially more lucrative investments.

Securing financing requires thorough research and strategic planning. By understanding and leveraging various credit options and loan types, you’ll be better positioned to build a robust and profitable real estate investment portfolio that offers the freedom and financial independence you seek.

Identify Profitable Properties

Pinpointing profitable properties is a critical skill that requires a keen eye for market trends, neighborhood dynamics, and potential return on investment.

Start by conducting a thorough property valuation. This isn’t just about the listing price; it’s about understanding the future value. Look at recent sales data in the area, the condition of the property, and any potential for renovations that could boost its value. A well-researched valuation will steer you away from overpaying and ensure you’re poised for appreciation.

Next, consider the rental yield. To calculate this, divide the annual rental income by the property’s purchase price. A high rental yield indicates a good income-generating property. Don’t just focus on the immediate figures; think about long-term rental demand in the area. Is the neighborhood attracting young professionals, families, or retirees? Each segment has unique needs that can affect your rental income.

Location is paramount. Properties in emerging neighborhoods often offer higher returns as the area develops. Research infrastructure projects, local amenities, and crime rates. A neighborhood on the rise can deliver substantial gains while offering a sense of community to your tenants.

Lastly, leverage technology. Use online platforms to analyze market trends and property performance. Tools like real estate heat maps and rental calculators can provide insights that aren’t immediately obvious. Stay informed about economic indicators and policy changes that could impact the housing market.

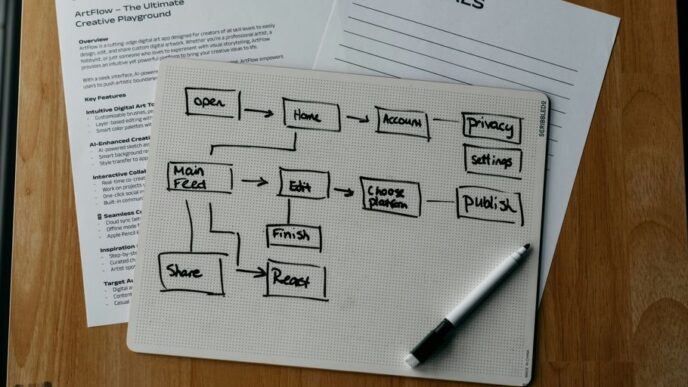

Manage Your Investments

Efficiently managing your real estate investments requires a strategic approach to maximize returns and minimize risks.

Begin by establishing a robust system for investment tracking. This allows you to monitor performance metrics such as rental income, property value appreciation, and maintenance costs. Use property management software or spreadsheets to keep all this data organized and accessible. Accurate tracking empowers you to make informed decisions quickly and confidently.

Next, conduct regular risk assessments. Real estate markets can be volatile, and understanding the potential challenges is crucial. Evaluate factors such as market conditions, tenant reliability, and property condition. By staying informed about these variables, you can preemptively address issues before they escalate. For instance, if you notice a trend of increasing vacancies in your area, you might adjust your marketing strategies or reconsider rental rates.

Communication is another key component. Maintain open lines with your tenants to ensure their needs are met and to address any concerns promptly. Happy tenants are more likely to renew leases, saving you the cost and effort of finding new occupants. Additionally, keep in touch with local buyers agents and property managers—they can provide valuable insights and updates on market trends.

Don’t forget to review your financials regularly. Assess your cash flow, debt levels, and overall portfolio performance. This will help you spot opportunities for reinvestment or areas where costs can be trimmed. Remember, the goal is to create a sustainable and profitable investment portfolio that gives you the financial freedom you desire.

Diversify Your Portfolio

Expanding your real estate investments across different property types and locations can significantly reduce risk and enhance your portfolio’s stability. By diversifying, you’re not putting all your eggs in one basket, which is a crucial tenet of sound investment strategies. You should consider spreading your investments across various asset classes, such as single-family homes, multi-family units, commercial properties, and even short-term rental properties.

When selecting these asset classes, conduct a thorough risk assessment. Evaluate the market conditions in each area you’re considering. Are property values appreciating? Is there a high demand for rental properties? Understanding these factors helps you make informed decisions that align with your financial goals.

Diversifying geographically is equally important. Real estate markets vary significantly from one region to another. Investing in different locations helps you mitigate the risks associated with local economic downturns or natural disasters. For example, while one city might experience a slump, another might be booming, balancing out your portfolio’s overall performance.

Your investment strategies should also adapt to changing market conditions. Stay informed about trends and shifts in the real estate sector. If a particular market shows signs of overheating, it might be wise to look elsewhere or shift your focus to a different type of property. Flexibility and proactive management are key to maintaining a robust, diversified portfolio.

Ultimately, diversification is about achieving freedom. By spreading your investments wisely, you reduce risk and increase the potential for stable, long-term returns. This strategic approach not only secures your financial future but also provides the peace of mind to enjoy the fruits of your investments.

Conclusion

Building a real estate investment portfolio is like navigating a well-charted course; you’ve defined your goals, researched market trends, secured financing, identified profitable properties, and managed your investments.

Now, it’s time to diversify your portfolio to weather any market storm. By following these strategic steps, you’ll steer your investments toward long-term success.

Remember, with expert knowledge and a client-focused approach, you’re not just investing in properties—you’re investing in a prosperous future.